January 2025

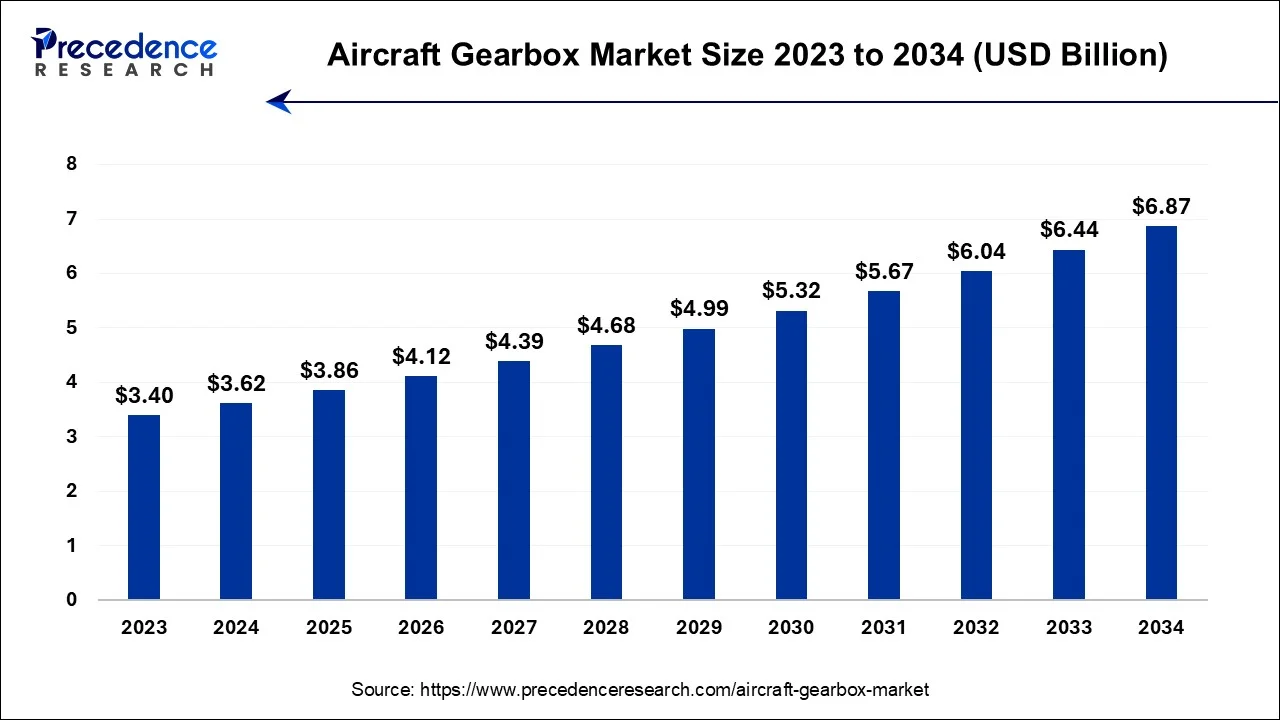

The global aircraft gearbox market size accounted for USD 3.62 billion in 2024, grew to USD 3.86 billion in 2025 and is projected to surpass around USD 6.87 billion by 2034, representing a healthy CAGR of 6.60% between 2024 and 2034. The North America aircraft gearbox market size is calculated at USD 1.59 billion in 2024 and is expected to grow at a fastest CAGR of 6.62% during the forecast year.

The global aircraft gearbox market size is estimated at USD 3.62 billion in 2024 and is anticipated to reach around USD 6.87 billion by 2034, growing at a healthy CAGR of 6.60% between 2024 and 2034.

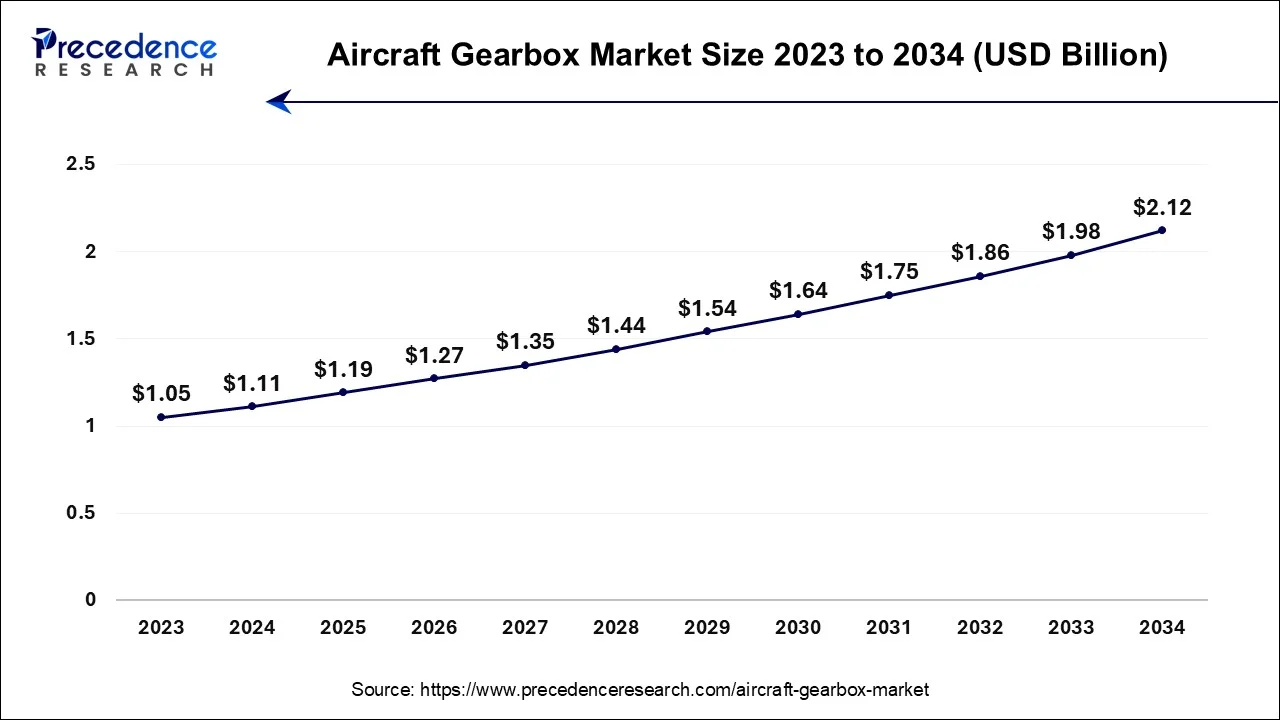

The U.S. aircraft gearbox market size accounted for USD 1.11 billion in 2024 and is expected to be worth around USD 2.12 billion by 2034, at a CAGR of 6.68% from 2024 to 2034.

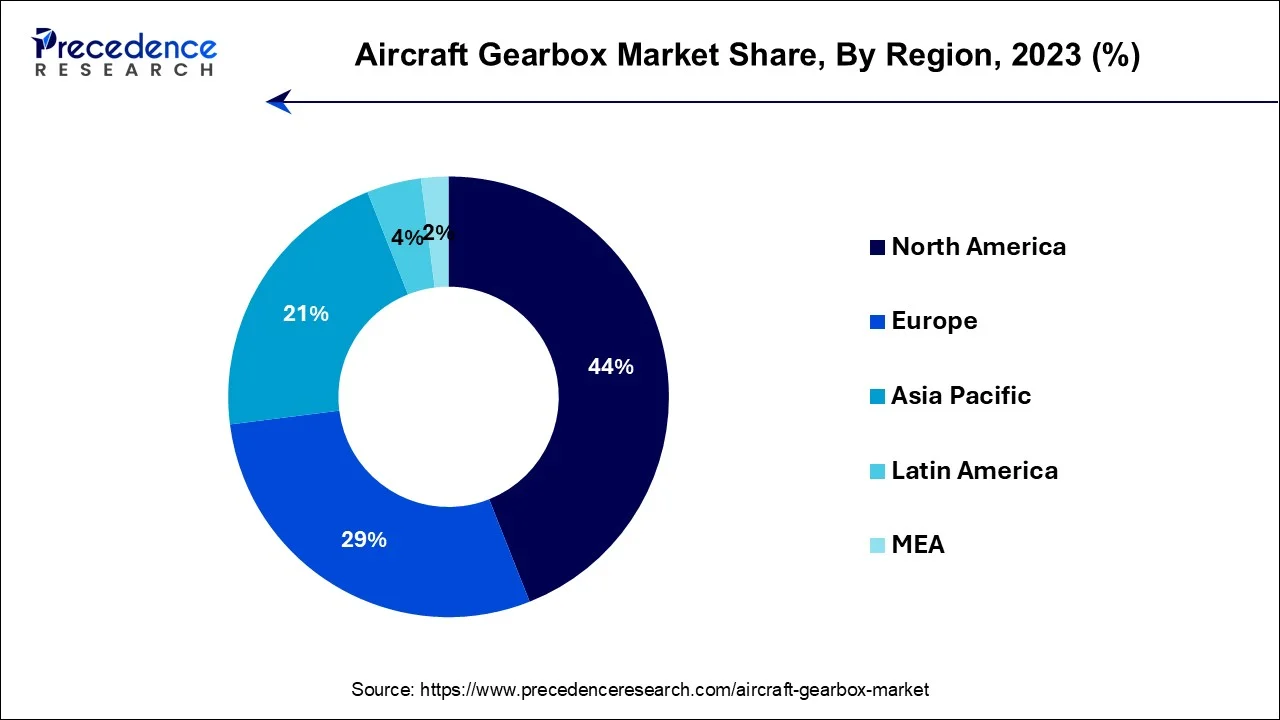

North America has held the largest revenue share 44% in 2023. North America commands a substantial share in the aircraft gearbox market due to several key factors. The region boasts a strong presence of leading aerospace manufacturers and operators, driving a consistent demand for aircraft gearboxes. North America's technologically advanced aerospace industry emphasizes innovation and performance, leading to frequent upgrades and replacements of gearbox components. Moreover, the region's robust military aviation sector and investments in defence further contribute to the market's growth. The presence of well-established aviation regulations and safety standards bolsters the demand for certified gearboxes, solidifying North America's major share in the global aircraft gearbox market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds significant growth in the aircraft gearbox market due to its dynamic aviation sector. The region experiences robust growth in commercial and military aviation, driven by expanding economies, increasing passenger traffic, and defense investments. As a result, aircraft procurement and fleet expansion are on the rise, necessitating a greater demand for aircraft gearboxes. Furthermore, Asia-Pacific's emergence as a manufacturing hub for aircraft and components, combined with a growing focus on technological advancements, positions the region as a key contributor to the aircraft gearbox market's growth and development.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.6% |

| Market Size in 2024 | USD 3.62 Billion |

| Market Size by 2034 | USD 6.87 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Component, End Use, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growth in aircraft gearbox

The aircraft gearbox market is seeing substantial growth, thanks to the expanding aircraft gearbox. This growth is influenced by several key factors. One of the main drivers is the increasing demand for air travel. With a growing global population and a burgeoning middle-class demographic, airlines are expanding their fleets. When airlines acquire new aircraft or modernize their existing ones, they require advanced and efficient gearboxes to optimize engine performance and ensure safety.

Furthermore, this growth isn't limited to commercial aviation. Military, cargo, and specialized aviation sectors are also on the rise, each with its specific gearbox requirements to meet operational demands. In response to these needs, the aircraft gearbox market is experiencing ongoing development and competition. This collaborative effort results in the advancement of gearbox technologies and materials, providing more reliable and efficient solutions for both current and future aircraft, ultimately contributing to the industry's growth and innovation.

Costly development

The costly development of aircraft gearboxes stands as a significant restraint on the growth of the aircraft gearbox market. The design, research, and manufacturing processes required to create advanced and reliable gearboxes demand substantial financial investments. This financial barrier can deter new entrants to the market, limiting competition and innovation. Moreover, stringent aviation safety regulations mandate rigorous certification procedures for aircraft gearbox components, driving up the costs and extending development timelines. These regulations are essential to ensure safety but can impede market growth due to increased expenses and time constraints.

The substantial upfront expenses and prolonged development cycles can discourage manufacturers from pursuing aircraft gearbox projects. Furthermore, it can lead to higher prices for aircraft operators, affecting the overall affordability of aircraft and potentially hampering market demand. Overcoming these cost-related challenges requires industry stakeholders to balance safety standards with cost-effective solutions, encouraging the development of innovative yet financially viable gearbox technologies.

Rising demand for electric propulsion

The rising demand for electric propulsion in aircraft is creating significant opportunities in the aircraft gearbox market. Electric and hybrid-electric propulsion systems are gaining prominence as the aircraft gearbox strives to reduce emissions and enhance energy efficiency. This transition requires specialized gearboxes tailored to the unique characteristics of electric motors and power distribution systems. Opportunities in this context include the development of lightweight, high-torque gearboxes capable of efficiently transmitting power from electric motors to propellers or rotors. These gearboxes need to meet stringent performance and safety standards while also contributing to the overall weight reduction goals of electric aircraft.

In addition, the adoption of electric propulsion technology offers opportunities for gearboxes designed with enhanced integration of advanced sensors and diagnostics. This facilitates real-time monitoring and predictive maintenance, which can improve the longevity and reliability of gearbox components. As electric aircraft gain traction, manufacturers in the aircraft gearbox market have the chance to position themselves as leaders in this transformative field, offering innovative solutions that align with the aircraft gearbox's sustainability goals. This shift represents a compelling opportunity for companies to innovate, develop, and supply cutting-edge gearboxes for the evolving aviation landscape.

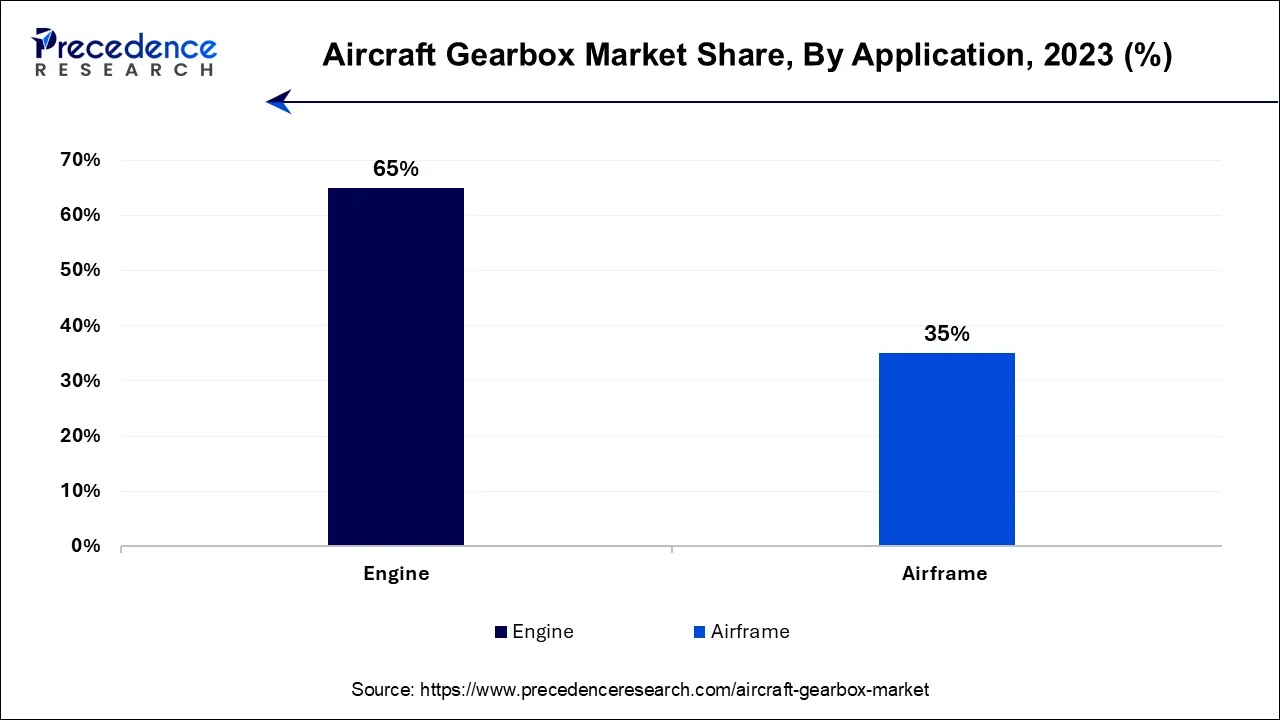

According to the engine, facial aesthetic products has held 65% revenue share in 2023. The engine segment holds a major share in the aircraft gearbox market due to its pivotal role in aircraft propulsion. Aircraft engines operate at high speeds, necessitating the use of gearboxes to transmit power to the propellers or rotors at optimal speeds for efficient thrust. Gearboxes in this segment must handle extreme forces and stresses. The consistent demand for new engines and engine upgrades in the aircraft gearbox, along with the ongoing maintenance requirements of existing engines, ensures a steady and substantial market share for gearbox manufacturers serving this critical component of the aircraft.

The airframe segment is anticipated to expand at a significant CAGR of 6.9% during the projected period. The airframe segment holds a major growth in the aircraft gearbox market primarily because gearboxes play a critical role in various aircraft systems beyond propulsion. They are instrumental in controlling functions like landing gear retraction, flap and slat deployment, and other airframe-related mechanisms. These components ensure smooth and precise operation, contributing to flight safety and operational efficiency. As airframes are central to an aircraft's structural and functional integrity, the demand for reliable and high-performance gearboxes remains consistently high, bolstering the airframe segment's prominence in the aircraft gearbox market.

In 2023, the gear segment had the highest market share of 45% on the basis of the raw material. The gear segment holds a significant share in the aircraft gearbox market due to its fundamental role in power transmission and engine optimization. Gears are critical components that ensure the proper rotation and torque transfer between the engine and propeller/rotor. They must meet stringent safety and reliability standards. With the growing demand for fuel-efficient aircraft and innovative propulsion systems, gear technology has become pivotal. The need for lightweight, durable, and high-performance gear solutions has led to substantial investments and advancements in this segment, cementing its dominant position in the aircraft gearbox market.

The bearing segment is anticipated to expand fastest over the projected period. The bearing segment holds a major growth in the aircraft gearbox market due to its critical role in ensuring the smooth and reliable operation of gearboxes. Bearings reduce friction and facilitate the movement of rotating components, thereby enhancing efficiency and durability. Given the rigorous demands and safety requirements of the aircraft gearbox, high-quality, precision-engineered bearings are essential. As a result, aircraft gearbox manufacturers prioritize bearings to meet stringent performance and safety standards, contributing to their significant market share as a vital component in the aviation propulsion system.

In 2023, the commercial aircraft segment had the highest market share of 40% on the basis of the end use. The commercial aircraft segment holds a major share in the aircraft gearbox market primarily due to the steady growth of the global aircraft gearbox. The increasing demand for air travel, driven by population growth and economic expansion, results in a continuous need for new and modern commercial aircraft. Gearboxes play a pivotal role in optimizing engine performance, ensuring safety, and meeting stringent regulations. The sheer volume of commercial aircraft in operation, combined with the ongoing need for replacements and upgrades, makes this segment a dominant force, contributing significantly to the overall market share in the aircraft gearbox industry.

The helicopters segment is anticipated to expand fastest over the projected period. The helicopter segment holds substantial growth in the aircraft gearbox market due to several factors. Helicopters rely on complex gearbox systems to control the main rotor's speed and manage power distribution. This critical role in helicopter propulsion leads to a consistent demand for specialized gearboxes. Additionally, the military and civilian applications of helicopters contribute to a diverse market for gearbox solutions. As helicopters are employed in various missions, including defence, medical evacuation, and transport, their gearbox requirements span a wide spectrum, making this segment a major contributor to the aircraft gearbox market.

In 2023, the OEM segment had the highest market share of 63% on the basis of the sales channel. The Original Equipment Manufacturer (OEM) segment holds a significant share in the aircraft gearbox market due to its strategic role in the supply chain. OEMs are directly involved in the design and production of aircraft, allowing them to integrate gearboxes seamlessly. Their ability to offer customized solutions, ensure compliance with safety standards, and provide comprehensive support makes them preferred partners for aircraft manufacturers. Additionally, long-term contracts with OEMs and their strong reputation for reliability contribute to their dominant market position, as airlines and operators seek trusted sources for critical components like aircraft gearboxes.

The aftermarket segment is anticipated to expand fastest over the projected period. The aftermarket segment holds significant growth in the aircraft gearbox market due to several factors. Aircraft gearboxes, being critical components, require periodic maintenance, repair, and replacement to ensure safety and optimal performance. Aging aircraft fleets and the need for upgrades contribute to a steady demand for aftermarket gearbox solutions. Additionally, stringent regulatory requirements often prompt operators to invest in certified aftermarket gearboxes. This consistent need for maintenance and replacement, driven by safety and regulatory compliance, solidifies the aftermarket segment's dominance in the market, making it a major revenue contributor for gearbox manufacturers.

Segments Covered in the Report

By Application

By Component

By End Use

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

January 2025