August 2024

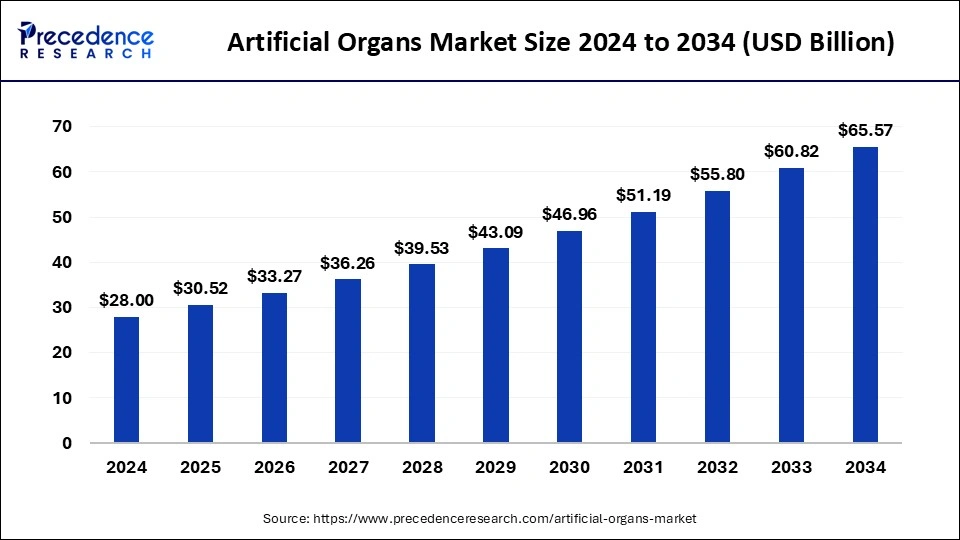

The global artificial organs market size accounted for USD 30.52 billion in 2025 and is forecasted to hit around USD 65.67 billion by 2034, representing a CAGR of 8.88% from 2025 to 2034. The North America market size was estimated at USD 10.36 billion in 2024 and is expanding at a CAGR of 9.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global artificial organs market size was estimated at USD 28.00 billion in 2024 and is predicted to increase from USD 30.52 billion in 2025 to approximately USD 65.67 billion by 2034, expanding at a CAGR of 8.88% from 2025 to 2034. The artificial organs market is experiencing a rise in the adoption of advanced biomaterials in artificial organs, marking one of the primary drivers contributing to its growth.

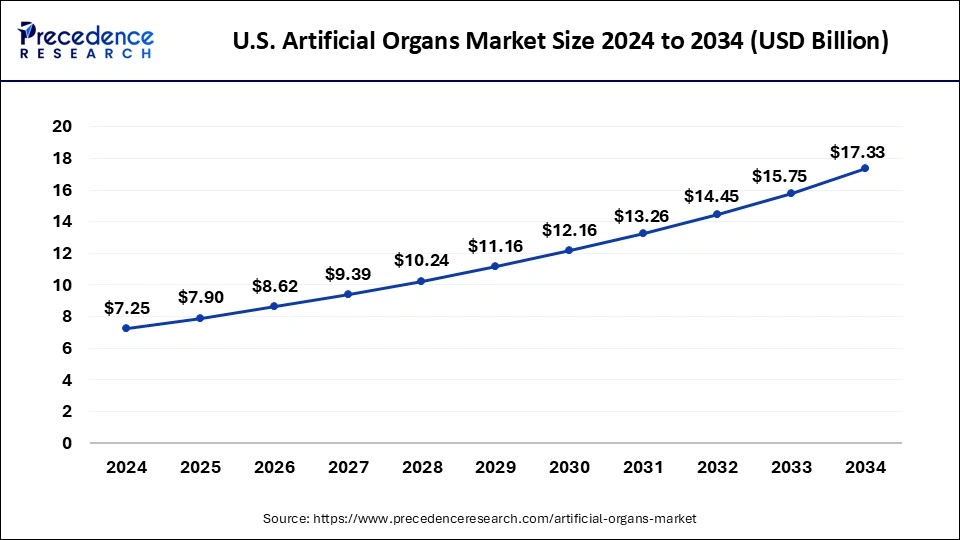

The U.S. artificial organs market size was exhibited at USD 7.25 billion in 2024 and is projected to be worth around USD 17.33 billion by 2034, growing at a CAGR of 9.11%.

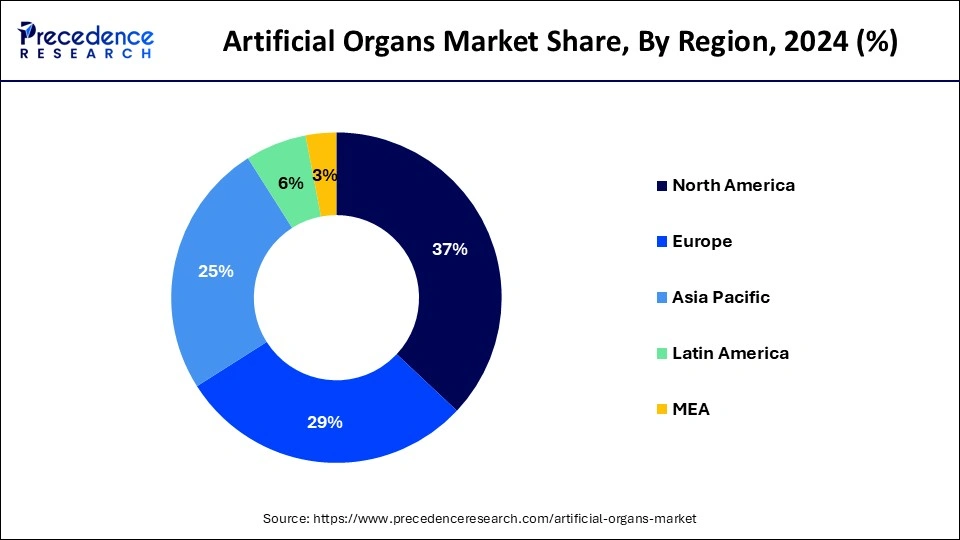

North America dominated the artificial organs market share of 37% in 2024 and is anticipated to maintain its dominant position in the coming years. The main factors fueling this growth include the increasing prevalence of chronic diseases like heart diseases, chronic kidney diseases, pulmonary fibrosis, organ failure, and others. Additionally, the region is witnessing a rise in the adoption of advanced technologies, a surge in product approvals, growing investments, and significant initiatives from key market players.

As highlighted in the Centers for Disease Control and Prevention's (CDC) February 2022 article titled 'Heart Disease Facts,' heart disease stands among the top causes of death in the United States. The article also notes that approximately 659,000 Americans experience a heart attack annually. Given the ongoing mortality rates associated with heart diseases, there remains a persistent demand for devices that can enhance heart efficiency, thereby influencing the artificial organs market in focus.

Europe is expected to gain a significant market share during the forecast period. The artificial organs market is expected to grow due to factors such as a rise in organ failures, increased incidence of disabilities, a shortage of donor organs, and technological advancements leading to expanded applications. Major organs like kidneys, liver, lungs, heart, central nervous system, and hematologic system are prone to failure among the target population. In Europe, organ failures have consistently increased over the past few decades, but the number of organ donors remains low. This situation is creating a demand for artificial organs in the region.

Artificial organs are specially crafted devices designed to be implanted in the human body, serving as substitutes for original organs. These organs are created using diverse materials, including metals, non-living polymers, living cells, and plastic embedded with stem cells sourced from the transplant recipient. As these innovative solutions save lives and contribute to improved functionality, the demand for artificial organs is rising worldwide.

Artificial organs mimic the functions of healthy organs or perform specific tasks, providing vital life support to individuals awaiting transplants. Additionally, they play a crucial role in enhancing the quality of life for patients, aiding in cosmetic restoration post-cancer surgery or accidents. The global artificial organs market caters to these growing demands, supported by rapid product launches and research and development activities.

In the artificial organs market, various organs like kidneys, lungs, livers, hearts, artificial pancreas, and cochlear implants are observed. These artificial organs are well-tolerated by the body, minimizing the risk of rejection by the immune system. Unlike some medical devices, they do not require a constant power supply or reliance on other stationary resources, making them suitable for patients with severe organ failure.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.88% |

| Market Size in 2025 | USD 30.52 Billion |

| Market Size by 2034 | USD 65.67 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Organ Type and Material Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in organ transplantation globally

The rapid demand for organ transplantation is due to the rising prevalence of vital organ failures, improved success rates, and enhanced post-transplant health conditions. However, the need for more donors to meet the growing demand has resulted in a crisis in the market for organ transplantation. However, there is a substantial increase in the number of patients awaiting transplants, leading to a higher mortality rate due to the unavailability of organs for transplantation, thereby driving the market growth of the artificial organs market.

The increasing prevalence of chronic disorders

The rising prevalence of conditions such as chronic kidney diseases, diabetes, hearing disorders, and cardiovascular disease. (CVDs) such as strokes and cardiac diseases, coupled with a growing aging population, is expected to drive the demand for artificial organs.

Unhealthy lifestyles, characterized by physical inactivity and poor diets, contribute to issues like elevated blood glucose, high blood pressure, and increased lipids, leading to hypertension, obesity, abnormal cholesterol, and diabetes. These factors, particularly affecting individuals aged 60 and above, contribute to the incidence of cardiac disorders.

The rising occurrence of cardiovascular diseases has resulted in a higher demand for devices like pacemakers and total artificial hearts. Consequently, the increasing prevalence of chronic diseases is a significant factor expected to fuel the growth of the artificial organs market over the forecast period.

The complications and limitations associated with artificial organs

The purpose of artificial organs is to replace damaged or diseased organs to restore their functions. While artificial organs can save lives, their benefits come with certain complications and limitations. Common complications observed in individuals with total artificial heart (TAH) implants include stroke, bleeding, thrombosis, infections, liver failure, renal failure, and neurological events like device malfunction.

Although infectious and hemorrhagic complications are infrequently reported as significant causes of death due to artificial organ implantation, these factors are projected to hinder the growth of the artificial organs market during the forecast period.

Advances in 3D bioprinting

Advancements in organ transplantation have been propelled by breakthroughs in 3D bioprinting, which offers the creation of artificial organs. The increasing adoption of this technology is driven by its ability to mitigate the risk of organ rejection. Moreover, the integration of artificial intelligence is poised to transform global approaches to utilizing artificial devices.

Nations worldwide are actively developing a tool for personalized organ and donor compatibility assessments. This innovative tool will play a pivotal role in making informed decisions about organ retrieval, allowing patients to choose between accepting donor organs or waiting for more favorable options.

Growing incidence of organ failure

The growing incidence of organ failure resulting from severe infections, cardiovascular disease, and trauma has led to an increased demand for organ transplant surgeries. Unhealthy habits like drinking and smoking contribute to liver and heart failure, further elevating the risk of organ failure. This rising prevalence of diseases underscores the need for artificial organs.

A surge in product launches and swift FDA approvals for these devices is addressing the donor shortage. This highlights the anticipation of substantial growth in the artificial organs market due to escalating healthcare spending and the swift FDA approval of synthetic human body parts during the forecast period.

The silicon segment dominated the artificial organs market in 2024. Silicone elastomers have gained extensive use as a soft and flexible material for constructing artificial organs and implants within the human body. Silicone elastomers are versatile materials that can be shaped using techniques similar to those used for other elastomers. Fillers like powdered metals or barium sulfate can be added to enhance visibility in medical imaging. It can undergo sterilization through steam autoclave, ethylene oxide, dry heat, or radiation. A high-performance medical-grade silicone elastomer, resistant to fatigue flexing and tear propagation, has been developed for use in implants for bone and joint reconstruction. This includes discussing silicone elastomers' properties, biocompatibility, durability, and medical applications.

The plastic segment was estimated to hold a significant share of the artificial organs market in 2024. Its biocompatibility and cost-effective manufacturing drive this growth. When implanted, the typical host reaction involves encapsulating the implant in fibrous tissue. Also, the plastic component's shelf-life under normal conditions is indefinite. The widespread use of high polymers in artificial organ replacement ensures the continued growth of this segment throughout the forecast period.

The liver segment is expected to hold a significant share of the artificial organs market over the forecast period. In order to address challenges like pathophysiology, liver failure, and human safety, a liver support system must replicate the metabolic and synthetic functions of the liver. Bio-artificial systems featuring modules contain live liver cells or hepatocytes that can provide synthetic functions for replacement, detoxification, and management in cases of liver failure. The regenerative treatment approach for hepatocytic conditions solves the shortage of available donors. Although artificial and bioartificial liver support devices have been shown to support liver regeneration and detoxification abilities and serve as a bridge to transplantation, further studies are needed to understand their survival effects.

The kidney segment is expected to grow at a notable rate in the artificial organs market in the upcoming years. Significant advancements have been observed in kidney replacement technology over the past two decades, particularly in cell growth techniques, nanotechnology, and bioreactors. Two recent innovations in this field, the implantable bioartificial kidney (BAK) and kidney regeneration technology, are currently in the preclinical stage, aiming to replicate normal kidney functions fully. Technologies showcase the potential to mitigate risks associated with dialysis and kidney transplants by addressing challenges such as donor organ shortages, complications from dialysis, and the use of immunosuppressants.

By Organ Type

By Material Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

September 2024

April 2025