February 2025

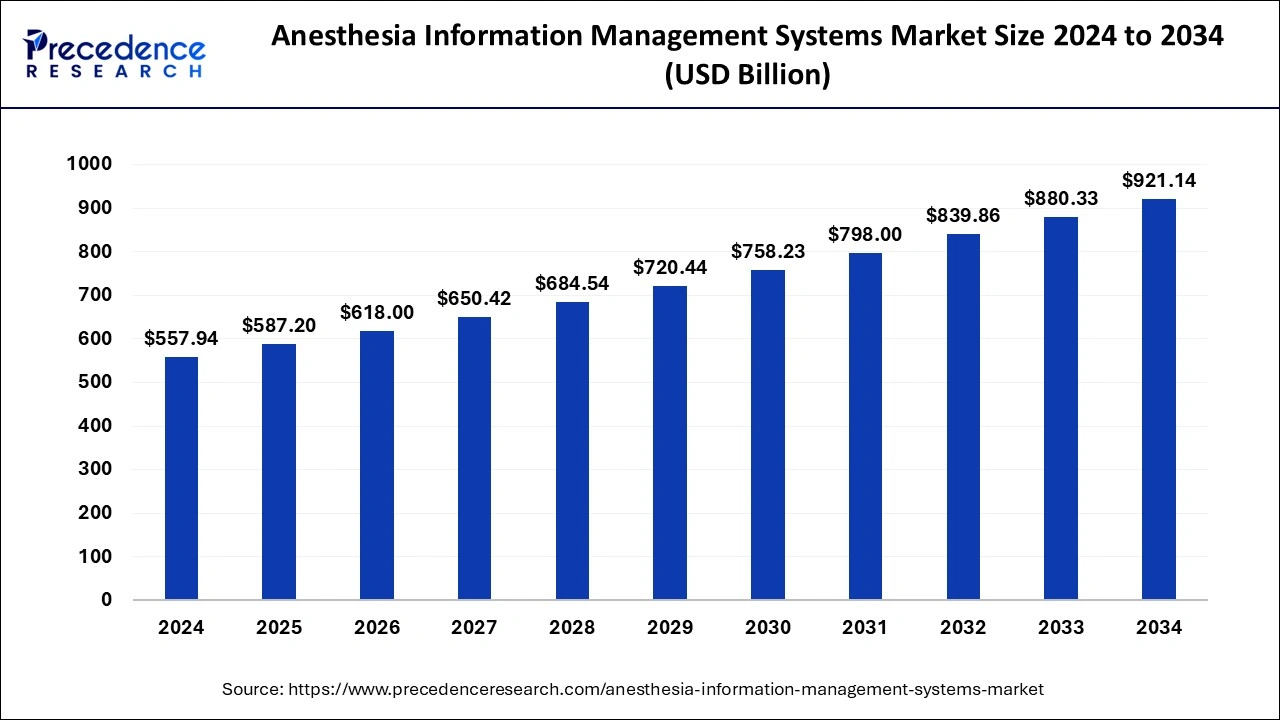

The global anesthesia information management systems market size is calculated at USD 587.2 billion in 2025 and is forecasted to reach around USD 921.14 billion by 2034, accelerating at a CAGR of 5.14% from 2025 to 2034. The North America anesthesia information management systems market size surpassed USD 362.66 billion in 2024 and is expanding at a CAGR of 5.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global anesthesia information management systems market size was accounted for USD 557.94 billion in 2024 and is anticipated to reach around USD 921.14 billion by 2034, growing at a CAGR of 5.14% from 2025 to 2034.

Advanced technologies like artificial intelligence (AI) and machine learning (ML) are transforming the market. AI-driven data analytics help manage anesthesia-related data in real-time. It provides detailed insights to healthcare providers by recording drug dosage, thereby reducing possible risks and enhancing patient care. AI’s predictive modeling capabilities forecast patient outcomes, which helps decision-making and adjust use of anesthesia.

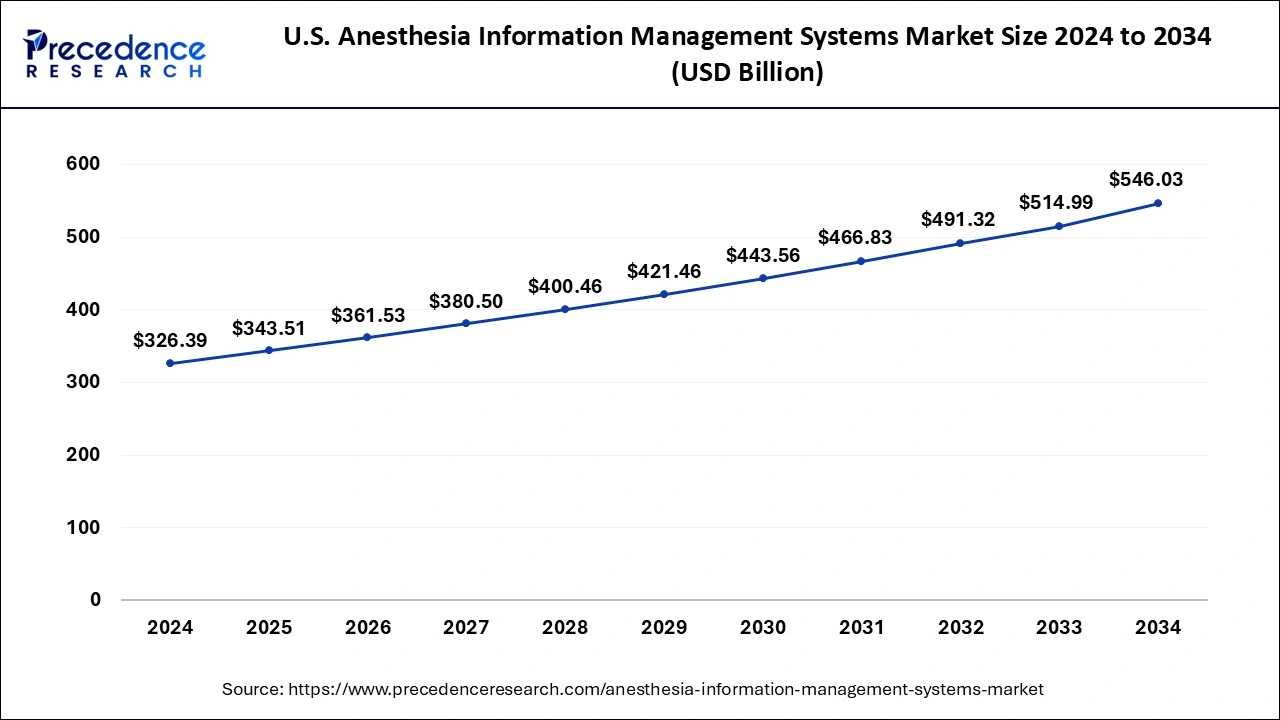

The U.S. anesthesia information management systems market size was evaluated at USD 326.39 billion in 2024 and is predicted to be worth around USD 546.03 billion by 2034, rising at a CAGR of 5.28% from 2025 to 2034.

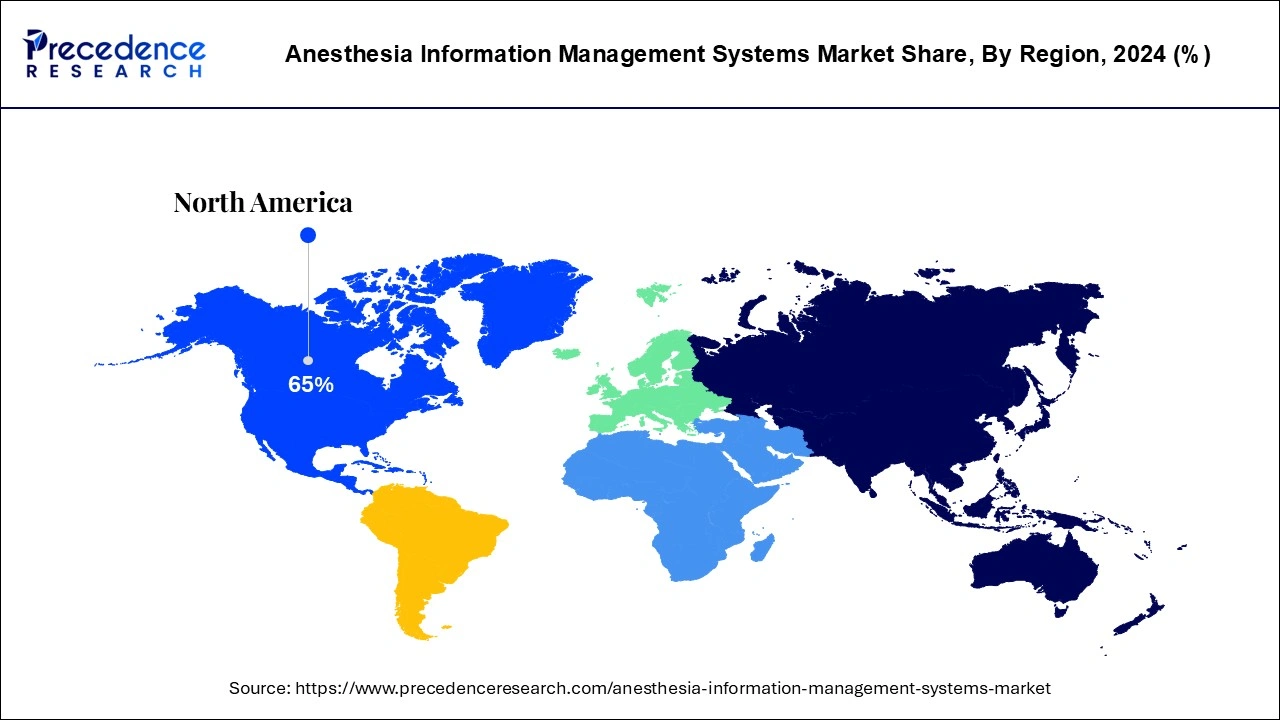

North America held the greatest share of over 65% in 2024 as a result of greater awareness of the efficacy of anesthesia information management systems, a focus on anesthetic dose and thorough data management, as well as rising demand for knowledge-based medical equipment. A few of the main causes for expecting the region to expand are the increasing number of efforts to enhance healthcare IT and the availability of healthcare programs.

The strategic actions made by industry players in the area and significant R&D spending are also expected to benefit the North American market. For instance, in March 2022, Surgical Information Systems moved its corporate offices to the Avalon district. The new office is intended to be a state-of-the-art meeting and collaboration space that accommodates flexible working hours.

The market in Asia-Pacific is anticipated to develop most quickly. The market is supported by a rapidly expanding healthcare infrastructure as well as a rising pool of patient populations with chronic illnesses that call for surgical treatments. The Indian government introduced the national digital health mission in August 2020, a comprehensive digital health ecosystem. These initiatives can help the market in the area to witness growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 587.2 Billion |

| Market Size by 2034 | USD 921.14 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.14% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution Type, By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

A growing focus on complete data management will facilitate growth at a rapid pace.

The global market for anesthesia information management systems is expanding as a result of increased awareness of the usefulness of these systems as well as rising demand for knowledge-based medical equipment. The use of anesthesia information management systems in university anesthesiology departments in the US is estimated to be 75%, with a projected increase to 84% by 2020, according to the Anesthesia Patient Safety Foundation.

In the upcoming year, this tendency will continue to expand the market for anesthesia information management systems. However, it is anticipated that the high cost of anesthetic management systems, high reported cases, difficulties in capturing reported cases of incorrect warnings, and confusing user interface would restrain the expansion of anesthesia information management systems globally.

Insufficient healthcare facilities in developing regions.

The market is threatened by the dearth of healthcare resources and services in rural regions that are undeveloped and backward. The anesthetic information management systems market is also predicted to face challenges from low health awareness, low per capita income, and subpar surgical facilities.

Inhaled anesthetics are expensive.

The high cost of inhaled anesthetics is motivating greater research and development spending on more affordable anesthetics with low carbon emission characteristics. It is projected that this will increase the market prospects for anesthesia information management systems.

Increasing senior population

Surgery cases and hospitalization rates are rising as a result of the aging population's increased prevalence of musculoskeletal injuries and intestinal and gastrointestinal illnesses. These will probably lead to more need for anesthesia information management systems.

Software with hardware and related components is also seeing a substantially increased market volume as a result of the majority of hospitals and related end-users adopting modern healthcare infrastructure. The user would have a cost-effective alternative of reducing the significant expenditure on capital equipment and associated upkeep by installing such software together with the whole configuration.

Additionally, an AIMS improves patient safety by generating evidence-based recommendations to lower risks during surgery and automatically uploading data from physiological monitoring and anesthesia equipment to an electronic anesthetic chart. These are just a few of the benefits that hospitals and medical professionals should find appealing since these cutting-edge technologies will ultimately result in fewer dosage errors, which will help the market grow throughout the projected period.

By using strategies like collaborations with local businesses to broaden their reach and provide better solutions at a lower cost, the firms are building their market presence, which will eventually lead to an increase in the total market growth over the course of the projection year. For instance, in order to sell and distribute its clinical productivity solution in Saudi Arabia, Provation hired Gulf Medical Company, Ltd. as an exclusive collaborator in February 2022.

Medical professionals make better judgments and manage hospital OR rooms and ASC settings overall thanks to the next-generation AIMS software and its related configuration, which promotes speedier adoption.

The hospital sector is expected to hold the largest market share in 2024 and is expected to maintain that position throughout the forecast period as most hospitals handle significant treatments for chronic or fatal diseases. As a result, the need for advanced OR settings—which, in some cases, also requires specialized AIMS installations—leads to the hospital sector.

Hospitals are a crucial part of healthcare and the industry's major revenue generator, supporting technology and research not just in the U.S. but also more broadly in regions like Europe. Because of this, only a few businesses invest in strategies like marketing, sales, and advertising to sell their goods at most hospitals. Plexus Technology Group, LLC said in February 2022 that the deployment of its Anesthesia Touch into more than 1,000 hospital systems throughout the nation had given it a significant breakthrough.

The ambulatory surgical centers segment has generated a 28% revenue share in 2024 and it is predicted to grow faster than other market segments over the forecast period. A significant issue facing the healthcare industry is the rise in expenses, which is compounded by the reality that only a select group of individuals can afford the necessary therapy, including surgical operations. ASCs are also advantageous locations for elective surgery and provide the patient with defensive measures.

As a result, healthcare professionals are now required to use more sophisticated settings, one of which incorporates AIMS as a component to discover new strategies for increasing the accessibility of such treatment without sacrificing its quality. Add to the category with faster growth as a result, since ASCs have shown to be a good answer in this case.

By Solution Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

November 2024