November 2024

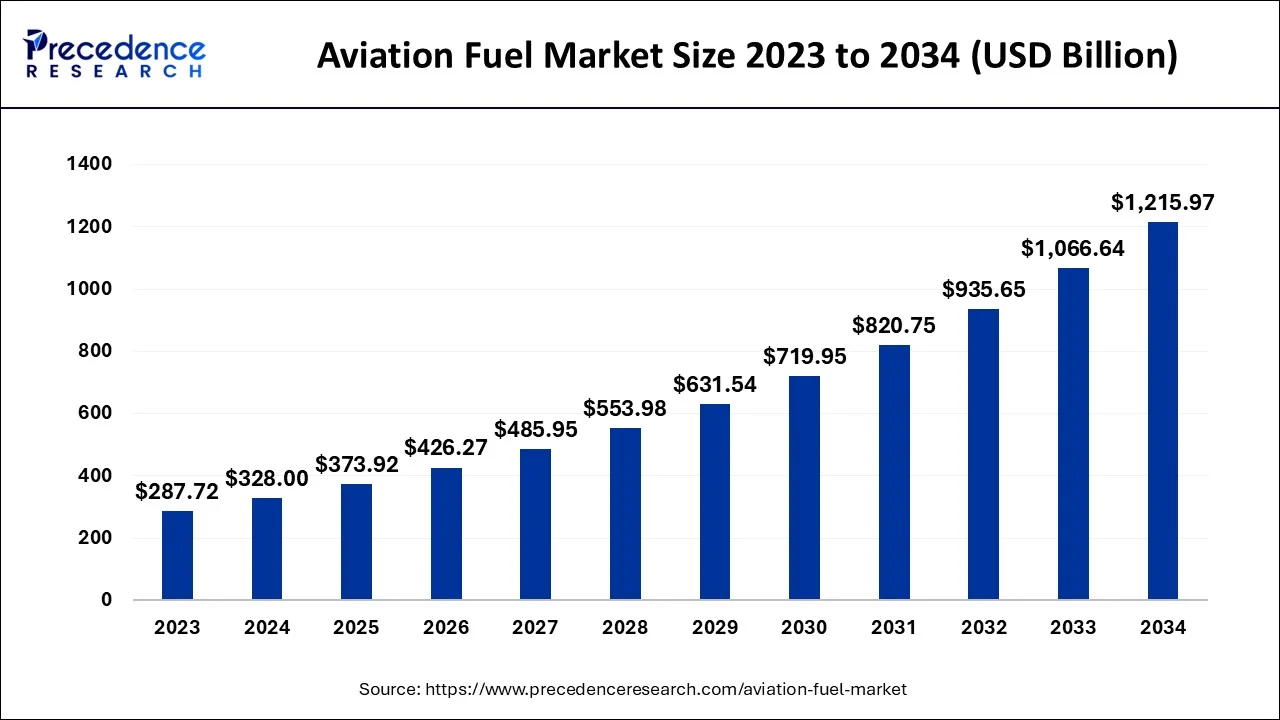

The global aviation fuel market size accounted for USD 328 billion in 2024, grew to USD 373.92 billion in 2025 and is projected to surpass around USD 1,215.97 billion by 2034, representing a healthy CAGR of 14% between 2024 and 2034.

The global aviation fuel market size is estimated at USD 328 billion in 2024 and is anticipated to reach around USD 1,215.97 billion by 2034, growing at a CAGR of 14% from 2024 to 2034.

Aviation fuel is used for powering aircraft and various types of aviation fuels are the by-products of crude oil. The aviation fuel market is majorly driven by the rising trend of air travel and the expanding aviation sector in various developing nations. The development of the latest aviation biofuels and the increasing requirement for low-cost carriers are also anticipated to create notable opportunities for all the market players during the study period. Factors such as stringent environmental regulations along with fluctuating crude oil prices can hinder the aviation fuel market growth to a certain extent.

Increasing investment in the aviation sector, rising disposable income, and the growing tourism industry are some of the latest factors that are supporting the aviation fuel market substantially.

In an effort to develop sustainable aviation fuel, United Airlines and 5 corporate partners announced to invest $100 million in February 2023. GE Aerospace, Air Canada, Boeing, JPMorgan Chase, and Honeywell are the 5 corporate partners which would help in the development of sustainable aviation fuel.

As per the data from the U.S. Bureau of Economics, personal income increased by $1.97 trillion (10.5%) and Disposable Personal Income (DPI) grew by $2.13 trillion in April 2020. With rising income levels and expanding tourism sector, the number of air travelers is increasing rapidly across various nations of the world.

In 2022, Dubai received around 14.36 million international overnight visitors. This number is a 97% year-on-year (Y-o-Y) increase as compared to 7.28 million tourist arrivals in 2021. According to the World Tourism Organization, a specialized agency of the United Nations (UN), tourist arrivals in Maldives in January 2021 stood at 92,103. This count rose to 99,397 by 3rd February 2021. The growing count of tourists is creating promising scope for the aviation industry.

As per our research, the global sustainable aviation fuel market was valued at $433.26 million in 2022 and is predicted to account for $14,842.13 million by 2032. The global sustainable aviation fuel market will grow at a compounded annual growth rate (CAGR) of 42.39% from 2023 to 2032. Thus, considering such a high compounded annual growth rate for the sustainable aviation fuel market, the aviation fuel market is also expected to grow exponentially.

| Report Coverage | Details |

| Market Size in 2024 | USD 328 Billion |

| Market Size by 2034 | USD 1,215.97 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2023 To 2034 |

| Segments Covered | By Fuel Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In order to enhance the development of aviation fuel, aviation fuel companies can consider expansion, collaboration, partnership, acquisition, and joint ventures. Furthermore, constantly evolving aviation engine technology can make the existing technology obsolete very soon. This can further intensify the industry rivalry among the prominent market players.

Since the count of aviation fuel providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is relatively higher as compared to the bargaining power of buyers. Due to promising profit margins, the threat of new entrants in the aviation fuel market is considered to be moderate.

As per the U.S. Department of Energy (DOE), air travel accounts for nearly 175 million metric tons of CO2 emissions or about 2.6% of domestic Greenhouse gas (GHG) emissions each year in the United States. According to Environmental Protection Agency (EPA), large business jets and commercial airplanes contribute around 10% of US transportation emissions and account for almost 3% of the country’s total greenhouse gas (GHG) production. Thus, such high contributions of harmful emissions hinder market growth to some extent.

The use of aircraft is highly growing across logistics applications. Airlines transport over 52 million metric tons of goods each year. According to International Air Transport Association (IATA), approximately 90% of cargo in international trade is shipped via sea route, and only around 0.5% is transported by air. But this transport by air cargo translates to around 35% of world trade by value or nearly $6 trillion in value. With an increasing demand for international products, the need for a safe and efficient air service is anticipated to rise enormously in the near future.

Our aviation fuel report includes an in-depth analysis of the recent market scenario. The report covers various key factors such as the competitive landscape, key players, the latest trends, and regional analysis. The analytical research on the COVID-19 impact helps in understanding the effects on the supply and demand side. The segmental analysis offers a clear overview of various types of aviation fuels.

Based on fuel type, the global aviation fuel market is segmented into conventional fuel and sustainable fuel. The conventional fuel segment held the largest market share in 2023. The sustainable fuel segment is expected to grow with the highest compounded annual growth rate (CAGR) during the study period.

Sustainable aviation fuel (SAF) is a type of biofuel that can be used for powering aircraft. Sustainable aviation fuel features similar properties to conventional fuel but with lesser carbon emissions. With advanced technologies and suitable feedstock for the production of sustainable aviation fuel, the carbon footprint can be reduced dramatically.

Owing to the characteristics such as safety, reliability, and low carbon emissions, the bio-jet fuel type is predicted to provide lucrative scope during the study period. In October 2022, Honeywell announced an innovative technology to process ethanol-to-jet fuel (ETJ). This latest technology allows fuel producers to convert sugar-based, cellulosic, or corn-based ethanol into SAF.

Based on end-user, the global aviation fuel market is segmented into commercial aircraft, private aircraft, and military aircraft. The commercial aircraft segment had the highest revenue share in 2022. The commercial aircraft segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2032. Increasing international air traffic is majorly contributing to the growth of the commercial aircraft segment.

According to the Australian Bureau of Statistics, the average equivalised disposable household income for FY 2017–18 accounted for $1,094 per week. For 2019-20, this amount increased to $1,124 per week. Thus, rising spending power and high living standards are augmenting the growth of the private aircraft segment substantially. Various defense forces are expanding their fleet of aircraft over past few years. As of December 2022, Dassault Aviation’s Rafale-M emerged as the top contender for the Indian Navy’s significant contract of 27 fighters.

The aviation fuel market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America held the largest share of the global Aviation Fuel Market in 2022. The U.S. held the largest share followed by Canada and Mexico in 2022. Considering the presence of countries with favorable economic policies, high gross domestic product, and early adoption of the latest aviation fuel, the North American region is anticipated to grow promisingly.

The European aviation fuel market is segmented into Germany, France, the United Kingdom, Italy, and the Rest of Europe. Germany is predicted to hold the largest share of the European aviation fuel market during the study period. The population in Europe is more inclined towards touring and holidaying to various destinations. In 2023, revenue from the Tourism & Travel industry is estimated to reach around $280.50 billion. Thus, the notably growing Tourism & Travel industry drives the demand for aviation fuel drastically.

The aviation fuel market in the Asia Pacific (APAC) region is segmented into India, China, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. In 2022, China dominated the Asia Pacific (APAC) region followed by India and Japan. The Latin America, Middle East, and African (LAMEA) aviation fuel market is segmented into South Africa, North Africa, Saudi Arabia, Brazil, Argentina, and the Rest of LAMEA. The Latin America region is expected to register notable growth in the aviation fuel market during the study period. In 2022, Brazil held the largest market share in the LAMEA region. Owing to uncertainty, low literacy, and civil war in African countries, the aviation fuel market in the African region is anticipated to grow at a slow rate.

Segments Covered in the Report:

By Fuel Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

January 2025

January 2025