January 2025

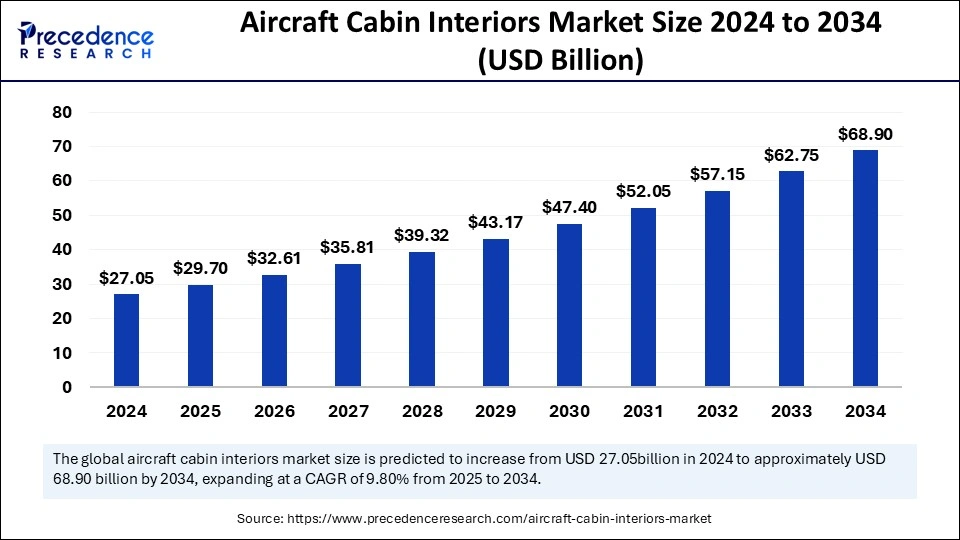

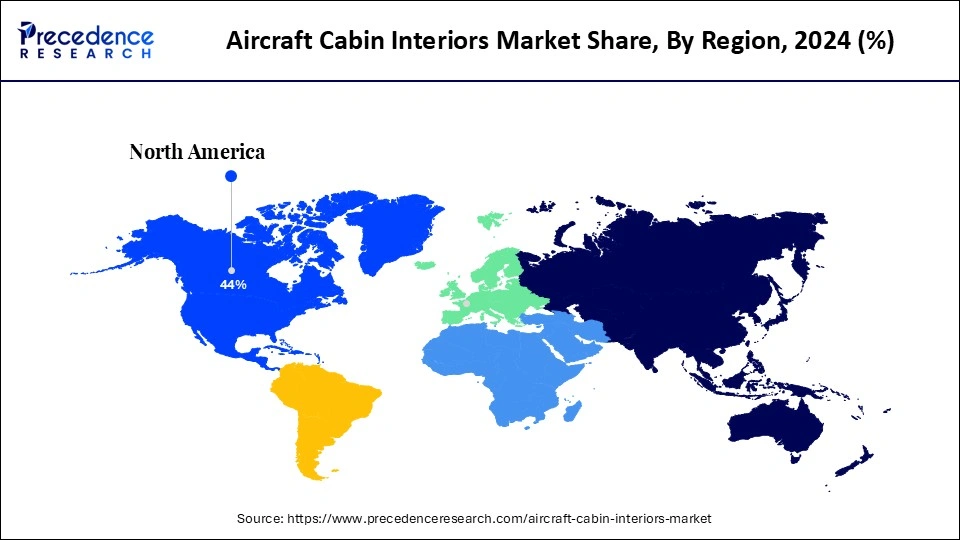

The global aircraft cabin interiors market size is calculated at USD 29.70 billion in 2025 and is forecasted to reach around USD 68.90 billion by 2034, accelerating at a CAGR of 9.80% from 2025 to 2034. The North America market size surpassed USD 11.90 billion in 2024 and is expanding at a CAGR of 9.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aircraft cabin interiors market size accounted for USD 27.05 billion in 2024 and is predicted to increase from USD 29.70 billion in 2025 to approximately USD 68.90 billion by 2034, expanding at a CAGR of 9.80% from 2025 to 2034. A strong emphasis on improving passenger comfort and experience is expected to boost the market growth during the forecast period.

The aircraft cabin interiors market receives transformative power from artificial intelligence (AI) through its capacity to design models quickly and perform continuous observation and predictive asset analytics. The AI technology enables airlines to automate operations that improve cabin comfort by adjusting lighting parameters and environmental temperatures and delivering customized streaming content. The implementation of machine learning helps accelerate product development through simulated cabin layout testing and lowers research and development expenses.

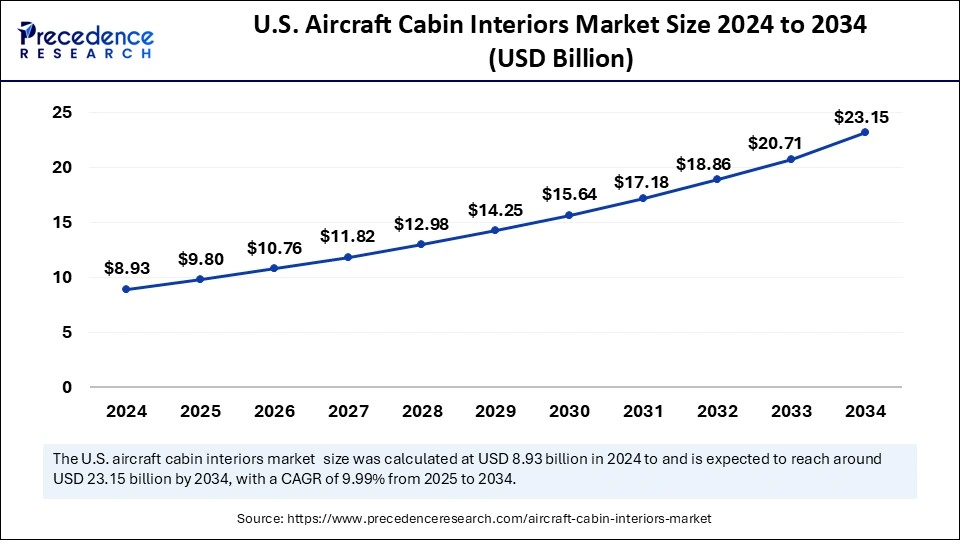

The U.S. aircraft cabin interiors market size was exhibited at USD 8.93 billion in 2024 and is projected to be worth around USD 23.15 billion by 2034, growing at a CAGR of 9.99% from 2025 to 2034.

North America led the aircraft cabin interiors market in 2024 by capturing the largest share. The regional market growth is mainly driven by the rise in aircraft production in the last few years. The region boasts some of the leading aircraft manufacturers, driving innovations in aircraft cabin interiors. The rapid expansion of commercial aircraft fleet and innovations in manufacturing technologies further bolstered the market growth in the region.

The U.S. and Canada play a major role in the North American aircraft cabin interiors market. The U.S. has a large domestic airline industry. Major carriers in the country, like Delta Air Lines and United Airlines, are focusing on upgrading their fleets to enhance travel experience. In October 2024, Delta Air Lines started a large-scale cabin redesign. The refresh includes new seat fabrics and materials, memory foam cushioning in some cabins, and mood lighting throughout the plane. The Canadian airline Air Canada also dedicated its efforts to upgrading its cabin amenities as it wanted to meet increasing customer demands. The aerospace companies in Canada and the U.S., including Collins Aerospace and Boeing Interior Responsibility Center, used innovative modular cabin design to maintain their position as a leader in the market.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The regional market growth can be attributed to the growing number of air passengers. With the growing tourism, the demand for air travel is increasing. Regional airlines are investing heavily to expand and modernize their fleet. According to Airbus’s prediction, Asia Pacific will require more than 17,600 new aircraft by 2040 due to the growing annual passenger traffic growth rate of 5.3% each year. Moreover, the domestic air passenger traffic in India is expected to reach 300 million by 2030, which is almost two folds from 2023. The Commercial Aircraft Corporation of China (COMAC) is struggling to surpass Boeing and Airbus by pursuing new certifications for its C919 jet after commercial service was launched in 2023. Airlines in South Asia and Southeast Asia are focusing on fuel-efficient aircraft designs and distinct aircraft interiors to stay competitive in the market, which sparks an increase in lightweight, customizable cabin design implementation.

Europe is expected to witness notable growth in the foreseeable future. The growth of the European aircraft cabin interiors market can be attributed to the rising investments by domestic airlines to optimize passenger satisfaction and accommodate modern consumer demands. In 2024, British Airways invested USD 9 billion in fleet transformation, which added fresh seating and enhanced in-flight entertainment systems throughout its Airbus A320neo planes and other aircraft. Moreover, the strong regional connectivity networks lead to increased demand for smaller aircraft with innovative cabin interiors, supporting regional market growth.

The aircraft cabin interiors market is witnessing significant growth due to the rising passenger demand for better journey comfort and inflight entertainment. Airlines use advanced composites together with lightweight, durable materials in their cabin modernization to achieve better fuel efficiency and decrease operational expenses. Airlines are now implementing standard smart cabin technology, which includes high-speed Wi-Fi and personalized seats, in order to fulfill customer expectations. Supply chain issues with aircraft seats represent a major problem for the industry as they obstruct flight cabin modernization efforts. With the rising disposable income, spending on air travel is increasing, which is expected to boost the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 68.90 Billion |

| Market Size in 2025 | USD 29.70 Billion |

| Market Size in 2024 | USD 27.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.80% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Platform, Material, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Air Passenger Traffic

The increasing air passenger traffic is a key factor driving the growth of the aircraft cabin interiors market. Global air travel expansion in the aviation industry continues to rise, which creates an urgent requirement to modernize cabin solutions. Airlines are placing strong emphasis on enhancing passenger comfort, boosting the need to modernize cabin with innovative seats, high-definition in-flight entertainment systems, and specialized onboard lighting systems. There is a high demand for interior parts that serve both economy and premium cabin groups. Airlines are investing heavily in advanced technologies to enhance passenger comfort, satisfaction, and experience, especially during long-haul flights. As air passenger traffic increases, so does the need for innovative cabin interiors, boosting the growth of the market.

Stringent Regulatory Standards

Stringent safety and regulatory standards are expected to hinder the growth of the aircraft cabin interiors market. Airlines need to meet stringent safety standards, which add complexity to the development of new cabin interiors. This probably slows down innovations in cabin interiors. Flight safety authorities, including the Federal Aviation Administration and European Union Aviation Safety Agency, require extensive material and safety assessments for aircraft cabin elements. New products face prolonged delays in launching, as manufacturers need to successfully meet the requirements for fire safety testing, toxicity assessments, and crashworthiness and electromagnetic interference testing. Regulatory challenges further lead to high development expenses that deter small airlines from adopting new cabin interiors. Moreover, certification approval creates challenges in the market.

Next-Generation Aircraft Demand

The heightened demand for next-generation aircraft is expected to create immense opportunities in the aircraft cabin interiors market. As the demand for next-gen aircraft increases, airlines must modernize their existing fleet to compete in the market. Next-gen aircraft are often equipped with advanced technologies, requiring sophisticated cabin interiors to seamlessly integrate them. Multiple airlines are focusing on expanding their fleet through acquisitions of fuel-efficient, wide-body aircraft that offer improved cabin design. In May 2024, the largest airline in India, IndiGo, placed a firm order for 30 Airbus A350-900 aircraft to expand its international network to long-haul destinations. This fuel-efficient, next-generation A320 Family is set to revolutionize domestic air travel in India.

The fleet modernization program of Air India featured a procurement of 10 A350 widebody aircraft and 90 single-aisle A320 Family aircraft in December 2024. Manufacturers pursue innovation in modular seating systems, integrated lighting technology, and high-tech entertainment units, as new aircraft models, including the Airbus A350 and Boeing 787 which present wider cabin dimensions and improved layout adaptability. Furthermore, the strong rise in air transport consumption requires OEMs and interior system suppliers to work together on aircraft development that satisfies modern aviation passenger requirements.

The in-flight entertainment & connectivity segment dominated the aircraft cabin interiors market with the largest share in 2024. This is mainly due to the increased passenger demand for customized digital content and continuous network connectivity. To address expanding connected travel demand, airlines began implementing fast satellite internet and wireless content distribution systems. According to the International Air Transport Association (IATA), global air traffic rose 10.4% in 2024 compared to 2023. As air traffic increases, so does the demand for in-flight entertainment and connectivity, especially for long-haul flights.

The aircraft galleys segment is expected to grow at the fastest rate in the coming years, as airlines are focusing more on service efficiency combined with food safety requirements. Airlines are redesigning their galleys to enhance operational efficiency and decrease service durations alongside expanding food selection options mainly intended for long-haul international flights. The WHO announced new food safety standards in 2024 that compel airline operators to install simple galley setups, which provide efficient cleaning methods for maintaining safety standards. Furthermore, the increase in demand for specialized meal services with dietary and allergy-specific options made carriers adopt a more sophisticated modular approach to their galley setups.

The narrow-body aircraft segment held the largest share of the aircraft cabin interiors market in 2024 as airlines initiated more short-haul and medium-haul flights while establishing new low-cost carrier routes. The numerous domestic and regional routes with high passenger traffic pushed airlines to depend on narrow-body jets, boosting the demand for standardized and retrofit-capable cabin interiors. A strong emphasis on improving seating arrangements, storage compartments, and lavatory arrangements with lighting technology to enhance passenger comfort further bolstered segmental growth. Furthermore, Airbus's A320 Family aircraft production reached 602 units in 2024, reflecting the narrow-body aircraft’s segment growth.

The wide-body aircraft segment is anticipated to grow at the highest CAGR over the studied years. Air carriers are investing heavily in wide-body aircraft systems to enhance operational capacity while raising the standard of onboard amenities for their international flights. Moreover, the leading carriers within the Middle East countries are launching wide-body jet purchasing programs as they want to establish dominance in the expanding tourism sector. The rising demand for long-haul travel and premium passenger experiences further supports segmental growth.

The alloys segment led the aircraft cabin interiors market in 2024. Alloys are widely used materials due to their high strength, durability, performance, and cost-effectiveness. Aluminum and titanium alloys are widely used to build structural components such as seating frames, galley fittings, and overhead storage bins. Such materials meet all necessary regulations regarding fire performance, structural stability, and weight reduction. Furthermore, alloys can be recycled easily, reducing the waste generation.

The composites segment is projected to expand rapidly in the coming years. The segment growth can be attributed to the rising focus on enhancing fuel efficiency and reducing the overall weight of aircraft. Composites like carbon fiber-reinforced plastics, fiberglass, and advanced polymers are heavily preferred for their enhanced strength and flexibility. These materials significantly improve the fuel efficiency of aircraft. The rising demand for lightweight components further supports segmental growth. Engineers can gain higher design possibilities through composites, which enables them to design intricate curvatures, reduce component numbers, and integrate modular functional components.

The aftermarket segment held the largest share of the aircraft cabin interiors market in 2024. This is mainly due to the rise in the need for refurbish and retrofit aging aircraft fleets. Leaders in the aviation industry have directed their attention toward cabin upgrades that combine aesthetic enhancements with passenger comfort improvement and brand identity alignment as they speed up interior transformations. With the rapid surge in the demand for personalized travel experiences, multiple airlines directed their focus on replacing original seating products, lighting fixtures, and entertainment systems to enhance passenger experiences.

The OEM segment is expected to grow at the fastest rate during the projection period due to the rapid expansion of commercial fleets. Innovative interior systems are installed at manufacturing sites among aircraft producers to fulfill the demands of passengers regarding comfort with connectivity features and design elements. Airbus shipped 766 commercial aircraft to customers during 2024 while providing the A321XLR and A350 models that came equipped with factory-manufactured ergonomic seating with LED lighting components and advanced in-flight entertainment equipment. Furthermore, the rising partnerships between aircraft manufacturers and OEMs lead to quicker cabin transformation programs. The rising production of aircraft further contributes to segmental growth.

Latest Announcement by Industry Leader

By Type

By Platform

By Material

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

January 2025