May 2025

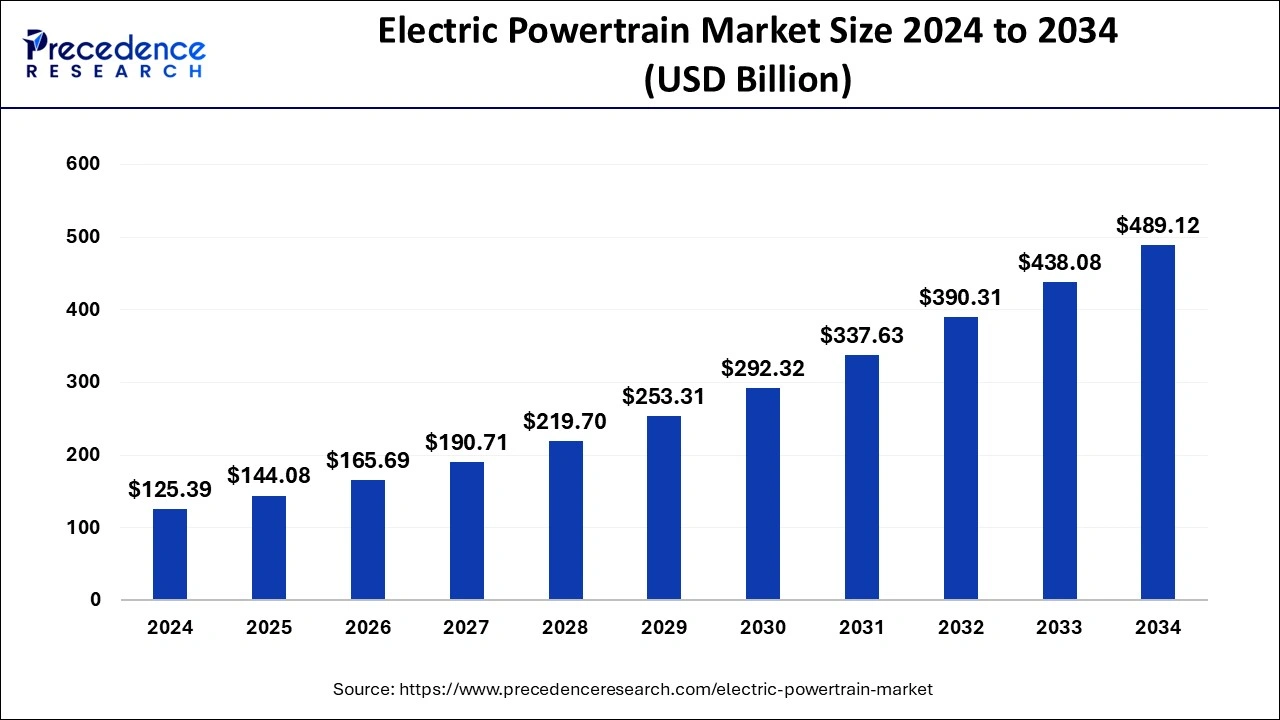

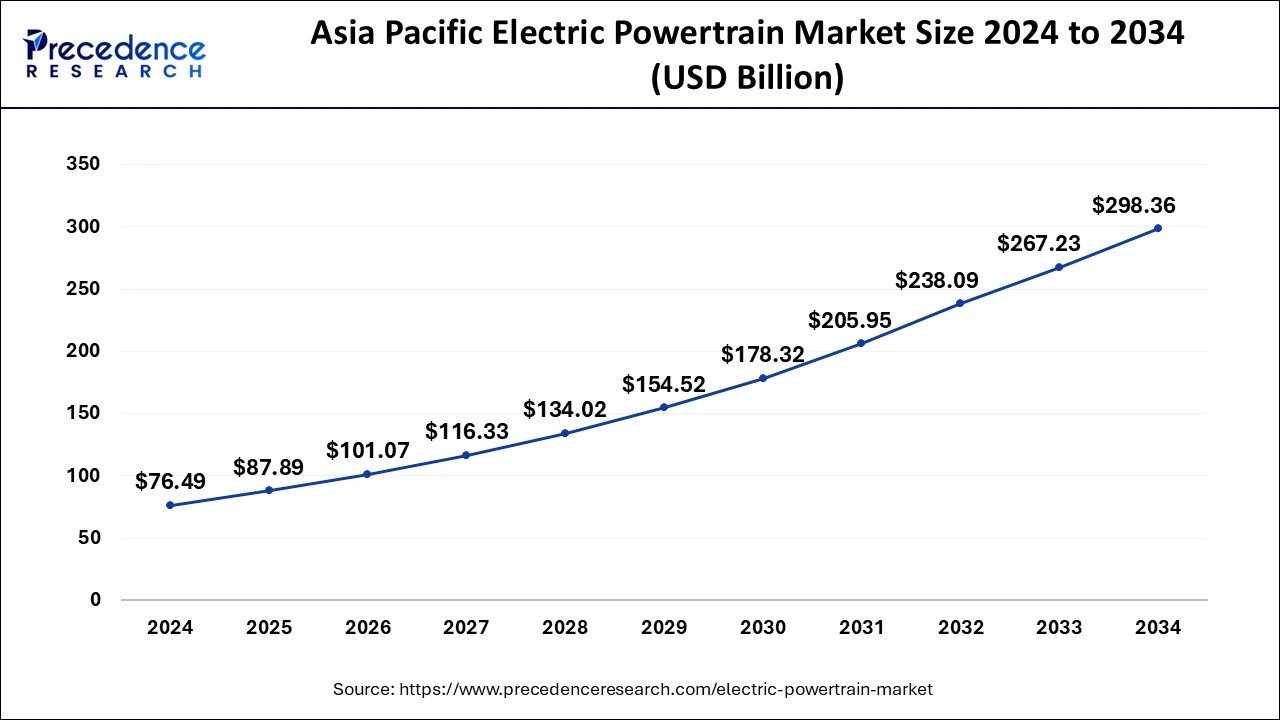

The global electric powertrain market size is calculated at USD 144.08 billion in 2024 and is projected to surpass around USD 489.12 billion by 2034, expanding at a CAGR of 14.6% from 2025 to 2034. The Asia Pacific electric powertrain market size was estimated at USD 87.89 billion in 2025 and is expanding at a CAGR of 14.6% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric powertrain market size accounted for USD 125.39 billion in 2024 and is expected to be worth around USD 489.12 billion by 2034, at a CAGR of 14.6% from 2025 to 2034. The policies enacted by the various governments to reduce carbon emissions, rising technologies innovations for developing efficient and affordable electric vehicles and increasing consumer demand for climate-neutral vehicles is boosting the growth of the electric powertrain market.

The integration of AI has improved the efficiency and dependability of electric powertrains in many ways such as in analysing power system conditions to maximize battery life and driving range, for optimizing battery development process, in predictive maintenance by identifying potential issues, enhancing braking allocation and most importantly in providing in-car assistance to drivers as well as monitoring the security. This overall helps in developing a smart environment and towards emission-free sustainable future.

The Asia Pacific electric powertrain market size was estimated at USD 76.49 billion in 2024 and is predicted to be worth around USD 298.36 billion by 2034, at a CAGR of 14.6% from 2025 to 2034.

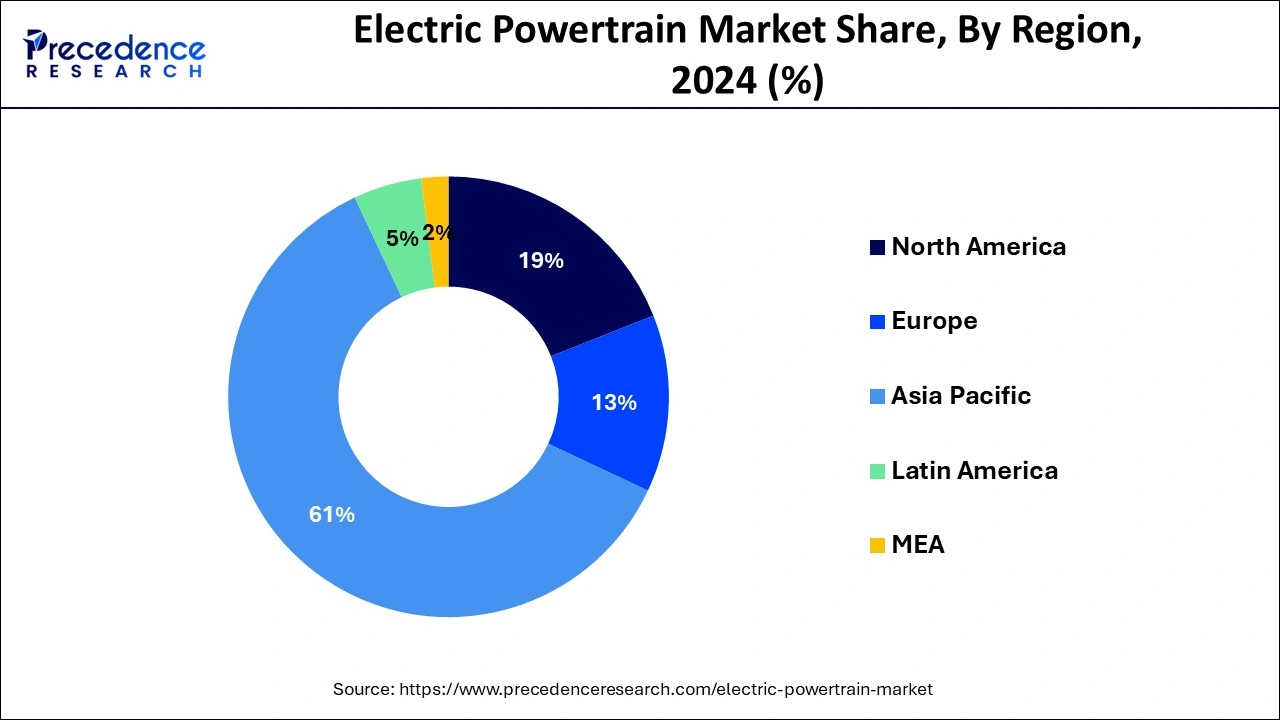

Asia Pacific emerged as the global leader with a value share of approximately 61% in 2024. This is attributed to the rising adoption of electric vehicles in emerging countries such as India and China. Increase in the per capita income of consumers in these countries along with stringent emission norms such as China VI and BS VI expected to significantly increase the penetration of electric vehicles in the region.

China Electric Powertrain Market Trends

Europe is projected to be a significant market for electric powertrain owing to the presence of numerous OEMs. Many European countries, such as the Netherlands, Norway, France, and Sweden witness significant rate of adoption for EV. This in turn, expected to boost the demand of electric powertrain in the region during the analysis period.

Germany Electric Powertrain Market Trends

Governments of various regions have issued stringent emission norms that drive the sale for electric vehicles. Moreover, for mass adoption and domestic production of electric vehicles governments of different regions offer attractive incentives that anticipated to proliferate the market for electric powertrain globally.

Electric vehicles are the next generation vehicles and analyzed as the future of automotive market space as the fossil fuels are exhausting rapidly. Consequently, an alternative power source is required for the vehicles, thereby triggering the growth of battery-powered vehicles. In the wake of same, many countries have issued strict regulations for the adoption of alternate power to vehicles to curb the carbon emission and preserve fossil fuels for other applications.

In addition, technological innovation in the battery production technology has transformed electric vehicles into more competitive over conventional ICE vehicles. The cost associated to the batteries used in an electric vehicle has shrunk prominently due to optimization in the production process, economies of scale, and technology advancement. As the prices associated to the components and battery of EV are expected to decline over the analysis period, the vehicles would reach Total Cost Ownership (TCO) parity that would enable mass-market penetration of electric vehicles.

| Report Coverage | Details |

| Market Size in 2024 | USD 125.39 Billion |

| Market Size in 2025 | USD 144.08 Billion |

| Market Size by 2034 | USD 489.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.6% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

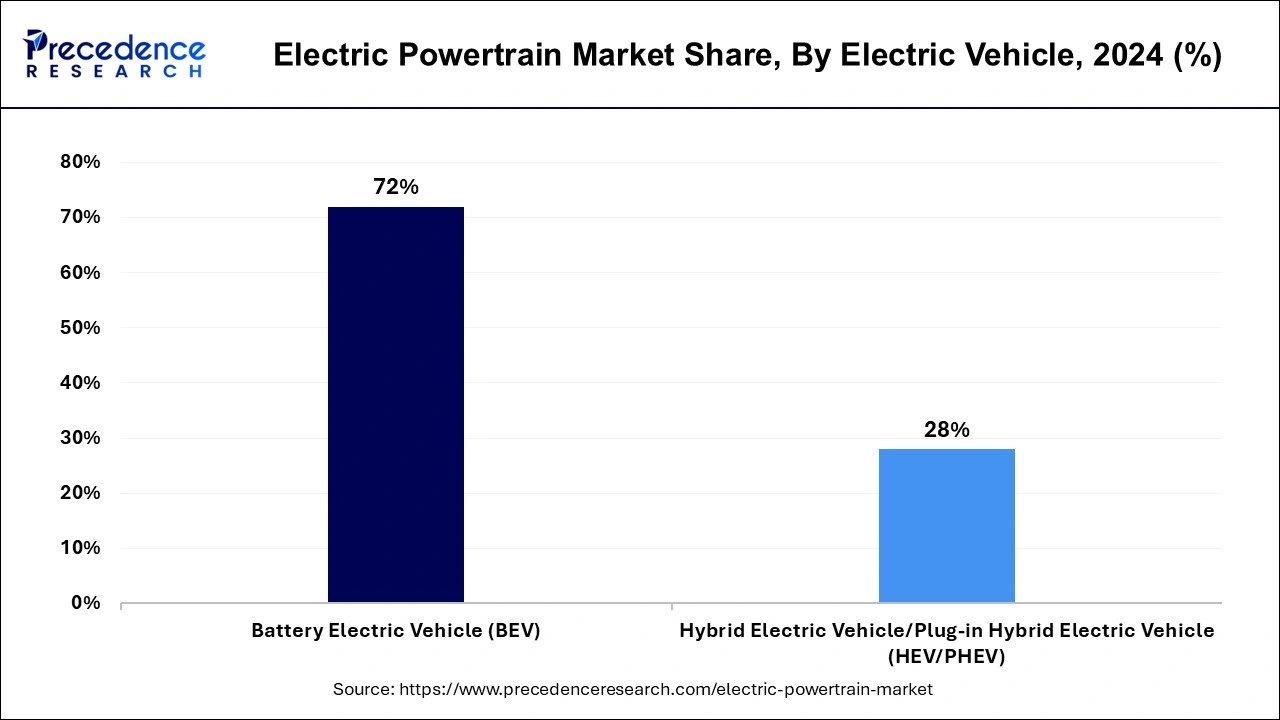

Based on electric vehicle, the global market for electric powertrain is classified into Battery Electric Vehicle (BEV) and Hybrid Electric Vehicle / Plug-in Hybrid Electric Vehicle (HEV/PHEV). The BEV segment dominated the market accounting for nearly 72% of value share in the year 2024. The rising adoption of BEV is majorly because of stringent government policies to regulate the carbon emission from transportation sector. Moreover, advancements in the battery technology along with declining price for lithium-ion battery anticipated to leverage the demand for BEV in the coming years.

Contrary, HEV/PHEVs analyzed to witness prominent growth of approximately 35.6% over the forecast period owing to its specific design that enhances the application of Internal Combustion Engine (IEC) in interaction with electric powertrain. PHEV and HEV assist driver with flexible charging along with long running capacity that again expected to propel the demand for PHEV in the near future.

The battery segment led the global electric powertrain market accounting for a value share of nearly 64% in the year 2024. A battery is the sole of an electric vehicle and constitutes around 50% of the total cost in the Battery-powered Electric Vehicle (BEV). In other types of electric vehicles it is used in combination with other power sources such as ICE to provide a back-up to the vehicle during drain-out condition. In addition, incorporation ICE with battery in an EV also enhances the efficiency and power of the vehicle.

On the other hand, motor/generator segment expected to show 30.4% CAGR over the analysis period. The growth of the segment is attributed to the escalated penetration of PHEV and BEV across the globe. These vehicles are equipped with similar e-motor configurations. Furthermore, joint ventures between Original Equipment Manufacturers (OEMs) and suppliers to produce e-motors would prominently leverage the electric powertrain demand. For example, in August 2019, Nidec Corporation, a manufacturer of e-motors signed a joint venture agreement with GAC Components Co., Ltd., under which the companies would manufacture automotive traction motors.

By Electric Vehicle

By Component

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

September 2024

May 2025