December 2024

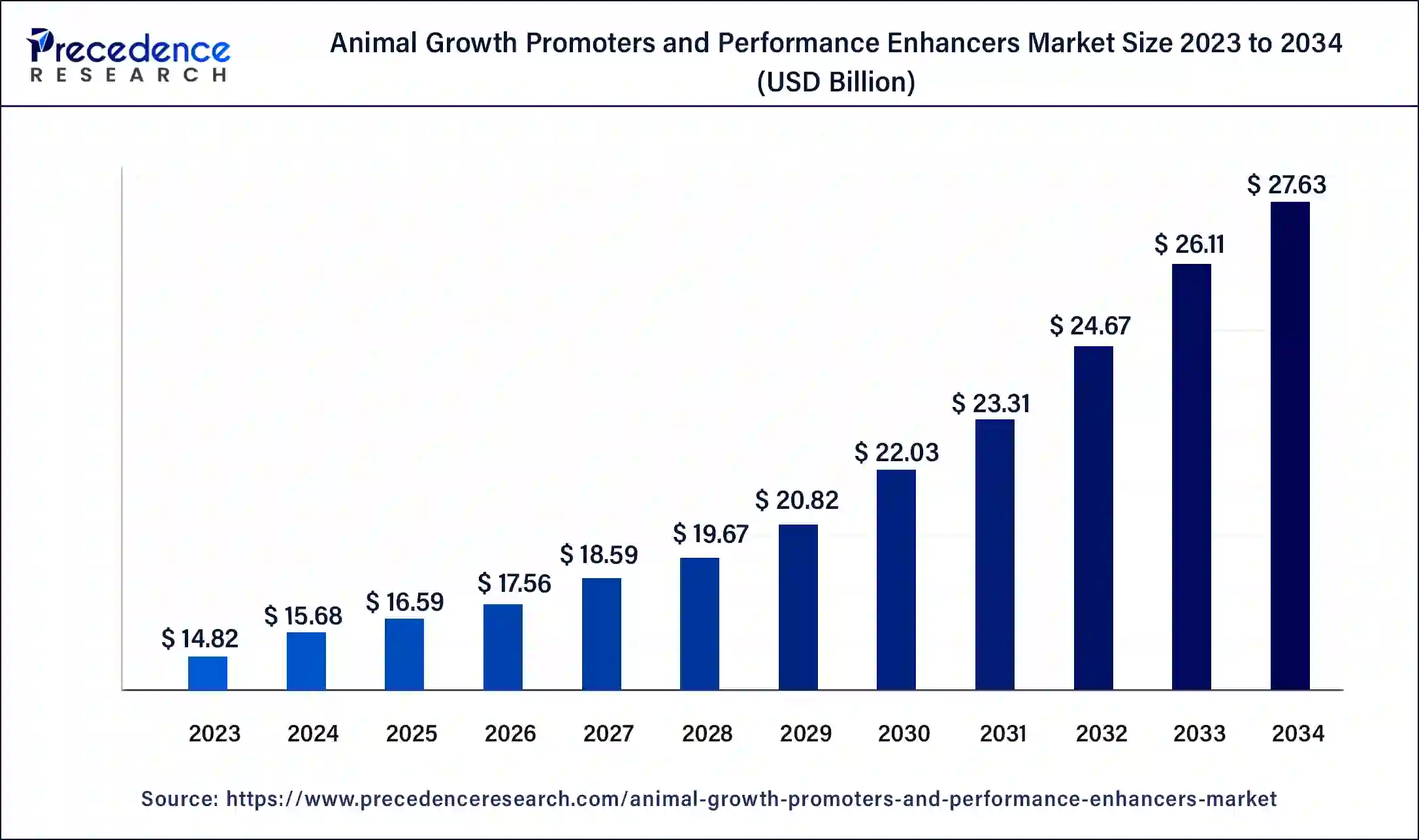

The global animal growth promoters and performance enhancers market size was USD 14.82 billion in 2023, calculated at USD 15.68 billion in 2024 and is expected to be worth around USD 27.63 billion by 2034. The market is slated to expand at 5.83% CAGR from 2024 to 2034.

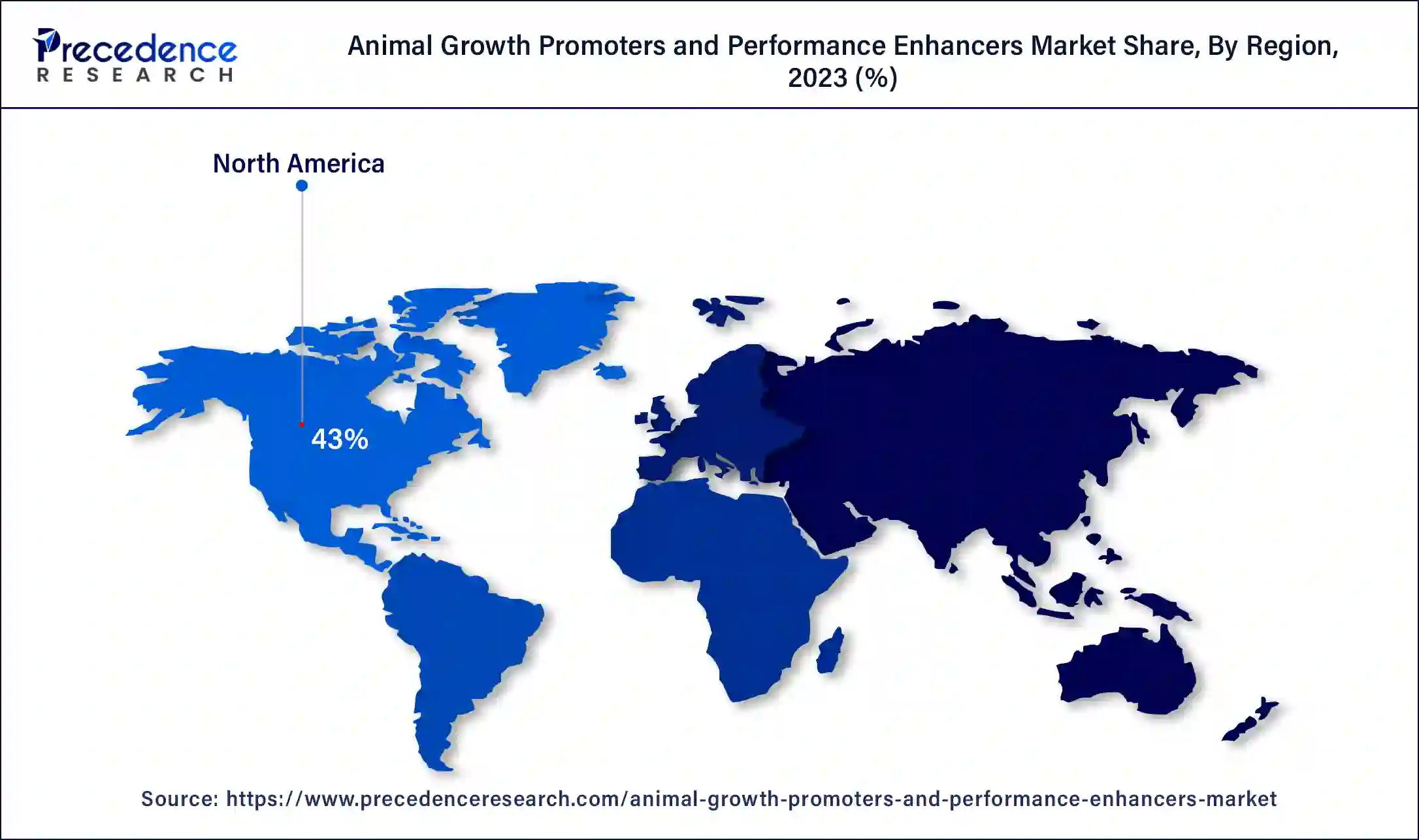

The global animal growth promoters and performance enhancers market size is predicted to reach around USD 27.63 billion by 2034 from USD 15.68 billion in 2024, at a CAGR of 5.83% from 2024 to 2034. The North America animal growth promoters and performance enhancers market size reached USD 6.37 billion in 2023. The animal growth promoters and performance enhancers market are driven by the animal disease prevalence and antibiotic resistance.

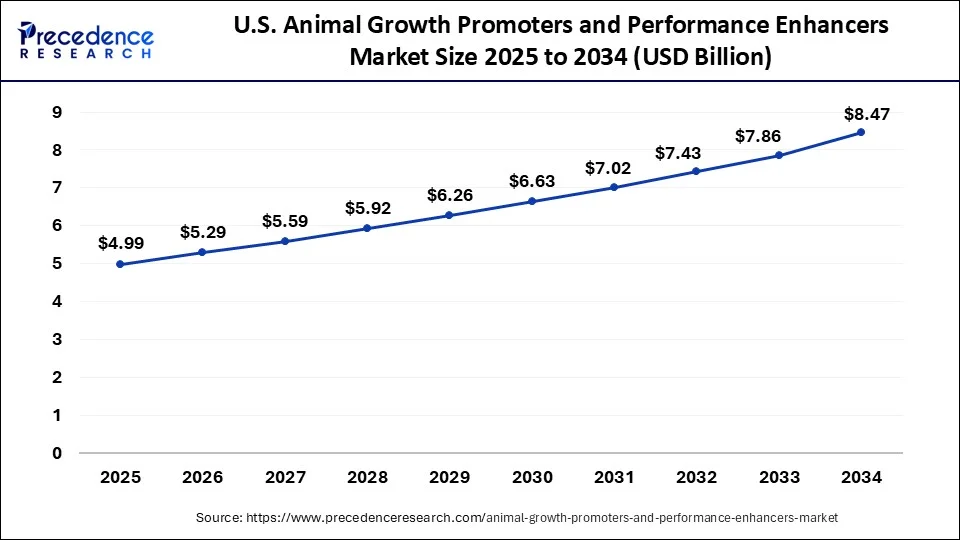

The U.S. animal growth promoters and performance enhancers market size was exhibited at USD 4.46 billion in 2023 and is projected to be worth around USD 8.47 billion by 2034, poised to grow at a CAGR of 6% from 2024 to 2034.

North America held the largest share of the animal growth promoters and performance enhancers market. The United States is well-known for having a highly developed and expansive agricultural sector in North America. The area gains by using cutting-edge farming methods, such as intensive livestock farming, which boosts productivity efficiency using performance boosters and growth promoters. Biotechnology has improved significantly, creating sophisticated growth promoters with reduced adverse effects and increased efficiency. These biotechnology advancements largely sustain the region's market dominance.

Except five nations, including the US, using recombinant bovine somatotropin (rBST), an artificial growth hormone, in the dairy industry is prohibited in most countries. Consumers are wary of buying dairy products from cows that have received rBST treatment, even though there is no scientific consensus regarding the effects of such consumption on health.

Asia-Pacific is observed to grow at the fastest rate in the animal growth promoters and performance enhancers market. Health concerns have led to a movement to reduce antibiotics as growth promoters, but there is also regulatory backing for using safe and effective alternatives. As a result, the use of non-antibiotic growth enhancers has increased. China is a significant regional development driver because of its enormous livestock industry, and government attempts to improve food safety and production. It is also the largest market in the region. The nation's efforts to limit the use of antibiotics have raised the need for substitute growth boosters.

Table: African swine fever (ASF) Situation Updates in Asia & Pacific

| S.No. | Country | Situation Update | Actions Taken |

| 1. | Malaysia | ASF outbreaks in pig farms in the states of Perak and Kedah occurred in late October after the disease was discovered in wild boars in Perak State in July 2023. | Following the initial verified outbreak in Sabah State in 2021, the nation has increased its level of surveillance. |

| 2. | Singapore | In February 2023, carcasses of wild pigs discovered in parks and woodland areas were linked to the first verified cases of ASF. ASF was found in the corpses of live pigs imported from Bulan Island, Indonesia, in April 2023 at a slaughterhouse. | The government continues to keep an eye on the health of wild boars in parks, natural reserves, and other green areas after verifying the first case of ASF in wild boars. |

| 3. | Cambodia | ASF outbreaks have been found in five provinces since the Ministry of Agriculture, Forestry, and Fisheries (MAFF) verified the first incidence in Ratanakiri Province in April 2019. | According to the media, Cambodia has stopped importing pigs from its neighbors and has tightened controls on domestic pig migration. |

| 4. | Myanmar | 12 ASF outbreaks have been reported in the states of Shan, Kachin, Kayah, and the Sagaing Region since the Ministry of Agriculture, Livestock, and Irrigation confirmed the first ASF epidemic in August 2019. | Good animal husbandry methods have been promoted and many control mechanisms, such as movement control, surveillance, and formal carcass disposal, have been put into place. |

| 5. | Bangladesh | On December 21, 2023, reports of the first ASF epidemic in Bangladesh were received from a government development pig farm located in Rangamati Sadar, Rangamati District, Chittagong Division. | Several control measures have been implemented, such as screening, surveillance, disinfection, disinfestation, movement control, control of vectors, official disposal of corpses and by-products, and waste management. |

Livestock farmers are under increasing pressure to increase productivity and efficiency as the demand for meat, dairy, and other animal products grows due to population growth and rising income levels. To help farmers satisfy this demand, growth promoters and performance enhancers play a critical role in raising animal growth rates, optimizing feed utilization, and boosting overall production efficiency.

In addition, by enabling larger yields and shortening the time it takes for animals to achieve market weight, these products assist in meeting the world's protein needs and promote food security. For farmers, they are also economically significant because higher growth and performance result in higher profitability.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.63 Billion |

| Market Size in 2023 | USD 14.82 Billion |

| Market Size in 2024 | USD 15.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Animal Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for meat and animal products

Meat consumption is noticeably rising as the world's population and wealth rise, particularly in developing nations. The trend toward diets heavier in protein raises the need for cattle production. Producers are investing in items and technologies that can improve animal growth rates and overall performance to fulfill this increasing demand. Meat products of a higher caliber and more consistent are in demand from consumers and retailers. Animal growth promoters help achieve consistent growth and better-quality meat, which is necessary to satisfy customers and uphold product standards. This drives the growth of the animal growth promoters and performance enhancers market.

Animal health and welfare concerns

Customers are becoming more conscious of the moral treatment of animals. As a result, there is now a more significant market for goods that meet stricter guidelines for animal welfare. Consequently, the demand for animal growth promoters and performance enhancers has moved in favor of goods that enhance the health and welfare of animals. Farmers can profit financially by investing in performance enhancers and growth promoters that improve health and lower disease incidence. Animal health and welfare products are in high demand due to rising healthcare expenditures and declining disease outbreak losses.

Antibiotic resistance concerns

The development of antibiotic resistance in bacteria results from their resistance to the medications intended to eradicate them. This resistance may give rise to illnesses that are hard to cure and may infect humans, posing a significant threat to public health. The overutilization and abuse of antibiotics in animal husbandry and human treatment both lead to the emergence of resistant microorganisms. The development of substitute growth promoters and performance enhancers is receiving more funding in response to the problems with antibiotic resistance. Probiotics, prebiotics, phytogenics, and other non-antibiotic compounds are some examples. These choices might be advantageous, but they also signal a change in the market dynamics and might necessitate more study and development. This limits the growth of the animal growth promoters and performance enhancers market.

Growing demand for protein

Most established nations, such as North America and Europe, and developing markets like Asia, Africa, and Latin America are seeing an increase in the need for protein. Increased cattle and poultry production in these areas opens new markets for performance enhancers and growth promoters. The animal growth promoter and performance enhancer industry's worldwide companies are drawn to these new areas due to their growth potential. This covers collaborations, purchases, and growth to take advantage of fresh chances.

Businesses will likely gain a competitive edge if they can provide goods that improve animal performance and health while addressing customer concerns about sustainability and safety. For example, the FDA has approved the animal medication bovine somatotropin (bST), sometimes called bovine growth hormone, to boost milk production in dairy cows. This medication is modeled after the somatotropin that cattle naturally make. Animal pituitaries, including those of humans, create the protein hormone somatotropin, which is necessary for healthy growth, development, and maintenance of body functions. This opens an opportunity for the growth of the animal growth promoters and performance enhancers market.

The non-antibiotic promoters segment dominated the animal growth promoters and performance enhancers market in 2023. Customers are calling for meat products devoid of antibiotic residues as they become more conscious of animal antibiotic use's effects on human health. As a result of this trend, the market for organic and antibiotic-free meat has grown significantly, further driving the industry's shift to non-antibiotic growth boosters. Many non-antibiotic promoters are affordable when you consider long-term advantages like better animal health, lower mortality rates, and higher feed conversion ratios. They have become appealing to farmers and producers due to their economic feasibility.

The antibiotic growth promoters segment shows a significant growth in the animal growth promoters and performance enhancers market during the forecast period. Due to the expanding world population, there is a greater demand for livestock products like meat, milk, and eggs. Farmers are searching for methods to improve animal development and productivity to satisfy this growing demand. Antibiotic growth promoters (AGPs) aid in increasing the feed conversion ratio, which causes cattle to develop more quickly and produce more. Combining AGPs with other growth promoters, such as probiotics and enzymes, is becoming increasingly popular. Better animal performance results from this synergistic strategy, which increases the total efficacy of growth promotion tactics.

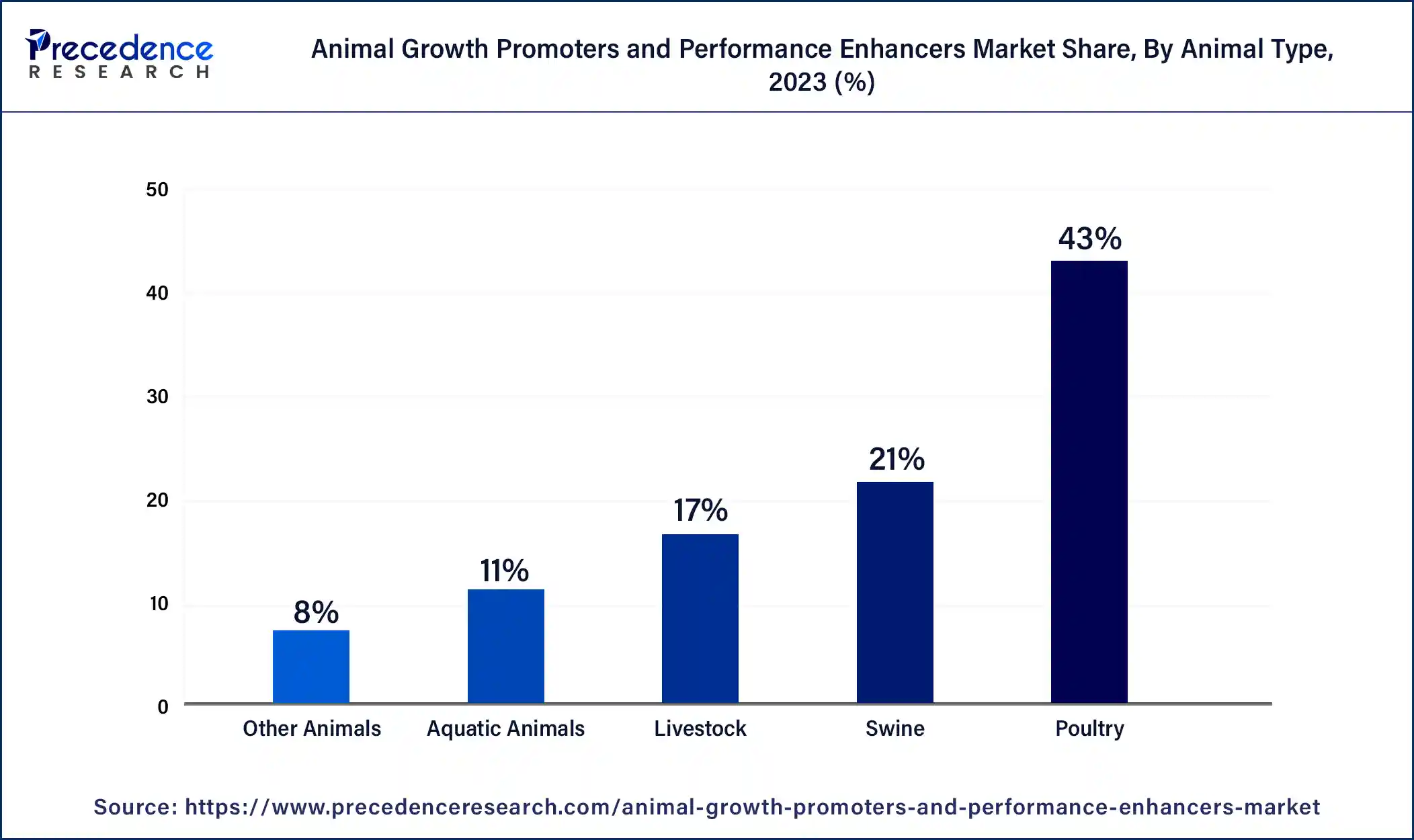

The poultry segment dominated the animal growth promoters and performance enhancers market in 2023. Around the world, one of the most popular animal proteins is poultry meat, especially chicken. Demand for it is driven by its accessibility, adaptability, and perceived health benefits compared to other meats like hog and beef worldwide. These boosters shorten the time it takes for chicken to achieve market weight. This rapid turnover is essential to meet the increasing demand for poultry products. Breeds of chicken raised in modern times are frequently genetically chosen and bred for quick growth. The poultry industry is a significant user of these goods since growth boosters are employed to improve the performance of these breeds further.

The swine segment shows a significant growth in the animal growth promoters and performance enhancers market during the forecast period. One of the most popular meats worldwide is still pork, especially in Asia-Pacific, North America, and Europe. The demand for pig products is driven by the growing global population and increased disposable income in emerging economies, helping to grow the swine segment. To improve food security and satisfy the ever-increasing demand for animal protein, many nations advocate using safe and authorized animal growth boosters. This regulatory support encourages producers to use these technologies.

The livestock segment shows a notable growth in the animal growth promoters and performance enhancers market during the forecast period. The demand for meat products is rising as the world's population and earnings rise, especially in developing nations. This increase in meat consumption directly impacts the livestock industry and highlights the need for larger-scale, more effective livestock production techniques. There is a growing consumer consciousness and demand for ethically raised livestock. Although still a niche industry, organic and free-range livestock farming is increasing and helping the entire livestock sector. This trend is driving this development.

Segments Covered in the Report

By Product

By Animal Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

October 2024

February 2024