August 2024

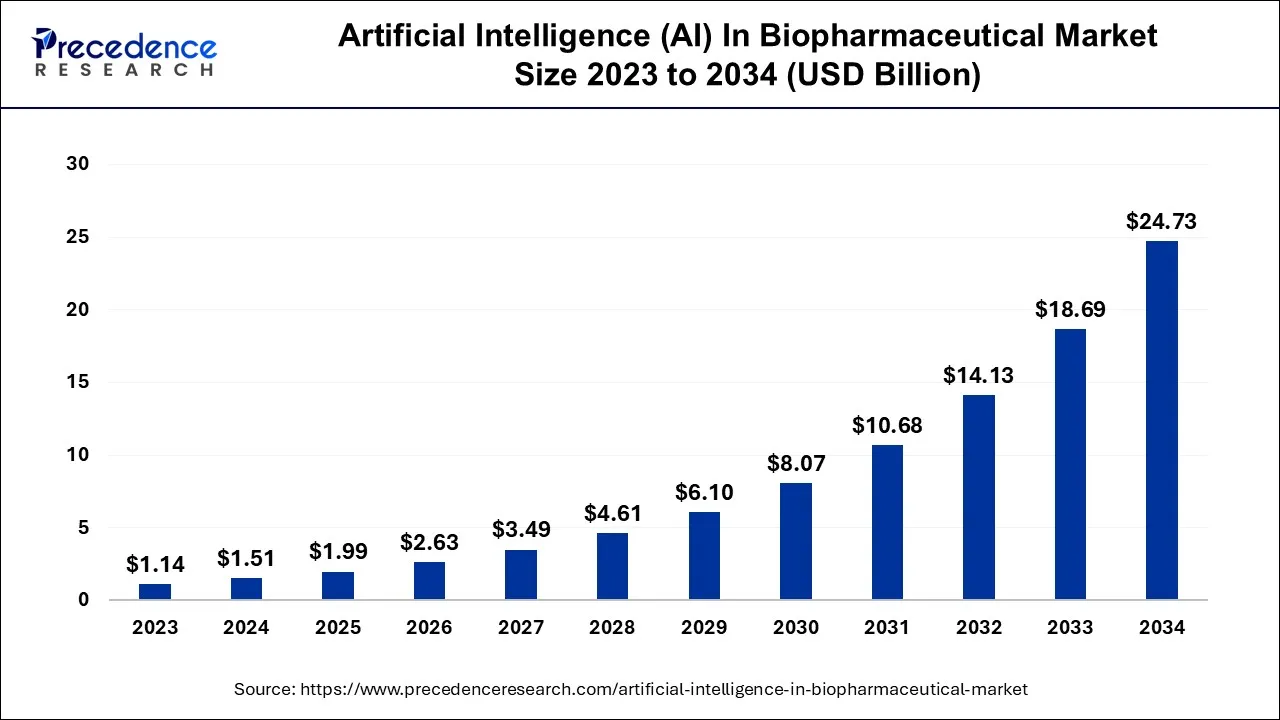

The global artificial intelligence (AI) in biopharmaceutical market size is calculated at USD 1.51 billion in 2024, grew to USD 1.99 billion in 2025, and is predicted to hit around USD 24.73 billion by 2034, expanding at a CAGR of 32.25% between 2024 and 2034. The North America artificial intelligence (AI) in biopharmaceutical market size accounted for USD 680 million in 2024 and is anticipated to grow at the fastest CAGR of 32.39% during the forecast year.

The global artificial intelligence (AI) in biopharmaceutical market size is expected to be valued at USD 1.51 billion in 2024 and is anticipated to reach around USD 24.73 billion by 2034, expanding at a CAGR of 32.25% over the forecast period 2024 to 2034.

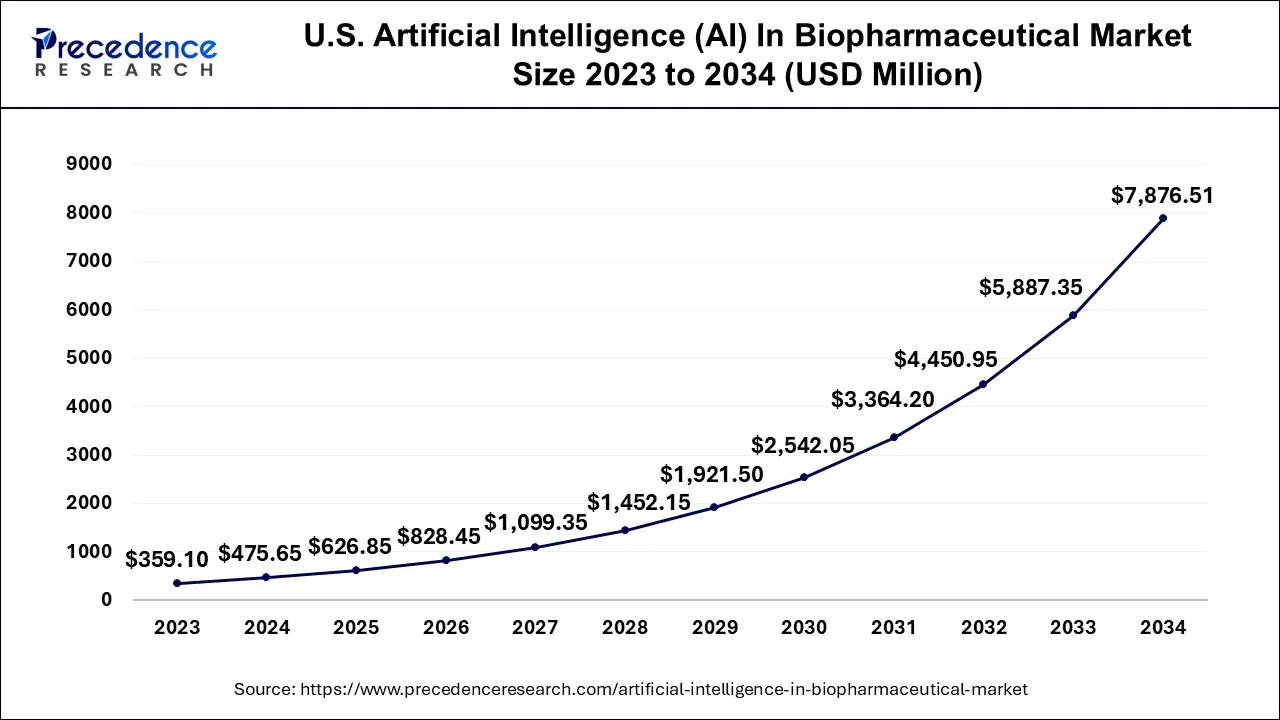

The U.S. artificial intelligence (AI) in biopharmaceutical market size accounted for USD 475.65 million in 2024 and is projected to be worth around USD 7,876.51 million by 2034, poised to grow at a CAGR of 32.29% from 2024 to 2034.

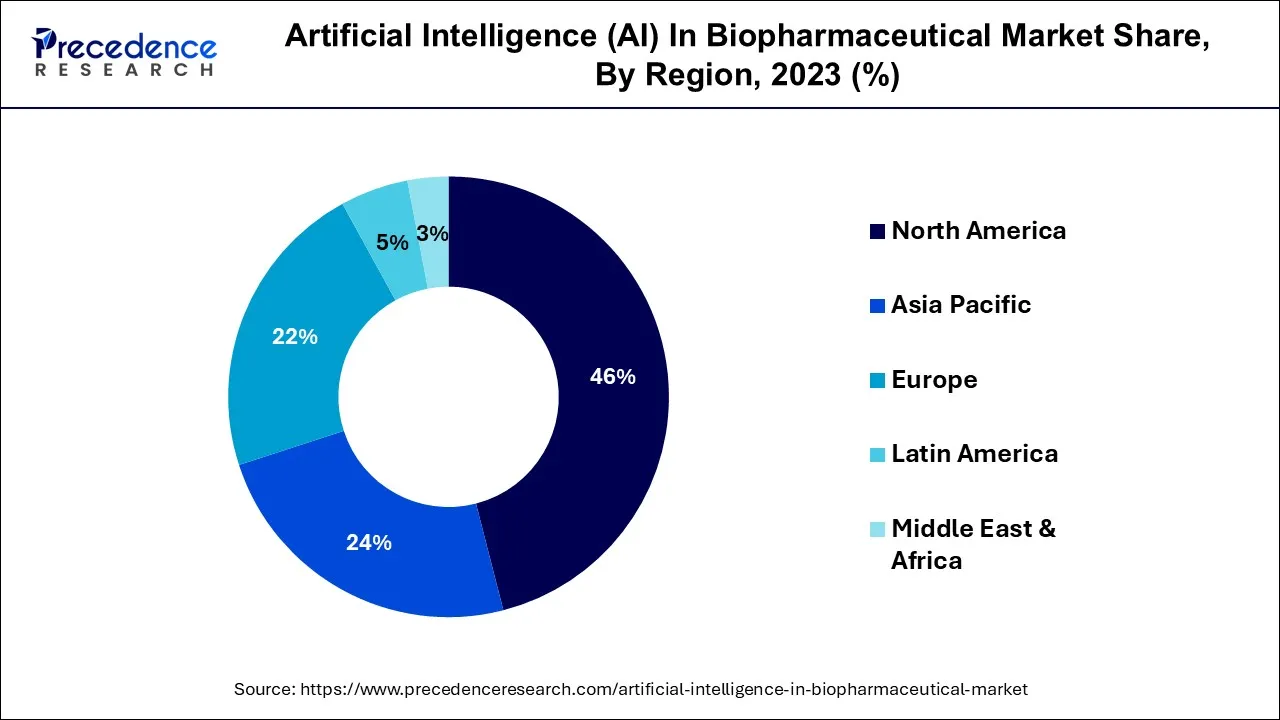

North America has held the largest revenue share 46% in 2023. North America leads the artificial intelligence (AI) in the biopharmaceutical market due to a combination of factors. Firstly, the region comprises a robust healthcare infrastructure and significant investments in AI research and development. Secondly, North America has a thriving biopharmaceutical industry, attracting both established companies and startups that are keen on integrating AI for drug discovery and personalized medicine.

Thirdly, the presence of world-renowned universities and research institutions fosters innovation and AI talent. Lastly, a supportive regulatory environment and substantial funding opportunities further drive AI adoption in the biopharmaceutical sector, solidifying North America's dominant market position.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific's significant foothold in the artificial intelligence (AI) biopharmaceutical market is underpinned by several pivotal factors. The region enjoys a swiftly expanding biopharmaceutical sector marked by increasing investments in research and development endeavors. Its sizeable patient population, coupled with growing healthcare demands, creates a robust appetite for AI-powered solutions, particularly in the realm of personalized medicine.

Moreover, supportive governmental policies and a surge in collaborations with AI technology providers foster an environment of innovation and widespread adoption. Furthermore, the region's cost-effective operational environment and the thriving pool of AI and biopharmaceutical research talent consolidate its position as a key influencer in this dynamically evolving market.

Artificial Intelligence (AI) within the biopharmaceutical sector entails the utilization of sophisticated computational methodologies and machine learning strategies to expedite the identification, development, and healthcare applications of drugs. AI facilitates the examination of extensive biological data sets, expedites the pinpointing of potential drug targets, refines the design of clinical trials, and enhances healthcare delivery by tailoring treatments to individual patients.

It enhances operational efficiency, trims expenses, and heightens the prospects for pioneering drug discoveries, ultimately resulting in more efficient treatment options, shortened developmental timelines, and improved patient outcomes in the biopharmaceutical field.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 32.25% |

| Market Size in 2024 | USD 1.51 Billion |

| Market Size by 2034 | USD 24.73 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application, By Technology, By Offering, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Big data handling

The burgeoning volume of extensive data, commonly denoted as "big data," serves as a pivotal engine driving the impressive surge of artificial intelligence (AI) within the biopharmaceutical sphere. The inflow of copious and intricate biological and clinical datasets, encompassing genomics, proteomics, patient records, and clinical trials, has elicited a pressing demand for advanced data governance and interpretation mechanisms. AI, with its proficiency in efficiently managing, structuring, and gleaning insightful findings from these substantial and multifaceted data reservoirs, decisively meets this exigent need.

Furthermore, AI's data-guided predictions and decision support systems amplify the precision and efficiency of research and development procedures. In this data-rich landscape, AI surpasses its role as a mere tool, emerging as a transformative force that empowers biopharmaceutical entities to make data-grounded decisions, curtail expenses, hasten market penetration, and ultimately furnish more potent therapeutic solutions to patients. As the realm of big data continues its expansion, AI's significance within the biopharmaceutical sector is projected to intensify, impelling innovation and reshaping the healthcare domain.

Regulatory hurdles and interoperability

Regulatory obstacles in the biopharmaceutical sector present a substantial impediment to the growth of Artificial Intelligence (AI). The industry's rigorous regulatory framework, particularly in pharmaceuticals, necessitates rigorous validation and the assurance of AI systems' safety, effectiveness, and adherence to regulatory standards. Demonstrating the transparency, reliability, and consistent performance of AI algorithms adds complexity to compliance endeavors. Interoperability challenges further constrain the adoption of AI in biopharmaceuticals.

Seamlessly integrating AI systems into existing infrastructure, software, and data environments proves to be a formidable task. The industry's reliance on diverse platforms and software often results in data isolation and compatibility complications. Establishing data-sharing standards and ensuring effective interfacing between AI and a variety of legacy systems are vital. These constraints collectively contribute to slower adoption, heightened compliance expenses, and difficulties in fully harnessing AI's potential to transform biopharmaceutical research, development, and patient care.

Enhanced drug safety

The elevation of drug safety, enabled by artificial intelligence (AI), opens an extraordinary avenue within the biopharmaceutical market. AI technologies bring a revolutionary dimension to pharmacovigilance and safety surveillance, rapidly identifying adverse events, potential safety issues, and regulatory irregularities in extensive datasets.

This proactive approach ensures the efficacy and safety of pharmaceutical products while expediting regulatory compliance and approvals. By mitigating the risks associated with drug development, AI boosts the confidence of regulatory bodies, pharmaceutical firms, and healthcare providers in the safety of new drugs, thereby expediting their market entry.

This heightened safety level also instills confidence in patients and healthcare practitioners. Consequently, AI-driven advancements in drug safety not only reduce potential liabilities but also lead to cost savings, shorter time-to-market, and the overall improvement of patient well-being, thus presenting significant prospects for AI integration in the biopharmaceutical industry.

According to the application, the drug discovery segment held 35% revenue share in 2023. The drug discovery segment commands a significant share in the artificial intelligence (AI) biopharmaceutical market due to its ability to revolutionize and expedite the drug development process. AI empowers researchers to analyze vast biological datasets, predict potential drug candidates, and optimize molecular structures, greatly reducing the time and cost involved in bringing new drugs to market.

Its precision and efficiency in target identification, hit identification, and toxicity prediction have made it an invaluable tool in biopharmaceutical research, offering the potential for breakthrough discoveries and substantial cost savings, ultimately driving its prominence in the market.

The research segment is anticipated to expand at a significantly CAGR of 32.8% during the projected period. The research segment holds a major growth in artificial intelligence (AI) in biopharmaceutical market due to its pivotal role in advancing drug discovery and development. AI empowers researchers to swiftly analyze vast biological datasets, predict drug candidates, and optimize clinical trial design.

It significantly accelerates research processes, reduces costs, and enhances the identification of potential therapeutic agents. This translates into more efficient research outcomes and, ultimately, a robust pipeline of innovative drugs. Consequently, AI's contribution to research applications remains a primary driver of its market growth in the biopharmaceutical sector.

By technology, the natural language processing segment held the largest market share of 32% in 2023. The natural language processing (NLP) segment commands a significant share in the AI biopharmaceutical market due to its adaptability and broad utility. NLP excels in extracting valuable insights from vast pools of unstructured textual data, encompassing medical literature, clinical records, and research documents.

Within the biopharmaceutical realm, where data holds immense importance, NLP simplifies the process of data analysis, aids in the identification of pertinent research, and expedites the examination of scientific literature. Its contributions span drug discovery, the optimization of clinical trials, and adherence to regulatory standards. NLP's prowess in transforming textual data into actionable knowledge firmly establishes it as a cornerstone technology within the biopharmaceutical AI landscape.

On the other hand, the deep learning segment is projected to grow at the fastest rate over the projected period. Deep learning commands a significant growth in the AI biopharmaceutical market due to its exceptional ability to process and interpret intricate biological data. Its multi-layered neural networks excel at recognizing complex patterns and relationships within genomics, proteomics, and clinical data.

This technology empowers drug discovery, patient stratification, and treatment optimization by extracting actionable insights from vast datasets. Deep learning's versatility in image analysis, natural language processing, and predictive modeling further solidifies its dominance, enabling biopharmaceutical companies to make data-driven decisions, expedite research, and enhance the overall efficiency and effectiveness of drug development and patient care.

In 2023, the hardware segment had the highest market share of 44% on the basis of the offering. The hardware segment holds a significant share in the artificial intelligence (AI) in biopharmaceutical market primarily due to the robust computational requirements of AI applications. AI in biopharmaceuticals demands powerful hardware infrastructure, including high-performance GPUs and processors, to handle the immense computational workloads required for data analysis, deep learning, and complex simulations.

This hardware ensures the rapid processing of extensive biological data, enabling quicker drug discovery and optimizing research efforts. Moreover, as AI continues to advance, there is a continuous need for more sophisticated hardware solutions, solidifying the hardware segment's substantial presence in the AI-driven biopharmaceutical market.

The services segment is anticipated to expand at the fastest rate over the projected period. The service segment holds a substantial growth in the artificial intelligence (AI) in biopharmaceutical market due to its essential role in providing tailored AI solutions and support to biopharmaceutical companies. AI implementation necessitates specialized expertise, data analysis, model development, and ongoing maintenance.

Service providers offer consultancy, custom AI development, and data analysis, enabling biopharmaceutical firms to harness the full potential of AI without developing these capabilities in-house. This cost-effective and efficient outsourcing of AI services empowers companies to expedite drug discovery, optimize clinical trials, and enhance patient care, driving the significant share of the service segment in the market.

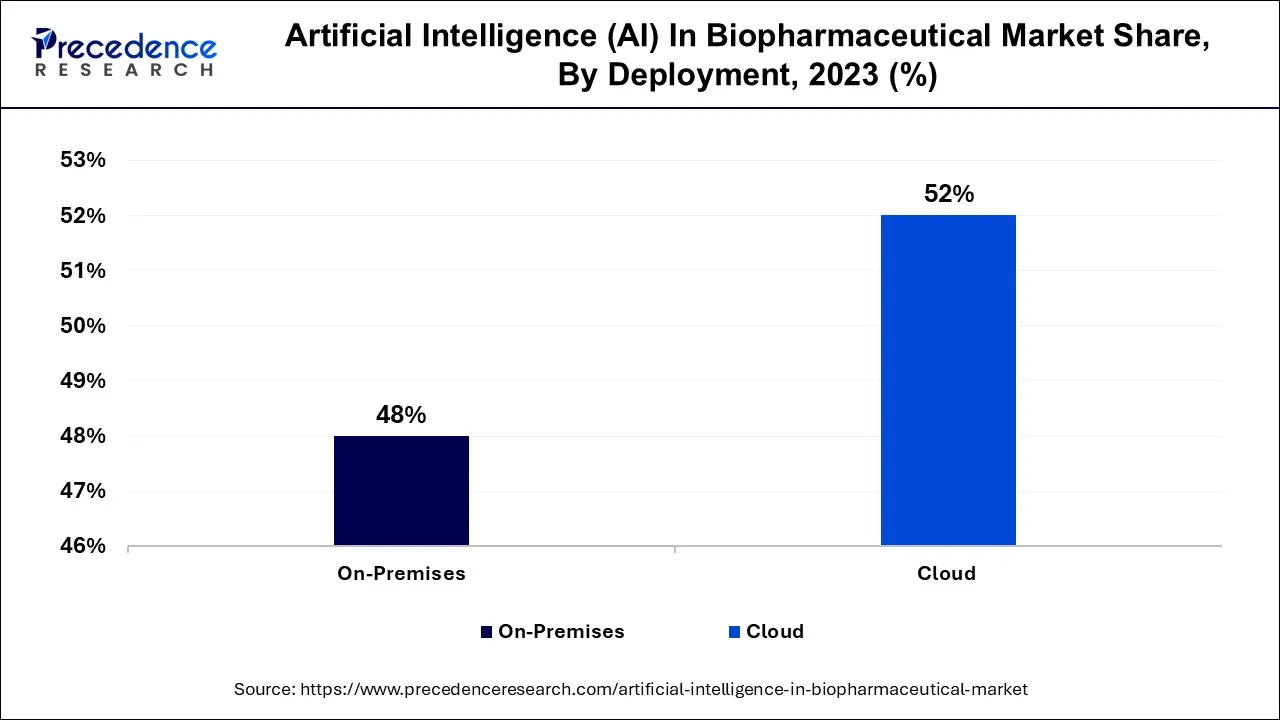

In 2023, the cloud segment had the highest market share of 52% on the basis of deployment. The cloud segment commands a significant growth in the Artificial Intelligence (AI) in the biopharmaceutical market primarily due to its scalability and accessibility. Cloud-based AI solutions offer biopharmaceutical companies the flexibility to access powerful computational resources without heavy upfront investments. This scalability is crucial for handling large datasets and complex AI algorithms in drug discovery and research.

Additionally, the cloud facilitates collaborative research and data sharing among geographically dispersed teams, a vital aspect in the biopharmaceutical field. Its cost-effectiveness, ease of maintenance, and potential for real-time updates make cloud deployment the preferred choice for AI applications in biopharmaceuticals.

The on-premises segment is anticipated to expand at the fastest rate over the projected period. Data sensitivity and regulatory compliance in the biopharmaceutical sector necessitate localized data storage and control, which on-premises deployment offers. Second, the industry's longstanding emphasis on data security and privacy favors on-site solutions. Third, on-premises deployments provide greater customization and integration capabilities with existing infrastructure. Finally, they offer more control over AI algorithms and data handling, vital for addressing unique biopharmaceutical challenges. These factors make on-premises deployments the preferred choice for biopharmaceutical companies seeking to leverage AI while ensuring data security and compliance.

Segments Covered in the Report

By Application

By Technology

By Offering

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

September 2024

April 2025