August 2024

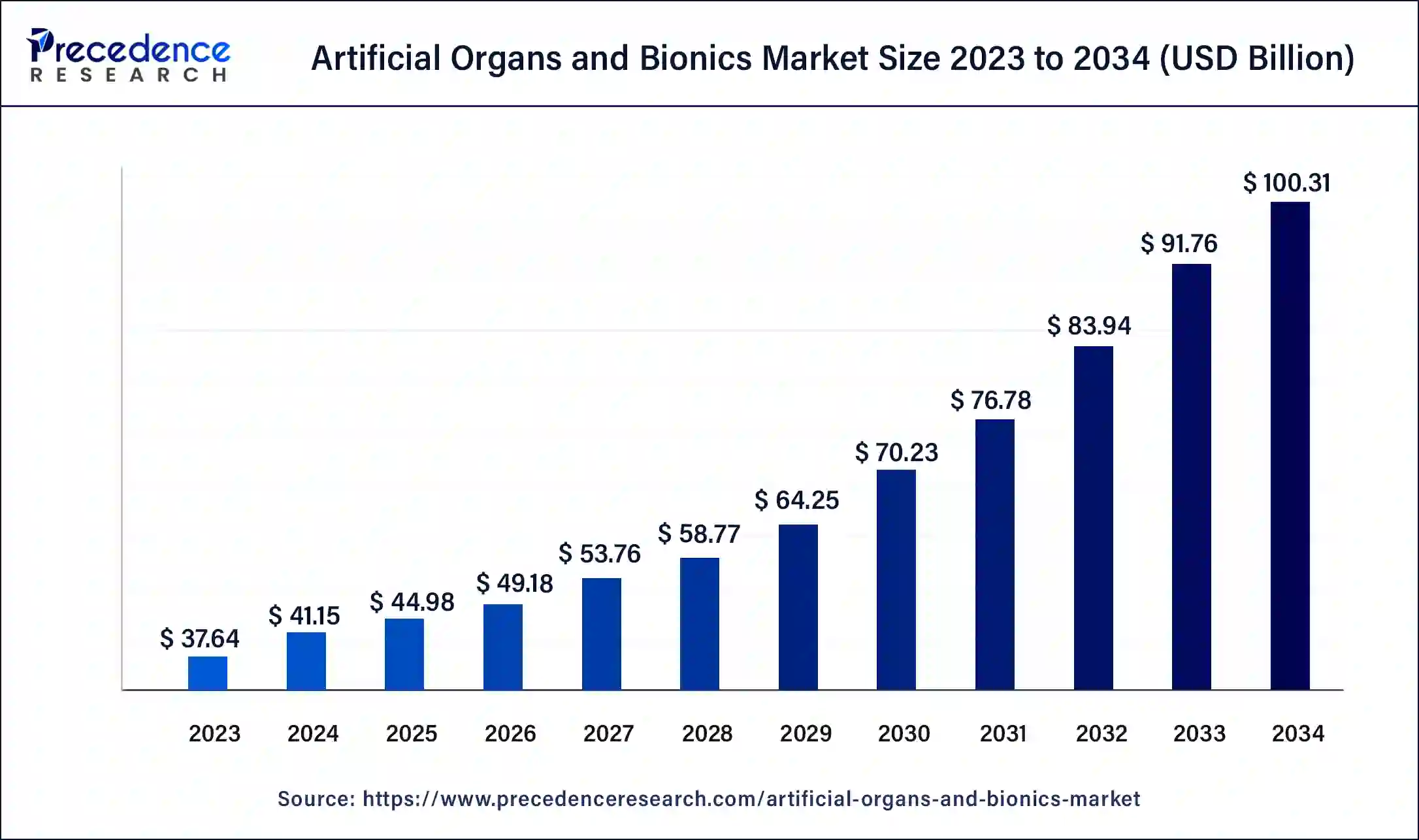

The global artificial organs and bionics market size was USD 37.64 billion in 2023, calculated at USD 41.15 billion in 2024 and is expected to be worth around USD 100.31 billion by 2034. The market is slated to expand at 9.32% CAGR from 2024 to 2034.

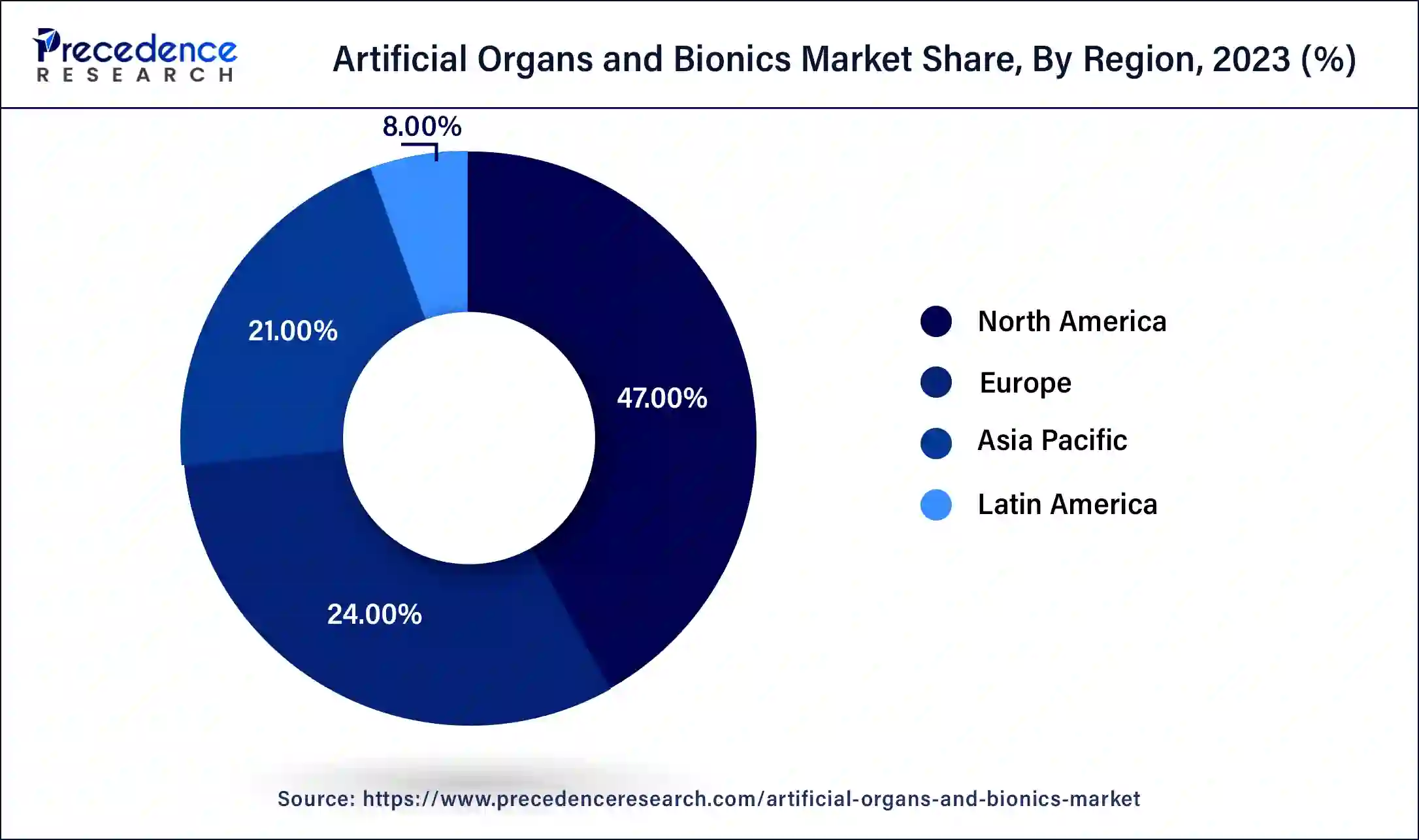

The global artificial organs and bionics market size is projected to be worth around USD 100.31 billion by 2034 from USD 41.15 billion in 2024, at a CAGR of 9.32% from 2024 to 2034. The North America artificial organs and bionics market size reached USD 17.69 billion in 2023. The key drivers of the artificial organs and bionics market are the increasing number of transplants and the rising number of people waiting for donors.

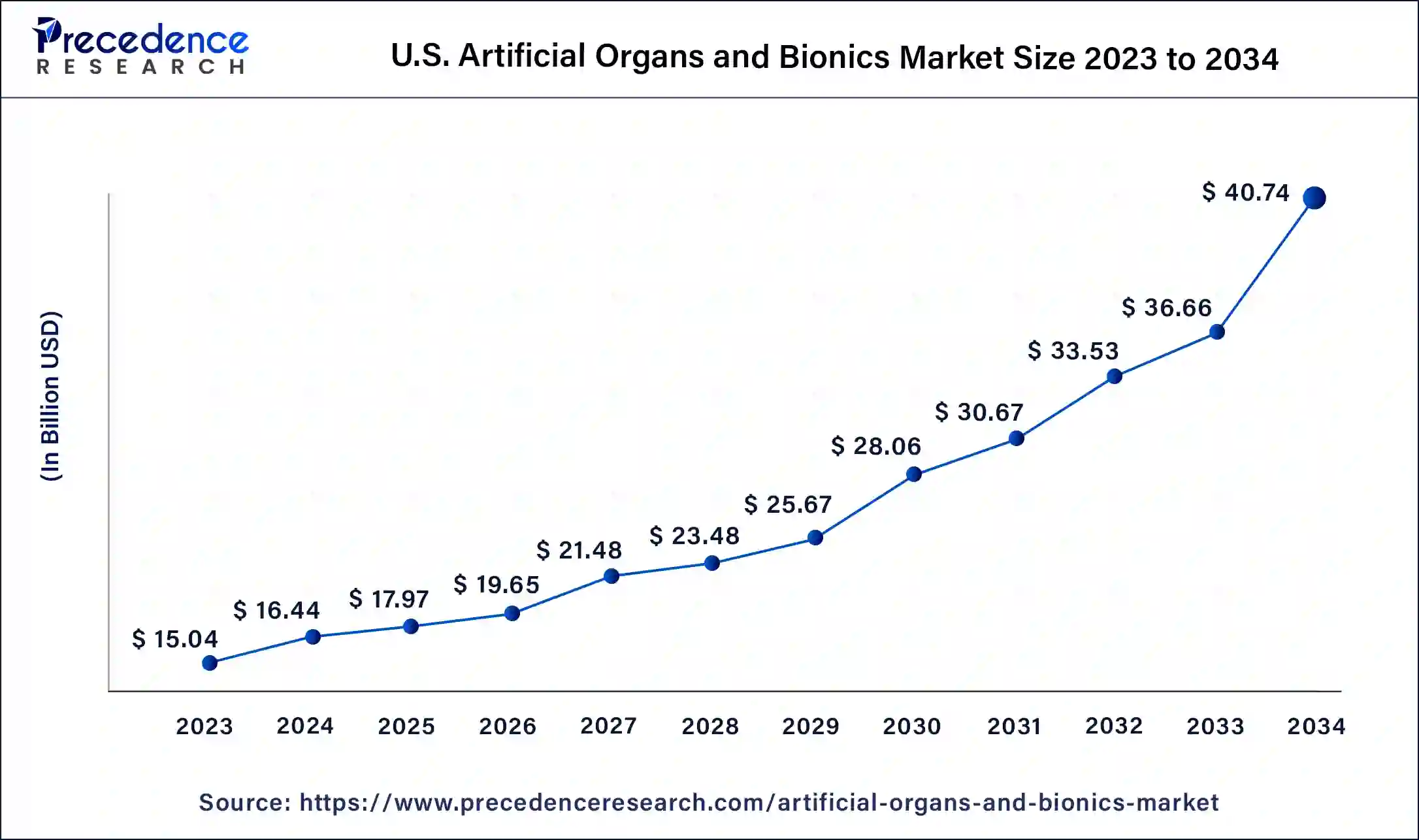

The U.S. artificial organs and bionics market size was exhibited at USD 15.04 billion in 2023 and is projected to be worth around USD 40.74 billion by 2034, poised to grow at a CAGR of 9.48% from 2024 to 2034.

North America dominated the artificial organs and bionics market in 2023. This dominance can be attributed to the rising number of transplantations and the growing incidence of organ failures. Additionally, the presence of a well-developed healthcare infrastructure and major biotechnology and medical device companies, such as Zimmer, Arthrex, Medtronic, Novartis AG, and Stryker, play a significant role.

Over the past five years, the U.S. has seen a substantial increase in donor numbers. One of the key drivers of the artificial organs and bionics market in the U.S. is the escalating demand for kidney donations.

Asia Pacific is anticipated to artificial organs and bionics market the fastest growth in the market during the forecast period. The region, comprising emerging economies like Japan, China, and India, boasts substantial populations and a high prevalence of chronic diseases. This surge in chronic ailments is expected to drive the demand for transplants soon.

Medical tourism is flourishing in these technologically advanced countries, which offer a variety of state-of-the-art surgical procedures. The affordability of surgical treatments in this region attracts numerous international patients seeking medical care. Therefore, the rise in medical tourism, combined with the prevalence of chronic diseases, can lead to organ failure; this has driven the growth of the artificial organs and bionics market in Asia Pacific.

Bionic implants and artificial organs are engineered medical devices worn externally or implanted in the body. These devices are manufactured artificially to replace or improve the function of natural organs. An artificial organ is a man-made device or tissue that is implanted or integrated into a person to interact with living tissue. It substitutes a natural organ, replicating or augmenting its function to help the patient resume normal life as quickly as possible. The replaced function does not always need to be linked to life support, though it frequently is. Bionics, also known as biologically inspired engineering, involves studying and developing engineering systems and modern technology based on principles derived from biological and natural systems.

Living Donation Trends

| Age Range | Number of Living Donors in 2023 | Percentage Increase Over 2022 |

| 18 to 34 | 1,736 | 1.1% |

| 35 to 49 | 2,720 | 7.9% |

| 50 and older | 2,495 | 12.1% |

Deceased Donation Trends

| Category | Number of Deceased Donors in 2023 | Percentage of Total Donors | Percentage Increase Over the Past Three Years |

| Percentage Increase Over the Past Three Years | 5,896 | 36% | 40.7% |

| Age 50 or Older | 6,884 | 42% | Not specified |

| Age Range 50 to 64 | 5,393 | Not specified | 16% over 2022 |

How Artificial Intelligence Can Improve the Organ Transplant Market

Artificial intelligence is majorly contributing to healthcare research with its wider applications in 3D printing technology. 3D-printed organ models provide high performance efficacy. The predictions of suitable organs, probability of organ rejection, organ donor-recipient matching are possible applications of AI in organ transplantation. The monitoring of immunosuppressant functioning is an AI-enabled approach before post-treatment care.

Machine learning helps optimize the printing parameters along with the classification of materials, functions, and products in 3D bioprinting technology. Machine learning has proven successful in detecting defects and running quality control and lowering of costs. Real-time data processing and data extraction are done by machine learning for implementation in clinical research technologies.

| Report Coverage | Details |

| Market Size by 2034 | USD 100.31 Billion |

| Market Size in 2023 | USD 37.64 Billion |

| Market Size in 2024 | USD 41.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Improved mobility and quality of life

Compared to a socket prosthesis, an Osseo-integrated prosthesis offers numerous advantages for individuals who have lost an arm or a leg. For example, walking becomes much easier due to the Osseo-integrated prosthesis connection, which provides greater stability and allows for a full range of joint movement.

Unlike socket prostheses, an Osseo-integrated prosthesis does not cause pain or damage to the skin when worn. Moreover, this type of prosthesis is directly attached to the bone, which can lead to a phenomenon known as natural Osseo-perception, where patients feel that their prosthesis is a part of their own body. This innovative approach significantly enhances the quality of life for amputees and has been widely adopted by numerous artificial organ and bionics manufacturers globally in recent years.

Ethical and regulatory challenges

Ethical concerns and intricate regulatory frameworks can present significant obstacles to the artificial organs and bionics market expansion. Upholding patient safety, privacy, and ethical standards while developing innovative technologies can delay the rollout of new products and treatments. Thus, it can hamper the growth of the artificial organs and bionics market during the forecast period.

Artificial organ technologies

Artificial organ technologies have now been leveraged in therapeutic areas. The future focus should not solely be on developing replacement organs but also on utilizing artificial organ technologies for therapeutic or preventive medicine. By aggressively applying technologies such as organ-on-chip, the progression to early end-stage organ failure can be prevented, which reduces the demand for artificial hearts, kidneys, orthopedic implants, and other implantable artificial organs. Furthermore, 3D bioprinting technology is expected to address the issue of organ shortages in the future. These factors can create opportunities for the artificial organs and bionics market.

The artificial organs segment was the leader in the global artificial organs and bionics market in 2023. Several factors, such as body size, blood type, distance from the donor, and illness severity, are considered while waiting for organ transplants. Meeting the unmet demand is a challenge that has prompted manufacturers to develop bio-lungs, artificial pancreas, and wearable artificial kidneys. The demand for kidney, heart, lung, and liver transplants is fueling the growth of this segment. Additionally, the increasing need for cochlear implants and brain bionics is also contributing to this segment's growth.

The artificial bionics segment is anticipated to grow at a faster rate in the artificial organs and bionics market over the forecast period. This can be attributed to the rising demand for cochlear implants, vision enhancements, and exoskeletons. The market expansion for artificial organs, bionics, and implants is further supported by favorable reimbursement policies and the rapid FDA approval process for implants, which facilitates faster commercialization. The device uses a cortical prosthesis to substitute the visual nerves in visually impaired individuals and is equipped with a camera, a brain implant, and a computer.

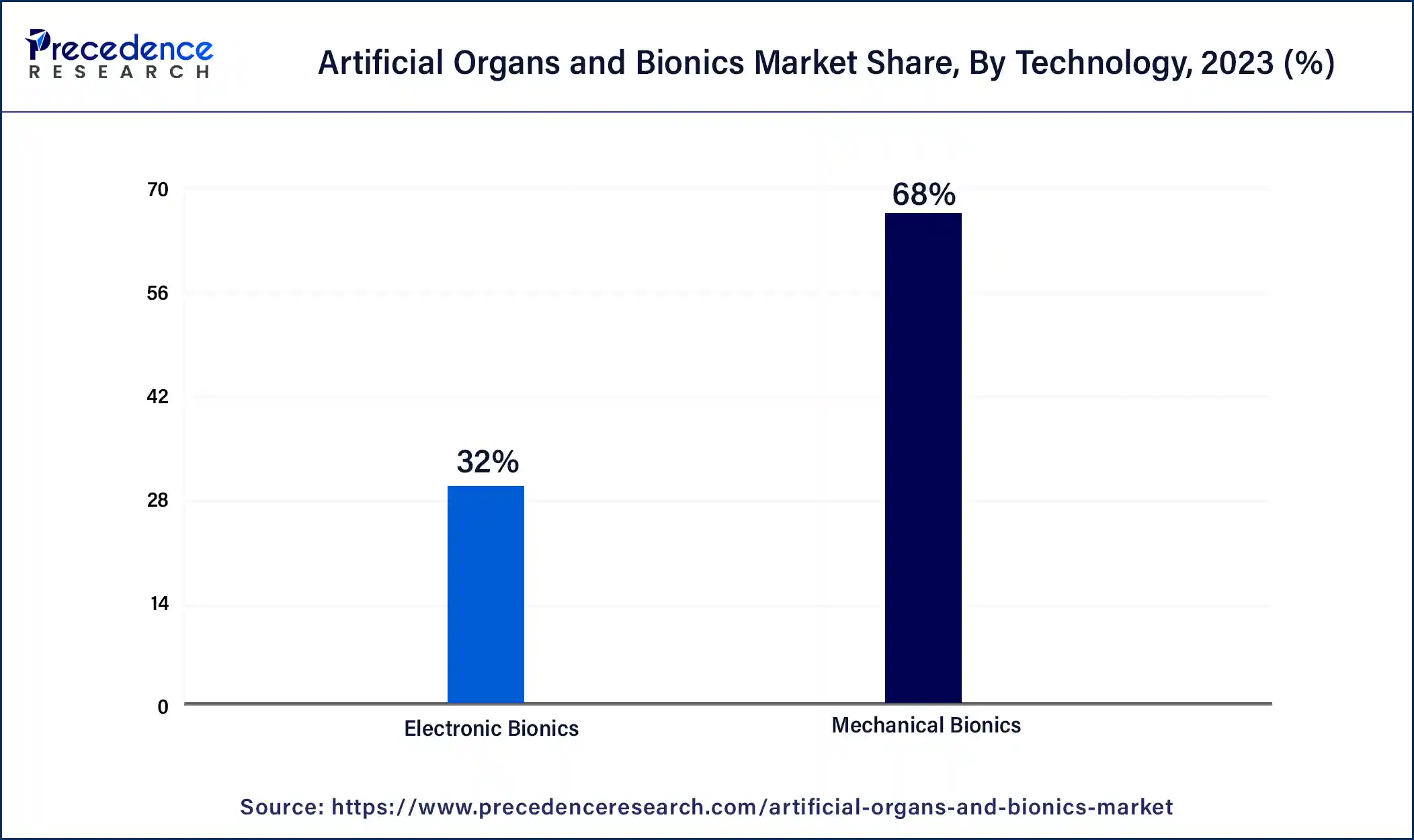

The mechanical segment accounted for the largest share of the artificial organs and bionics market in 2023. The primary factors driving this growth of the segments are the increasing incidence of organ failure and the affordability of mechanical bionics. Mechanical artificial heart valves, which have a significantly longer lifespan compared to other options, are in high demand. Additionally, expedited FDA approvals and favorable reimbursement policies are contributing to market expansion. The extended durability of mechanical artificial heart valves, along with quick regulatory approvals and supportive reimbursement frameworks, is further fueling the demand.

The electronic segment is anticipated to grow at the fastest rate in the artificial organs and bionics market during the projected period. The growing number of road accidents, the increasing prevalence of amputees, and the birth of individuals without limbs are anticipated to drive the demand for electronic bionics. In many developing nations, logistical and financial challenges remain substantial. Sensory electric technologies enable mobility in these artificial organs. Machine learning, smart wearables, and element modeling contribute to achieving this mobility. For numerous disabled individuals, the only available option is to acquire prosthetics such as artificial hands, arms, and legs. These prosthetics often incorporate battery-powered and myoelectric-controlled electronic systems that facilitate nerve movement through sensors.

Segments Covered in the Report

By Product

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

April 2025

December 2024