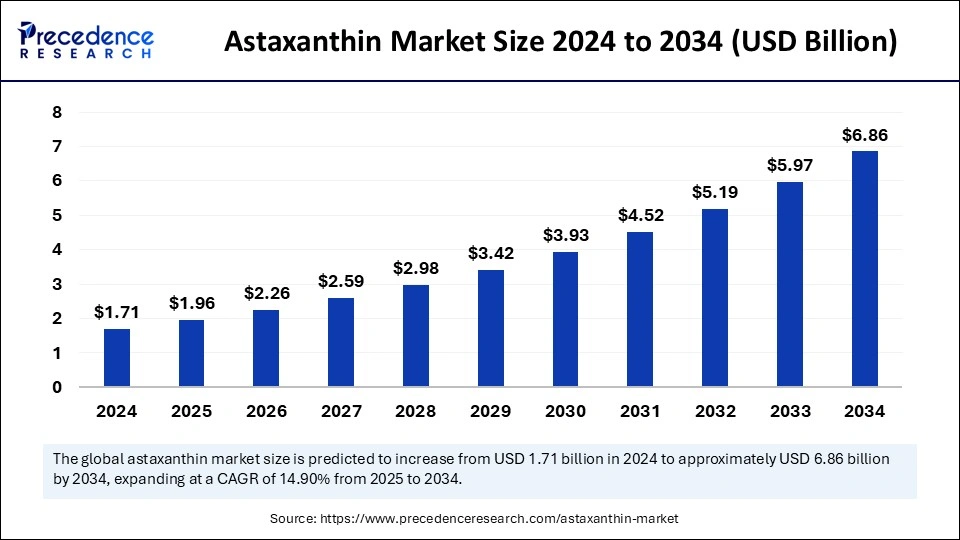

The global astaxanthin market size is calculated at USD 1.96 billion in 2025 and is forecasted to reach around USD 6.86 billion by 2034, accelerating at a CAGR of 14.9% from 2025 to 2034. The North America market size surpassed USD 600 million in 2024 and is expanding at a CAGR of 15.05% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global astaxanthin market size accounted for USD 1.71 billion in 2024 and is predicted to increase from USD 1.96 billion in 2025 to approximately USD 6.86 billion by 2034, expanding at a CAGR of 14.90% from 2025 to 2034. The rapid growth of the astaxanthin market results from consumer interest in natural antioxidants, health advantages, and their use in supplements, cosmetics, and aquaculture products.

The astaxanthin market operations are experiencing production optimization through Artificial Intelligence and automated systems that increase operational efficiency. Artificial Intelligence enables better management of cultivation, extraction, and quality control, thereby improving astaxanthin production quantities and consistency levels. Real-time environmental monitoring through automated systems checks light, temperature, and nutrient levels as they ensure microalgae grow optimally. The implementation of technology advances, astaxanthin production scalability to allow manufacturers the development of new formulations and industrial product applications for health supplements, cosmetics, and food applications.

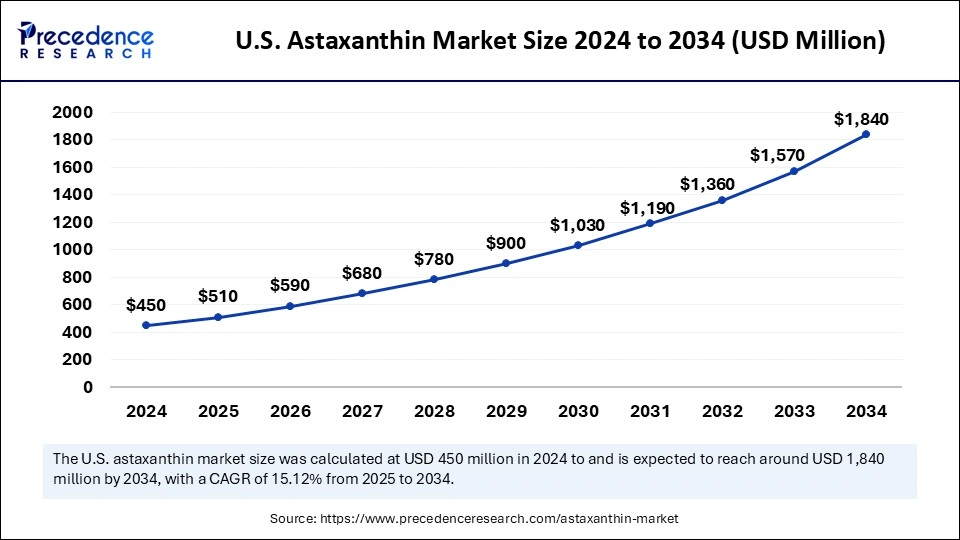

The U.S. astaxanthin market size was exhibited at USD 450 million in 2024 and is projected to be worth around USD 1,840 million by 2034, growing at a CAGR of 15.12% from 2025 to 2034.

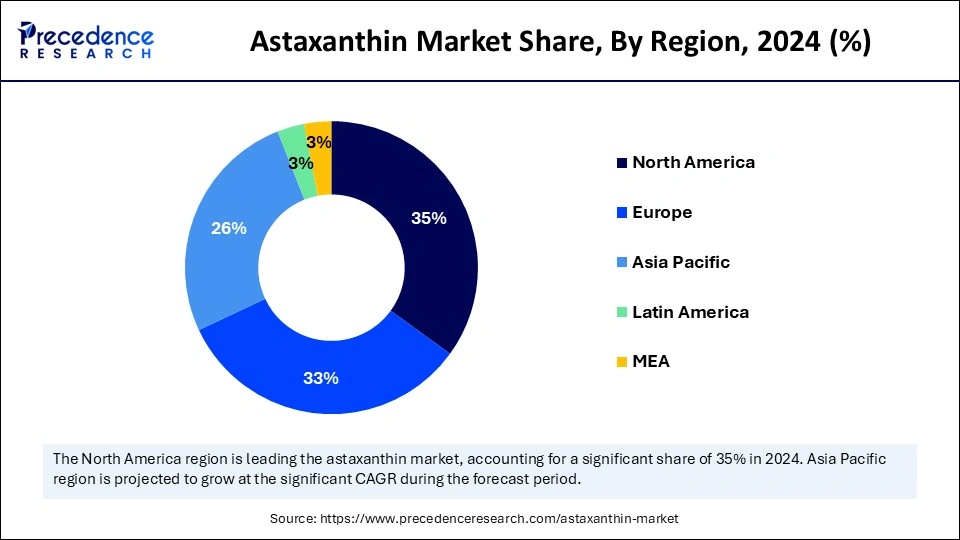

North America held the dominating share of the astaxanthin market in 2024 because of the leading industry players and increase in health awareness among regional consumers. The antioxidant properties of Astaxanthin draw manufacturers to use it for supplements and functional foods because they protect skin while reducing inflammation and improving general well-being. The region maintains an established and quickly developing dietary supplement market structure.

The market is expanding because of increasing commercial use of astaxanthin in aquaculture feed. The market in the U.S. and Canada expands rapidly because of rising seafood and animal product consumption, since such products depend on astaxanthin for coloring and health advantages.

Asia Pacific Astaxanthin Market Trends

Asia Pacific is expected to witness the fastest rate of growth during the predicted timeframe. A region-wide population focused on personal wellness shows growing concern for healthy aging, thus providing extensive business possibilities for astaxanthin producers. The market will benefit from urban development and rising incomes together with rising consumer knowledge about natural products that appear in nutritional supplements and functional food applications.

Astaxanthin producers can access major growth potential in the Chinese market because this country has populations who actively pursue health and wellness. Natural antioxidant demand for astaxanthin continues to rise since consumers care about their health and look for ingredients to maintain their skin and immune system functions and general well-being.

Europe Astaxanthin Market Trends

Europe is observed to grow at a considerable growth rate in the upcoming period. The growing health-conscious behavior of European consumers leads to increasing demands for natural astaxanthin antioxidants in nutritional supplements as well as functional food products. The market receives further momentum because the EU regulation on ingredients urges manufacturers to use this natural alternative compound instead of additives. Natural and clean-label products are gaining noticeable popularity throughout the regional market landscapes.

The European Algae Biomass Association (EABA) leads algae sector development through its research and development promotions. Through their work, the EABA developed platforms for policymaker collaboration with scientists and industry representatives to advance natural astaxanthin production technologies significantly.

Astaxanthin represents a strong xanthophyll carotenoid compound that occurs naturally in microorganisms, marine animals, and some algae species. Its anti-inflammatory properties and antioxidant capabilities make astaxanthin an attractive choice in modern health and wellness markets. Astaxanthin serves as a crucial component in aquaculture systems as it improves the color appearance of salmon, trout, and shrimp, thus adding value to the farmed aquatic products. The dietary supplement form of Astaxanthin serves various industries through cosmetic use, food production, beverage ingredients, and animal feeding applications.

The growing consumer awareness about astaxanthin's health advantages, including antioxidant power and anti-inflammatory properties, keeps it among the key drivers of market growth. Astaxanthin experiences increased popularity as a natural ingredient which appears in dietary supplements and cosmetic formulations. The expanding market for astaxanthin is owing to the rising consumer interest in sustainable ingredients and natural products, thus producing broader industry growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.86 Billion |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size in 2024 | USD 1.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.90% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Application, Product, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Demand for Natural Alternatives in Cosmetics and Nutraceuticals

People prefer natural alternatives in order to avoid potentially harmful effects that synthetic additives and chemicals present in food and topical products. The medical field of dermatology values nutraceuticals, because studies establish astaxanthin, reduces oxidative pressure, supports skin elasticity, and directs aging indicators.

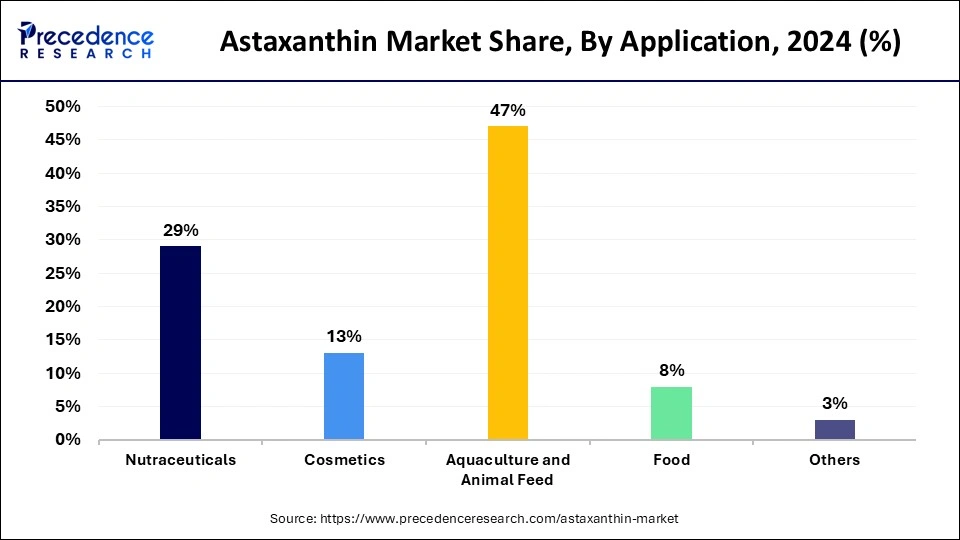

Premium skincare products contain astaxanthin because of its important features as an anti-aging component and UV-protectant. The food and beverage industry maintains dual application of astaxanthin for natural coloring purposes while seeking its health value benefits in addition. The pigmentation of farmed seafood improves through astaxanthin use in aquaculture production because it enhances marketability and visual appeal.

Risks associated with adulteration and clean label requirements

The astaxanthin market encounters substantial limitations from the risk of product adulteration and the need to fulfill clean label standards. The consumption of adulterated astaxanthin generates severe health risks across humans and animals and the environment because animals receive astaxanthin exclusively through their diet. The manufacturing process of natural astaxanthin from microalgae proves expensive and labor-intensive, thus making the product less accessible. Astaxanthin cannot qualify as a clean-label ingredient due to its frequent integration with multiple other substances, which prevents its adoption in food-grade manufacturing.

Advancements in Biotechnology for Sustainable Astaxanthin Production

The sustainable production of astaxanthin relies on Haematococcus pluvialis microalgae, which functions as the main natural astaxanthin supplier. Modern cultivation methods such as photobioreactors, controlled outdoor pond systems, enhance production scale and operational expenses of astaxanthin manufacturing. The advanced astaxanthin production methods decrease ecological damage but adhere to consumer demand for sustainable green products. Advanced biotechnology advances combined with improved algae cultivation strategies show great promise for increasing the natural astaxanthin market through sustainability-based quality initiatives.

The natural segment contributed for the largest share of the astaxanthin market in 2024. Natural astaxanthin attracts consumers because they seek organic, clean-label and sustainable product choices. The bacterial species Haematococcus pluvialis primarily produces natural astaxanthin, whereas this antioxidant gains popularity since it exhibits superior properties. Natural supplements gain popularity because they provide health benefits and immune support with anti-aging advantages.

The adoption of environmentally friendly and sustainable resources such as astaxanthin from microalgae directly correlates with consumer concern about sustainability since synthetic production techniques typically lead to a larger environmental impact. The demand for clean-label products that minimize processing aligns perfectly with natural astaxanthin attributes, thus making it increasingly popular in supplements and food items.

The synthetic segment is expected to grow considerably in the astaxanthin market. The production methods of synthetic astaxanthin by chemical synthesis or biotechnology lead to important advantages, which include producing at low cost while maintaining scalability and ease of manufacturing. Market expansion of synthetic astaxanthin has increased due to growing consumer recognition of its antioxidant power, its cardiovascular support capabilities, its anti-inflammatory effects, and its benefits for skin health.

The dried algae meal or biomass segment accounted for the largest share in the astaxanthin market in 2024. The dominating position of dry algae biomass as astaxanthin source results from factors such as its role in formulations and low processing needs as well as its bulk production capabilities and applications in animal feed. Dried algae biomass stands as the most commonly selected form by manufacturers because it presents economical advantages and adjustable use capabilities. Direct administration of astaxanthin powder leads to usage opportunities for pharmaceutical formulation manufacturing and capabilities to create tablets and capsules.

The softgel segment is anticipated to witness significant growth in the astaxanthin market over the studied period. Usage of softgels remains the consumer preference due to their ease of consumption, which appeals most strongly to the older adult population. Softgel formulations have gained increasing popularity because they provide users convenient features, thus preferring them above other supplement alternatives.

The increasing number of elderly people requires easier supplement consumption methods, softgels have gained increased popularity compared to tablets and liquids. Softgels work as the perfect nutraceutical choice through their ability to deliver uniform and dependable delivery systems. Softgels provide exact dosage of astaxanthin because their design enables proper delivery amounts to consumers.

The aquaculture & animal feed segment accounted for the largest astaxanthin market share. The compound maintains vital value for enhancing health and pigmentation of seafood production in aquaculture systems and livestock farms. Astaxanthin serves as a key ingredient in aquaculture because it intensifies fish coloration in salmon and trout and other species, thus raising their commercial value when presented in the market. The growing market demand for premium fish and animal products with natural ingredients will stimulate greater use of astaxanthin in animal nutritional formula.

The nutraceutical segment is anticipated to witness significant growth in the astaxanthin market over the studied period. The market demand for astaxanthin as a natural antioxidant in nutraceuticals increases because consumers show more interest in health and rising awareness of its health advantages. The established health benefits of astaxanthin, which include skin improvements, anti-inflammatory response and enhanced wellness appeal, make it suitable for multiple nutraceutical product lines. The food and beverage industry implements astaxanthin in functional foods to broaden its uses throughout this market sector. Many consumers choose preventive healthcare through nutraceuticals, thus creating rising market demand for astaxanthin.

By Source

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client