November 2024

Aerospace Nanotechnology Market (By Type: Nano Devices, Nano Sensors; By Application: Commercial Aviation, Space & Defense) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

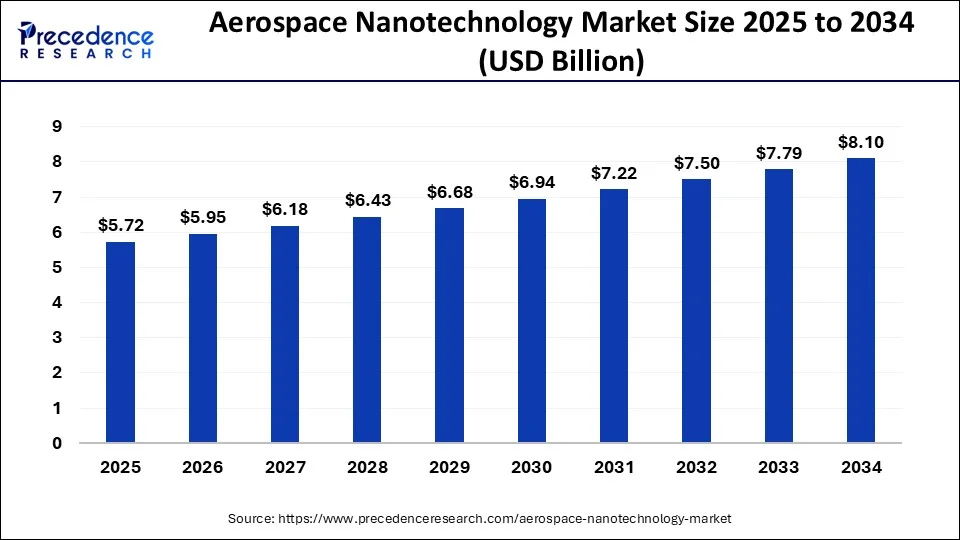

The global aerospace nanotechnology market size was USD 5.30 billion in 2023, calculated at USD 5.51 billion in 2024 and is expected to reach around USD 8.10 billion by 2034, expanding at a CAGR of 3.93% from 2024 to 2034. The North America aerospace nanotechnology market size reached USD 2.49 billion in 2023. Advances in nanotechnology and the growing demand for lightweight and fuel-efficient aircraft in the commercial and space sectors are driving growth in the aerospace nanotechnology market.

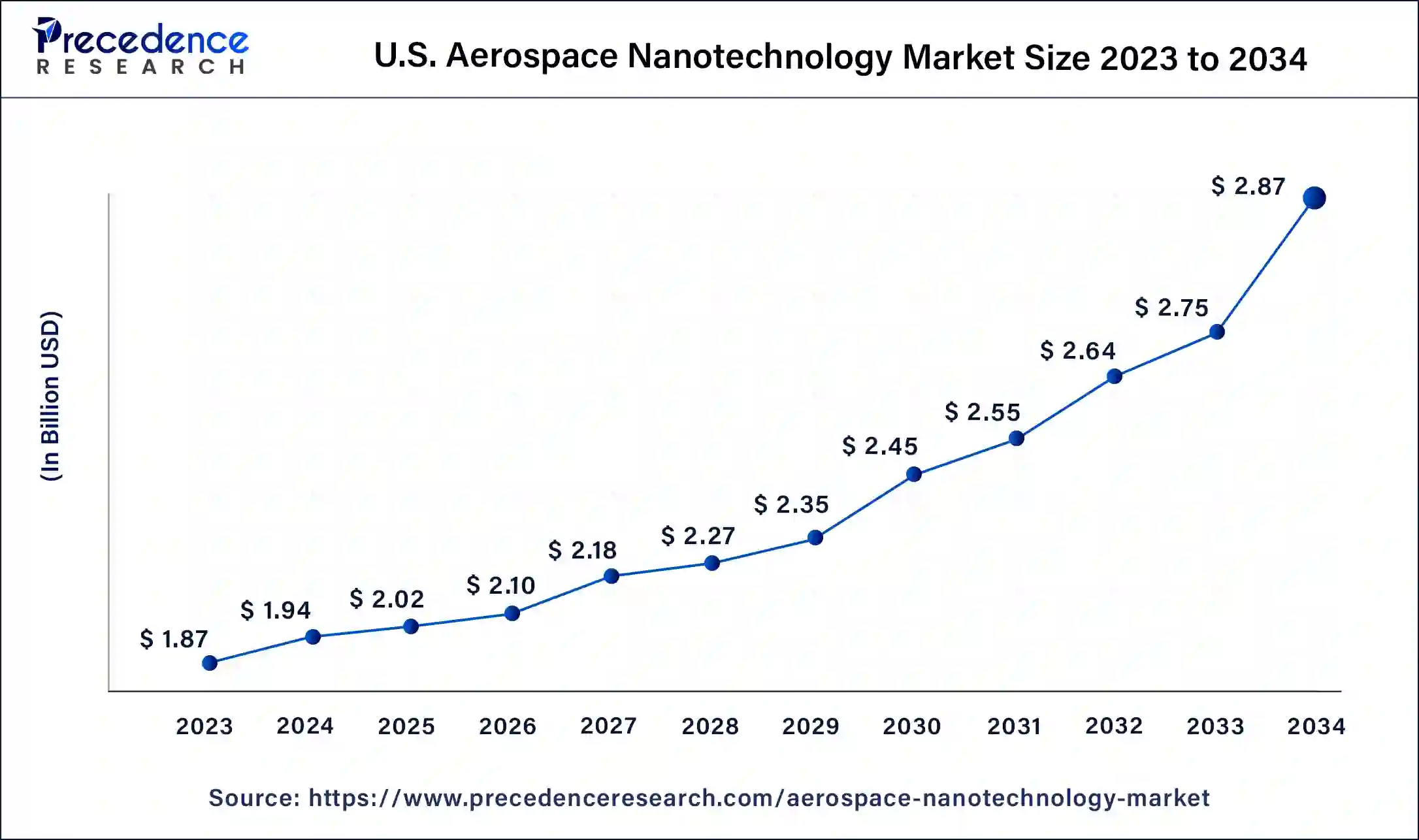

The U.S. aerospace nanotechnology market size was exhibited at USD 1.87 billion in 2023 and is projected to be worth around USD 2.87 billion by 2034, poised to grow at a CAGR of 3.97% from 2024 to 2034.

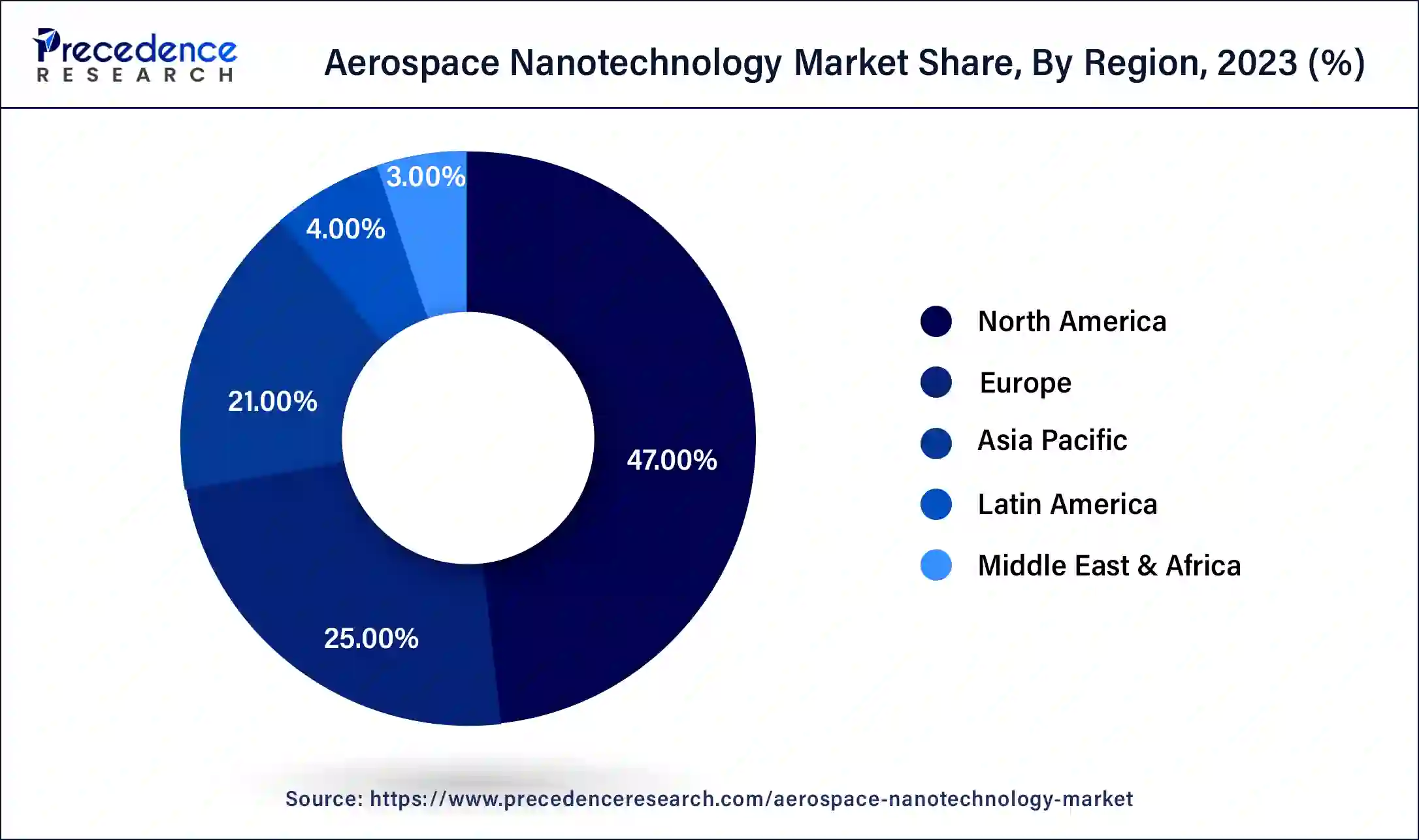

North America held the dominant share of the aerospace nanotechnology market in 2023 due to the presence of several of the world’s largest aerospace companies. These companies have made significant investments in the research and development of nanotechnology. The region also sees increasing demand for advanced nanomaterials and components due to the rising production of lightweight and fuel-efficient aircraft. The region is also home to some of the world’s leading aerospace research centers and universities that engage in the development of nanotechnology-based products. Federal initiatives in the region are also instrumental in the development of the aerospace nanotechnology market.

Asia Pacific is expected to be the fastest-growing region during the estimated period of 2024-2033. Rapid industrialization and economic growth have propelled advances in the aerospace nanotechnology market in the region. Countries like China, India, and Japan invest heavily in expanding their aerospace capabilities. Asia Pacific is experiencing significant advances in the development of nanomaterials used in lightweight structures, sensors, and nanoelectronics for state-of-the-art avionics systems.

Europe is also making up a significant share of the aerospace nanotechnology market and is experiencing steady growth. The region is also home to several aerospace companies which are investing in nanotechnology research. These advances are leading to improved safety and reliability of aircraft used in the commercial sector.

The aerospace nanotechnology market is a relatively new industry of engineering and science dealing with the design, production, and use of structures and systems by manipulating molecules and atoms at a nanoscale. Materials at this scale exhibit unique properties that differ significantly from their larger-scale counterparts. Smaller particles have a higher surface area than volume, leading to quantum mechanical effects becoming more significant. Aerospace nanotechnology has been instrumental in developing lighter and stronger materials that enhance fuel efficiency and are structurally stable enough to handle the extreme environmental conditions of outer space.

Nanoparticles such as carbon nanotubes and graphene are added to metals, ceramics, and polymers to create composites. This makes them lightweight and enhances their mechanical properties, such as improving tensile strength. Nanoparticles such as graphene are also utilized in the development of new lithium-ion batteries with higher capacities that can recharge quicker, making them useful for applications in aerospace missions. Aerospace nanotechnology is used to improve the thermal resistance of external aerospace components, which provides spacecraft protection against high temperatures during re-entry into the earth’s atmosphere.

Aerogel is a solid with extremely low density and extremely low thermal conductivity. It was first developed to provide insulation in spacecraft. Recently, aerogels have made their way into composites. By combining nanomaterials with a variety of matrix materials, lightweight, high-performance composite aerogels have been developed for several applications, including lithium-ion batteries and tissue engineering materials.

Recent developments in the aerospace nanotechnology market have enabled the development of smart materials that can sense and respond to environmental changes. These nanosensors detect cracks, corrosion, and excess heat before they become critical or visible. Some nanomaterials are also engineered to mimic biological processes to self-heal minor damage.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.10 Billion |

| Market Size in 2023 | USD 5.30 Billion |

| Market Size in 2024 | USD 5.51 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Unique properties of nanotechnology are useful in aerospace engineering

The increasing demand in the aerospace nanotechnology market is being driven by the unique properties of nanoparticles. Their exceptional strength, electrical conductivity, stiffness, mechanical and thermal stability, and resistance make them highly sought-after for applications in aerospace engineering. Advances in synthesis methods and fabrication have led to the development of carbon nanotubes, graphene, silicon carbide, boron nitride nanotubes, and silver nanoparticles, which have applications in structural composites, coatings, sensors, high-temperature components, thermal protection systems, and antimicrobial coatings in aerospace technology. These integrations increase technical performance and contribute to environmental sustainability by cutting down on fuel consumption and emissions.

Commercialization of spaceflight and spread of 5G

The commercialization of spaceflight and the spread of 5G technology have been driving factors in the aerospace nanotechnology market. Innovations in nanotechnology have allowed the development of improved sensors and imaging systems for mapping the cosmos. Satellites are also increasingly used to monitor and analyze Earth’s climate and introduce 5G connectivity. Nanotechnology developments are being used to enhance satellite services used in satellite television and internet services.

Deploying nanotechnology in aerospace has reduced the overall price of satellite deployments. Conventionally designed rockets and satellites are costly to launch. They need a lot more energy to be expended to overcome Earth’s gravitational pull. Nanotechnology reduces the overall size and weight of satellite and rocket components, making launching them more cost-effective. Spaceflight and satellite launches are no longer performed only by federal space programs. Private players are also making their way into aerospace. The spread of 5G technology across emerging nations is spurring demand for nanosatellites.

Regulatory restrictions in aerospace industries

Companies face several hurdles due to the numerous, complex safety and environmental standards and the constantly shifting regulatory landscape in the aerospace nanotechnology market. There are also several challenges in terms of protecting intellectual property rights due to the interdisciplinary nature of nanotechnology research. Government agencies are also looking into concerns surrounding nanotechnology, including potential toxicity and long-term effects, emphasizing the need for robust safety protocols and regulatory insight. Government agencies and private firms need to encourage investment and innovation in the industry by more narrowly defining patents and enforcing them appropriately.

Sustainable nanotechnology initiatives

Sustainable aerospace nanotechnology initiatives will help minimize the environmental impact of nanomaterials and their applications. Processes like green synthesis are used in the development of nanomaterials through environmentally friendly production, reducing waste and resource consumption and helping cut down on environmental risks. Nanocomposites, nanocoating, nanocatalysts, and nanolubricants have tremendous potential to replace conventional materials and composites to make the aerospace industry more environmentally friendly.

Integrating Nanotechnology into AI and IoT

Innovations in artificial intelligence and the Internet of Things are expected to drive the development of nanomaterials and devices. These integrations are expected to provide enhanced functionalities, real-time sensing and response, and autonomous operation. Nanocomputing provides numerous benefits as an effective architecture for implementing AI and machine learning processes. Artificial neural networks have significant potential in numerical simulations.

The nanodevices segment dominated the aerospace nanotechnology market in 2023. These devices are crucial in the manipulation and control of nanotechnology. They have several applications ranging from electronics to material sciences. Nanodevices have unique properties that allow for improved functionality compared to their macro counterparts by improving energy efficiency and durability.

The nanosensors segment is expected to be the fastest-growing segment in the aerospace nanotechnology market during the forecast period. Nanosensors are chemical or mechanical sensors that are used to detect the presence of certain chemicals, nanoparticles, and parameters such as temperature and pressure on a nanoscale. These sensors are characterized by higher sensitivity and quick response time, allowing for real-time data collection. These advantages are expected to boost growth in the nanosensors segment of the aerospace nanotechnology market.

The commercial aerospace segment dominated the aerospace nanotechnology market in 2023. The sector has witnessed significant growth due to the demand for nanomaterials like graphene for commercial flights. Graphene is used in the wings to reduce the impact of lightning strikes. Materials like graphene could also be used to improve the plastic in the carbon fiber used in the wings and in sensors to detect damage to the plane. Researchers are also looking to use graphene to completely replace carbon fiber and make crafts lighter and more fuel-efficient.

The space & defense segment is expected to be the fastest-growing segment in the aerospace nanotechnology market during the forecast period. The demand for satellite deployments is set to grow significantly. Aerospace nanotechnology is used to optimize materials and components on a nanoscale, improving satellite durability, reducing weight, and increasing overall efficiency during spaceflight. Nanomotors, coating, devices, and nanosatellites are becoming integral parts of several federal and private space programs.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

November 2023

October 2024