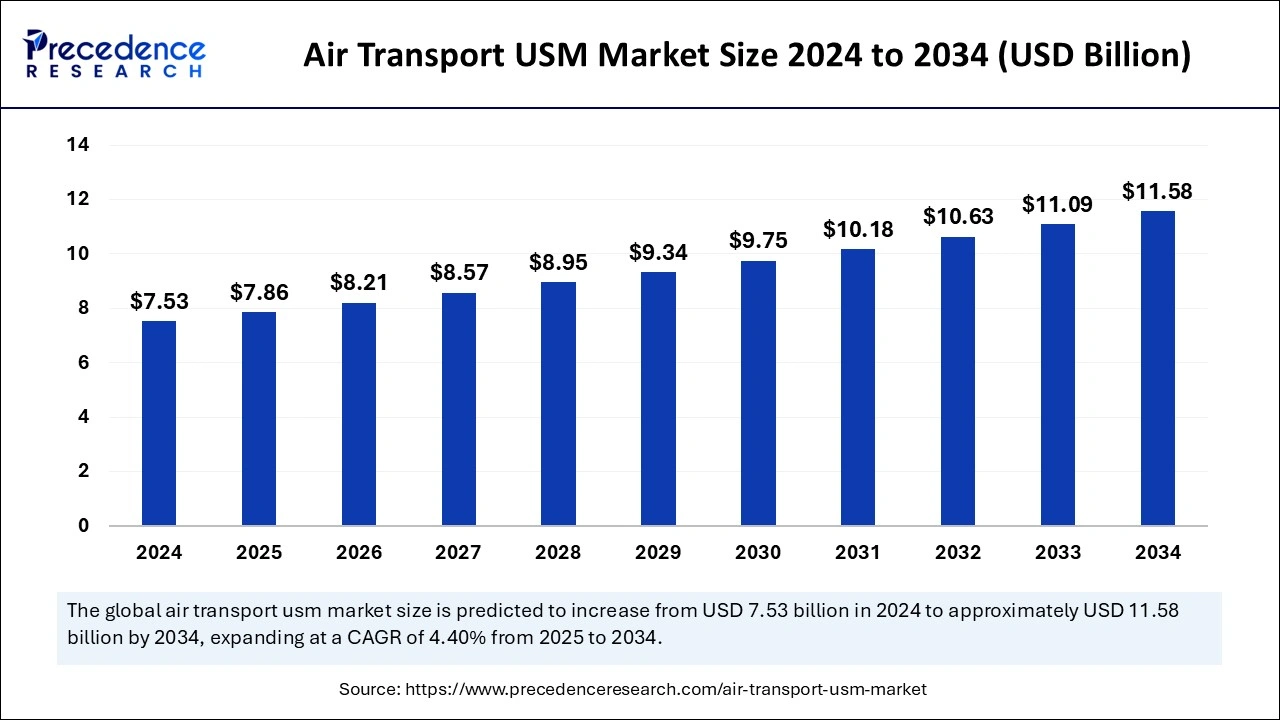

The global air transport USM market size is calculated at USD 7.86 billion in 2025 and is forecasted to reach around USD 11.58 billion by 2034, accelerating at a CAGR of 4.40% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global air transport USM market size was estimated at USD 7.53 billion in 2024 and is predicted to increase from USD 7.86 billion in 2025 to approximately USD 11.58 billion by 2034, expanding at a CAGR of 4.40% from 2025 to 2034. The market growth is attributed to the increasing demand for cost-effective and reliable aircraft maintenance solutions driven by the rising fleet size and aging aircraft across global airlines.

Specific component failure predictions from artificial intelligence predictive analytics enable airlines to perform preventive replacements, thus reducing aircraft service time and boosting operating efficiency. Machine learning algorithms now predict specific USM part requirements, which improves both stock optimization and on-demand accessibility. Machine learning establishes automated tracking for parts, which maintains regulatory adherence and produces enhanced safety outcomes.

AI-powered platforms accelerate the sourcing process of premium air transport USM market services by matching airline demands with supplier information assessed through global databases. These technologies let airlines manage sustainable operations through part lifetime extension they accomplish while cutting down production waste.

The air transport USM market is facilitated by the escalating customer needs for budget-friendly aircraft maintenance solutions. Led by Asia Pacific and the Middle East emerging markets, the global aviation industry demonstrates steady growth while facing elevated demands to sustain older planes and restrict their operational costs. The adoption of USM (Used Serviceable Materials) continues increasing as airlines discover affordable options for maintaining safety alongside operational performance.

Advanced technologies in predictive maintenance improve USM utilization through their capacity to help airlines and MRO providers forecast part failures, thus enabling proactive part replacement management. Global air passenger demand has been experiencing robust growth, with total demand increasing by 7.1%. Auditing industry projections indicate that high-quality USM requirements rise as airlines maintain their commitment to fleet sustainability.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.58 Billion |

| Market Size by 2025 | USD 7.86 Billion |

| Market Size in 2024 | USD 7.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.40% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Aircraft Type, Product Type, Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising aircraft fleet size

Increasing aircraft fleet size is expected to boost the air transport USM market growth in the coming years. The rising worldwide aircraft fleet requires persistent maintenance operations, thus enabling potential growth opportunities for USM services. Middle Eastern carriers continue to grow their flight fleets according to similar trends found in Asia-Pacific airlines. The general expansion of aircraft fleets throughout the region drives increased demand for cost-effective maintenance technologies, including USM.

The Dubai Airshow in November 2023 saw Emirates make a substantial USD 58 billion order, which included 90 Boeing 777Xs in addition to five 787s and 15 Airbus A350s, and raised its total wide-body aircraft order book to 310 units.

Stringent regulatory compliance requirements

Stringent regulatory compliance requirements are expected to hamper the growth of air transport in the USM market. The aviation industry operates under strict regulatory frameworks to ensure safety and reliability. The aviation industry operates with strict regulatory requirements that secure safety and reliability as they change the methods for deploying used serviceable materials. The FAA (Federal Aviation Administration), together with EASA (European Union Aviation Safety Agency), demand precise certification standards for USM that aircraft operations need to pass before approval.

Standards for documentation, together with traceability systems and thorough inspections, form an integral part of this protocol. Supplementing USM acquisition with regulatory compliance requirements raises acquisition expenses while expanding processing periods, which leads to inefficient supply chain operations. Furthermore, the regulatory compliance expenses and timelines are likely to keep small operators from entering the air transport USM market, which reduces both the company's future growth potential and accessibility to new participants.

Technological advancements in predictive maintenance

Rising technological advancements in predictive maintenance are expected to enhance USM utilization and further create opportunities for the players competing in the market. Predictive maintenance technology integration with aviation produces substantial opportunities for airlines to maximize their serviceable material usage. The United States Marketplace for Sustenance Check (USM) Maintenance and Survey (ICF) expects advanced data analytics paired with machine learning tools to transform both operations while reducing service downtime.

Aircraft data analysis reveals patterns that enable the prediction of upcoming system failures so airlines, together with MRO providers, secure replacement components in advance. Through such maintenance planning, airlines convert irregular repairs into scheduled maintenance operations, which lower maintenance outages while enhancing passenger convenience. The combination of technological innovations will create fresh opportunities for the air transport USM market to support industry data-centric approaches that boost operational effectiveness and maintenance safety.

The commercial aircraft segment held a dominant presence in the air transport USM market in 2024 due to the increased global air travel during the period. The restart of air travel resulted in enhanced flight operations that used a greater number of commercial aircraft, thereby driving higher requirements for competitive maintenance.

The rotary wing segment is expected to grow at the fastest rate in the forecast period of 2025 to 2034 as helicopters grow more widespread across military service emergency response and oil and gas exploration. The helicopter industry incurs substantial operational costs through recurrent component changes; therefore, operators expect to increase their USM consumption as they search for efficient alternatives to purchasing new components. Rotary wing aircraft components demand USM availability because these components naturally degrade more rapidly than other aircraft elements.

The engine component segment accounted for a considerable share of the air transport USM market in 2024, as they support both aircraft performance and safety operations. Aircraft engines represent the airline industry's most valuable airframe components, while maintenance costs routinely eat into airline budgets. Airline service requirements intensified dramatically in 2023, as the growing flight numbers required more engine overhauls while driving up dependence on used serviceable engine components (USM). Moreover, the aviation industry's commitment to reducing costs while managing rising fuel prices and maintenance expenses will foster ongoing demands.

The avionics segment is anticipated to grow with the highest CAGR during the studied years, owing to the increasing aircraft systems requirements that are creating this growth scenario. Avionics technology has become significantly advanced as aircraft companies utilize complex communication navigation and flight control systems. The aviation industry's goal to enhance operational efficiency and safety motivates airlines, together with MRO providers, to shift towards used serviceable avionics as an economical replacement for new components. Market growth for USM is expected in the avionics sector because older aircraft need upgrading with modern systems, and these essential components experience frequent replacements.

In 2024, the aftermarket segment led the global air transport USM market due to the increasing aircraft fleet sizes and mounting maintenance procedures worldwide. Airlines that use older aircraft find aftermarket parts to solve their maintenance cost problems as they support safe operation in addition to maintaining operational efficiency. The aftermarket section distributes various components, including engine parts along with avionics and airframe elements, as their necessity in maintaining aircraft health due to operational fatigue. Originating from sustainability needs and cost-saving initiatives, the USM market developed its preference for aftermarket parts, particularly when using recycled materials.

The OEM segment is projected to expand rapidly in the coming years, owing to the growing demand for high-quality certified components. The aviation industry demands components from original equipment manufacturers that meet rigorous safety criteria and performance benchmarks, allowing airlines to operate under intense regulatory mandates. Electronic systems manufacturing from OEMs continues growing in popularity among airlines that require traceable certified parts to support their operations. The recovering and expanding air travel market drives OEM suppliers to grow their part delivery capacity, which serves both commercial and military aviation sectors through new component manufacturing and replacement part production.

North America dominated the global air transport USM market in 2024 due to its extensive fleet and production of aircraft by Boeing. The U.S. airline industry witnessed increasing demand for used serviceable materials, as airlines and MROs faced rising maintenance costs while aircraft needed to accommodate an aging fleet. Operating aircraft numbers combined with MRO network efficiency throughout North America results in the region's leading position within the USM market.

Asia Pacific is projected to host the fastest-growing air transport USM market in the coming years, owing to the rapid growth in air traffic and aircraft fleet size in countries including China, India, and Southeast Asia. The rapidly expanding airport traffic in India, one of the world's most dynamic aviation markets, is propelling the drive-up demand for maintenance and repair solutions, such as air transport USM.

By Aircraft Type

By Product Type

By Provider

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client