July 2024

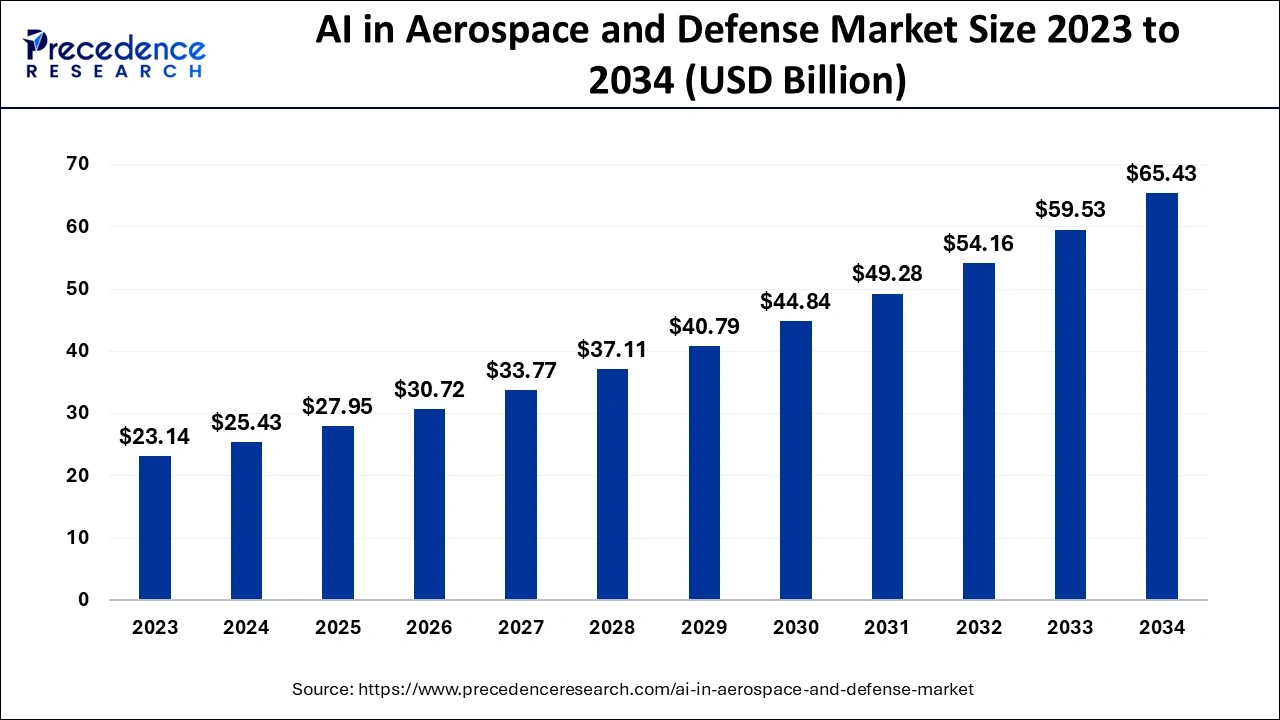

The global AI in aerospace and defense market size is calculated at USD 25.43 billion in 2024, grew to USD 27.95 billion in 2025 and is projected to reach around USD 65.43 billion by 2034. The market is expanding at a CAGR of 9.91% between 2024 and 2034. The North America AI in aerospace and defense market size is evaluated at USD 10.43 billion in 2024 and is expected to grow at a CAGR of 10.02% during the forecast year.

The global AI in aerospace and defense market size accounted for USD 25.43 billion in 2024 and is expected to exceed USD 65.43 billion by 2034, growing at a CAGR of 9.91% from 2024 to 2034. The AI in aerospace and defense market is growing due to its utilisation to accelerate speed in terms of concept and detailed design phases and enhances the surveillance, security and training in defense sector.

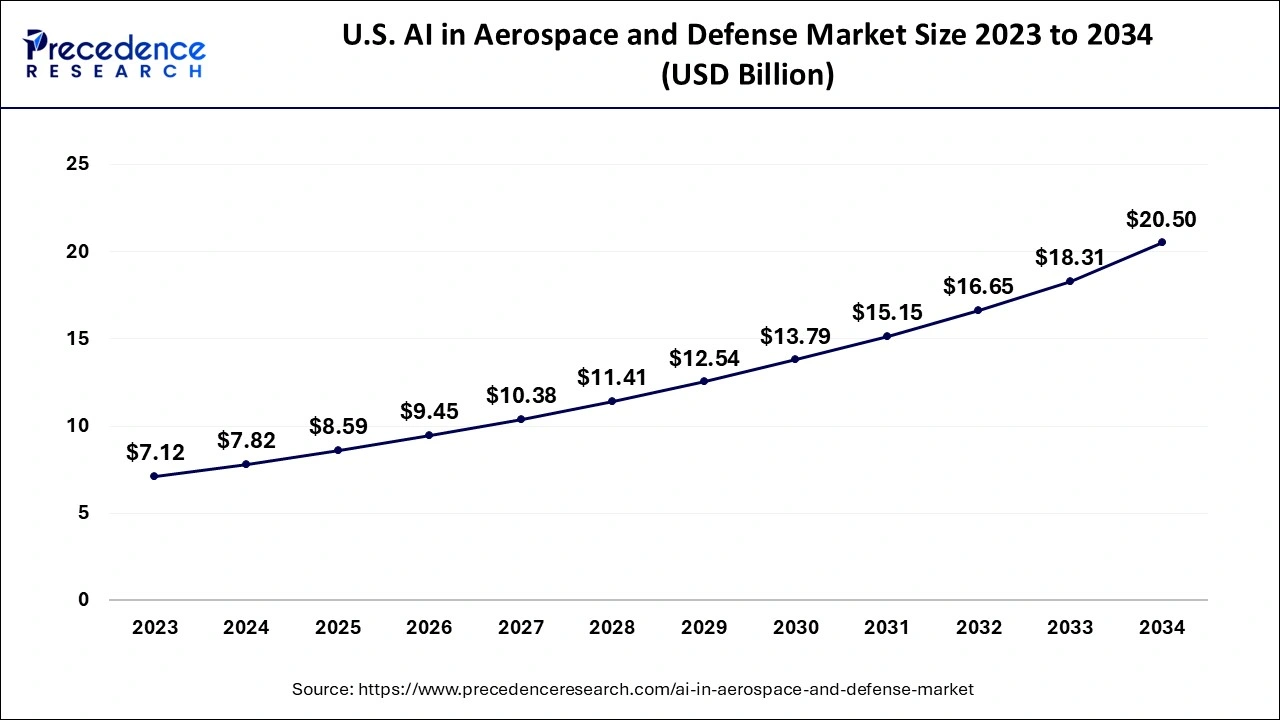

The U.S. AI in aerospace and defense market size is exhibited at USD 7.82 billion in 2024 and is anticipated to be worth around USD 20.50 billion by 2034, growing at a CAGR of 10.09% from 2024 to 2034.

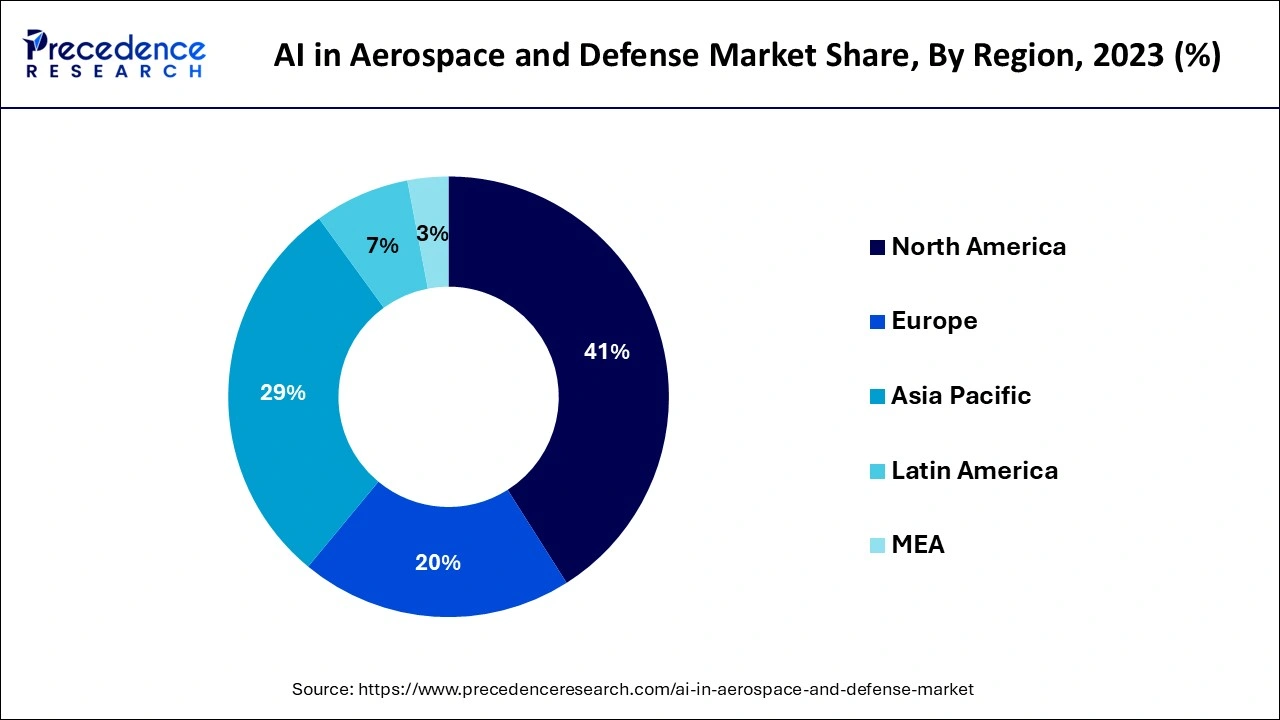

North America dominated the AI in aerospace and defense market in 2023. The dominance of this region is stimulated by robust investment in both commercial aviation and defense sectors. Companies such as Boeing, Lockheed Martin, and Northrop Grumman are greatly investing in AI to enhance their capabilities in aircraft design, autonomous systems, and military applications. The U.S. government and military are investing highly in AI and demanding the presence of AI on government contracts.

Europe is expected to grow at the fastest CAGR in the AI in aerospace and defense market during the forecast period. The growth in this region is due to Europe's global leadership in the production of civil and military aircraft, helicopters, drones, aero engines, and other systems and equipment. The large aeronautical enterprises are located in countries such as France, Germany, Italy, and Spain.

The concept of artificial intelligence in aerospace and defense represents the adoption of AI systems by companies to speed up their design cycles, which is a crucial phase before the manufacturing and final deployment with air traffic control. AI in aerospace and defense market is implemented in manufacturing and maintenance, which includes factory automation, supply chain streamlining, and processing large data sets to help maintenance engineers.

The application of AI in aerospace and defense market is not a futurist concept. The Department of Defense, the Air Force, and the U.S. Navy are all considering the incorporation of AI in military applications and weapons systems, commencing with cloud initiatives such as DOD Cloud One. AI-powered modeling platforms are essential to designing and developing a new aircraft system quickly, safely, and efficiently.

| Company | Country | Investment |

| Boeing | United States | USD 17.5 billion |

| AIRBUS | France | USD 14.4 billion |

| Lockheed Martin | United States | USD 9.5 billion |

| Northrop Grumman | United States | USD 6.8 billion |

| Raytheon Technologies | United States | USD 6.0 billion |

| General Dynamics | United States | USD 5.3 billion |

| BAE Systems | London | USD 5.2 billion |

| Safran | France | USD 4.0 billion |

| Thales | France | USD 3.5 billion |

| Pratt & Whitney | United States | USD 3.1 billion |

| Report Coverage | Details |

| Market Size by 2034 | USD 65.43 Billion |

| Market Size in 2024 | USD 25.43 Billion |

| Market Size in 2025 | USD 27.95 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Offering, Deployment Type, Platform, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Technological advancements

The AI in aerospace and defense market has revolutionized the manufacturing process and provided efficiency and productivity. By analyzing larger sensor data from aircraft systems and components, AI algorithms detect anomalies and failure detection and trigger maintenance action before an issue occurs. Predictive maintenance technology helps optimize performance and reduce downtime.

Additionally, quality control also plays a crucial role by leveraging computer vision and machine learning algorithms, the AI in aerospace and defense market systems rapidly inspect and identify defect in components with great accuracy.

Flawed prediction and incorrect decision

Several companies have reported several negative impacts of AI applications in the AI in aerospace and defense market. As AI algorithms solely depend on high-quality and relevant data, and when companies contain inadequate or biased data, the outcome is inaccurate decision-making.

Another issue with the AI in aerospace and defense market is the inability to explain the reasoning behind AI decisions. In safety-critical aerospace applications, explainability and interpretability are crucial aspects to gain user trust. Additionally, growing work efficiency is leading to job displacement. For instance, an analyst at Georgetown University presented an incident where AI mistook atmospheric conditions over Bering Strait as a missile attack and launched missile interceptors, which China then viewed as an attack against them.

Innovation in aerospace and defense using AI

The implementation of the AI in aerospace and defense market services provides a promising future with innovative discoveries. One feature that is expected to be witnessed in the aerospace industry is autonomous space explorations; this feature consists of AI-powered robots that deal with complex tasks in space, paving the way for deeper exploration and colonizing other planets. Personalized air travel features let an individual passenger adjust cabin temperature and pressure according to the desired comfort. Another feature is hypersonic flight, which allows a vehicle to travel at several times the speed of sound. AI helps in developing a safe and efficient hypersonic travel experience.

Moreover, AI in aerospace and defense market has various applications, such as warfare systems, including weapons, sensor navigation, aviation support, and surveillance, which can employ AI to operate much more efficiently. Drone swarms, strategic decision-making, data processing and research, combat simulation and training, threat monitoring, cybersecurity, and transportation are some additional aspects where AI is applicable and is expanding with novel discoveries.

The hardware segment contributed the biggest share of the AI in aerospace and defense market in 2023. The dominance of this segment is due to its quick processing of large datasets with efficiency and scale. Some commonly used AI hardware components are processors, AI accelerators, and specialized memory units. Each hardware component of artificial intelligence has different aspects. For instance, processor speed directly impacts the AT model calculation performance, and memory and storage affect the quantity of data handled and accessed.

The software segment is anticipated to witness significant growth in the AI in aerospace and defense market over the studied period. The growth is attributed due to rising popularity to install software on aircraft and space vehicles. The manufacturing and system suppliers must meet the strict regulatory requirement standards such as DO-160, DO-178C and DO-254 in aviation. A comprehensive software is required to experience a seamless workflow from model definition to real-time testing.

The on-premise segment accounted for the highest share of the AI in aerospace and defense market in 2023. The dominance of this segment is noticed as on-premise runs AI services and applications with the organization’s physical environment; it is operated by the organization’s employees, which are an ideal choice for controlling in the aerospace and defense sector. This also allows enhanced security and privacy with customized and controlled applications.

The cloud-based segment is expected to show considerable growth in the AI in aerospace and defense market over the forecast period. Cloud AI allows companies and enterprises to utilize AI’s full potential, such as machine learning, natural language processing, and computer vision. The integration of cloud-based AI offers multiple advantages to the organization, equipping businesses with a competitive edge.

The airborne segment led the global AI in aerospace and defense market in 2023. Airborne intelligence, surveillance, and reconnaissance offer faster targeting and response for threat identification, security built into the model to detect and prevent tampering, optimizes SWAP management by model compression, increases the capability and payload of drones and other airborne devices, and the data can be offloaded post-mission for data deeper analytics. All these factors contribute to the growth of this segment.

The space segment is expected to grow at the highest CAGR in the AI in aerospace and defense market during the forecast period. The Space Force officials are urging increased investments in AI and machine learning to maintain the country’s dominance in air and space industries. The growth is attributed to AI's transformative advancements in exploration, in-space servicing, command-and-control decision-making, and more resilient communication.

The machine learning segment held the largest share of the AI in aerospace and defense market in 2023. The dominance of this segment is observed due to its transformative property in the aerospace sector. The application of machine learning is used in aircraft design and optimization, structural health monitoring, flight control, and navigation, satellite image analysis, and space exploration. These advanced contributions of machine learning technology are growing the aerospace and defense industry.

The computer vision segment is expected to grow at a notable CAGR in the AI in aerospace and defense market during the forecast period. The growth of this segment is due to the rising demand to eliminate global threats and boost military capabilities. Computer vision technology offers organizations with large amount of visual data, allowing them to make quick and accurate decisions. In the defense sector, this technology improves operations, safety, and decision-making.

The surveillance & monitoring segment contributed the highest AI in aerospace and defense market share in 2023. The dominance of the segment is attributed to the growing demand to detect aircraft and send detailed information to the air traffic control system, which allows air traffic controllers to safely guide the aircraft. AI enhanced the efficiency and accuracy of surveillance systems, providing real-time insights and alerts for various applications.

The navigation & guidance systems segment is expected to expand at the fastest CAGR in the AI in aerospace and defense market over the forecast period. The growth of this segment is due to its demand for making the mission successful as it offers smart weapon solutions with low risk at an affordable cost. The navigation guidance systems provide advanced precision guidance for missiles and munitions which are highly accurate, small, and lightweight.

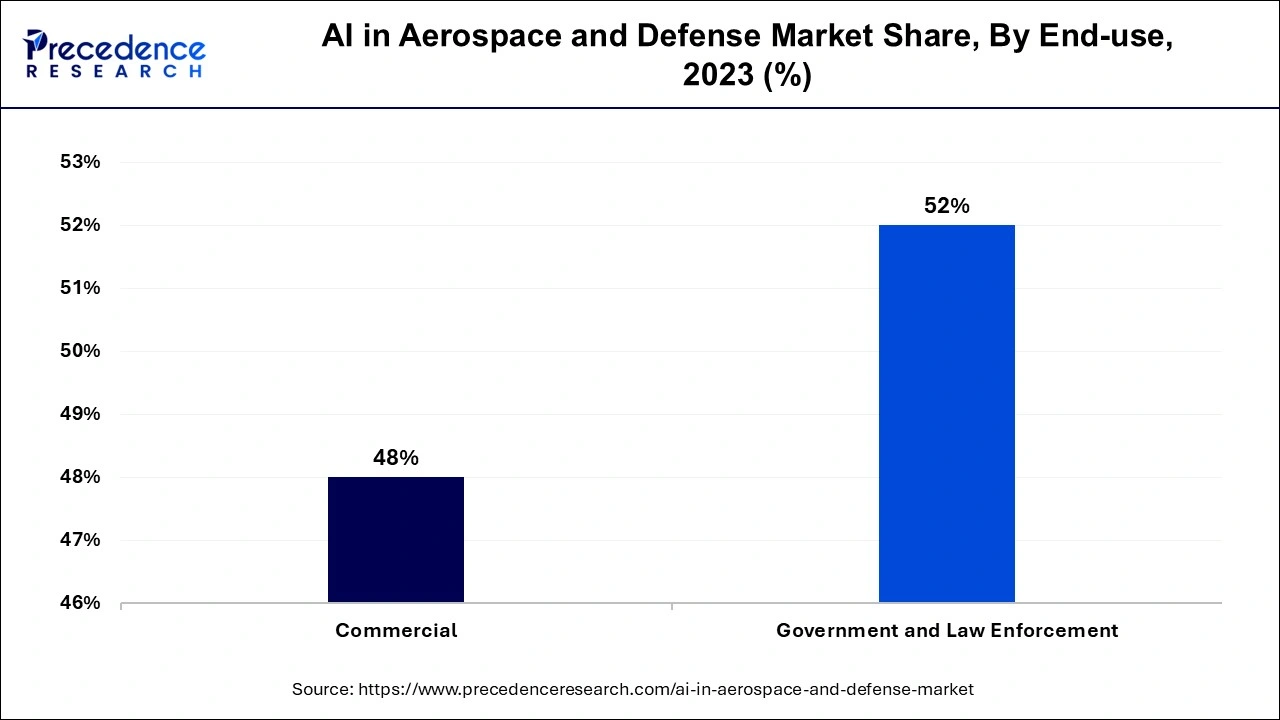

The government & law enforcement segment accounted for the highest share of the AI in aerospace and defense market in 2023. The rising demand for government & law enforcement is noticed to provide public safety, criminal justice, and security. Artificial intelligence has the ability to collect data from various sources, such as sensors and satellites, and submit a conclusion that helps government & law enforcement to undertake operations or tasks all by themselves.

The commercial segment is anticipated to grow at a solid CAGR in the AI in aerospace and defense market during the projected period. The application of commercial aircraft manufacturing with generative AI is boosting this segment, it offers a easy and effective tailors design for specific operation.

By Offering

By Deployment Type

By Platform

By Technology

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2025

November 2023

October 2024