April 2025

Alternative Protein Market (By Product: Plant Proteins, Legumes, Roots, Ancient Grains, Nuts & Seeds, Microbe-Based Protein, Insect Protein; By Application: Food & Beverages, Infant Formulations, Clinical Nutrition, Animal Feed, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

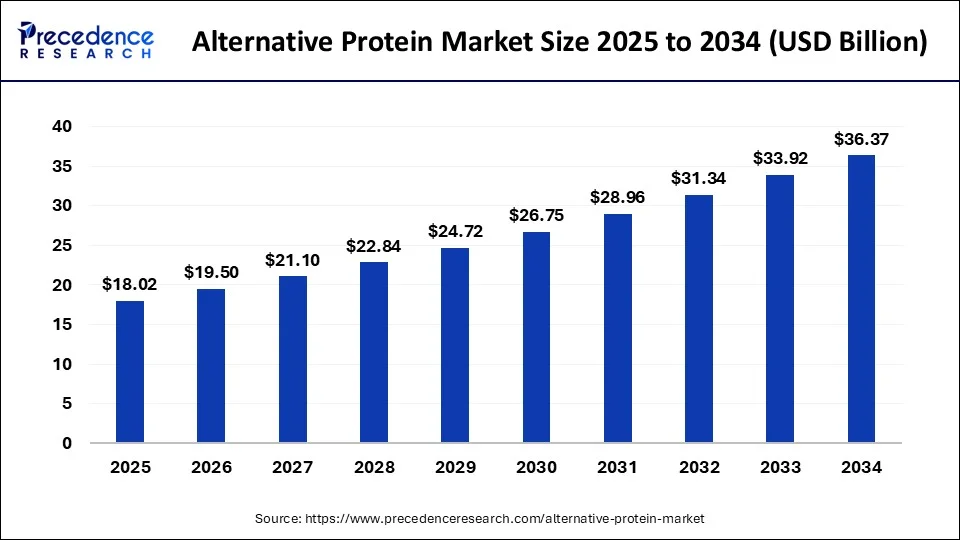

The global alternative protein market size was USD 15.38 billion in 2023, calculated at USD 16.65 billion in 2024 and is expected to reach around USD 36.37 billion by 2034, expanding at a CAGR of 8.23% from 2024 to 2034. The North America alternative protein market size reached USD 5.84 billion in 2023. Rising awareness about the benefits of plant-based protein can increase the alternative protein market.

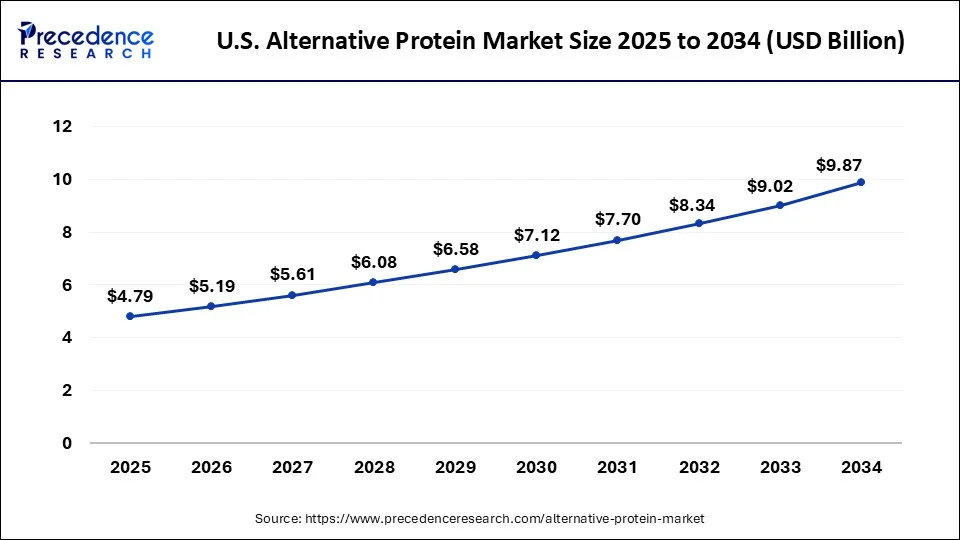

The U.S. alternative protein market size was exhibited at USD 4.09 billion in 2023 and is projected to be worth around USD 9.67 billion by 2034, poised to grow at a CAGR of 8.45% from 2024 to 2034.

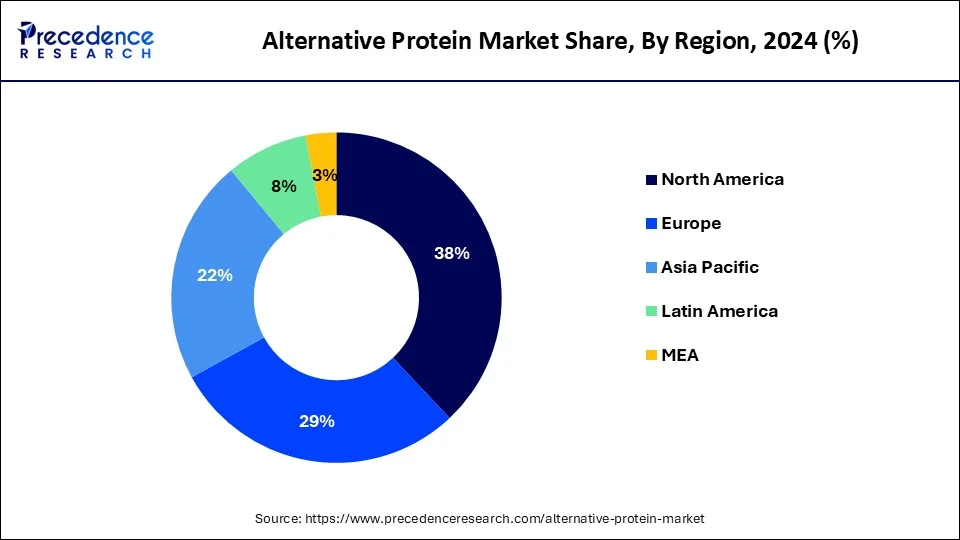

North America dominated the alternative protein market in 2023. The demand for alternative protein products from consumers has increased significantly in North America because of trends including flexitarianism, veganism, vegetarianism, and health-conscious eating. As alternatives to conventional animal-based goods, consumers in this region are actively looking for plant-based, insect-based, and cell-based protein sources.

North America gains from a thriving market infrastructure that facilitates the manufacturing, distributing, and advertising of substitute protein goods. These include wide-ranging food service channels, strong retail networks, and internet platforms that serve a variety of customer demographics. In the field of alternative proteins, innovation and product development are concentrated in North America. In the region, a large number of start-ups, food firms, and research institutes are actively engaged in creating new protein sources and enhancing current goods.

Asia Pacific is expected to grow at the highest CAGR in the alternative protein market during the forecast period. There is a sizable and quickly expanding population in Asia Pacific, especially in metropolitan areas. The demand for alternate protein sources, greater consumer knowledge, and shifting dietary habits are all linked to urbanization. The growing middle-class size and increased discretionary income are the results of the economic expansion seen by several of the region's countries.

The dietary tastes in Asia Pacific are shifting in favor of healthier and more sustainable sources of protein as a result of these demographic changes. The growing worries about environmental sustainability and food security have led to a surge in interest in alternative proteins, which, when compared to traditional animal-based proteins, promise reduced environmental impact and effective resource utilization. Insect and plant-based protein eating are part of the cultural traditions of many Asia Pacific nations. The adoption of different protein sources in the community is facilitated by this cultural acceptability.

The alternative protein market refers to protein sources that are not obtained from conventional animal sources, such as cattle, chicken, pig, or fish, which are referred to as alternative proteins. Rather, they include a wide variety of protein-rich substitutes that may be obtained from algae, fungus, plants, insects, and even animal cells that have been cultivated or developed in a lab.

Many factors, including health advantages, environmental sustainability, ethical issues, and technical breakthroughs in food production, are contributing to the growing popularity of these proteins. Because they may lessen their environmental effect, fulfill a range of consumer dietary demands and tastes, and solve global food sustainability concerns, alternative proteins are becoming more and more popular as viable substitutes for traditional animal-based proteins.

| Report Coverage | Details |

| Market Size by 2034 | USD 36.37 Billion |

| Market Size in 2023 | USD 15.38 Billion |

| Market Size in 2024 | USD 16.65 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of plant-based protein

The rising adoption of plant-based protein can grow the alternative protein market. The health advantages of plant-based diets, such as lowered risks of diabetes, heart disease, and several malignancies, are becoming more well-known to consumers. The plant-based protein products are in high demand due to this shift in customer preferences.

Possibility of side effects in allergic people

The possibilities of side effect in allergic people may slowdown the alternative protein market. The plant-based proteins are frequently produced from common allergens such as soy, almonds, and legumes. Customers may be discouraged from trying or consistently drinking these items due to their concern about allergic responses.

Innovation in food technology

The innovation in food technology may be the opportunity to boost the alternative protein market. Plant-based proteins that closely resemble the flavor, texture, and nutritional makeup of animal-based proteins may now be produced because of developments in food technology. This increases the attractiveness of these alternatives to a wider range of consumers, including non-vegans and vegetarians.

The plant protein segment dominated the alternative protein market in 2023. The growing consciousness among consumers regarding the potential health advantages of plant-based diets, such as lowered cholesterol, decreased heart disease risk, and improved weight control, has stimulated the market for plant-based proteins. Customers are looking for more sustainable options, such as plant-based proteins, as a result of growing worries about the negative environmental effects of animal agriculture, such as greenhouse gas emissions, deforestation, and water consumption.

Choosing plant-based proteins over those obtained from animals has become more popular among consumers due to ethical concerns regarding animal welfare. With a large range of products that imitate the flavor, texture, and appearance of animal-based proteins, the market for plant-based proteins has experienced substantial innovation. The products like plant-based sausages, burgers, dairy substitutes, and more fall under this category.

The insect protein segment is expected to grow at the highest CAGR in the alternative protein market during the forecast period. Because of their high protein content, vitamin, mineral, and essential fatty acid content, insects offer a nutrient-dense substitute for conventional animal-based proteins. Compared to conventional animal farming, insect farming uses less space, water, and feed, making it a more sustainable source of protein.

This is consistent with the growing emphasis on environmental sustainability among consumers & businesses. Compared to conventional cattle, insects may generate a substantial quantity of protein per unit of meal intake due to their high feed conversion efficiency. Because it produces less greenhouse gas emissions than traditional cattle farming, insect farming is becoming more and more popular as a sustainable source of protein. Since many cultures already include insects in their regular meals, the acceptance and adoption of insect-based protein products are facilitated in those areas.

The food & beverages segment dominated the alternative protein market in 2023. The alternative proteins are adaptable components that may be utilized to make a range of food and drink items. Examples of these include proteins derived from plants, insects, and cells. This covers plant-based dairy alternatives (like yogurt and plant-based milk), meat replacements (like burgers and sausages), baked products, snacks, and more. Concerns about the effects of food choices on health and the environmental impact of food production are growing among consumers.

When opposed to traditional animal-based proteins, alternative proteins frequently provide perceived health benefits (such as lower cholesterol and saturated fats) and environmental advantages (such as fewer greenhouse gas emissions and reduced water consumption). The wider range of consumers may now obtain alternative protein products as they become more generally available in stores, supermarkets, and online. Increased availability fuels demand and propels the food & beverages segment to the alternative protein market supremacy.

The animal feed segment is expected to grow at the highest CAGR in the alternative protein market during the forecast period. The need for animal feed high in protein rises in tandem with the worldwide demand for meat, dairy, and aquaculture products. Alternative proteins can be effective and sustainable sources of protein for the aquaculture and cattle sectors. Traditional animal feed sources like fish meal and soybean meal have issues with availability, cost, and sustainability.

These conventional feed components can be supplemented or replaced with alternative proteins, such as those derived from insects, microorganisms, or even plants. Comparing alternative proteins to traditional feed components, animal feed frequently has a lesser environmental impact. For instance, compared to animal farming or conventional feed crops, insect farming uses less land and water and produces less carbon emissions.

Segment Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

December 2024

February 2025