January 2025

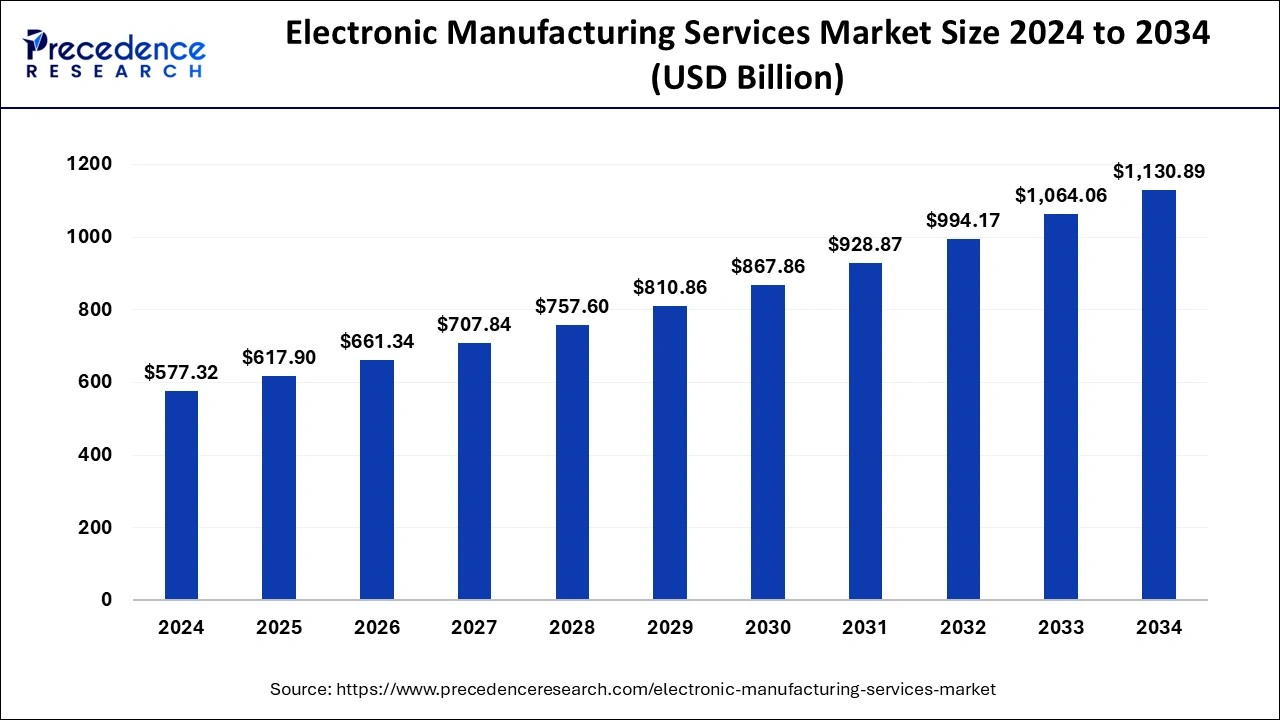

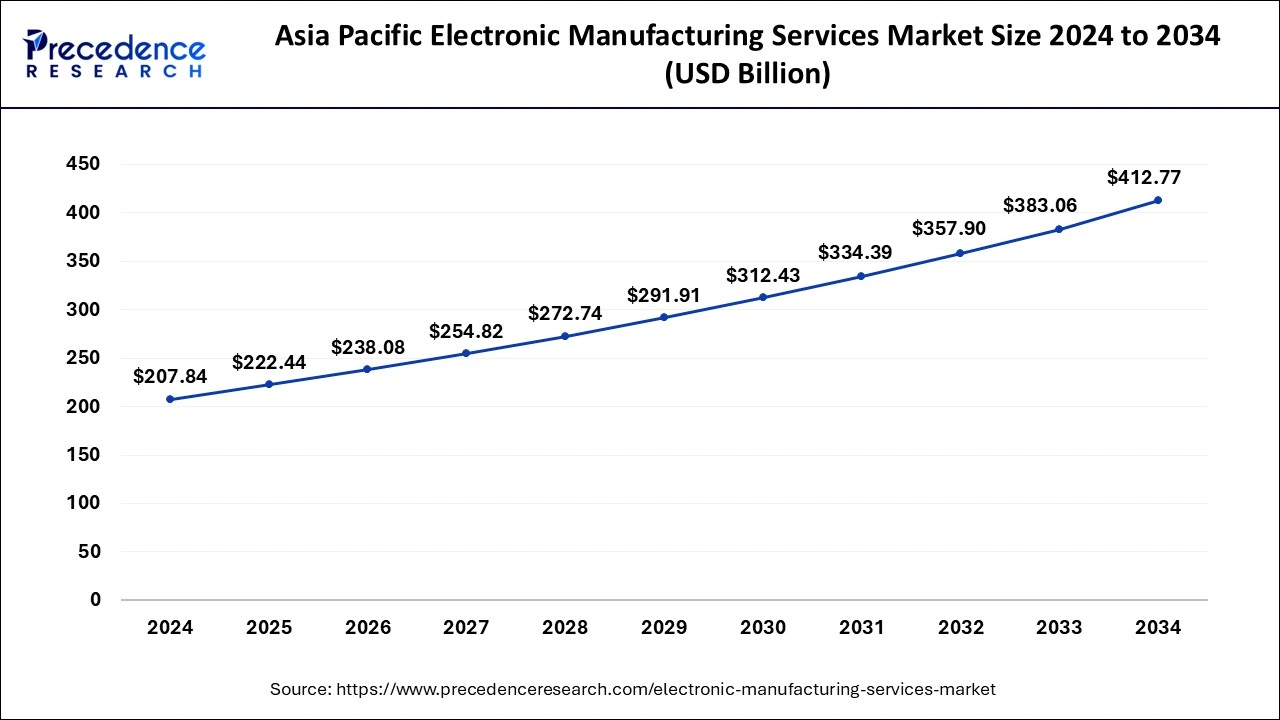

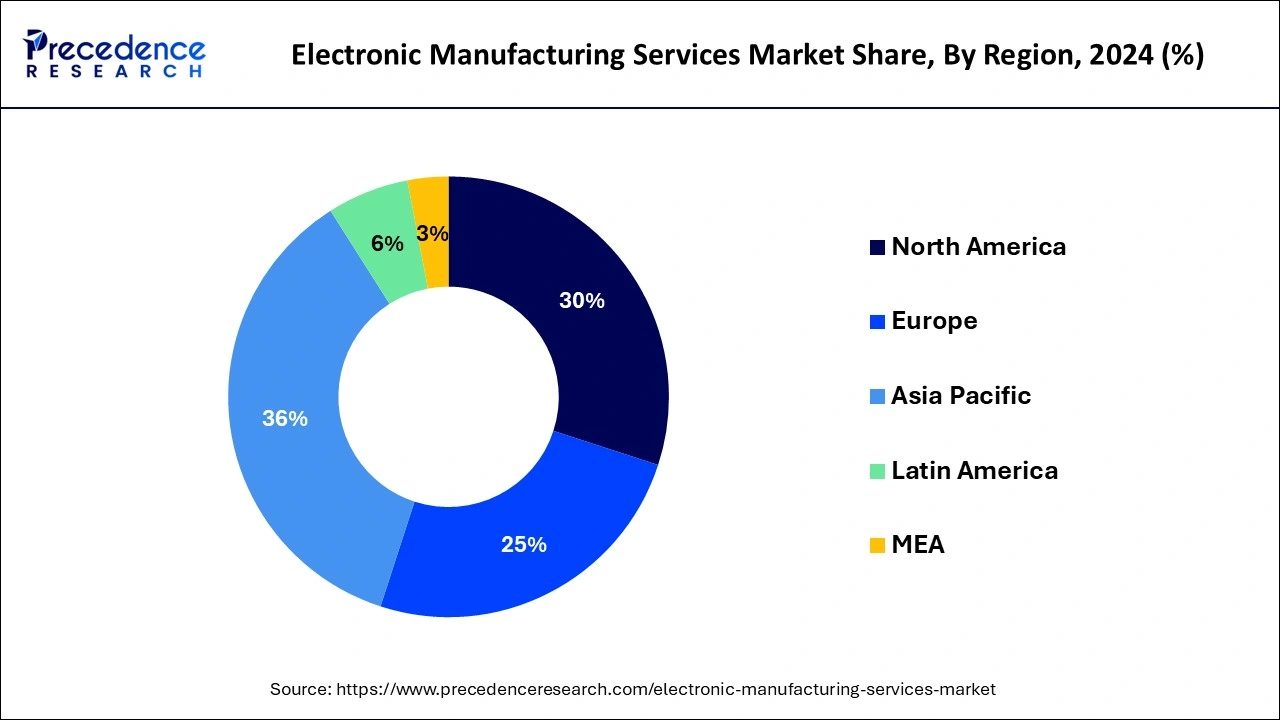

The global electronic manufacturing services market size is calculated at USD 617.90 billion in 2025 and is forecasted to reach around USD 1130.89 billion by 2034, accelerating at a CAGR of 6.95% from 2025 to 2034. The Asia Pacific electronic manufacturing services market size surpassed USD 222.44 billion in 2025 and is expanding at a CAGR of 7.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electronic manufacturing services market size was estimated at USD 577.32 billion in 2024 and is predicted to increase from USD 617.90 billion in 2025 to approximately USD 1130.89 billion by 2034, expanding at a CAGR of 6.95% from 2025 to 2034. The trend of outsourcing manufacturing activities to cater to the growing demand for customized electronic products, as well as the trend of outsourcing manufacturing activities, are significant forces fueling the electronics manufacturing services market.

The Asia Pacific electronic manufacturing services market size was estimated at USD 207.84 billion in 2024 and is predicted to be worth around USD 412.77 billion by 2034, at a CAGR of 7.10% from 2025 to 2034.

Asia Pacific dominated the electronic manufacturing services market in 2024. China is a key player in its region because of lower maintenance costs, material availability, and faster production compared to other countries like the United States. Cities like Shenzhen and Penang in China have become major hubs for electronic manufacturing services (EMS), attracting companies like Apple Inc. However, Pegatron, based in Taiwan, had to move its production to countries like Vietnam and Indonesia due to rising costs and trade issues. Many Asian businesses had to reassess their investments and relocate their operations due to the uncertainty caused by trade tensions.

Europe is expected to show significant growth in the electronic manufacturing services market over the forecast period. Major European automotive companies like Mercedes, BMW, Ferrari, and Audi are teaming up with electronic manufacturing services (EMS) suppliers for various aspects like PCB production, engineering, prototyping, and design to advance connected car technologies. Furthermore, The European Union's initiatives to boost the production of electric vehicles, electronic lighting, and safety equipment are also fueling the growth of EMS in the region.

The electronics manufacturing services market comprises of specialized companies that handle all aspects of manufacturing electronic components and devices. This includes design, assembly, testing, and logistics. EMS suppliers support original equipment manufacturers (OEMs), enabling them to concentrate on their main strengths. Furthermore, EMS providers offer cost-effective and efficient solutions to various industries such as telecommunications, automotive, consumer electronics, and healthcare.

EMS providers' expertise in electronic production ensures top-notch products and empowers OEMs to meet market demands with flexibility and innovation. Today's electronic manufacturing services market is driven by diverse consumer preferences, leading to a rise in demand for personalized electronic items. Consumers also seek products related to their specific needs and interests. EMS providers facilitate effective customization of electronic products to ensure they meet individual customer requirements, which drives market growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.95% |

| Market Size in 2025 | USD 617.90 Billion |

| Market Size by 2034 | USD 1130.89 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Type and By Industry Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising functionalities across various industries

The global electronic manufacturing services market is primarily driven by the growing demand for various functionalities such as engineering, component assembly, and premium circuit board design. Contract manufacturers play a crucial role by offering functional testing and sub-assembly production services. Moreover, electronic contract manufacturing provides outsourcing services for core production skills by allowing OEMs to focus on their strengths. This strategic outsourcing helps enhance operational efficiency, reduce production costs, and minimize the need for fixed capital investment.

Increased competition

As technology evolves, consumer preferences also change. To stay competitive, electronics manufacturers must have efficient processes for introducing new products. The global electronic manufacturing services market faces increased competition, leading to shrinking profit margins and economic losses. Economic instability and fluctuating demand can further impact the electronic manufacturing services market. Additionally, concerns about confidentiality and security raise risks of information leaks and intellectual property theft.

Focus on core competencies

A key reason for the electronic manufacturing services market growth is the focus on the core strengths of companies in various industries. They recognize the importance of specializing in what they do best to stay competitive in today's fast-paced business world. By outsourcing tasks like manufacturing to EMS providers, companies can concentrate on vital areas like marketing, innovation, and research and development. This shift in resources enhances efficiency and profitability. EMS providers play a crucial role in supporting businesses by streamlining processes and ensuring high-quality output.

Industrial applications to drive the demand for EMS

As the environmental movement gains momentum, there's a growing demand for electric motor controls that enhance the efficiency of industrial motors. Also, there's a pressing need for increased integration at minimal costs to support the widespread adoption of new technologies, ensuring improved safety and reliability. This surge in demand is particularly evident in electronic products used in smart motors, including digital signal controllers for voltage control operations. Moreover, the advent of Industry 4.0 promises significant enhancements in factory data automation efficiency and productivity. The concurrent progress in industrial IoT and artificial intelligence (AI) also contributes to this growth trajectory. While the electronics industry has yet to fully realize the potential of intelligence and automation, the transition toward Industry 4.0 is underway, as evidenced by recent trends in the electronics manufacturing services market.

The engineering services segment dominated the electronic manufacturing services market in 2024. The rise in investment in research and development for high-performance electronic assembly materials is attributed to the dominance of the electronics manufacturing services segment in the market. Circuit boards are gaining significance in tablets and other electronic devices, driving this trend.

In the electronic manufacturing services market, the electronics manufacturing services segment is projected to be the fastest-growing segment over the forecast period. Companies in the industrial automation sector require continuous access to all system-generated data. However, due to the complexity of many operational utility applications, acquiring this data can be challenging. Regions such as Europe and North America are increasingly implementing Supervisory Control and Data Acquisition (SCADA) systems to ensure accurate data collection.

The IT & telecom segment dominated the electronic manufacturing services market in 2024. The growth of the industry is fueled by technological advancements, rising demand for mobile devices, and the need for cost-effective manufacturing solutions to meet the dynamic needs of the telecom sector. This emphasizes the industry's dependence on EMS providers to boost productivity, innovation, and competitiveness in the rapidly evolving telecommunications market.

The automotive segment is experiencing notable growth in the electronic manufacturing services market. This growth is driven by increasing digitization, the integration of IoT in vehicles, and the growing popularity of electric vehicles. Companies in these industries are turning to outsourcing services to improve flexibility and reduce expenses. Also, the rise of the electric vehicle market is propelled by increased component production outsourcing.

By Service Type

By Industry Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

January 2025