January 2025

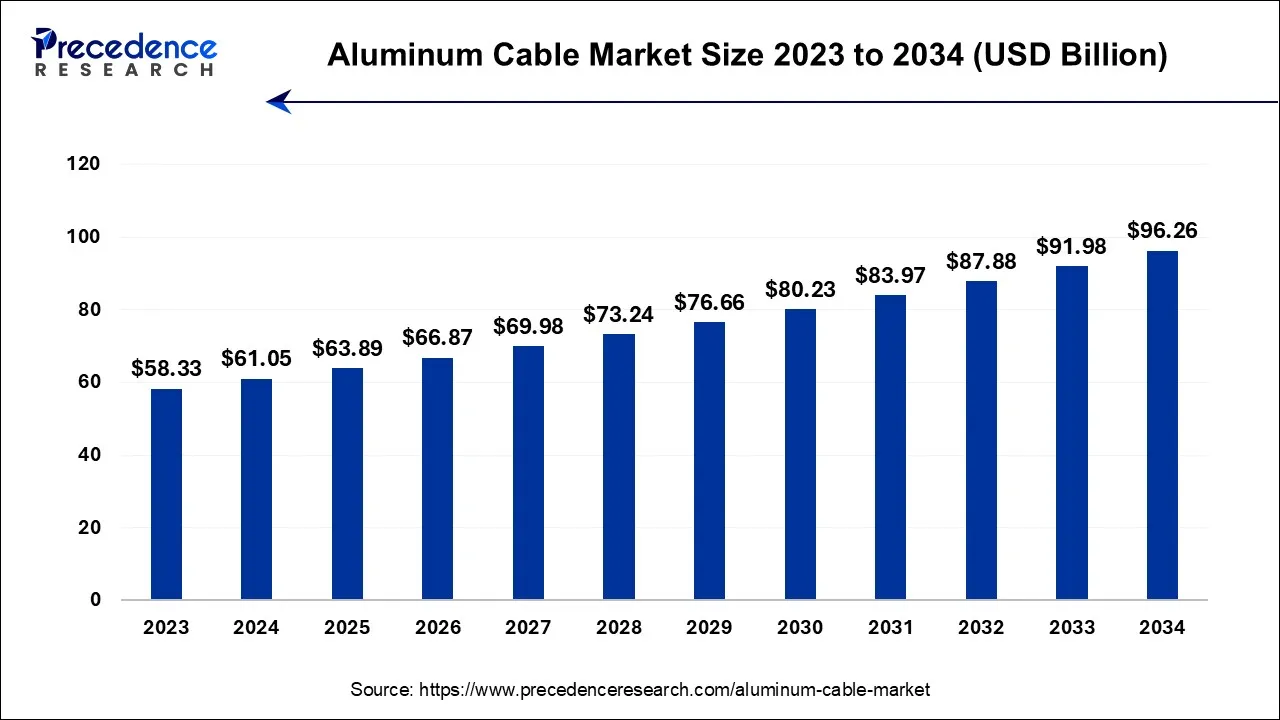

The global aluminum cable market size is calculated at USD 61.05 billion in 2024, grew to USD 63.89 billion in 2025, and is predicted to hit around USD 96.26 billion by 2034, poised to grow at a CAGR of 4.66% between 2024 and 2034.

The global aluminum cable market size is expected to be valued at USD 61.05 billion in 2024 and is anticipated to reach around USD 96.26 billion by 2034, expanding at a CAGR of 4.66% over the forecast period from 2024 to 2034.

The aluminum cable market deals with the sale and manufacturing of wires and cables that use aluminum as the primary conductor material. Aluminum cables provide advantages over traditional copper such as being lighter in weight, being less prone to corrosion, and having greater tensile strength. Due to their ability to handle high currents at lower costs compared to copper cables, they are commonly used for household wiring applications, ground wires for communication towers, and overhead power lines. In addition, the increasing expansion of railway networks and rising demand from the power sector. Furthermore, increasing demand for home appliances and consumer electronics, rising disposable incomes, changing lifestyles, and increased purchasing power have boosted the sales of various consumer products such as laptops, televisions, washing machines, refrigerators, conditioners, and other small appliances.

Aluminum wires provide greater resistance to corrosion, and they provide versatility due to which they are used in various sectors to a great extent. Extensive use of aluminum wires in electrical appliances, the automotive sector, transformers and electrical fittings has grown. Demand for these aluminum cables is growing well in various nations across the globe as the use of these aluminum wires is more in different types of industries. Industries like electronics and automotive along with the food and beverages industry make extensive use of aluminum wires. The microorganism can be prevented from growing with the use of Aluminum and it also helps in preserving different types of food for a longer period of time. The automotive industry makes use of aluminum in the making of vehicles as it assists in reducing the weight of the vehicle. Even though the weight of the vehicle is reduced the strength is not compromised and the carrying capacity is also not compromised.

| Report Coverage | Details |

| Market Size in 2024 | USD 58.33 Billion |

| Market Size by 2034 | USD 87.91 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.66% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Grade, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product, the enameled segment has held the highest revenue share in 2023 as it has generated an amount of about 25 billion in the past. align cables are used on a large scale in the Transformers as they are light in weight, and they have great resistance to heat. Moving coils are used in various electrical gadgets where aluminum wires are of great use. Generators and refrigerators make extensive use of Aluminum cables due to which the market is expected to grow significantly.

Paper-insulated rectangular and round aluminum wires will also show a good growth in the coming years. They have great resistance to solvents and abrasion. They provide better electricity performance. Fiberglass insulation Aluminum wires will also show a good demand as these wires provide a great deal of thermal stability. As these wires are highly insulated, they are good use in Transformers. These wires are resistant to abrasion, and they have electrical properties.

The electrical grade segment accounted for the largest market share in 2023. Aluminum has been used in electrical appliances and its substitution and usage against copper in electrical appliances increased post-World War ll leading to its lightweight, high electrical conductivity, and low cost. Aluminum is the most preferred material for electricity distribution, transmission, and other related applications.

The mechanical segment is expected to grow fastest during the forecast period. The flexibility provided by aluminum cables, tailored to their lightweight makes them preferable for use in mechanical appliances. Aluminum cables are used in the production of wire cloth or wire mesh, which are significantly used in industrial, commercial, and residential applications. Wire mesh is used in balustrades, walls, ceilings, and facades, in residential applications. Other uses of aluminum wires such as floor gratings, warehouse & industrial shed slabs, precast panels, pavement, animal-loading cages, security fences, safety barriers, and storage containers.

On the basis of application, the automotive sector held more than 48% revenue share in 2023. Aluminum cables are of great help in reducing the weight of the vehicle by about 49% due to which the demand for aluminum cables is expected to grow significantly. Terminal contact is also increased, and it also provides better flexibility. Galvanic corrosion can also be reduced to a great extent due to the use of this product and the market will show significant growth in the coming years due to its rapid demand for the automotive sector. 3% growth has been registered for the aluminum wires in the application of meters, switches and circuit Breakers.

Electrical appliances make great use of aluminum wires as it helps in improving the quality. They are also used in light bulbs and also used for different types of connectors. Rotating machines and motors also make a great use of aluminum wires and the application of aluminum wires in this sector will lead to a significant growth which is expected to be about 15 U.S. dollars in the coming years. In order to increase the efficiency of various motors and in the motors where there are major irregularities aluminum wires are used.

The aluminum cable market will register maximum growth in the North American region in the coming years. Aluminum cables are used in various industries, especially for the transmission of electricity and distribution of electricity. Aluminum wires are considered to be extremely safe for home wiring and for buildings. These wires offer maximum durability and shelf life which is expected to be about 40 years. These buyers provide high strength due to which they are preferred mostly in many construction industries. Regional growth is driven using aluminum cables in the electrical connections across the North American region.

The aluminum cable market is expected to show a significant growth even in the European region for the nations like France, Netherlands, Italy, Germany and United Kingdom. Sustainable buildings or green buildings. Walls and building projects make use of aluminum as insulation and it also provides fresh air and daylight in the houses and buildings. But the word for aluminum is expected to grow extensively in the European region to save electricity Peter in the countries like China India and Japan the new aluminum wire will increase during the forecast period is expected to show a compound annual growth rate of about 3.5%. These are the countries that will register maximum growth in the Asia Pacific region. Aluminum cables do not break easily, and they have better durability and strength as compared to the other options they are largely used in the construction sector in the region. The market growth is stimulated due to the property of the cables being lighter in weight.

Segments covered in the report

By Grade

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

November 2024