February 2025

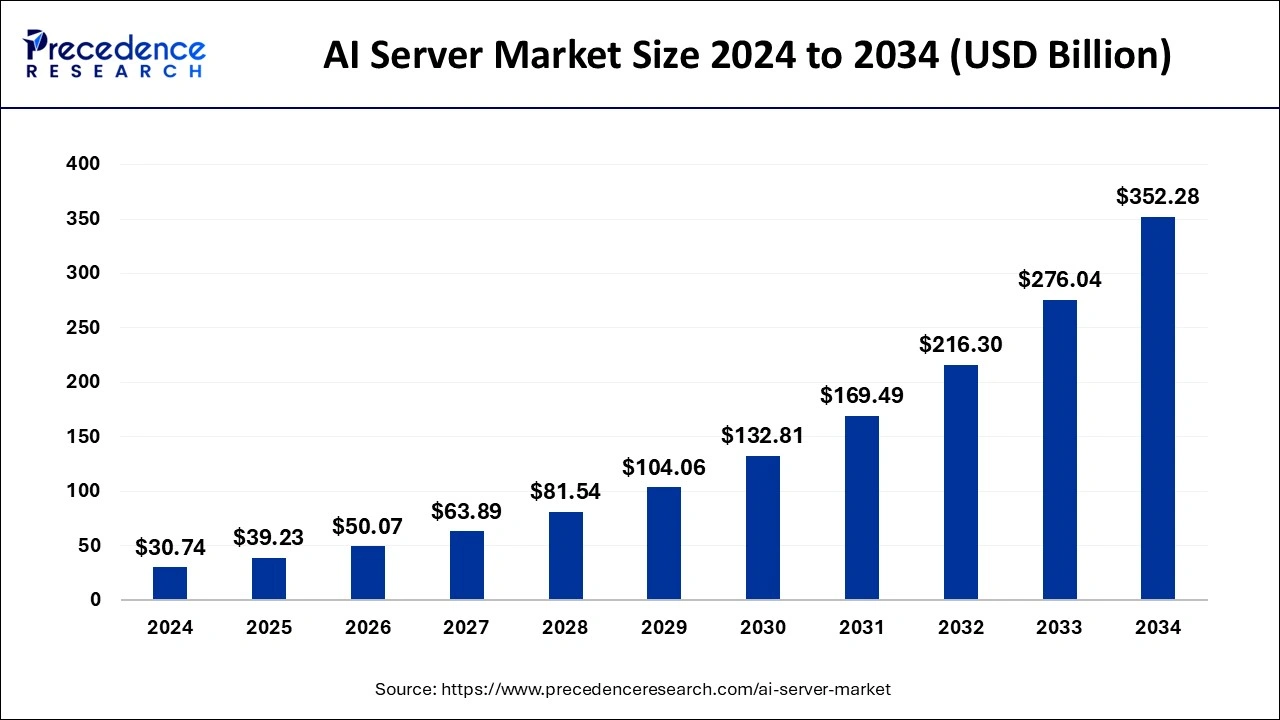

The global AI server market size accounted for USD 30.74 billion in 2024, grew to USD 39.23 billion in 2025 and is estimated to hit around USD 352.28 billion by 2034, representing a CAGR of 27.62% between 2025 and 2034. The North America AI server market size is calculated at USD 11.07 billion in 2024 and is expected to grow at a CAGR of 27.79% during the forecast year.

The global AI server market size is predicted to reach around USD 352.28 billion by 2034 increasing from USD 30.74 billion in 2024, with a CAGR of 27.62% from 2025 to 2034. The increased demand for AI applications, improvements in the technology of AI, the evolution of cloud and edge computing, and big data analysis together with cost-efficient solutions have led to extensive use of AI servers leading to a rising market.

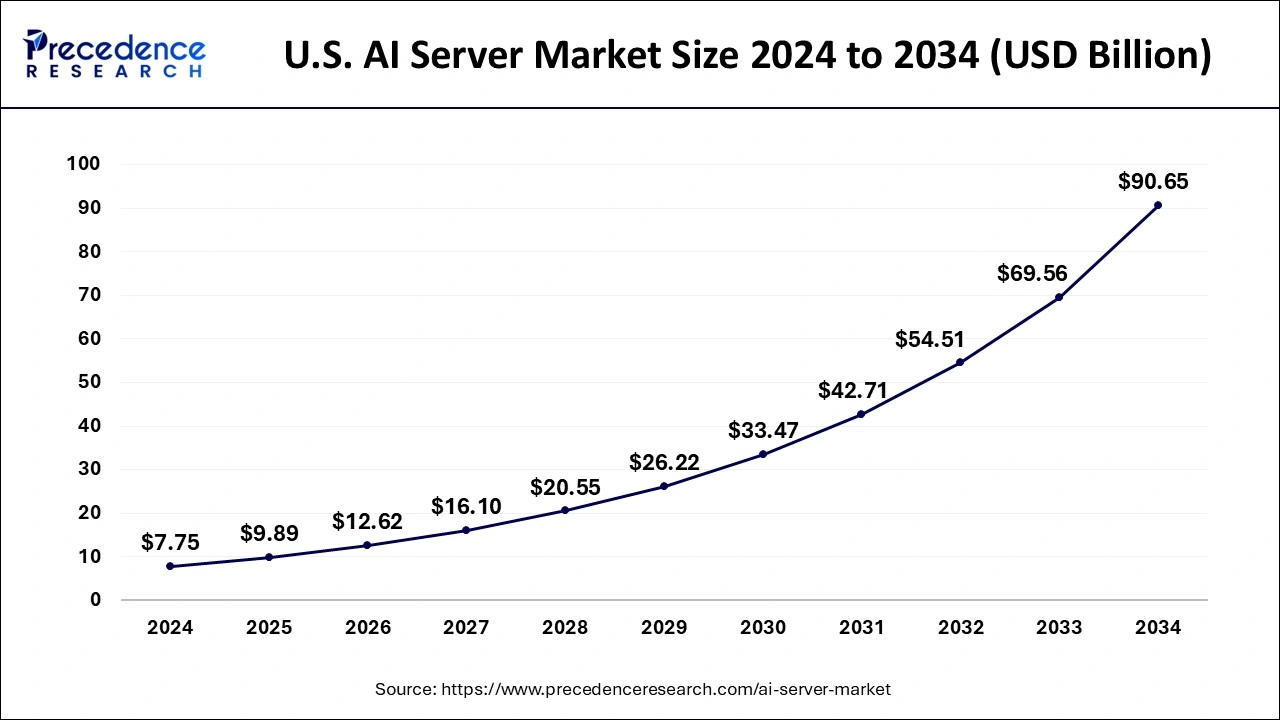

The U.S. AI server market size was evaluated at USD 7.75 billion in 2024 and is expected to be worth around USD 90.65 billion by 2034, growing at a CAGR of 27.88% from 2025 to 2034.

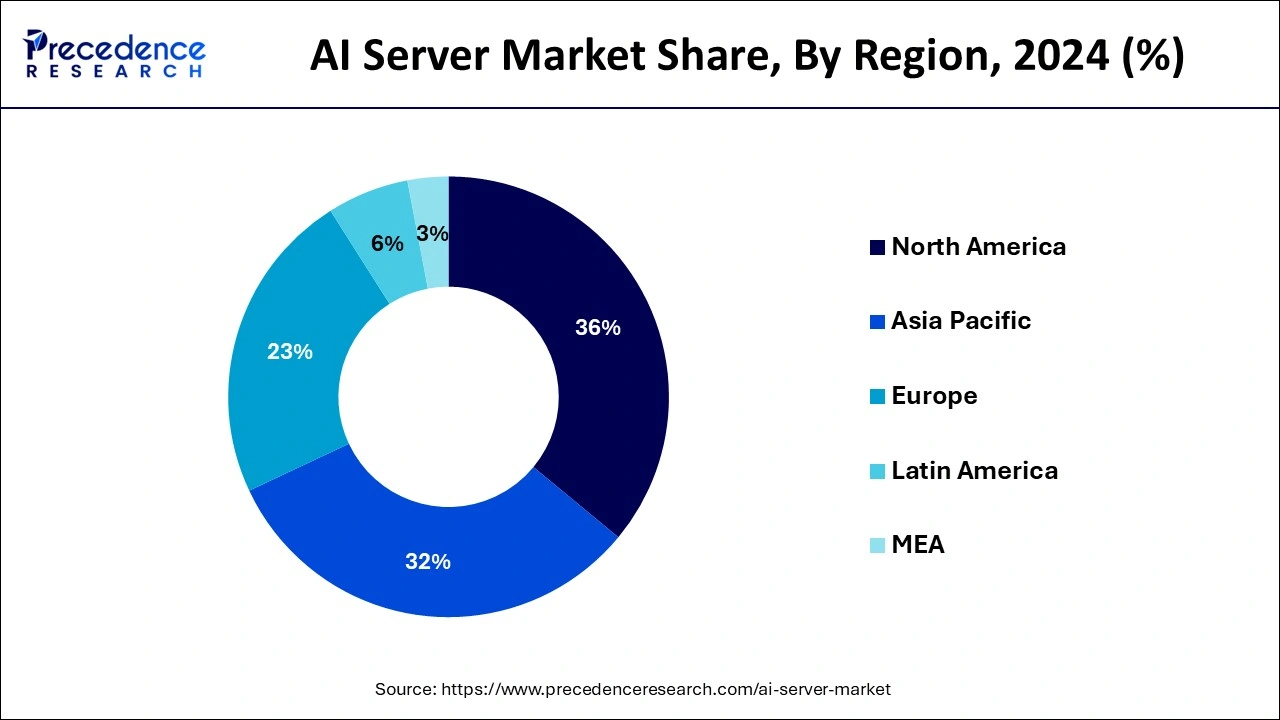

North America dominated the global AI server market in 2024. North America has resilience in IT infrastructure and makes a huge investment in cloud solutions that are suitable for the installation of AI servers. The growth of a strong financial segment and a heavily IT-enabled healthcare segment also depends on the need for AI servers because such fields entail large data handling and significant computational abilities needed to process enormous amounts of data.

The North American AI server market includes the leading organizations operating in the industry, focusing on the development of new and innovative products and the implementation of efficient and modern technologies in their supply chain. Market leaders are more concerned with the sustainability, quality, and customer solutions.

Asia Pacific is expected to grow at the fastest rate in the AI server market during the forecast period. Asia Pacific announced huge investments in developing technology structures and artificial intelligence. The public sector acts as an enabler through digitalization and AI readiness across industries such as retail and e-commerce, automotive, and manufacturing industries. Many industries require AI servers for the processing and analysis of vast amounts of data collected by these industries. The spending on IT systems has been rising, and there is a high increase in the percentage that goes to the cloud. The analysis shows that China, Japan, and India are significant players in remodeling AI servers.

AI servers are unique computing technologies that are specifically developed to meet the requirements of artificial intelligence applications. The AI servers are designed for high compute requirements as typical for AI applications. As opposed to conventional servers, AI servers are designed to contain powerful components including graphic processing units to handle encouraging volume and density of data as well as intricate scientific computations. This optimization allows us to address different tasks related to AI, such as machine learning, deep learning, and training neural networks.

The progress in AI server demand is compelled by advancements in hardware technologies, with specialized accelerators like GPUs, TPUs, and FPGAs improving performance and accelerating AI workloads. The market of Artificial Intelligence server shipment across the globe is improving, and this is due to the growing adoption of Artificial Intelligence resources in various sectors. The AI server market is expected to considerably expand in the upcoming years, mainly because the need for AI grows in multiple sectors such as medicine, automobiles, and banking. There is a growing demand for computing efficiency in AI workloads like machine learning model training and handling of massive data.

| Report Coverage | Details |

| Market Size by 2024 | USD 30.74 Billion |

| Market Size in 2025 | USD 39.23 Billion |

| Market Size in 2034 | USD 352.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.62% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Servers, Hardware, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for high-speed data processing

The demand for speed in data processing is a clear imperative leading to AI server market growth. With real-time applications and analytics, machine learning, and deep learning, businesses can obtain meaningful insights and make decisions swiftly, but more specifically, they require high-performance servers with specialized graphic processing units and tensor processing units for timely data processing. Due to the boosted speed in memory and parallel processing, these computers have faster modes of storage, accessibility, and data analysis. AI servers efficiently manage large amounts of data, making them ideal for businesses that depend on data-driven insights. Their high-speed memory and advanced processing capabilities ensure that data can be stored, accessed, and analyzed quickly and accurately.

Lack of skilled workforce

The key factor that inhibits the growth of the AI server market is there is a limited skilled workforce to help support the growing demand for IT services. The firms that intend to develop, oversee, and execute artificial intelligence require a highly trained workforce. Important technologies like cognitive computing, machine learning, deep learning, and identifying objects from images are practically implemented by experts in AI systems. In addition, there is a problem of low R&D investments and scant patenting for small enterprises to include Al technology into present systems. Also, small errors may lead to a system failure, which tremendously affects the desired goals and achievement.

Multisector applications

The AI server market offers multiple growth opportunities in several industries. Cloud AI services are increasing due to cloud adoption, driving the need for AI infrastructure that scales, delivering efficient value and performance at a lower cost. In the healthcare industry, it is also possible to use artificial intelligence for diagnostics, developing an individual approach to treatment, or creating new drugs; this also requires servers for data analysis. Similarly, the automotive industry, particularly with the move towards more self-driving cars and other advanced driver assistance systems (ADAS), requires high-speed artificial intelligence servers for processing data in real time. All these diverse opportunities indicate the growing trends of AI servers and their relevance in developing solutions for diverse and severing different verticals.

The AI training server segment held the dominating share of the AI server market in 2024. AI servers are high-performance computing systems that are specifically developed for AI training and inference, as well as highly integrated software and hardware packages required for state-of-the-art AI computations on large volumes of data. There is a constant emergence of complex AI models in many industries and fields, such as health, finance, automobile, and natural language processing. With organizations attempting to implement more precise and complex AI-based systems, there is a demand for effective AI servers with dedicated hardware, including GPUs and CPUs. These servers are intended to provide high computational loads for the training of intricate models of machine learning. AI training servers that are open and graphical models tend to have the benefit of hardware support organizations that plan to improve model learning and creation.

The GPU segment held the leading share of the AI server market in 2024. With ongoing developments and the increasing scope of AI across several sectors, the reliance on GPU servers is expected to continue, ensuring sustained growth and technological progression in the AI landscape. GPU servers are designed specifically to work in parallel, which makes them ideal for handling artificial intelligent applications such as machine learning and deep learning. This improves undertaking such as image creation, writing, and any sort of artificial intelligence-facilitated creative work. GPUS has a parallelism that highly enhances the training and inference cycles of the machine learning models, making them vital for applications that need real-time data processing and analysis. The use of GPUs has been further encouraged by their functionalities in different areas and the use of such procedures as natural language processing, computer vision, and deep learning duties.

The ASIC segment is expected to grow at a notable rate in the AI server market during the forecast period. The application specific integrated circuits (ASIC) are integrated circuits (ICs) or chips tailored or customized for a specific purpose. The development of artificial intelligence integration, the tendency to adopt automation technology across industries, the high demand for cryptocurrency mining, and the high requirement for accurate chips for driving self-driving cars are developments that could expand the ASIC chip market growth. The use of chips in telecommunication, automobiles, healthcare, industries, etc.

The IT and telecom segment held the dominating share of the AI server market in 2024. AI has great potential to revolutionize many aspects of telecom organizations, as it offers permanent and accurate tuning of various network factors. The working of IT & Telecom with a huge traffic inflow and multiple executions makes its possibility to adopt the AI servers visible. Telecom operators use artificial intelligence to forecast and prevent network outages, as well as to perform traffic control and enhance their service provision based on the key parameters shaped through analytics and decision-making. Constant improvements in AI and machine learning applications, plus the growth of the digital communication infrastructure, should maintain a strong stream of demand within this segment, requiring continued RE changes and adaptations. Another critical aspect of mobile networks and IoT apps is for AI servers to handle all the data processing that is precipitated by most mobile gadgets and IoT apps to ensure enhanced and optimized network connectivity.

By Servers

By Hardware

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024