January 2025

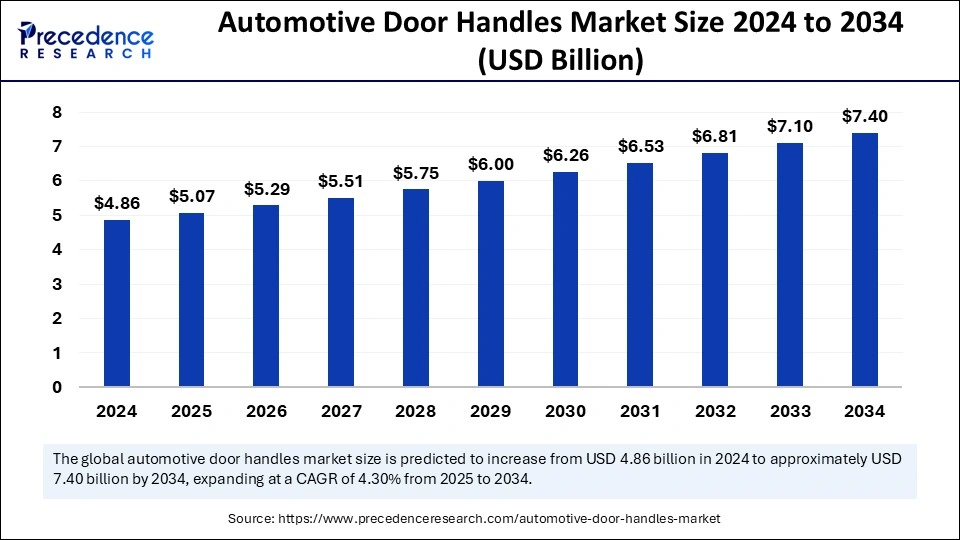

The global automotive door handles market size is calculated at USD 5.07 billion in 2025 and is forecasted to reach around USD 7.40 billion by 2034, accelerating at a CAGR of 4.30% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive door handles market size accounted for USD 4.86 billion in 2024 and is predicted to increase from USD 5.07 billion in 2025 to approximately USD 7.40 billion by 2034, expanding at a CAGR 4.30% from 2025 to 2034. The surge in passenger and commercial vehicle production is the key factor driving the growth of the market. Also, high disposable incomes among the middle-class population coupled with the increasing urbanization in developing countries can fuel market growth further.

Artificial intelligence technology is changing the automotive door handles market by launching innovative features such as enhanced safety systems and customized user experiences. AI-powered advancements such as touchless functionality and gesture recognition are increasingly being implemented into door handle designs, improving accessibility and convenience for users. Furthermore, AI in manufacturing processes is also enabling significant cost reductions and enhanced efficiency in production.

Automotive door handles are devices utilized to operate vehicle doors. They are generally located on the exterior of the automobile. Door handles are available in many shapes and sizes. The most general type is a pull-style handle or a lever that is utilized to open the door. New automotive door handles are created to be aesthetic can functional. They are made of durable materials like metal, plastic, or a combination of both.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.40 Billion |

| Market Size in 2025 | USD 5.07 Billion |

| Market Size in 2024 | USD 4.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 to 2034 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Handle Type, VehicleType, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Stringent government regulations

Strict safety regulations implemented by governments across the globe, like mandating the utilization of safety features in cars such as high-grade door handles that can bear impacts and also prevent pollutants from being expelled from the vehicle during a collision, are anticipated to raise the demand for innovative door handles having standard safety features.

High manufacturing cost

The high cost associated with manufacturing these handles is the major factor constraining the automotive door handles market growth. The automotive door handles generally involve specialized manufacturing, design, and customization processes, which in turn results in higher costs as compared to the traditional door handles. Moreover, the expenses associated with advanced features can act as a hurdle, hindering the market's expansion in the near future.

Introduction of lightweight door handles

Major players in the automotive door handles market are increasingly focusing on developing lightweight door handles that are made from innovative materials like aluminum, carbon fiber, and magnesium to decrease the weight of vehicles, improve fuel efficiency, and minimize emissions. Furthermore, retractable handles can enhance aerodynamics by decreasing drag. Improves the vehicle's aesthetic appeal and also enhances fuel efficiency by reducing air resistance.

The exterior door handles segment dominated the automotive door handles market in 2024. The dominance of the segment can be attributed to the increasing adoption of these door handles while manufacturing automobiles. These handles can be made from various materials such as wood and grass and are also available in different styles like doorknobs and lever handles. The most essential feature of this door is the knob or lever, which is utilized to open and close the door.

The interior door handles segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the various advantages of this type of door over conventional car doors. This is basically a knob situated on the inside of a vehicle door, utilized to manually open the door from inside. Furthermore, interior door handles in cars offer a grip point for passengers to enter and exit the car easily providing stability and support.

The passenger vehicle segment held the largest automotive door handles market share in 2024. The dominance of the segment can be linked to the growing adoption of advanced technologies such as virtual reality (VR) and artificial intelligence (AI)to make vehicle design and manufacturing more efficient and faster. Moreover, Modern passenger vehicles are manufactured by taking passenger comfort into account with features such as comfortable seating, air conditioning, and entertainment systems.

The commercial vehicles segment is estimated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the benefits offered by these vehicles, such as efficiency, safety, and customer experience. Additionally, AI-driven security systems and driver assistance systems make road travel safer.

The mechanical handle segment led the automotive door handles market in 2024. The dominance of the segment is owing to the enhanced efficiency, safety, and cost-effectiveness offered by these handles in the automobile industry. Also, mechanical handles can enhance safety by decreasing the risks of errors and accidents. Predictive maintenance can help to protect from potential mechanical failures that manipulate operations.

The automatic handle type segment is expected to show the fastest growth over the projected period. The growth of the segment is due to the various advantages given by these handles, such as enhanced fuel efficiency, safety, and a vehicle's aerodynamics. In addition, automatic door handles, such as flush door handles, can decrease air resistance, which in turn enhances the vehicle's overall performance.

In 2024, the original equipment manufacturer (OEM) segment dominated the market by holding the largest market share. The dominance of the segment can be attributed to its provision of high-quality components and parts at competitive prices. OEMs help major market players to meet safety standards and perform reliably. OEM parts are manufactured from high-grade materials.

The aftermarket segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because of the strong adherence of this segment to industry regulations and certifications that further help to ensure product quality and safety. Services such as proactive maintenance and break-fix support help consumers stay loyal and raise vehicle uptime.

Asia Pacific dominated the automotive door handles market in 2024. The dominance of the region can be attributed to the increasing sales of automobiles coupled with the rising investment by automotive market players for developing innovative door handles for vehicles which has propelled the industrial expansion.

In Asia Pacific, China led the market. The dominance of the country is owing to the increase in demand for electric vehicles in the region along with the technological innovations in the automobile sector. China is the major manufacturer of door handles market in this region.

North America is expected to grow at a significant rate in the automotive door handles market over the forecast period. The growth of the region can be credited to the strict safety regulations imposed by governments in the region. Furthermore, automotive market players in countries such as the U.S. and Canada are increasingly investing in research and development (R&D) initiatives, implying positive market expansion shortly.

In North America, the U.S. dominated the market owing to the ongoing technological advancements in the automobile sector coupled with the strong presence of major market players in the country. Also, the advent of autonomous driving and electric vehicle technology can drive the country's growth further in the region.

By Type

By Handle Type

By Vehicle Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025