December 2024

Animal Model Market (By Application: Cancer, Immunological Disease, Infectious Disease, Others; By Animal Type: Mice, Rat, Guinea Pigs, Rabbits, Hamsters, Others; By End-use: Pharmaceutical & Biotechnology Companies, Academic Research Institute, Contract Research Organization) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

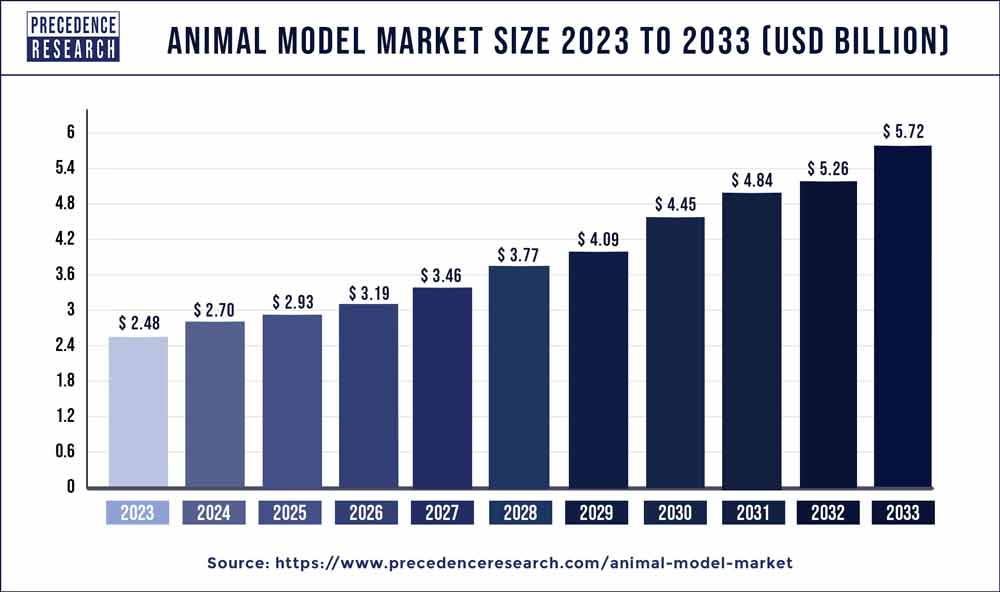

The global animal model market size surpassed USD 2.48 billion in 2023 and is estimated to hit around USD 5.72 billion by 2033 growing at a CAGR of 8.71% from 2024 to 2033.

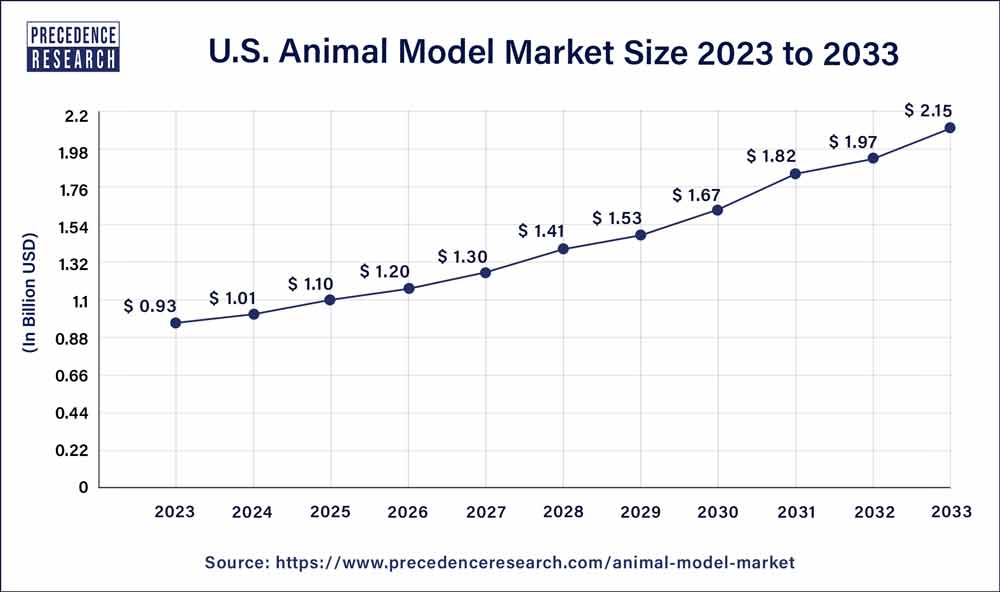

The U.S. animal model market size was valued at USD 0.93 billion in 2023 and is anticipated to reach around USD 2.15 billion by 2033, poised to grow at a CAGR of 8.80% from 2024 to 2033.

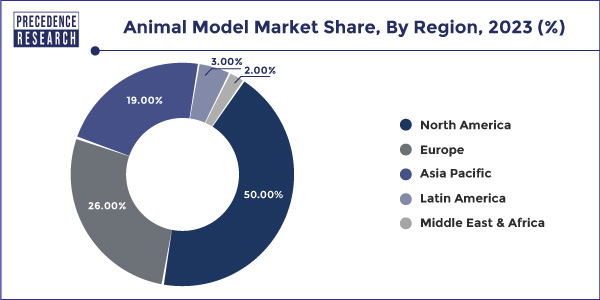

North America led the market with the biggest market share of 50% in 2023, fueled by robust research activities and a diverse range of animal models, including those for cystic fibrosis (CF). Various species, such as mice, rats, ferrets, rabbits, pigs, sheep, zebrafish, and fruit flies, are employed to model CF disease, underscoring the region's comprehensive approach to biomedical research.

The United States accounts for a significant portion of animal usage in research, education, and testing, with an estimated annual utilization of 17 million to 22 million animals. Mice and rats constitute approximately 85% of these research animals, reflecting their widespread use in scientific investigations. Notably, federal agencies like the National Institutes of Health (NIH), the Food and Drug Administration (FDA), the National Institute on Drug Abuse (NIDA), and the National Institute for Occupational Safety and Health (NIOSH) conduct intramural animal research, with NIH being the largest contributor to animal experimentation among federal entities.

Animal Model Market Overview

Animal model market serves as invaluable tools in biomedical research, mirroring human biology and disease processes to facilitate a deeper understanding of human health. Through species such as mice, rats, and zebrafish, researchers can conduct experiments that are impractical or ethically restricted in humans, leading to insights critical for medical advancement. Spontaneous animal models, like dogs for prostate cancer, offer unique insights into naturally occurring diseases. Moreover, biomedical research benefits animals, aiding endangered species through embryo transfer, parasite elimination, illness treatment, and anesthetic advancements, thus improving overall animal welfare.

With anatomical and physiological parallels between humans and animals, particularly mammals, researchers can explore mechanisms and test novel therapies in animal models before human application. Despite ethical considerations, a substantial portion of research, approximately 47 percent of NIH-funded endeavors, involves animal experimentation, reflecting the significant investment, with nearly $42 billion allocated in 2020 for research and development.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.71% |

| Global Market Size in 2023 | USD 2.48 Billion |

| Global Market Size by 2033 | USD 5.72 Billion |

| U.S. Market Size in 2023 | USD 0.93 Billion |

| U.S. Market Size by 2033 | USD 2.15 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Application, By Animal Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Growing necessity of animal models

The expanding necessity of non-human primates and other animal models in various areas of research, including AIDS, hepatitis, dentistry, orthopedic surgical techniques, Parkinson's disease, cardiovascular surgeries, psychological disorders, drug development, vaccine development, toxicological studies, and other acts of significant importance drive the growth of the animal model market. Their utilization has led to the discovery of vaccines and diagnostic modalities, benefiting both humans and animals by enhancing lifespan and preventing zoonotic diseases.

Rat and mouse models demonstrate exceptional importance in biomedical research, while other small domestic animals such as guinea pigs, hamsters, rabbits, ferrets, birds, amphibians, fishes, flies, and worms also exhibit anatomical and physiological resemblances to humans, further expanding the scope of research. Additionally, large animal models offer unique anatomical and physiological characteristics relevant to specific research areas, further stimulating growth in the animal model market.

Animal models drive preclinical drug screening advancements, fueling market growth

In recent years, the utilization of animal models has emerged as a pivotal strategy in the realm of pre-clinical drug screening, serving as indispensable tools prior to the commencement of clinical trials. Recognized as the foremost in vivo models, animal models play a crucial role in assessing fundamental pharmacokinetic parameters such as drug efficacy, safety, and toxicological profiles, prerequisites for the translation of pharmaceutical interventions into human applications.

Animal models are instrumental in conducting a spectrum of toxicological tests, encompassing assessments for general toxicity, mutagenicity, carcinogenicity, and teratogenicity, as well as evaluating potential irritant effects on the eyes and skin. Often, a comprehensive approach is adopted, where both in vitro and in vivo models are synergistically employed to corroborate findings before advancing to medical trials. Predominantly conducted in mice, rats, and rabbits, the utilization of in vivo models not only ensures the integrity and validity of preclinical data but also acts as a significant driver for growth in the animal model market.

Restraints

Emerging technologies

The advent of innovative technologies such as 3D cell culturing, human-induced pluripotent stem cells, and gene editing is reshaping the landscape of biomedical research by offering alternative solutions that replace, refine, and reduce the dependence on animal models. While these advancements hold promise for improving drug testing methodologies, they also present challenges to the growth of the animal model market.

Patients often encounter toxic or ineffective drugs due to the imperfections inherent in animal models used for preclinical testing. Indeed, statistics reveal that only about 10% of drugs entering clinical trials are ultimately approved, with the remaining 90% failing due to various reasons such as off-target effects, problematic dosing, and lack of efficacy. This high failure rate, particularly attributed to issues like toxicity, serves as a significant restraint on the expansion of the animal model market.

Limitations in establishing disease-specific animal models

The establishment of disease-specific animal models encounters significant hurdles, primarily due to incomplete pathway annotation in animals and a lack of understanding of organism-specific pathway regulation. While animal models can detect similarities and differences in pathway activity compared to humans, challenges arise in identifying deviations from the human version due to a dearth of organism-specific pathway data. Additionally, while cellular models of human disease offer mechanistic insights, they often fail to replicate in vivo biology accurately.

Model organisms remain central to aging research due to ethical concerns, long natural lifespans, and genetic heterogeneity, as using human subjects poses challenges. Despite being utilized in pharmaceutical and industrial research to predict mortal toxicity, animal models have been shown to be poor predictors of drug safety in humans. The growth of the animal model market is further limited by the high cost of animal research, both financially and in holds in drug approval procedures, coupled with the loss of potentially beneficial drugs for human use.

Opportunities

Rising life expectancy

Advancements in pharmaceuticals and medical technology have revolutionized healthcare, leading to a decline in deaths from infections and other ailments, consequently driving up the average life expectancy. However, this positive trend has given rise to a new medical challenge: aging diseases. Chronic age-related diseases, which manifest as individuals age, pose a significant burden on healthcare systems worldwide, affecting quality of life and increasing disability rates. To address this challenge, researchers have turned to animal models of adult-onset neurodegenerative diseases, facilitating the evaluation of new therapeutic strategies.

Recent breakthroughs in genomic and proteomic technologies have further bolstered the study of aging-related diseases. Genome-wide approaches for analyzing protein localization in model organisms such as Drosophila, along with proteomic profiling techniques, have enabled systematic analysis of protein expression and localization in various cellular and developmental contexts. These advancements provide a solid foundation for further mechanistic studies, paving the way for targeted therapeutic interventions.

Personalized medicine development

Animal models play a crucial role in advancing personalized medicine approaches by targeting human mutations and providing insights into intraspecies differences. Personalized medicine, which tailors treatments based on individual genetic variations, relies on understanding how small differences in genetic makeup can significantly impact responses to drugs and diseases. This principle extends to complex systems, where minor changes in initial conditions can lead to vastly different outcomes. This presents a compelling opportunity for researchers and pharmaceutical companies to enhance drug discovery and development efforts, ultimately driving growth in the animal model market.

While personalized medicine leverages intraspecies differences, animal models used in drug development and disease research often exhibit greater disparities from the complex systems they aim to model. Despite these variations, these animal models continue to offer valuable insights into disease mechanisms and therapeutic responses, presenting significant opportunities for the animal model market. By addressing the need for models that more accurately reflect human biology and disease processes, there is immense potential for the development of improved animal models that better align with personalized medicine approaches.

The cancer segment emerged as a dominant force within the application segment of the animal model market in 2023. With cancer ranking as the second-largest cause of morbidity and mortality globally, it remains a focal point of research in the medical field. Consequently, there's been a notable increase in the construction and utilization of animal models for cancer research. Various methods, including chemical induction, xenotransplantation, and gene programming, are employed to create diverse cancer animal models. Patient-derived xenotransplantation (PDX) models, in particular, have gained traction due to their ability to preserve the microenvironment of primary tumors and fundamental cellular characteristics.

Animal models not only facilitate the study of biochemical and physiological processes underlying cancer development but also play a crucial role in drug screening and exploring gene therapy options. Among the plethora of mouse models available for patient-derived xenografts, oncology research, those based on cell line-derived xenografts, and humanized animals are increasingly favored. These models closely mimic tumor initiation, progression, metastasis, and the intricate tumor microenvironment, thus driving the growth of the animal model market within the cancer research domain.

The mice and rat segment stood as the dominant force in the animal segment of the animal model market in 2023. Mice are favored for their small size, facilitating easy housing and maintenance, along with their short reproductive cycle and lifespan. Additionally, they possess a mild-tempered and docile nature, coupled with genetics, biology, and a wealth of information available regarding their anatomy. Another significant advantage is the ability to breed genetically manipulated mice and those with spontaneous mutations.

Mice serve as versatile research subjects across various disciplines, including biology, psychology, and engineering. They are extensively utilized to model a wide array of human diseases, ranging from hypertension and diabetes to Alzheimer's disease and various cancers. This comprehensive utilization underscores their significance in biomedical research aimed at finding treatments or cures for debilitating conditions such as heart disease, muscular dystrophy, and spinal cord injuries. Consequently, the prevalence of mice and rats as indispensable animal models fuels the growth of the animal model market.

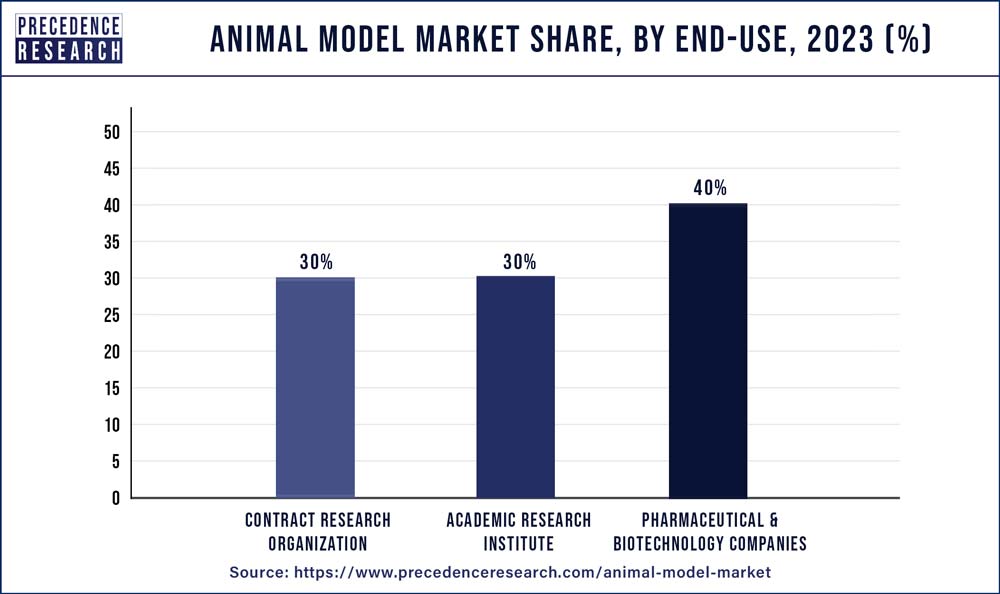

The pharmaceutical & biotechnology companies segment asserted dominance within the end-use segment of the animal model market in 2023. Animal utilization in research constitutes a crucial component of the drug discovery process, facilitating scientific advancement and serving as invaluable models for studying diseases. Animals play a pivotal role in the development and testing of potential new medicines and therapies. Their involvement in testing procedures is deemed critical for evaluating the quality, efficacy, and safety of pharmaceutical products, as mandated by regulatory authorities worldwide.

Biopharmaceutical companies are ethically and legally obligated to conduct thorough evaluations of new medicines before administering them to patients. Regulatory bodies, including the U.S. Food and Drug Administration, mandate safety studies in animals as a prerequisite before commencing clinical trials in humans. This stringent regulatory framework underscores the indispensable role of animal models in ensuring the safety and efficacy of pharmaceutical interventions, thus driving growth in the animal model market.

Segments Covered in the Report

By Application

By Animal Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

September 2024

October 2024

August 2024