January 2025

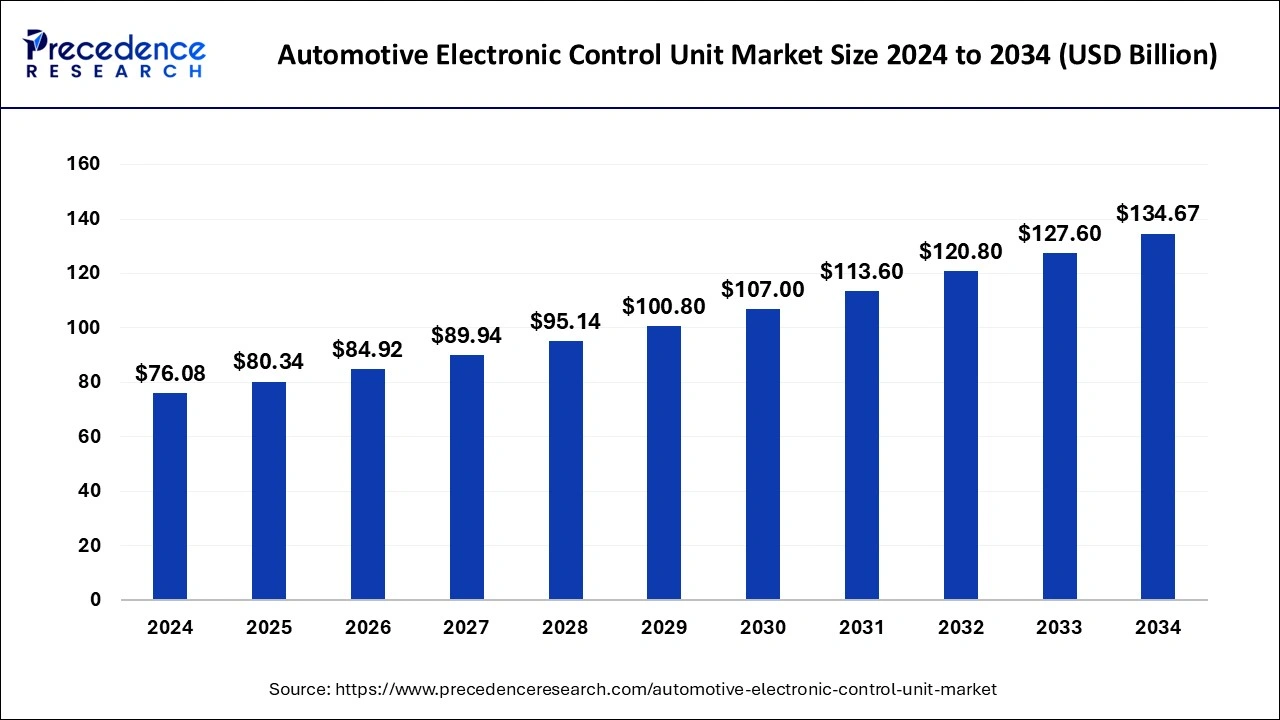

The global automotive electronic control unit market size is calculated at USD 80.34 billion in 2025 and is forecasted to reach around USD 134.67 billion by 2034, accelerating at a CAGR of 5.87% from 2025 to 2034. The Asia Pacific automotive electronic control unit market size surpassed USD 38.25 billion in 2024 and is expanding at a CAGR of 6.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive electronic control unit market size was estimated at USD 76.08 billion in 2024 and is anticipated to reach around USD 134.67 billion by 2034, expanding at a CAGR of 5.87% from 2025 to 2034.

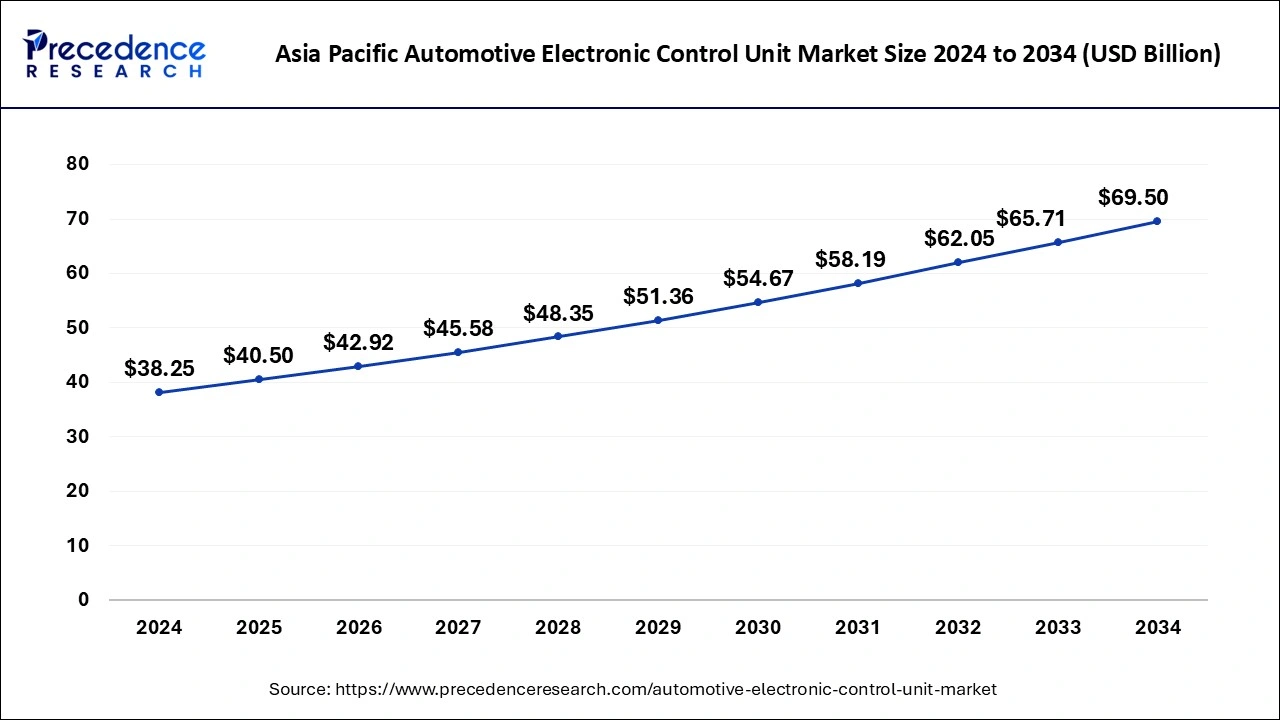

The Asia Pacific automotive electronic control unit market size was exhibited at USD 38.25 billion in 2024 and is projected to be worth around USD 69.50 billion by 2034, growing at a CAGR of 6.15% from 2025 to 2034.

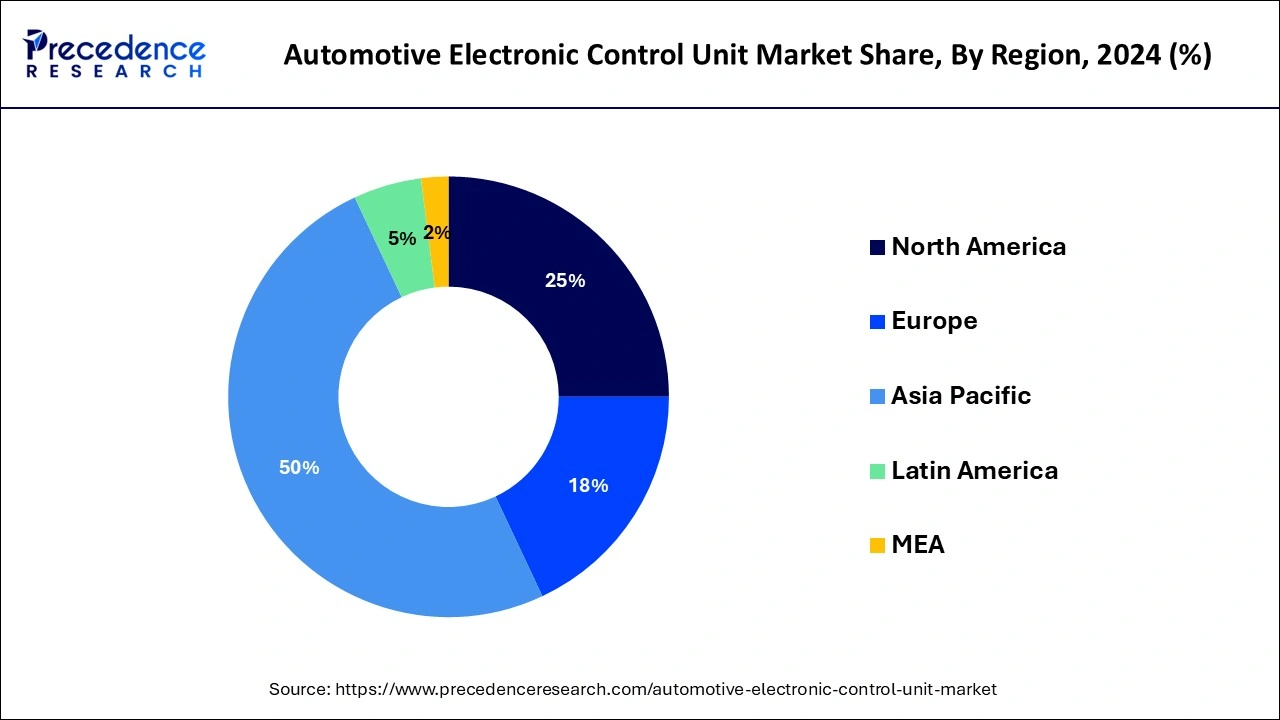

The Asia Pacific emerged as the global leader in the global automotive ECU and accounted for more than half of the overall revenue share in 2023. In addition, the region poised to grow at the fastest growth rate over the forecast period. The significant growth of the region is primarily due to rising demand for in-vehicle communication and infotainment applications in passenger vehicles.

Moreover, the rapid growth of China in the market is mainly driven by the significant growth of automotive industry in the country that offers ample opportunity for the incorporation of ECU in the new vehicles. Increasing population along with the rising disposable income again triggered the growth of automotive ECU in the region.

Rising adoption for autonomous driving features and technologies such as Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), park assist, blind-spot detection, and Lane Departure Warning (LSW) systems propel the market growth significantly. Further, increasing demand for fuel-efficient self-driving cars, Electric Vehicles (EVs), and vehicle-to-vehicle communication technology expected to flourish the growth of electronic control units market in the coming years. As the rise in electronic control units (ECUs) per vehicle decreases the efficiency, thus various automotive players are collaborating with Original Equipment Manufacturers (OEMs) consolidating ECUs without affecting their functionalities. This subsequently decreases weight of vehicle as well as saves space in the vehicle that in turn reduces the fuel consumption. For instance, in June 2017, Sasken Technologies Ltd. introduced hypervisor-based consolidator for visualizing both cluster and infotainment systems. The main motive behind ECU consolidation is to provide a single enhanced version of ECU that can control multiple functions.

| Report Highlights | Details |

| Market Size in 2025 | USD 80.34 Billion |

| Market Size by 2034 | USD 134.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.87% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

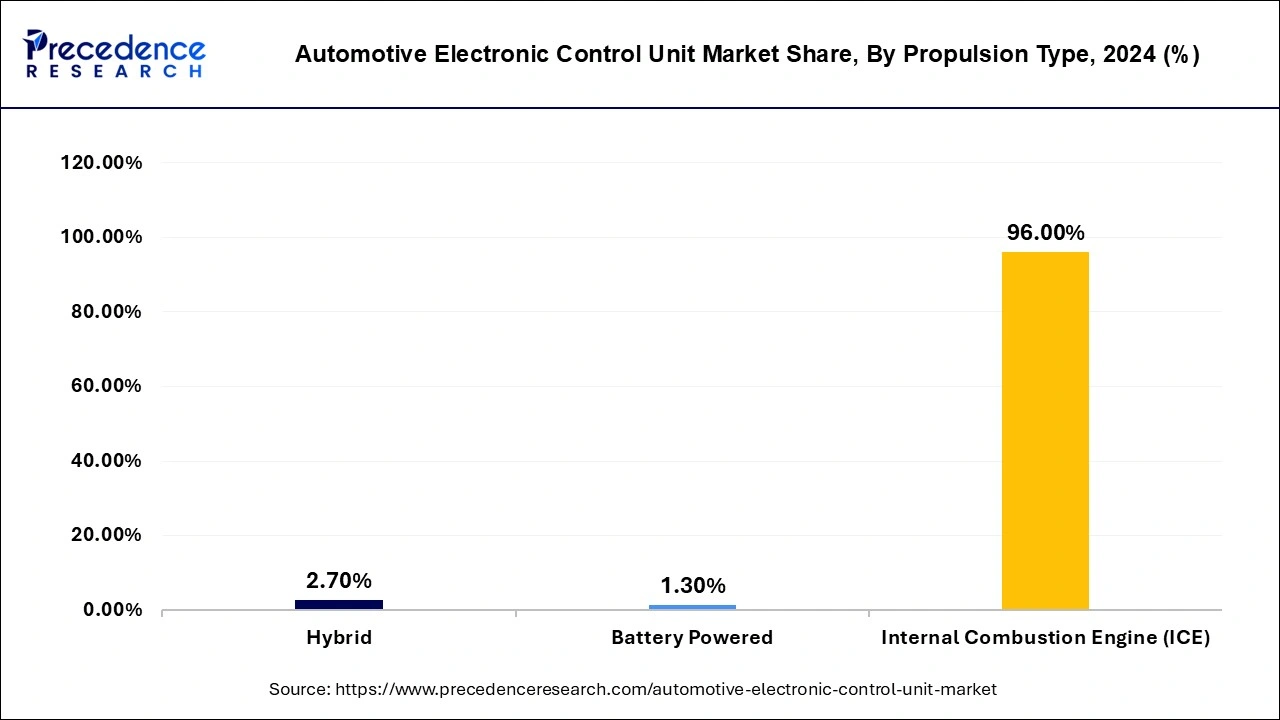

Internal Combustion Engine (ICE) vehicles led the global automotive electronic control unit (ECU) market with significant revenue share proportion in the year 2023, accounting for nearly 96%. Further, the segment expected to dominate the overall automotive ECU market during the forecast period. This is majorly attributed to the rising production of ICE vehicles across developing countries especially in China and India. However, the segment projected to exhibit minimal growth rate over the analysis period due to increasing penetration of electric and hybrid vehicles.

Hybrid vehicles anticipated to flourish prominently with remarkable CAGR over the forecast period owing to low carbon emission, enhanced fuel efficiency, and extended driving range. On the contrary, battery-powered vehicle encountered the fastest growth in the coming years. The segment growth is mainly because of the increasing government initiatives to control pollution along with rising consumer awareness for energy-efficient vehicles.

Passenger cars is the most promising segment that dominated the global automotive ECU market and likely to expand at an attractive CAGR during the forecast period. The passenger cars segment accounted for around 88% of the revenue share in the overall market in the year 2023. Besides this, the global automotive industry witness a shift in consumer preference for hybrid and luxury vehicles with advanced safety and electronic features. Luxury vehicles seek high implementation of ECUs x compared to other vehicles owing to high demand for advanced features supporting their vehicle management systems. On an average, 15-20 ECUs are deployed in a standard car whereas the number of ECUs crosses 100 in a premium or luxury cars. Rise in purchasing power along with improved lifestyle has triggered the growth of premium luxury cars.

Automotive ECUs are used in various applications that include powertrain electronics, chassis electronics, ADAS &Safety System, infotainment systems, and others. ADAS & safety system application led the global automotive ECU market accounting for a revenue share of around 35% in the year 2023. It includes monitoring and control features such as LDW, ABS, AEB systems, Tire Pressure Monitoring System (TPMS), blind-spot detection, and Electronic Stability Control (ESC).

On the other hand, Infotainment application predicted to emerge as the rapidly growing segment during the forecast period. The prime factor driving the growth of the segment is increasing demand for in-vehicle infotainment systems. In addition, luxurious cars or smart vehicles incorporate advanced ECUs that provide a combination of both information and entertainment to offer enhanced in-vehicle experience.

By Propulsion Type

By Vehicle Type

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025