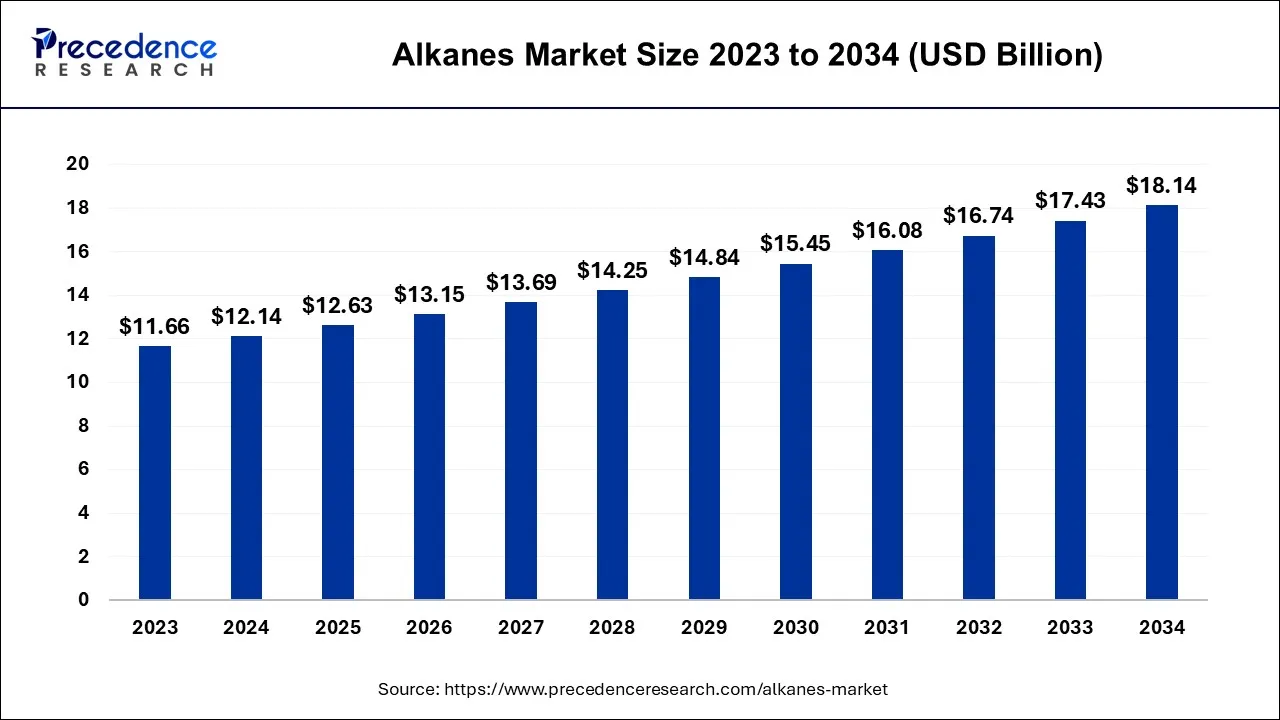

The global alkanes market size is calculated at USD 12.14 billion in 2024, grew to USD 12.63 billion in 2025, and is predicted to hit around USD 18.14 billion by 2034, expanding at a CAGR of 4.1% between 2024 and 2034. The North America alkanes market size accounted for USD 4.86 billion in 2024 and is anticipated to grow at the fastest CAGR of 4.22% during the forecast year.

The global alkanes market size is expected to be valued at USD 12.14 billion in 2024 and is anticipated to reach around USD 18.14 billion by 2034, expanding at a CAGR of 4.1% over the forecast period 2024 to 2034.

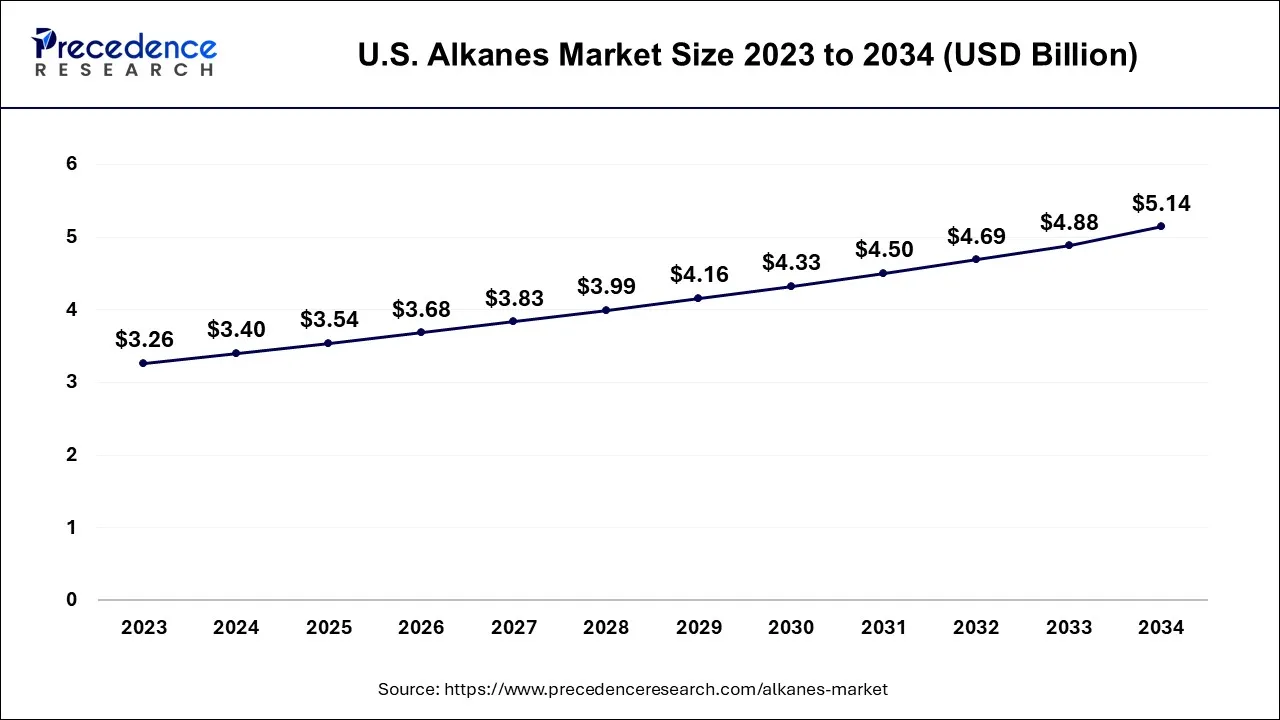

The U.S. alkanes market size is accounted for USD 3.40 billion in 2024 and is projected to be worth around USD 5.14 billion by 2034, poised to grow at a CAGR of 4.21% from 2024 to 2034.

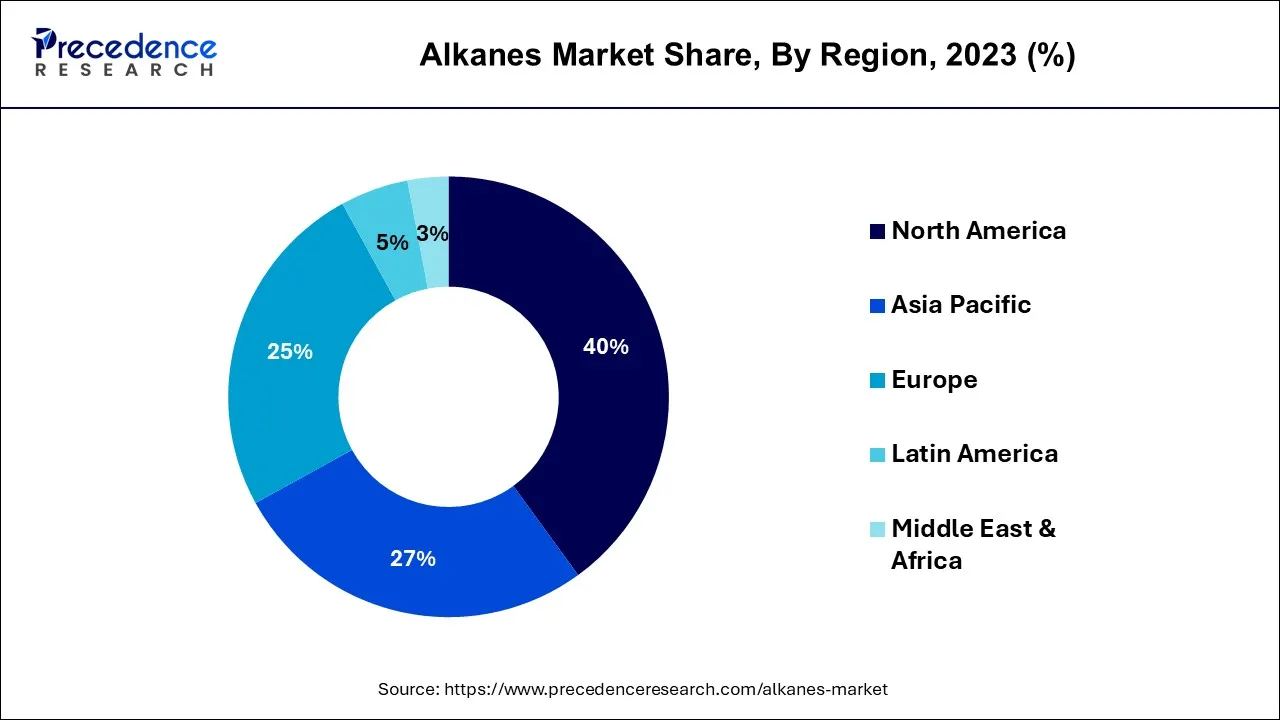

North America has held the largest revenue share of 40% in 2023. The alkanes market in North America is characterized by the prominence of the oil and gas industry. The region's established energy infrastructure and advanced extraction techniques drive substantial production. Recent trends include the growing exploration and production of shale gas, offering abundant sources of alkanes. Additionally, increasing focus on sustainability and transitioning towards cleaner energy sources is impacting the demand for natural gas, a significant component of alkanes.

Asia Pacific is estimated to observe the fastest expansion. Asia-Pacific is experiencing a significant surge in the alkanes market, primarily driven by the escalating energy demands of emerging economies. China and India, two prominent countries in the Asia-Pacific, are leading consumers in the alkanes market. Their consumption is bolstered by rapid industrialization and urbanization.

A noteworthy trend in this region is the increasing adoption of natural gas, considered a cleaner alternative to coal for power generation. Moreover, there's a strong focus on research and development initiatives, which aim to enhance extraction methods while prioritizing environmentally sustainable practices. These endeavors are a response to the ever-growing energy and petrochemical needs of the dynamic markets in Asia Pacific.

The alkanes market primarily deals with a group of hydrocarbons that are saturated and linear in structure, consisting of carbon and hydrogen atoms. These compounds have various applications across industries, including chemicals and petrochemicals, pharmaceuticals, cosmetics, polymers and plastics, and more. Saturated alkanes have single carbon-carbon bonds and find use as feedstock for various chemical processes.

Isomeric and branched alkanes offer unique properties in different applications. The market's growth is driven by the demand for hydrocarbon-based raw materials and feedstock in various industrial sectors, and it is influenced by factors such as energy needs, industrial production, and technological advancements.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.14 Billion |

| Market Size by 2034 | USD 18.14 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.1% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Plastic & polymer production and expanding petrochemical sector

The alkanes market experiences significant demand driven by two key factors: plastic and polymer production and the expanding petrochemical sector. Alkanes, as crucial components in the production of various types of plastics and polymers, are integral to these industries. The versatile applications of plastics in sectors such as packaging, construction, automotive, and consumer goods drive consistent demand for raw materials like alkanes. As global plastic consumption continues to rise, especially in emerging economies, the demand for alkanes to create polymers and plastics is set to grow steadily.

Moreover, the expanding petrochemical sector relies heavily on alkanes as feedstock. Petrochemical industries, particularly in regions experiencing rapid industrialization, are a major driver of alkane consumption. These industries use alkanes in the production of chemicals, solvents, and other essential materials. As economies develop and demand for chemicals and plastics increases, the alkanes market finds itself in a pivotal position to meet these growing needs. Consequently, the market's growth is closely tied to the robust expansion of the plastic, polymer, and petrochemical sectors.

Fluctuating crude oil prices and competition from renewable energy sources

Fluctuating crude oil prices have a significant impact on the alkanes market. Alkanes are predominantly derived from petroleum and natural gas, and their production is highly sensitive to fluctuations in crude oil prices. When crude oil prices rise, the cost of alkane production also increases, affecting their affordability and overall market demand. Conversely, during periods of low oil prices, there can be reduced incentives for energy companies to invest in alkane extraction and production. This price volatility makes it challenging for consumers and industries to predict and manage their expenses, leading to uncertainty in the demand for alkanes.

Moreover, the increasing competition from renewable energy sources presents another restraint to the alkanes market. Renewable energy sources like wind, solar, and hydropower are progressively supplanting conventional fossil fuels across diverse applications. This shift stems from growing environmental consciousness, stricter government regulations, and remarkable technological advancements in the renewable energy sector. As renewables gain traction and become more accessible, they lessen society's reliance on alkanes, presenting a formidable and enduring challenge to sustaining market demand in the context of ever-evolving energy preferences.

Growing demand in emerging economies and research development

The alkanes market is surging in response to the rapid industrialization and urbanization of emerging economies, notably China and India. These regions are experiencing a substantial rise in energy consumption, which directly drives the demand for alkanes. Alkanes, as fundamental components for fuel, chemicals, and plastics production, are integral to meeting the energy and material needs of these burgeoning industrial and urban sectors.

Moreover, these regions are investing in infrastructure development, which requires substantial amounts of plastic materials derived from alkanes. This robust industrial and economic growth in emerging economies propels the global demand for alkanes.

Research and development and continuous advancements in technology and chemistry are driving the discovery of novel ways to synthesize alkanes, expanding their applications and increasing efficiency. For instance, researchers are working on developing green and sustainable production methods for alkanes to meet the growing demand for eco-friendly alternatives.

Furthermore, R&D efforts aim to enhance the overall properties of alkanes, such as their combustion efficiency and compatibility with emerging clean energy technologies. This focus on innovation and technological advancement ensures the steady growth of the alkanes market by broadening its utility in diverse industrial sectors.

The saturated alkanes segment held 54% revenue share in 2023. saturated alkanes, also known as paraffins, are hydrocarbons consisting of only single bonds between carbon atoms. These linear or branched alkanes are characterized by their stability and lack of double bonds, making them crucial in applications like fuel and lubricants. In the alkanes market, the demand for saturated alkanes is primarily driven by their extensive use in the production of gasoline and diesel fuel, which is a key component of the global transportation sector.

The unsaturated alkanes segment is anticipated to expand at a significant CAGR of 7.2% during the projected period. Unsaturated alkanes, on the other hand, contain at least one carbon-carbon double bond, introducing reactivity and versatility. Commonly referred to as olefins, these alkanes are instrumental in the production of plastics, synthetic rubber, and chemicals.

Trends in the alkanes market indicate an increasing demand for unsaturated alkanes due to the expanding plastics and petrochemical industries. As these sectors grow, so does the need for feedstock such as ethylene and propylene, both important unsaturated alkanes. This growing demand reflects the ongoing global emphasis on sustainable materials and chemicals, further influencing industry trends in the alkanes market.

Based on the type, the linear alkanes segment is anticipated to hold the largest market share of 38% in 2023. Linear alkanes, also known as n-alkanes, are saturated hydrocarbons with a simple linear carbon chain structure. They are crucial components of many fuels and petrochemical products. In the alkanes market, linear alkanes are witnessing increased demand due to their use as feedstock in various industrial applications, particularly in the production of solvents, detergents, and lubricants.

On the other hand, the acyclic alkanes segment is projected to grow at the fastest rate over the projected period. Acyclic alkanes, on the other hand, are open-chain hydrocarbons that may have branches or substituents in their structure. They are versatile compounds that find application in a range of industries. In the market suggest growing demand for acyclic alkanes due to their utilization in the production of high-performance motor fuels and the increasing emphasis on green and sustainable chemistry practices. These trends reflect the market's responsiveness to environmental concerns and the need for cleaner and more efficient energy solutions.

In 2023, the chemicals & petrochemicals segment had the highest market share of 42% on the basis of the end user. In the alkanes market, the chemicals & petrochemicals sector is a prominent consumer. These chemicals, including ethylene and propylene, play an indispensable role in synthesizing plastics, resins, and a wide range of chemical products.

With the global demand for plastics and chemical goods showing no signs of diminishing, the chemicals & petrochemicals segment stands as a robust driver for the alkanes market. Additionally, there's a growing focus on sustainable practices within this sector, leading to increased demand for renewable and bio-based alkanes as a greener feedstock.

The polymers & plastics segment is anticipated to expand at the fastest rate over the projected period. In the polymers & plastics segment, alkanes are primarily utilized as the building blocks for polymer production. With the increasing demand for plastics in various industries, including packaging, automotive, and construction, the need for alkanes remains strong.

The market trend is shifting towards developing biodegradable and sustainable plastics, which is expected to influence the choice of feedstock. As environmental concerns rise, the industry is exploring alternative sources for alkanes, like bioplastics and recycling, to meet sustainability objectives while maintaining the production levels of polymers and plastics. This transition aligns with the global push for eco-friendly and circular economy practices.

Segments Covered in the Report

By Product

By Type

By Application

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client