January 2025

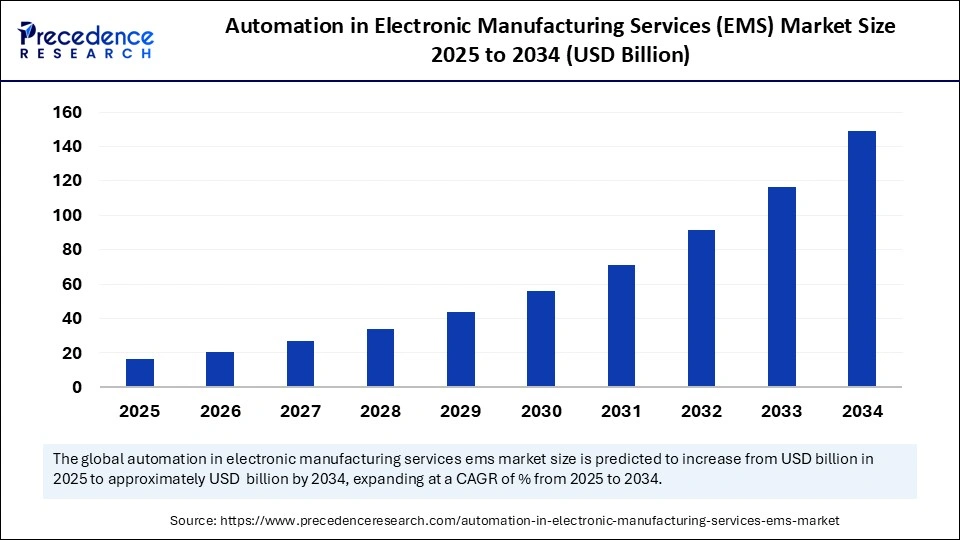

The automation in electronic manufacturing services (EMS) market focuses on integrating advanced technologies like robotics and AI to enhance efficiency, precision, and scalability in electronics production. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year

The automation in electronic manufacturing services (EMS) market enhances electronics production through robotics, AI, and smart systems, boosting efficiency, quality, and scalability. The market growth is attributed to the increasing demand for efficient and scalable productions processes. Ongoing advancements in automation technologies further contribute to market expansion.

Artificial Intelligence (AI) leads to a fundamental automation transformation within electronic manufacturing services, as it allows enhancement in operation precision. Manufacturers can utilize computer vision systems to check for assembly defects, thus maintaining high product standards while running at full speed. Furthermore, the integration of AI reduces human mistakes and enables manufacturers to develop personalized products with accelerated innovation cycles. AI also optimizes workflows and increases production efficiency.

The automation in electronic manufacturing services (EMS) market is growing rapidly, driven by the rising need for increased efficiency, accuracy, and speed in production. The demand for advanced manufacturing technologies continues to rise, further driving the growth of the market. The combination of robotics with AI and Machine Learning technologies is revolutionizing electronic production lines. The rising focus on improving quality and production output further drives market growth. According to the World Economic Forum’s report on mixed manufacturing (2023), more than 70% of worldwide manufacturing organizations perform automated procedures for cost reduction combined with quality advancement. Additionally, the increasing adoption of Industry 4.0 technologies and government initiatives promoting industrial automation contribute to market growth.

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Automation, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Adoption of Industry 4.0 Approach

The high utilization of the Industry 4.0 approach in various industries is a major factor driving the growth of the automation in electronic manufacturing services (EMS) market. Manufacturing industries are rapidly transitioning toward the Industry 4.0 approach. This approach enables manufacturers to enhance efficiency, productivity, and flexibility while enabling more intelligent decision-making and customization in manufacturing operations. Such approaches provide complete transparency that allows quick decisions throughout the manufacturing domain. In addition, the rising focus on industrial automation drives the market’s growth. Automation solutions allow businesses to deliver customized products while minimizing waste. According to the International Telecommunication Union (ITU), in 2023, manufacturing companies across industrialized nations have adopted one or more 4.0 technologies. Furthermore, through the Industry 4.0 approach, manufacturing businesses can satisfy varying consumers’ needs.

High Initial Investments

High initial investments are anticipated to limit the widespread adoption of automation technologies, which hinders the growth of the automation in electronic manufacturing services (EMS) market. Implementing automation technologies requires significant upfront investments in software, hardware, and equipment. Small and middle-sized enterprises often encounter difficulties paying for advanced automation and robotics systems. In addition, integrating automation into existing production lines creates complexities, requiring special training and limiting the adoption of automation technologies.

Rising Investments in Smart Factory

Rising investments in smart factory infrastructure are expected to create immense opportunities for key players competing in the market. The development of smart manufacturing receives financing through entities. This funding enables manufacturers to invest in AI, the Internet of Things (IoT), and robotics technologies. The European Commission invested heavily under its Digital Europe Program in 2024 to establish smart electronics production facilities throughout all EU member states. Moreover, the development of new technologies creates immense market opportunities with capabilities to maintain connected and scalable operations.

The industrial robots (assembly, welding, material handling, etc.) segment dominated the automation in electronic manufacturing services (EMS) market in 2024. This is mainly due to their exceptional precision and efficient task execution capabilities. Industrial robots perform essential tasks, reducing the need for manual intervention and labor. According to a research report by the National Institute of Standards and Technology (NIST), industrial robots gained significant popularity in smart manufacturing programs in 2023. The rise in the demand for industrial automation further bolstered the segment’s growth.

The software automation (MES, ERP integration, AI-driven analytics) segment is projected to grow at a significant CAGR in the coming years, owing to the rising adoption of software solutions in automation technologies. Software automation automates repetitive tasks and processes, reducing human intervention and increasing efficiency and accuracy. With the growing digital manufacturing ecosystems, software automation is emerging as an essential element. Additionally, manufacturers choose this flexible solution due to its cost-effectiveness.

The consumer electronics segment held a considerable share of the automation in electronic manufacturing services (EMS) market in 2024. This is mainly due to the increased demand for electronic devices. Since modern electronic devices have become increasingly complex, manufacturers choose automation technologies for precision manufacturing. The World Health Organization (WHO) declared in 2023 that digital technologies need to be used for improving supply chain efficiency by replacing manual work with automated systems. The increased production of consumer electronics further bolstered the segment’s growth.

The automotive & EVs segment is anticipated to grow at the highest CAGR during the forecast period. The growth of the segment can be attributed to the rising focus on existing fleet electrification and increasing integration of ADAS and infotainment systems. This, in turn, boosts the demand for complex automotive electronics that require improved manufacturing techniques. The rising production of vehicles is likely to support segmental growth.

Asia Pacific led the automation in electronic manufacturing services (EMS) market by capturing the largest share in 2024. This is mainly due to the presence of a large number of electronics manufacturing facilities in this region. Countries like China, India, South Korea, and Taiwan are the world’s largest manufacturing hubs for electronics, boosting the demand for advanced automation technologies. Government initiatives promoting industrial automation further bolstered the market in the region. Government-led programs, like "Make in India" campaign, encouraged manufacturers to invest in automation technologies, solidifying the region’s position in the global market.

North America is expected to experience the fastest growth during the forecast period. The growth of the market in the region can be attributed to the region's strong focus on reducing operational costs and enhancing production output. The labor shortage is encouraging electronics manufacturers to adopt automation solutions. There is a high demand for high-tech and specialized EMS solutions in sectors like healthcare, automotive, and aerospace. The presence of major tech companies further supports market growth. Rockwell Automation and other tech companies are focusing on enhancing their regional operations to enhance their software and hardware research capacities. Furthermore, the region’s robust industrial base and the rapid development of advanced technologies contribute to regional market growth.

By Type of Automation

By End-Use Industry

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

November 2024