December 2024

Animal Biotechnology Market (By Product: Diagnostics Tests, Vaccines, Drugs, Reproductive and Genetic, Feed Additives; By Animal Type: Companion, Livestock; By Application: Diagnosis of Animal Diseases, Treatment of Animal Diseases, Preventive Care of Animals, Drug Development, Others; By End-use: Laboratories, Point-of-Care Testing/In-house Testing, Veterinary Hospitals & Clinics, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

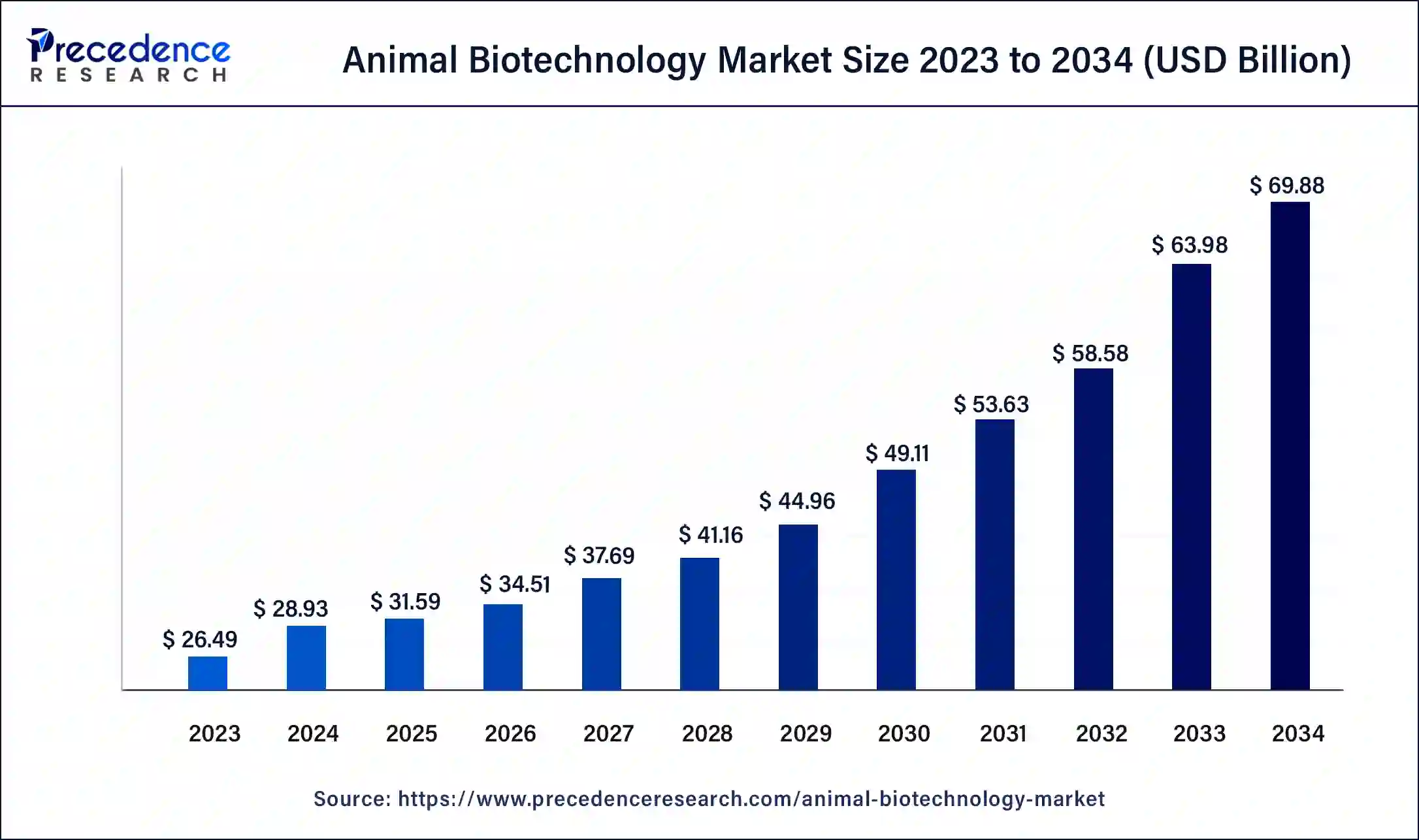

The global animal biotechnology market size was USD 26.49 billion in 2023, calculated at USD 28.93 billion in 2024 and is expected to reach around USD 69.88 billion by 2034. The market is expanding at a solid CAGR of 9.22% over the forecast period 2024 to 2034. The North America animal biotechnology market size reached USD 9.01 billion in 2023. The animal biotechnology market is driven by the frequency and intricacy of animal illnesses rising.

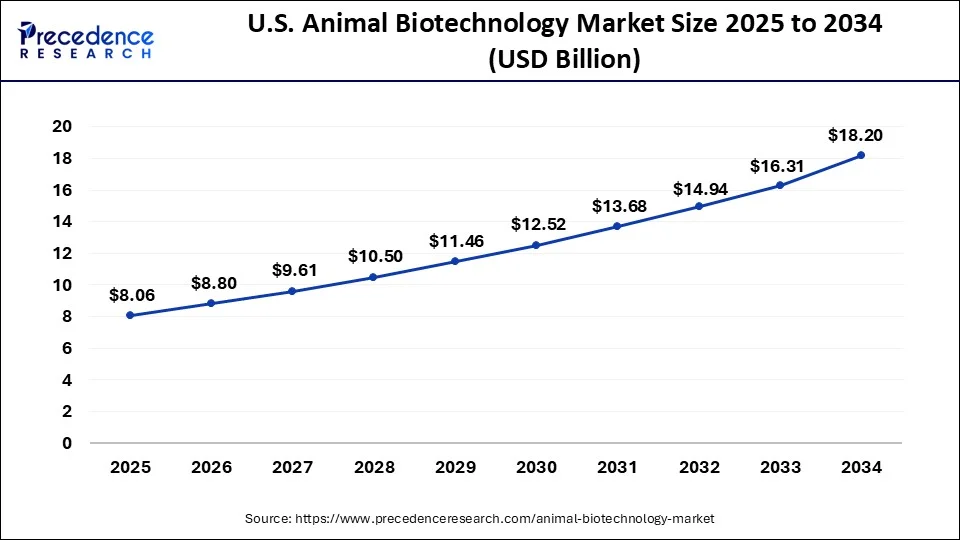

The U.S. animal biotechnology market size was exhibited at USD 6.75 billion in 2023 and is projected to be worth around USD 18.20 billion by 2034, poised to grow at a CAGR of 9.43% from 2024 to 2034.

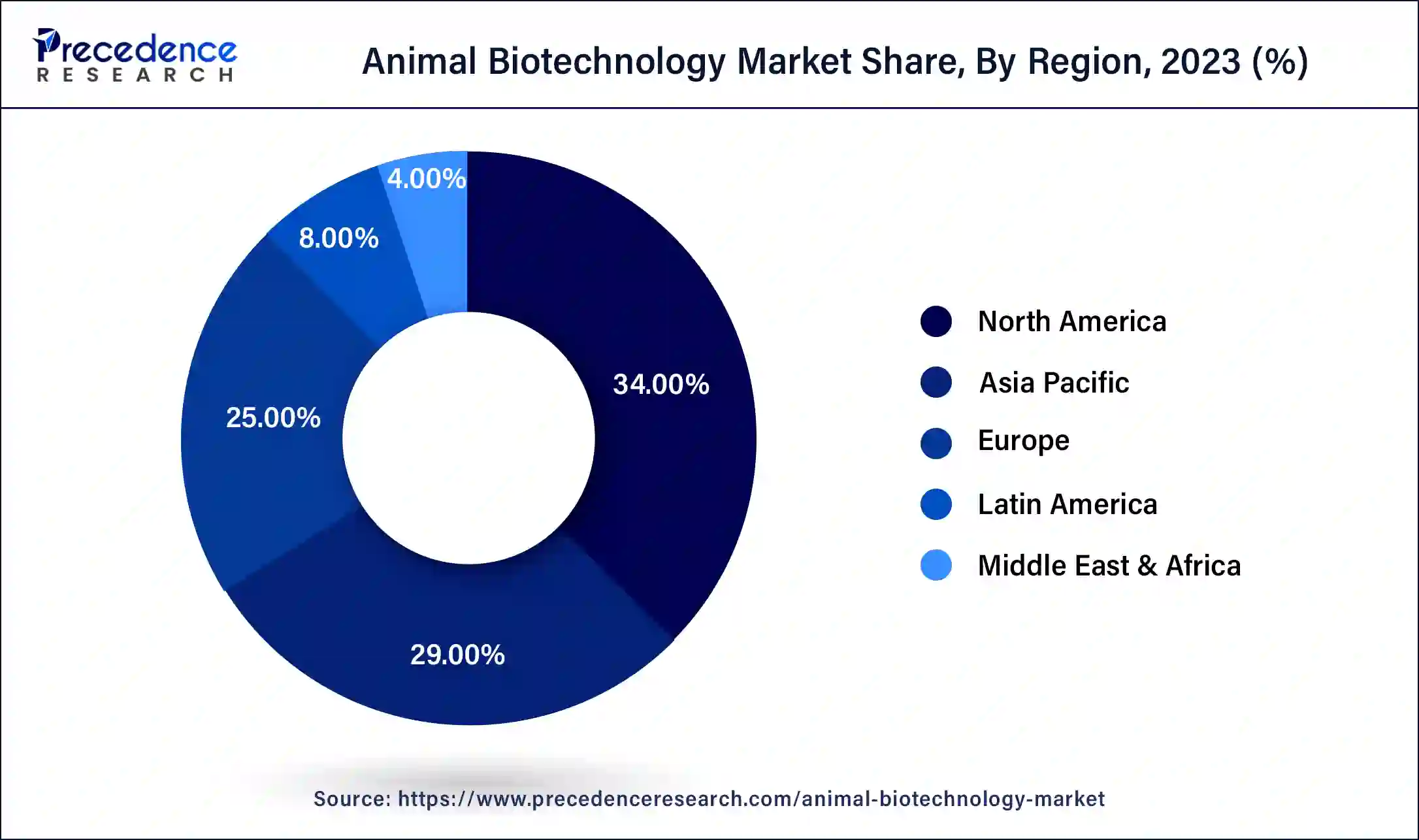

North America dominated in the animal biotechnology market in 2023. The United States Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA) are two examples of established regulatory bodies in North America that offer precise standards and frameworks for developing and approving biotechnological goods. These organizations guarantee goods' efficacy and safety, promoting customer confidence and market access. Rigorous intellectual property regulations well protect biotechnological innovations in the United States and Canada. This instills confidence in businesses to engage in R&D since they know their innovations will be protected from unlawful usage.

Asia-Pacific is observed to be the fastest-growing in the animal biotechnology market during the forecast period. Increasing disposable incomes result from the rapid economic expansion of Southeast Asian, Indian, and Chinese nations. This, in turn, fuels the demand for premium animal products and cutting-edge veterinary care. Biotechnological advancements find fertile ground as farming and animal husbandry operations become more advanced and efficient due to the growing urban population.

Anand Srivastava of the National Institute of Animal Biotechnology (NIAB) and his colleagues used a computational biology method to build a multi-epitope protein, a collection of numerous tiny peptides combined into a single continuous protein fragment, as a potential LSD virus vaccine.

Molecular biology methods are applied in animal biotechnology to genetically alter animals or change their genomes to make them more suitable for industrial, medicinal, or agricultural use. Recent developments in gene expression, metabolic cell profiling, and animal genome sequencing have made animal biotechnology advances more uncomplicated. Recent advancements in genome editing technologies, such as Zinc Finger Nucleases, TALENS, and CRISPR-Cas systems, have made generating animal genetic changes that enhance agricultural productivity, health and well-being, and disease resistance easier.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.88 Billion |

| Market Size in 2023 | USD 26.49 Billion |

| Market Size in 2024 | USD 28.93 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Animal Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising need to develop genetically modified therapeutic proteins

Therapeutic proteins can replace an aberrant or insufficient protein in each condition. Moreover, they can increase the body's supply of healthy protein to lessen the effects of chemotherapy and illness. Proteins that have been genetically modified can be made to resemble better the natural proteins they are meant to replace, or they can be made to function longer by including sugars or other compounds.

Among the macromolecular therapeutic proteins are cytokines, IFNs, and monoclonal antibodies. CYP enzymes are not suitable substrates for proteins. Generally, they are eliminated through renal filtration or broken down into smaller peptides or amino acids in various tissues by phagocytic cells that circulate or target antigen-containing cells. This is what fuels the expansion. This drives the growth of the animal biotechnology market.

Application in cancer treatment

Cancer is a hotspot for medical research because it has historically been the subject of global human interest. Researchers utilize animals in their studies to learn more about the mechanisms underlying cancer, including tumor growth and dissemination, and to create novel approaches to diagnosing, treating, and preventing the illness. Mice whose tumors can resemble those of human cancer patients are the primary tool used in research at the ICR. Research on cancer in mice replicates the intricate processes involved in tumor growth and metastasis in humans.

Animal models can be used for gene therapy research, cancer treatment screening, and the biochemical and physiological mechanisms of cancer incidence and progression in objects.

High development costs pose challenge for small players

The development of biotechnology solutions necessitates pricey cutting-edge equipment and knowledge. Small businesses frequently lack the funding essential to invest in the cutting-edge labs, and knowledgeable staff required for creative R&D. Small players must negotiate a complicated web of national, international, and local laws, each with specific criteria for compliance. Because businesses frequently need to pay regulatory specialists or consultants to manage this process, this increases the financial burden. This limits the growth of the animal biotechnology market.

Growing awareness regarding animal health and welfare

Animal welfare, as defined by the Farm Animal Welfare Council (FAWC), concerns the physical and emotional health of animals. Another name for it is the "quality of life" of an animal. Legally speaking, a person's need to assume responsibility for and care for animals protects animal welfare.

Even in the most developed nations today, there is still a noticeable lack of dedication to animal care, primarily due to a lack of public knowledge and responsibility for pet ownership. Since the Internet and the media are so widely accessible, information regarding unresolved pet-related queries is easily obtainable. As a result, a veterinarian's job is more comprehensive, mainly when he provides his patients with information that helps them understand their condition and prevents misunderstandings.

The vaccines segment dominated the animal biotechnology market in 2023. New and improved vaccinations have been made possible by developments in genetic engineering and molecular biology. Subunit, DNA, and recombinant vaccines are examples of this; they are frequently safer and more effective than conventional vaccinations. Immune responses to vaccines have been strengthened and made more targeted thanks to biotechnology. As a result, there are now fewer adverse effects, and vaccination campaigns are more effective overall.

The diagnostics tests segment is observed to be the fastest growing in the animal biotechnology market during the forecast period. Accurate and prompt diagnoses are more critical than ever since animal infectious and chronic diseases like foot-and-mouth disease, avian flu, and zoonotic diseases are on the rise. The necessity of early and accurate detection for efficient disease management and control drives the demand for diagnostic tests. Given that animal health impacts public health and food safety, government agencies and international organizations are focusing on it more and more. The industry is expanding due to funding and projects to upgrade the infrastructure for animal health, such as creating and implementing cutting-edge diagnostic procedures.

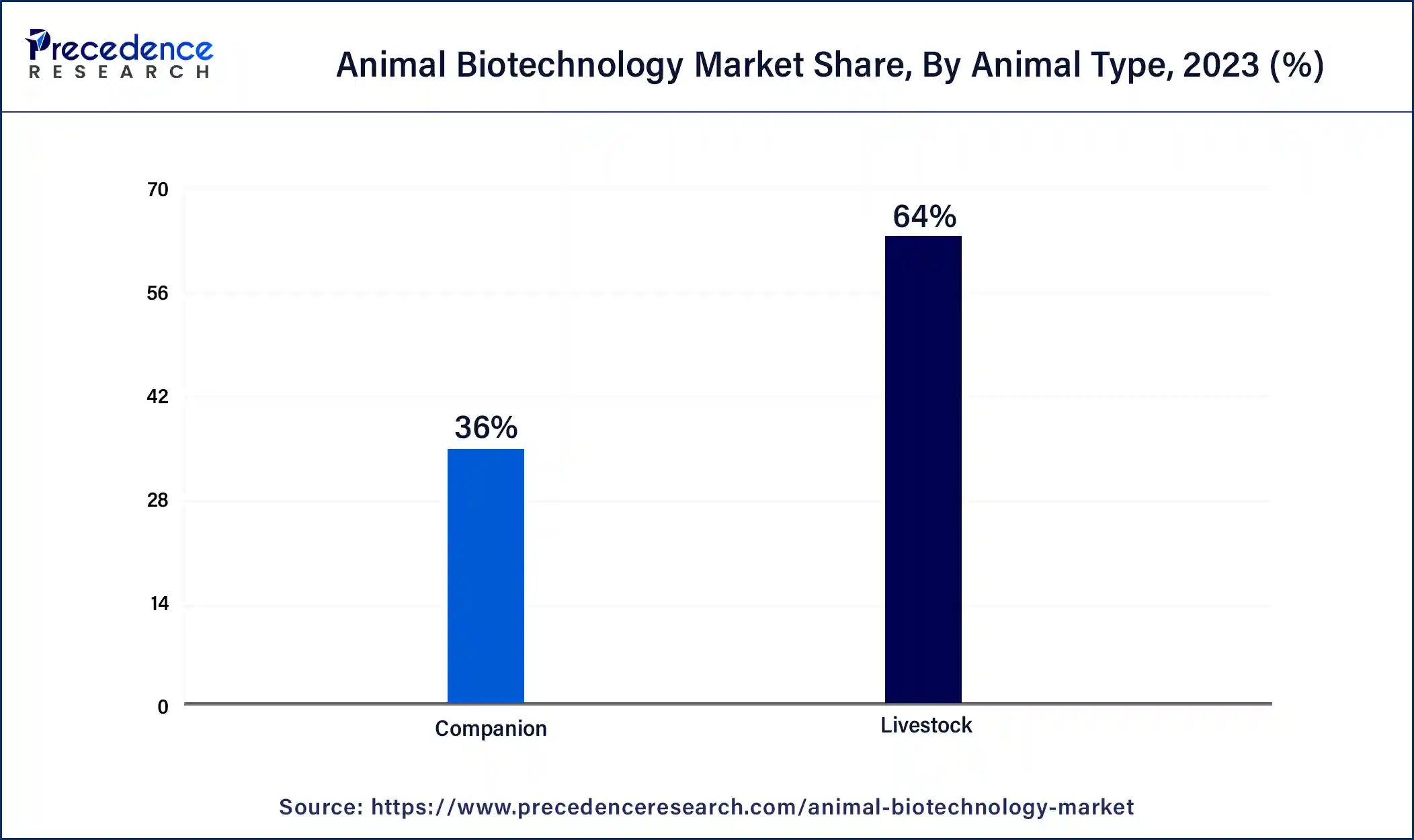

The livestock segment dominated the animal biotechnology market in 2023. Biotechnology has transformed livestock breeding through cloning, marker-assisted selection, and genetic engineering. These techniques improve desired characteristics like feed efficiency, growth rate, and disease resistance. For farmers, genetically modified animals are more profitable and sustainable because they grow quicker, provide more milk, and are disease resistant.

The companion segment shows lucrative growth in the animal biotechnology market during the forecast period. Advances in genetic engineering and gene therapy have made it possible to treat genetic illnesses in pets, extending their lives and enhancing their quality of life. Pets with chronic diseases like cancer and arthritis are now receiving better care because of biopharmaceuticals like monoclonal antibodies.

The preventive care of animals segment dominated in the animal biotechnology market in 2023. Farmers and pet owners might benefit financially from preventive treatment since it lowers the long-term expenses of treating illnesses. It is frequently less expensive to prevent diseases than to treat them. Better growth rates, higher rates of reproduction, and enhanced product quality (e.g., milk, meat, eggs) correlate with healthier cattle. Preventive care helps pets live longer, healthier lives, which eases the financial and emotional strain on their owners.

The drug development segment shows a significant growth in the animal biotechnology market during the forecast period. Pet ownership is becoming more and more popular around the world, and this is driving up demand for veterinary medications to keep pets healthy and happy. Owners are prepared to pay extra when it comes to premium medications and therapies. The livestock sector is also growing to fulfill the demand for meat, dairy, and other animal products on a global scale. To control diseases and productivity, it is essential to ensure livestock health using effective medications.

The Indian government recently authorized an amendment to the New Drugs and Clinical Trial Rules (2023) to eliminate animal experimentation in research, particularly drug testing. To evaluate the safety and effectiveness of novel medications, the amendment permits researchers to substitute non-animal and human-relevant techniques, such as 3D organoids, organs-on-chip, and sophisticated computational techniques.

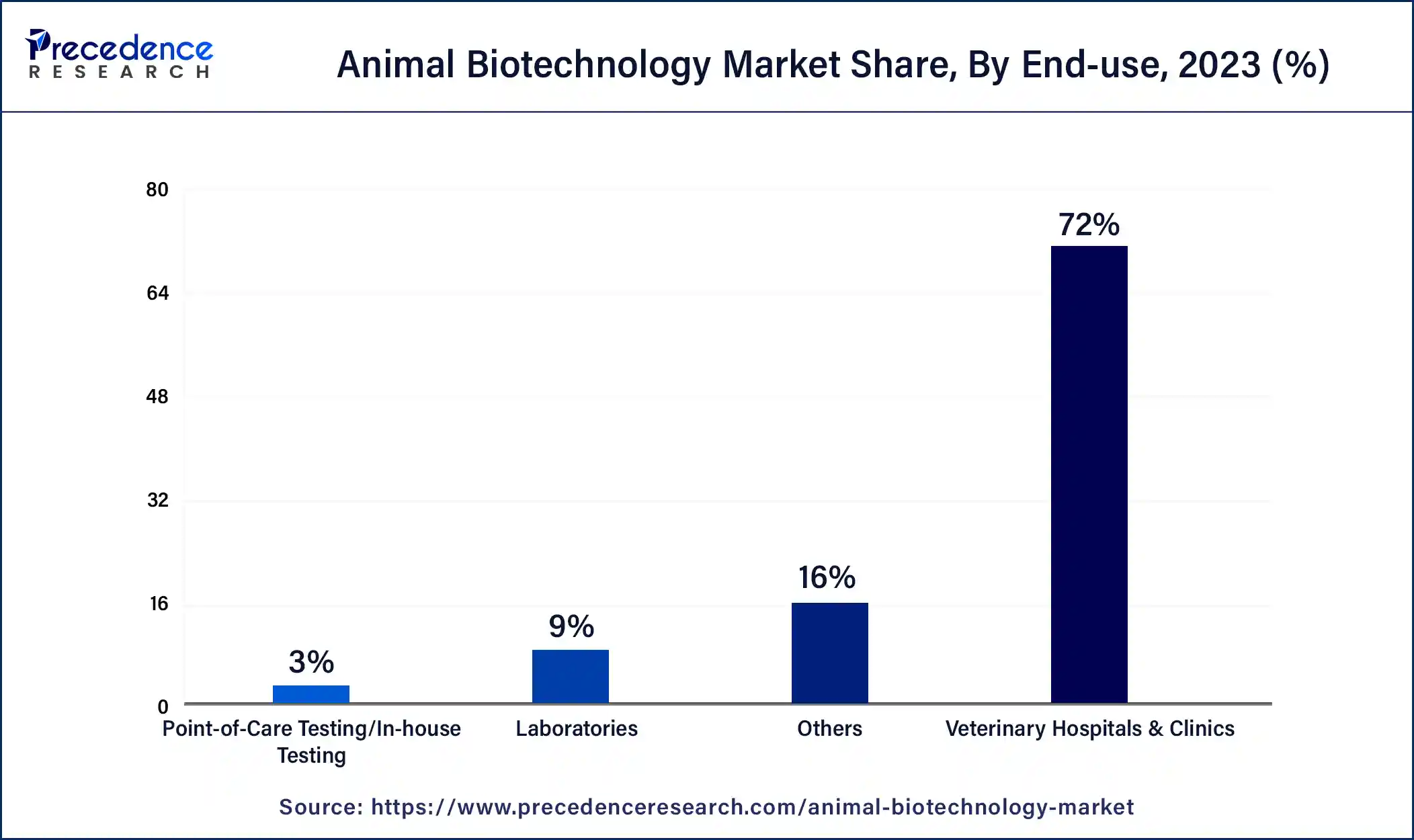

The veterinary hospitals & clinics segment dominated the animal biotechnology market in 2023. Modern diagnostic technologies, including genome sequencing, PCR (Polymerase Chain Reaction) testing, and molecular diagnostics, are used in veterinary clinics and hospitals. These instruments make accurate diagnosis and early disease identification possible, which is essential for efficient disease management and treatment. Treatment options for various animal diseases have improved with the development and implementation of biotechnological medicines, including gene therapy, stem cell therapy, and monoclonal antibodies. By utilizing these cutting-edge therapies, veterinary clinics are leading the way in enhancing patient results.

Segments Covered in the Report

By Product

By Animal Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

October 2024

February 2024