January 2025

Aromatic Solvents Market Size, Share and Growth Analysis (By Product: Benzene, Xylene, Toluene, and Others; By Application: Pharmaceuticals, Automotive, Oilfield Chemicals, Paints & Coatings, and Others) - Global Industry Analysis, Trends, Regional Outlook, and Forecast 2024 - 2034

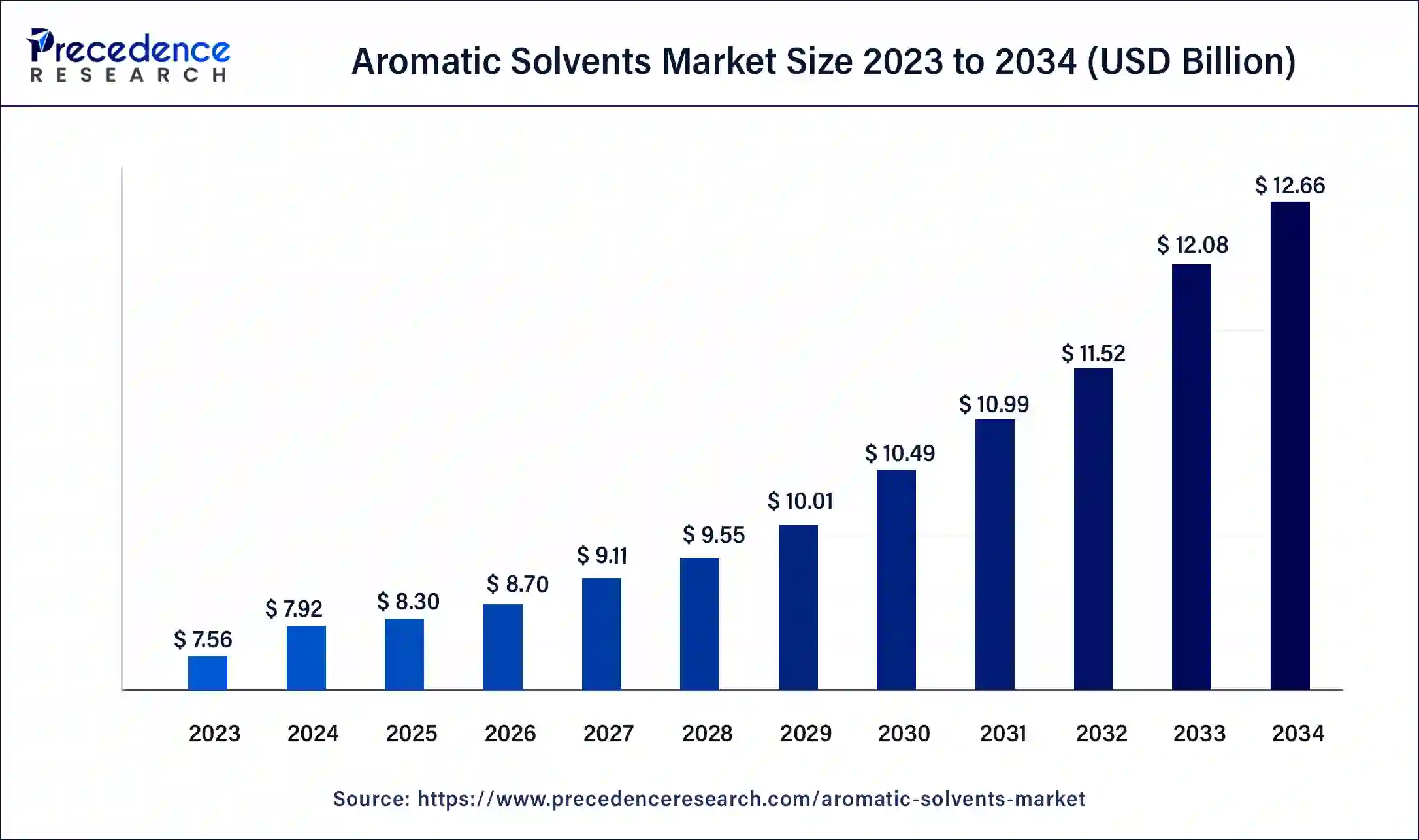

The global aromatic solvents market size was USD 7.56 billion in 2023, accounted for USD 7.92 billion in 2024, and is expected to reach around USD 12.66 billion by 2034, expanding at a CAGR of 4.8% from 2024 to 2034.

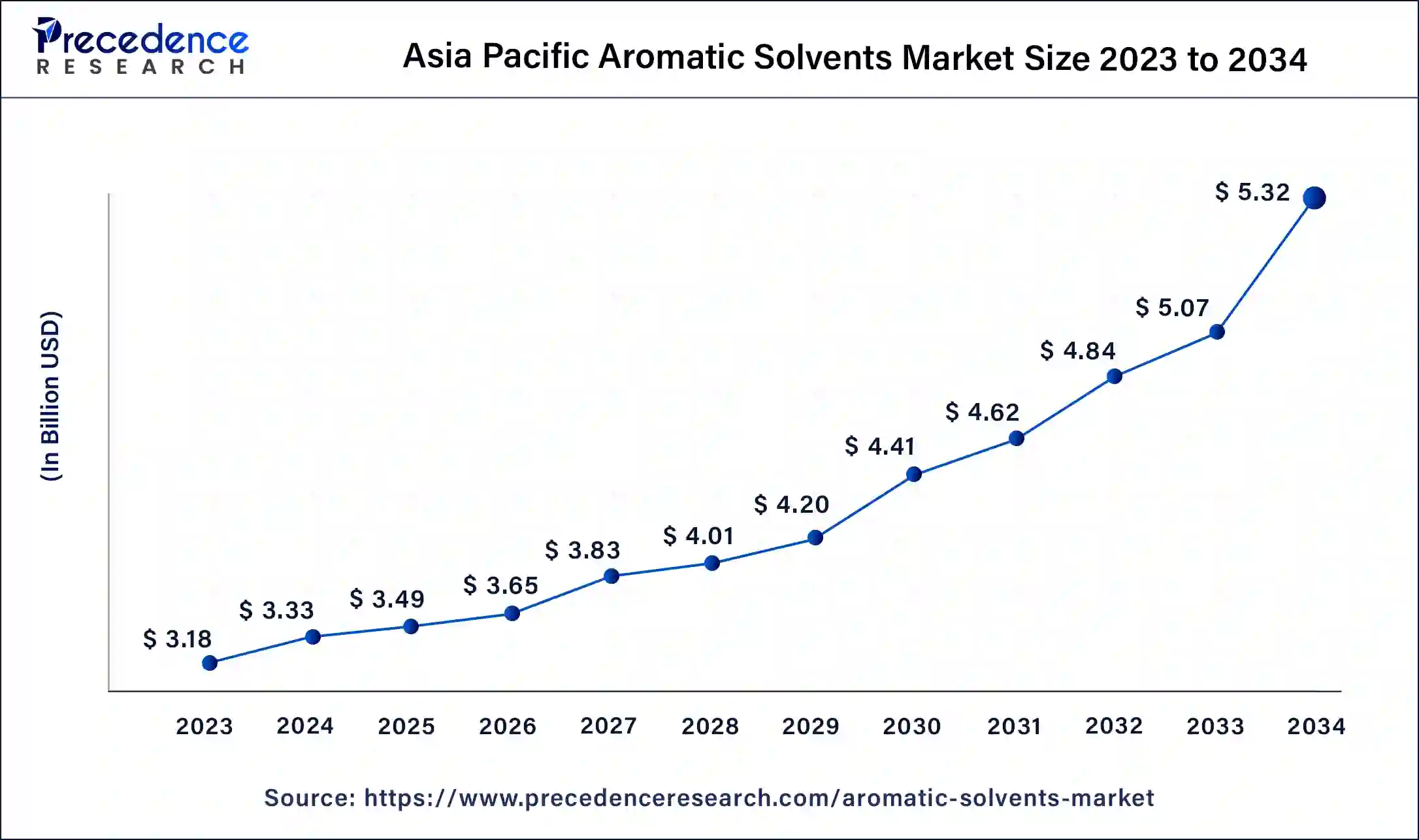

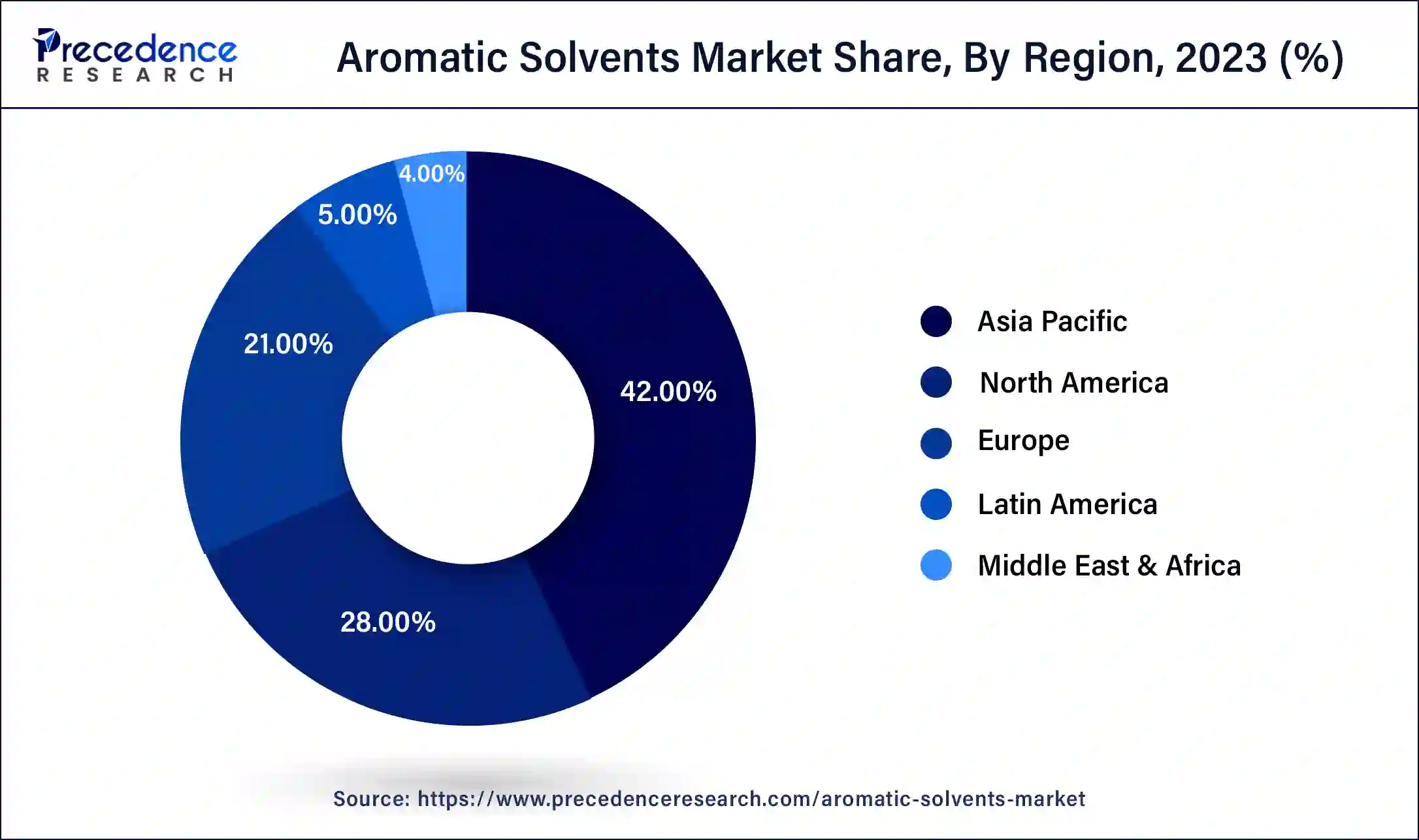

The Asia Pacific aromatic solvents market size was estimated at USD 3.18 billion in 2023 and is predicted to be worth around USD 5.32 billion by 2034, at a CAGR of 5% from 2024 to 2034.

The Asia Pacific estimated to be the most promising market in terms of revenue and growth in the global aromatic solvents market. Magnificent growth of automotive, construction, and general industry sectors because of the presence of large consumer base in the region accounts for the prime factor that drives the growth of the region. Further, significant investments in the developing nations under various development acts also supports the exponential growth of the aromatic solvents industry. Rising per capita disposable income, urbanization, and rising demand for automobiles particularly in the emerging nations that include India, China, and South Korea.

North America is another important market to hit revenue share of 28% in 2023. The U.S. construction industry is predicted to generate high revenue to the overall market. The major automobile manufacturers are expected to drive growth in the region.

Aromatic solvents have high rate of solvency that helps in the formation of efficient homogenous solution. In addition, these solvents are well known for their high evaporation rate that helps in speeding up the drying and curing processes. These all above mentioned properties of aromatic solvents are the major factor behind their diverse application across various industries such as paints & coatings, automotive, oilfield chemicals, pharmaceuticals, varnishes, nail polish remover, and many others.

Moreover, spontaneous growth in the automotive sector further aids in the profound growth of the aromatic solvents market. Rising demand for electric vehicles along with autonomous vehicles expected to further boost the sales in automotive sector that spurs the demand for aromatic solvents consequently. The automotive industry is on the verse of massive transformation that is shaping the future of automotive sales such as shared mobility, alternative drivetrains, connectivity, and many others. As per International Energy Agency (IEA), automotive sales were 80 million units in the year 2017 and the figure expected to reach billions of units in the coming years. Hence, the prominent growth in the automotive industry results in the market growth of aromatic solvents market.

Other than automotive, aromatic solvents are excellently used in construction, oil & gas, and various other general industries. In paints & coatings industry, these aromatic solvents are largely used as thinners. Hence, the accelerating growth rate of paint & coatings market along with exponential growth in construction sector particularly in the developing nations expected to flourish the aromatic solvents market in the upcoming years.

| Report Highlights | Details |

| Market Size in 2023 | USD 7.56 Billion |

| Market Size in 2024 | USD 7.92 Billion |

| Market Size by 2034 | USD 12.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, and Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Based on product, the global market for aromatic solvents is bifurcated into benzene, xylene, toluene, and others. Toluene accounted to hold majority of the revenue share of approximately 50% in the year 2023 and expected to seek significant growth over the forecast period. Toluene-based aromatic solvent increases viscosity in adhesive films and are largely used in adhesive applications because of their high evaporation rates. Moreover, the toluene-based products are prominently used in the production process of paint thinners for cosmetics, inks, correction fluids, and many others. Hence, the outstanding growth in the cosmetic sector anticipated to propel the market growth for toluene segment.

Others segment in the global aromatic solvents market includes mixed xylenes, ethylbenzene, and others. These products are prominently used in the manufacturing of other industry chemical products. In addition, xylene is the second largest product segment in terms of revenue. Because of low toxicity and high solvency power xylene anticipated to exhibit profound growth during the upcoming years.

By application, paints & coatings segment dominated the global aromatic solvents market in terms of revenue in the year 2023 and anticipated to exhibit similar trend during the forthcoming period. Paints & coatings segment captured nearly half of the total market revenue in 2023. This is mainly attributed to the prominent growth in the paints & coatings market globally because of increasing product consumption in various sectors such as automotive, construction, and general industries.

The application type segments is classified into Pharmaceuticals, Automotive, Oilfield Chemicals, Paints & Coatings, Others. Increasing demand for packaging products for food and beverages contributing the growth of packaging industry in the aromatic solvents market.

Key Companies & Market Share Insights

The global market for aromatic solvents consists of few major players that operate globally with large production capacities because of this the market is highly consolidated in nature. For instance, Reliance Industries Limited (RIL) is the second largest producer of Paraxylene (PX) across the world with total production capacity of 4.3 MMTPA. Aromatic solvents are the major product line among the company’s petrochemical sector with a total capacity of 5.7 MMTPA. Similarly, other companies in the market have significant product capacity and restricts the entry of new players in the market. Brand recognition and customer loyalty also plays a major role in market consolidation. Other than this, industry participants also focus prominently towards forward and backward integration to gain advantage over product price.

Segments Covered in the Report

By Product Type

By Application Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

August 2024