January 2025

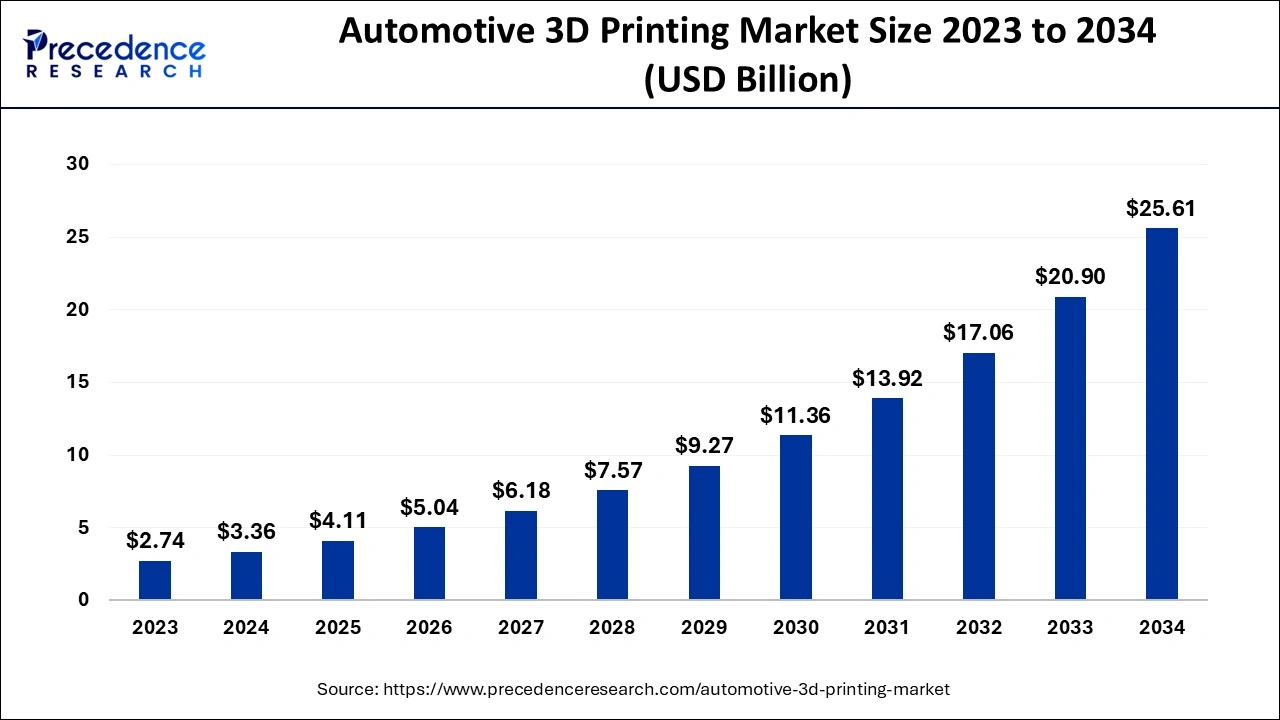

The global automotive 3D printing market size is calculated at USD 3.36 billion in 2024, grew to USD 4.11 billion in 2025 and is predicted to hit around USD 25.61 billion by 2034, expanding at a CAGR of double-digit 22.53% between 2024 and 2034. The North America automotive 3D printing market size is evaluated at USD 1.34 billion in 2024 and is expected to grow at a CAGR of 22.63% during the forecast year.

The global automotive 3D printing market size accounted for USD 3.36 billion in 2024 and is expected to exceed USD 25.61 billion by 2034, growing at a CAGR of 22.53% from 2024 to 2034. The automotive 3D printing market growth is attributed to the increasing demand for lightweight, customizable vehicle components and the rising focus on sustainability in automotive 3D manufacturing.

Artificial Intelligence has a positive impact on the market. It has made it possible to improve productivity by optimizing design and improving production line efficiency. Integrating AI algorithms in 3D printing technologies automates various tasks and helps create intricate models that are impossible with conventional design techniques. It allows automotive manufacturers to enhance vehicle production seamlessly. It also detects possible errors during the printing process, further reducing material waste and improving precision.

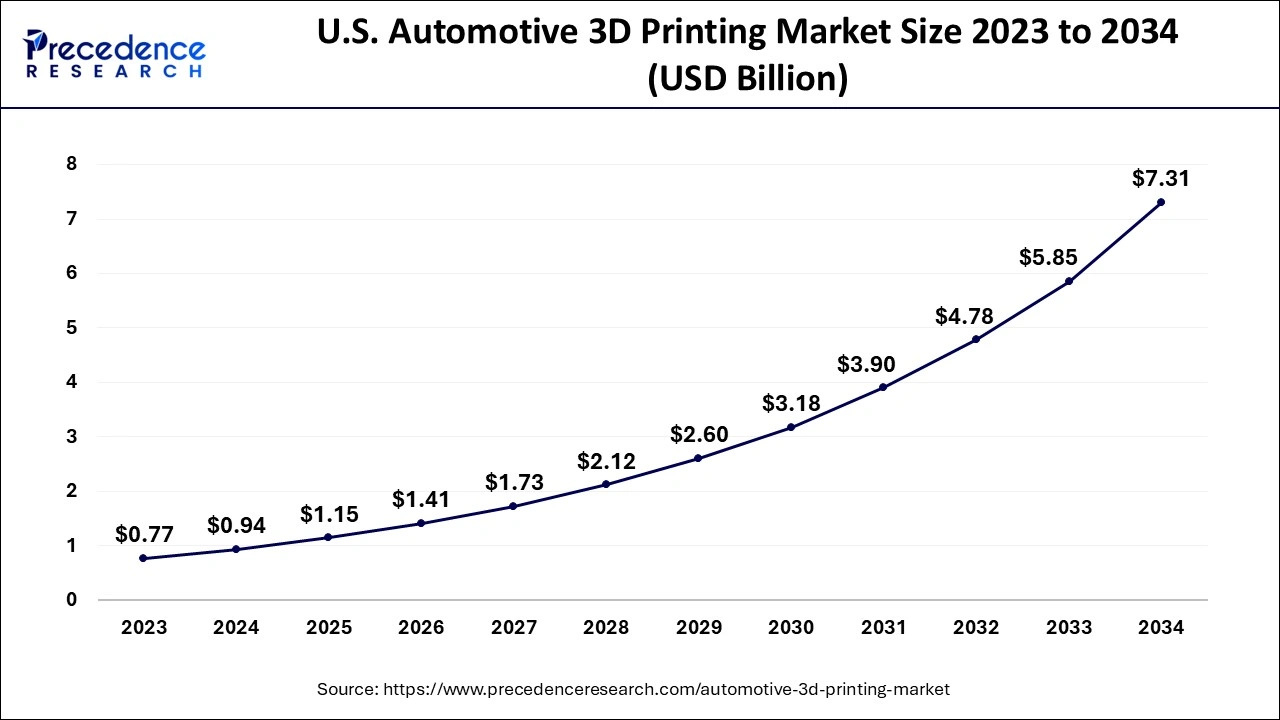

The U.S. automotive 3D printing market size is evaluated at USD 0.94 billion in 2024 and is projected to be worth around USD 7.31 billion by 2034, growing at a CAGR of 22.70% from 2024 to 2034.

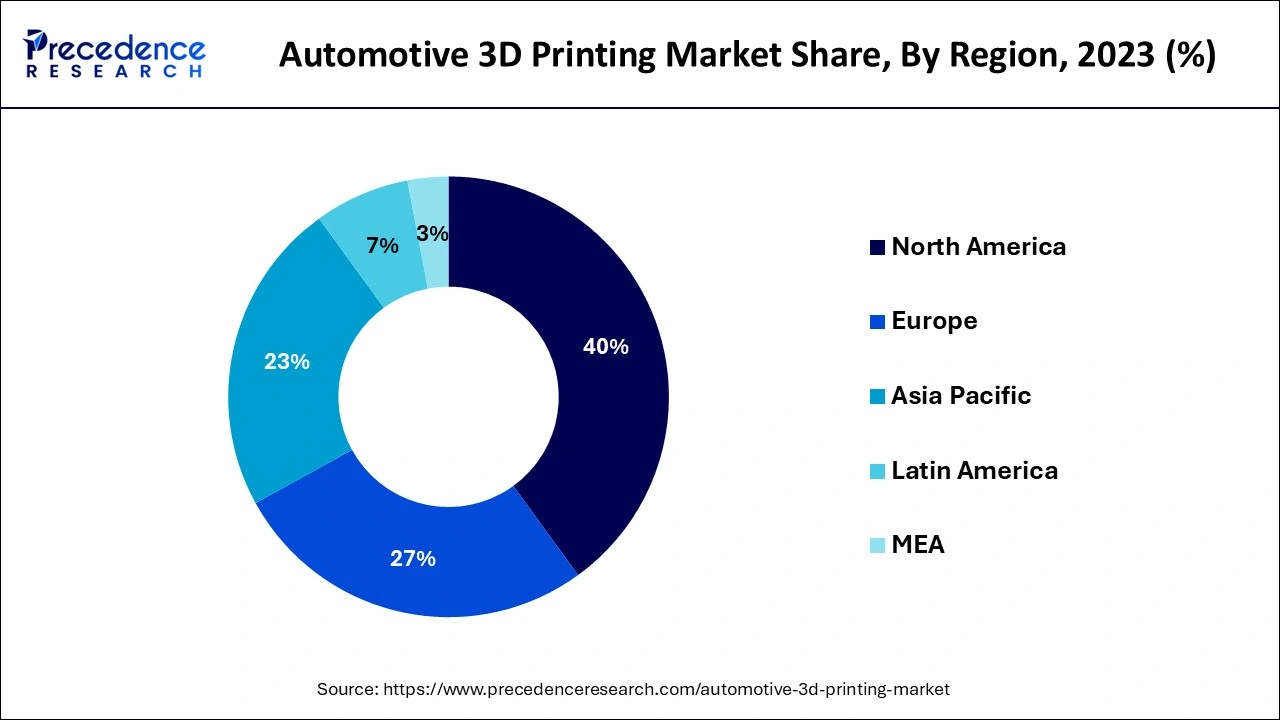

North America dominated the global automotive 3D printing market in 2023 due to the level of development of automotive manufacturing in the region and its high rate of integration with innovative technologies. The automotive industry in the United States of America has massive participation from key players, including Ford, General Motors, and Tesla, who are embracing 3D printing for prototyping and even products. The U.S. Department of Energy’s Advanced Manufacturing Office has estimated in a report published in 2024 that the most common additive manufacturing technologies, inclusive of 3D printing, are expected to cut the time and the cost of prototyping and actual production by up to 30%, especially in automotive manufacturing.

Asia Pacific is projected to host the fastest-growing automotive 3D printing market in the coming years, owing to the increase in the automotive industry. China, Japan, and South Korea, in particular, are applying 3D printing in automobile manufacturing due to optimism about curbing manufacturing expenses while driving a growing trend for customers’ individualized car amenities. The Chinese National Manufacturing Innovation Center has committed large amounts of its resources to upgrading 3D printing technology related to automobiles. Moreover, Japan already has a developed auto industry that covers a large segment of the global car market and is testing 3D-printed parts for electric vehicles.

Automotive 3D printing utilizes dimensional deposition of material to build fully functional, intricate components & parts, with the ability to build tooling, prototypes, and end-use parts for the automotive sector in a relatively short time frame. This technology greatly reduces time to market and cost of production, critical factors especially when dealing with automobiles. Moreover, the automotive 3D printing market technologies make it possible to customize and use lightweight structures that are fundamental to enhancing fuel consumption efficiency, considering the current international challenges of sustainability.

| Report Coverage | Details |

| Market Size by 2034 | USD 25.61 Billion |

| Market Size in 2024 | USD 3.36 Billion |

| Market Size in 2025 | USD 4.11 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Technology, Material, Offering, Component, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing demand for lightweight components

Increasing demand for lightweight automotive components is anticipated to drive the adoption of the automotive 3D printing market. This tool allows the creation of complex, slender structures for the production of vehicles. 3D printing helps manufacturers increase their fuel economy and decrease emissions. The top manufacturers, including Toyota, BMW, and Ford, stepped up their activity in terms of the components printed through 3D Technology in the year 2023. Their main focus is on electric and hybrid vehicles that require a significant reduction in weight to deliver better performance. Furthermore, the rising industries’ concern towards minimizing the cost and wastage further fuels the demand for these types of technologies.

Global Vehicles Sales, (2019-2023)

| Years | Sales (Units) |

| 2019 | 92065258 |

| 2020 | 79668562 |

| 2021 | 83638420 |

| 2022 | 82871094 |

| 2023 | 92724668 |

High initial cost

High initial costs are expected to restrain the widespread adoption of the automotive 3D printing market. Implementing 3D printing technology, especially for the most expensive category, metal, requires capital investment in equipment, software, and human capital. For the smaller companies or manufacturers in the emerging economy, these expenses are formidable since they are unable to afford the incorporation of such capital-intensive technologies. Moreover, businesses might defer early adoption.

Increasing application of rapid prototyping in R& D

Automakers’ expanding research and development efforts are anticipated to create immense opportunities for the players competing in the automotive 3D printing market. The use of 3D printing is projected to improve the design and manufacturing of automobile components with regard to lightweight and green manufacturing. The U.S. Department of Energy’s Advanced Manufacturing Office offers various ways through which the automotive industry benefits from 3D printing. This technology cuts down on the amount of materials used and the time taken to make products, improving the time taken in production and other benefits, including prototyping.

Those cost-saving benefits are predicted to lead to a significant decrease in manufacturing costs and increased flexibility. The session at the World Economic Forum reveals how 3D printing makes manufacturing and on-demand production sustainable by using sustainable materials. Its adoption is expected to partially decrease the carbon impact of automotive manufacturing and decrease the need for conventional supply chains. Additionally, the adoption of 3D printing in automotive production complies with the sectoral trends toward cleaner and smarter solutions, further propelling the market.

The stereolithography segment accounted for a considerable share of the automotive 3D printing market in 2023 due to the high accuracy and excellent producible geometries. SLA cures the liquid resin step by step through the use of the laser, making it possible to achieve high intricate and polished surface. Moreover, its usability in making a small number of parts, especially when the parts call for intricate details.

The selective laser sintering segment is anticipated to grow with the highest CAGR in the automotive 3D printing market during the studied years. This technology involves the use of a laser to bond powdered material in a sequential manner, leading to the formation of stable solid components. SLS is effective in creating functional parts with a hardness that is easily manageable from the 3D model and without the need for support structures. Studies conducted on customer satisfaction surveys by the U.S. National Institute of Standards and Technology (NIST) reveal that SLS is being adopted for both prototyping and direct production of end-use parts. Moreover, the steelmakers adapt to building lighter and stronger components. SLS is important in automotive parts manufacturing, further boosting the demand for this type of technology.

The metals segment led the global automotive 3D printing market due to these materials' high strength, durability, and thermal conductivity. Technologies such as SLS, EBM, and DED are mostly applied to metal materials, including titanium, aluminum, and steel. These metals are fundamental in the manufacturing of compressive automobile applications covering engine components, chassis, and framework. The U.S. Department of Energy acknowledges that metal 3D printing is gradually being deployed in the development of lightweight, durable parts with high-performance characteristics. Furthermore, the advantage of this material is that it minimizes material waste since metal 3D printing allows for intricate structures to be created for a part.

The plastic segment is projected to expand rapidly in the automotive 3D printing market in the coming years. Fused deposition modeling (FDM) and stereolithography (SLA) are primary methods of printing plastic components to create a variety of automotive parts through shorter prototyping time. Polymeric materials, including PLA, ABS, and polycarbonate, are often used in the construction of non-critical parts such as dashboards, trims, and connectors, among others. Additionally, the increasing use of low-cost, lightweight material for production and the uptake of plastic 3D printing systems in automobiles will further fuel the segment in the coming years.

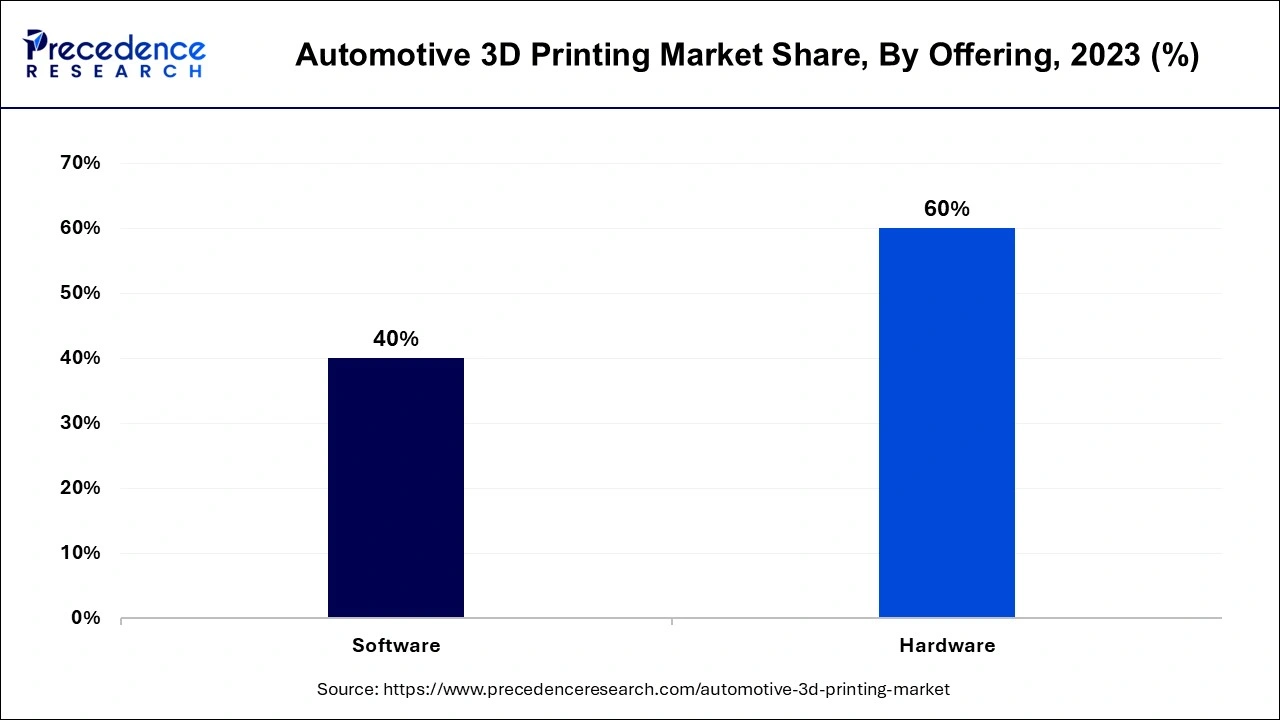

The hardware segment dominated the global automotive 3D printing market in 2023. The widely used technologies, including SLS, FDM, and EBM, are used for their suitability in the fabrication of automotive parts by printing complex metallic parts with superior mechanical strength and stamina. Car makers employ top-of-the-range 3D printing machines that have sinking mechanisms that allow for thickness control during the layer deposition process. This is extremely important for complex part shapes that are not easy to manufacture through conventional processes. The US Department of Energy and the EU Commission have separately reported that higher specification hardware is required in automotive 3D printing, and as ever, more prototypes and limited production batches are produced. Furthermore, the increasing manufacturing of custom or low-run components, particularly for electric and hybrid vehicles, further boosts hardware 3D printing technology usage.

The software segment is projected to grow at the fastest rate in the automotive 3D printing market in the future years, as these tools assist the designers and engineers in modeling three-dimensional models that are fit for the 3D printing techniques. Software is also significant in keeping the result of the final product precise and responsive to the efficiency of the materials used. CAD and CAM programs help in developing precision models, which can be set in machine language, and simulation software is used to check the working of the design. Additionally, the growing trend of automakers and automotive suppliers employing software tools for designing lighter, stronger, and more performing materials is propelling the segment.

The interior component segment dominated the automotive 3D printing market during the forecasting period because 3D printing provides the capacity to create complicated and thin connections that were difficult and not possible to manufacture by conventional techniques. It is set to increase more due to advancements in technology, where automakers shift their attention to interior design and innovative spaces, particularly electric cars and more luxurious cars. Additionally, 3D printing technology enables manufacturers to produce parts on demand and at a far lower cost than conventional methodologies.

The exterior component segment is projected to grow rapidly in the automotive 3D printing market in the future years, as 3D printing helps automakers create strong, lightweight exterior parts that enhance drive dynamics and fuel economy and offer design freedom. The modern automobile requires intricately designed components such as bumpers and grills. Thus, when implemented through 3D printing technology, it is easier and possible to manufacture than through traditional industrial methods. Furthermore, the transportation of numerous elements that need to be assembled for everyday use ultimately leads to an increase in cost, while the integration of as many details as possible allows for 3D printing of a single part of the product.

The ICE vehicles segment held a dominant presence in the automotive 3D printing market in 2023 due to the use of 3D printing technology increasing progressively and being applied to prototyping, tooling, and manufacturing of sophisticated parts. Cars with Internal Combustion Engine (ICE) are prevalent in the automotive market, particularly in areas where electric infrastructure and technology are yet to gain traction. ICE vehicles, through 3D printing, the automotive industry benefits from allowing manufacturers to design lightweight components, engaging parts, and efficient exhaust. Furthermore, the U.S. Department of Energy has pointed out that 3D printing can improve the design and production of powertrain components of ICE vehicles.

The electric vehicles segment is expected to grow at the fastest rate in the automotive 3D printing market during the forecast period of 2024 to 2034, owing to the growing use of the production of complicated lightweight components. It benefits from cost-efficient, lightweight, and innovative materials such as carbon fiber composites or plastics to produce energy-efficient parts through 3D printing. Structurally significant parts like battery enclosures, structure building blocks, and heat management parts are being made through AM technology. Additionally, the manufacturers of EVs are expected to shift towards 3D printing for prototyping, product development, and fabrication at a higher rate of speed.

The prototyping & tooling segment held a dominant presence in the automotive 3D printing market in 2023 due to its importance in some preliminary stages of vehicle construction. This application gives automotive manufacturers the capacity to produce early working models of their products as fast as possible. Prototyping also provides an ability to redesign objects following distinct designs faster, as it is introduced into manufacturing at a lower cost and in a shorter amount of time than if a firm were to devise new ideas from scratch. Furthermore, the escalating demand for product development at a faster pace, together with a push for studies, integration of customized solutions, and acquiring complex features, are expected to bolster the adoption of 3D in this sector.

The prototyping & tooling segment is expected to grow at the fastest rate in the automotive 3D printing market during the forecast period of 2024 to 2034, owing to the increasing interest of the automotive industry in the development of new materials and future types of vehicles. Automakers are likewise applying it to their experimentation in model creation for R&D purposes. This includes the rules of using lightweight composite materials and structurally sound geometries as a measure towards improving weight on cars without compromising the strength and durability properties that accompany bulkier steel wrought. A report by the European Commission’s Joint Research Centre states that the auto industry is continually finding applications of 3D printing in materials, such as carbon fiber composites and advanced polymers for vehicle production. Furthermore, the integration of 3D printing in auto R&D is set to rise, particularly in the production of electric and autonomous vehicles.

By Application

By Technology

By Material

By Offering

By Component

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025