January 2025

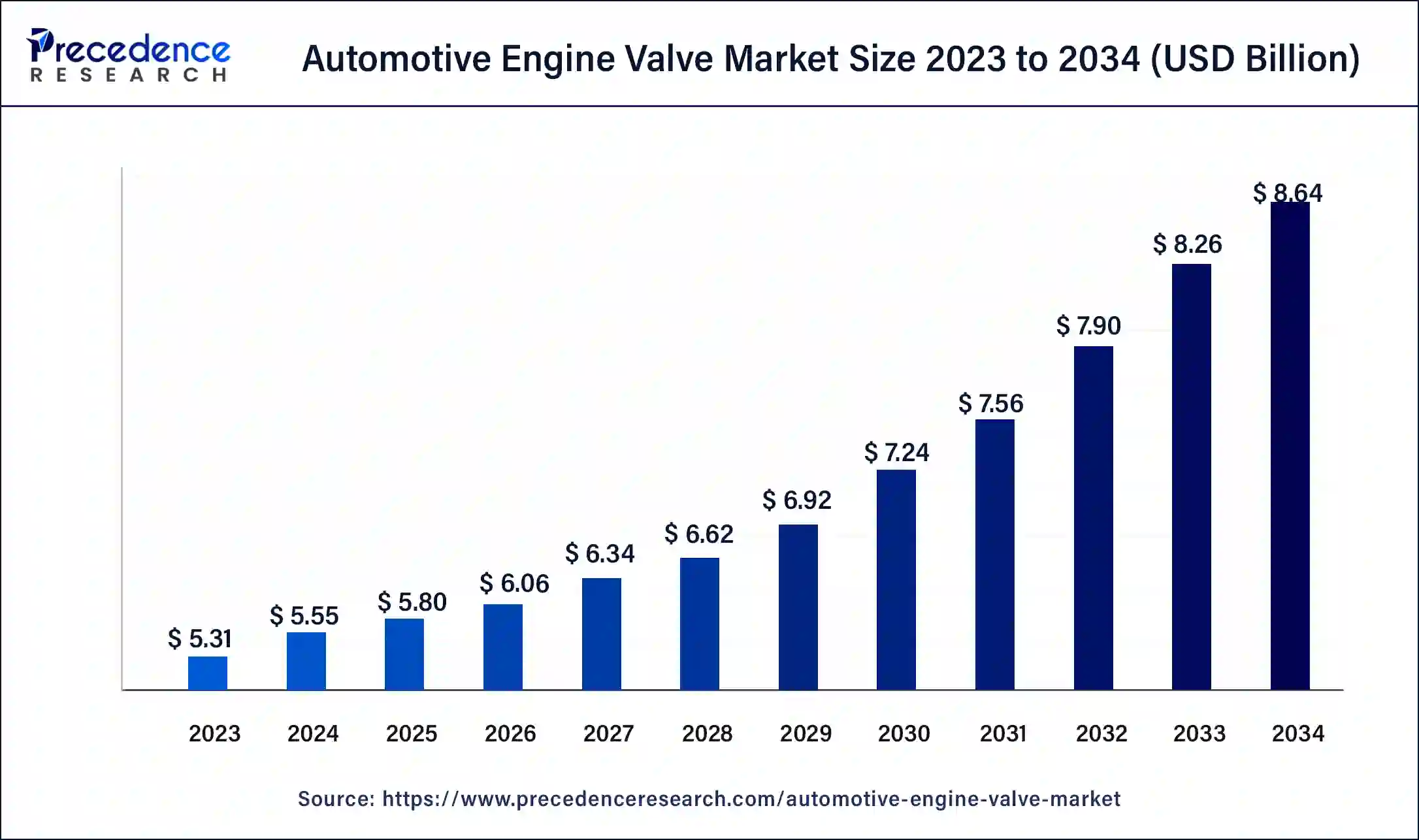

The global automotive engine valve market size was USD 5.31 billion in 2023, calculated at USD 5.55 billion in 2024 and is expected to be worth around USD 8.64 billion by 2034. The market is slated to expand at 4.52% CAGR from 2024 to 2034.

The global automotive engine valve market size is projected to be worth around USD 8.64 billion by 2034 from USD 5.55 billion in 2024, at a CAGR of 4.52% from 2024 to 2034. The rising demand for commercial and passenger vehicles is driving the growth of the market.

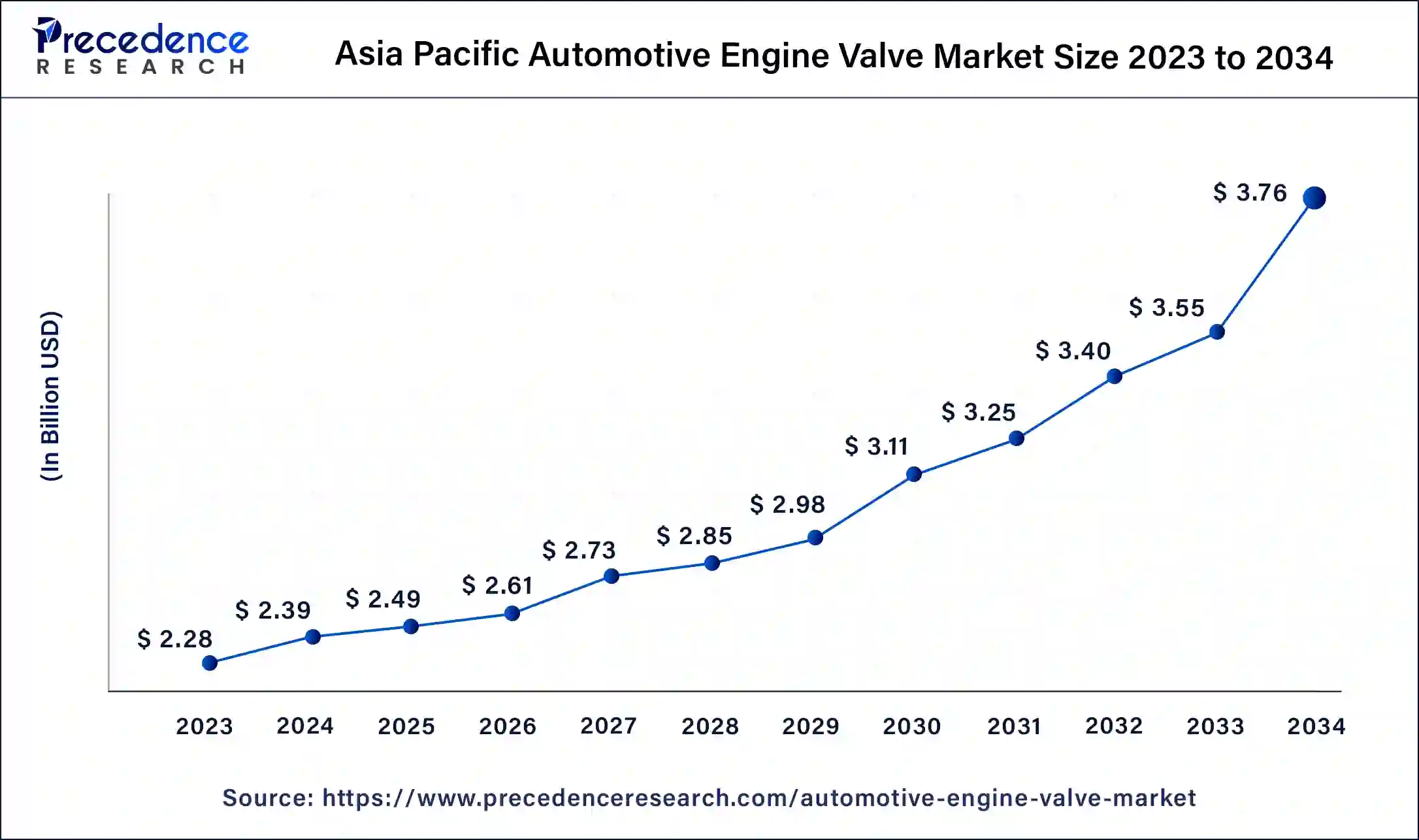

The Asia Pacific automotive engine valve market size was exhibited at USD 2.28 billion in 2023 and is projected to be worth around USD 3.79 billion by 2034, poised to grow at a CAGR of 4.65% from 2024 to 2034.

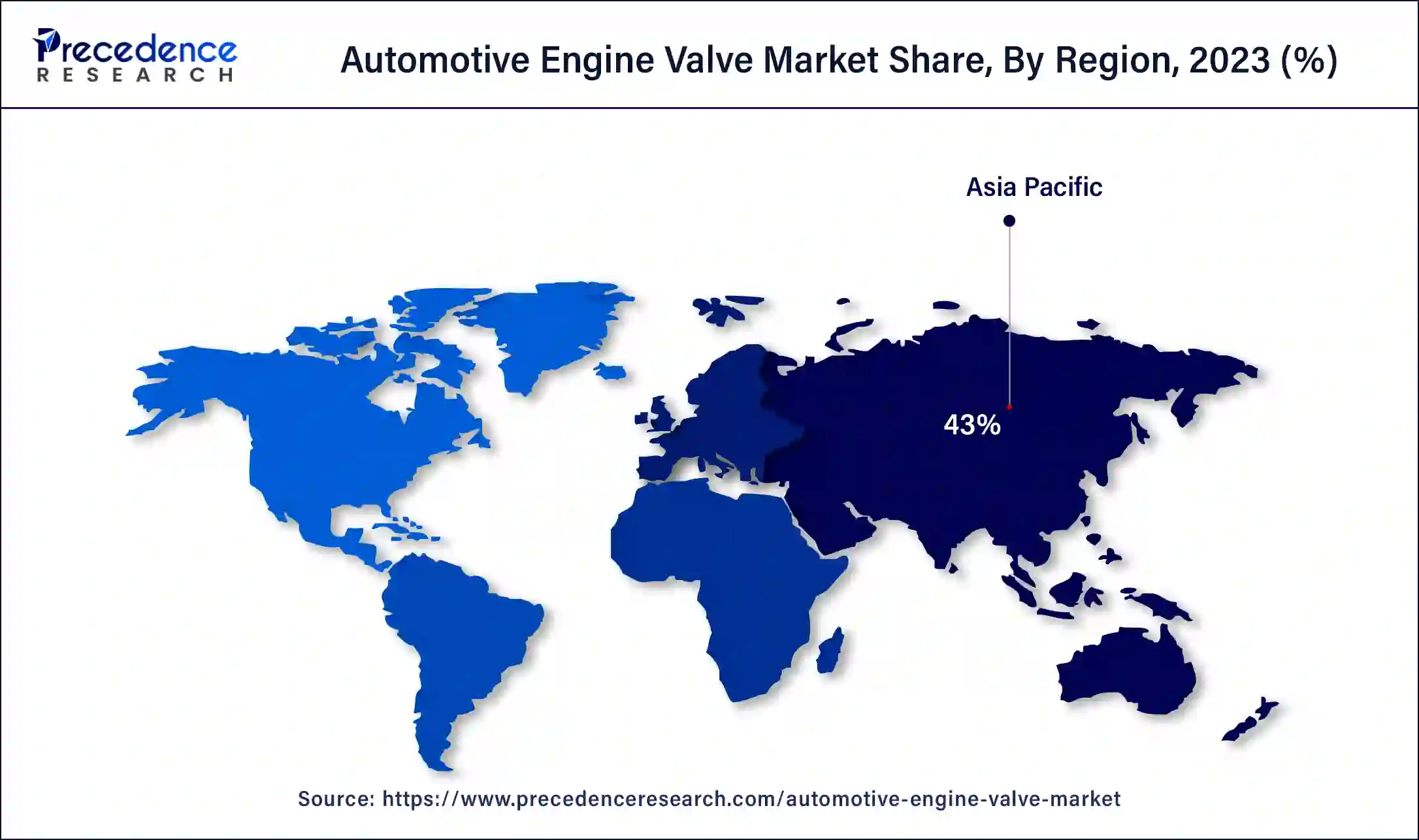

Asia Pacific dominated the automotive engine valve market in 2023. The growth of the market is attributed to the rising population, and the increasing demand for passenger vehicles and commercial vehicles is driving the demand for automotive engine valves. The rising advancement in automobile vehicles in regional countries like China, India, and Japan is driving the growth of the market. Additionally, the rising investment in research and development activities in the growth of the automotive industry is highly useful.

North America is estimated to grow at the fastest rate during the forecast period. The growth of the automotive engine valve market is attributed to the rising demand for the automotive industry due to the rising disposable income in the population and the rising living standards are driving the demand for the automobile industry. The higher presence of the leading automotive players is driving the demand for the automotive engine valve market. The rising technological advancements, such as autonomous vehicles and electric vehicles, are beneficial.

The engine valves are used in the regulation of the movement of fuel and air in and out of the internal combustion engine. The engine valve plays one of the most important roles in the internal combustion engine due to its precise mechanism and intricate designs. There are different types of engine valves, including poppet valves, sleeve valves, rotary valves, and reed valves. The engine valves consist of two major types of valves: an intake valve and an exhaust valve.

The entry valve allows the entrance of the mixture of air-fuel, and the exhaust valve facilitates the expulsion of exhaust gases. Both the engine valves are made of different materials due to their optimization in the engine. The inlet valves are made from materials like tungsten or nickel steel, and the exhaust valves are made from cobalt-chromium and silicon-chromium alloys. The engine valves play an important role in optimizing power output, engine performance, and fuel efficiency.

How can AI impact the automotive engine valve?

Artificial intelligence and electric vehicles are transforming the automotive sector in the future. The implementation of artificial intelligence (AI) into the internal combustion engine of vehicles is driving the enhancement in the consumer experience. The AI algorithms can detect data from several sources and sensors to fine-tune engine performance. It helps in ignition timing, air-fuel mixture, and valve timings in the internal combustion engine. Artificial intelligence plays an important role in reducing harmful emissions from vehicles. It controls the selective catalytic reduction (SCR) systems and exhaust gas recirculation (EGR) in petroleum engines to minimize nitrogen oxide emissions. It provides real-time insights about adjustments to reduce emissions by monitoring the emitted engine and gas parameters.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.64 Billion |

| Market Size in 2023 | USD 5.31 Billion |

| Market Size in 2024 | USD 5.55 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.52% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Vehicle Type, Material Type, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising demand for EV valves

The rising evaluation of electronic vehicles is transforming the era of the automotive industry. The rising concern about environmental pollution due to the rising carbon emission by vehicles is driving the adoption of electric vehicles globally. The increasing advancements in the EV valves for electric vehicles provide durability and can handle the temperature of fluid up to 400° F. The electric vehicles valve series provides customer-specific end connections, specially coated materials, and trim materials. The EV valves are used to maintain and control the flow of air, vacuum, water, and other lower-viscosity fluids.

Higher cost

The increased cost of raw material and end-products related to the automobiles and the high cost of manufacturing process in the automobile is restraining the growth of the automotive engine valve market.

Advancements in the automotive sector

The rising demand for the automobile sector and the investment in the evalution of the automotive sector such as electric vehicles and autonomous or self-driving cars are driving the demand for the market. Additionally, the rising intervention by the leading industry giants such as Tesla, Honda, Toyota, and others in the advancements in the contribution in the growth.

The bimetallic engine valves are projected to capture the largest share of the automotive engine valve market during the forecast period. The growth of the market is attributed to the rising demand for the bimetallic type of engine valves due to their high corrosion resistance and extreme temperature resistance. The material has a high tensile strength, which is an advantageous property for automotive applications. The metallic engine valves are made through friction welding. On the other hand, mono-metallic valves are also in demand for engine valves due to their greater siding properties and high heat resistance. The engine valves are made from one material only.

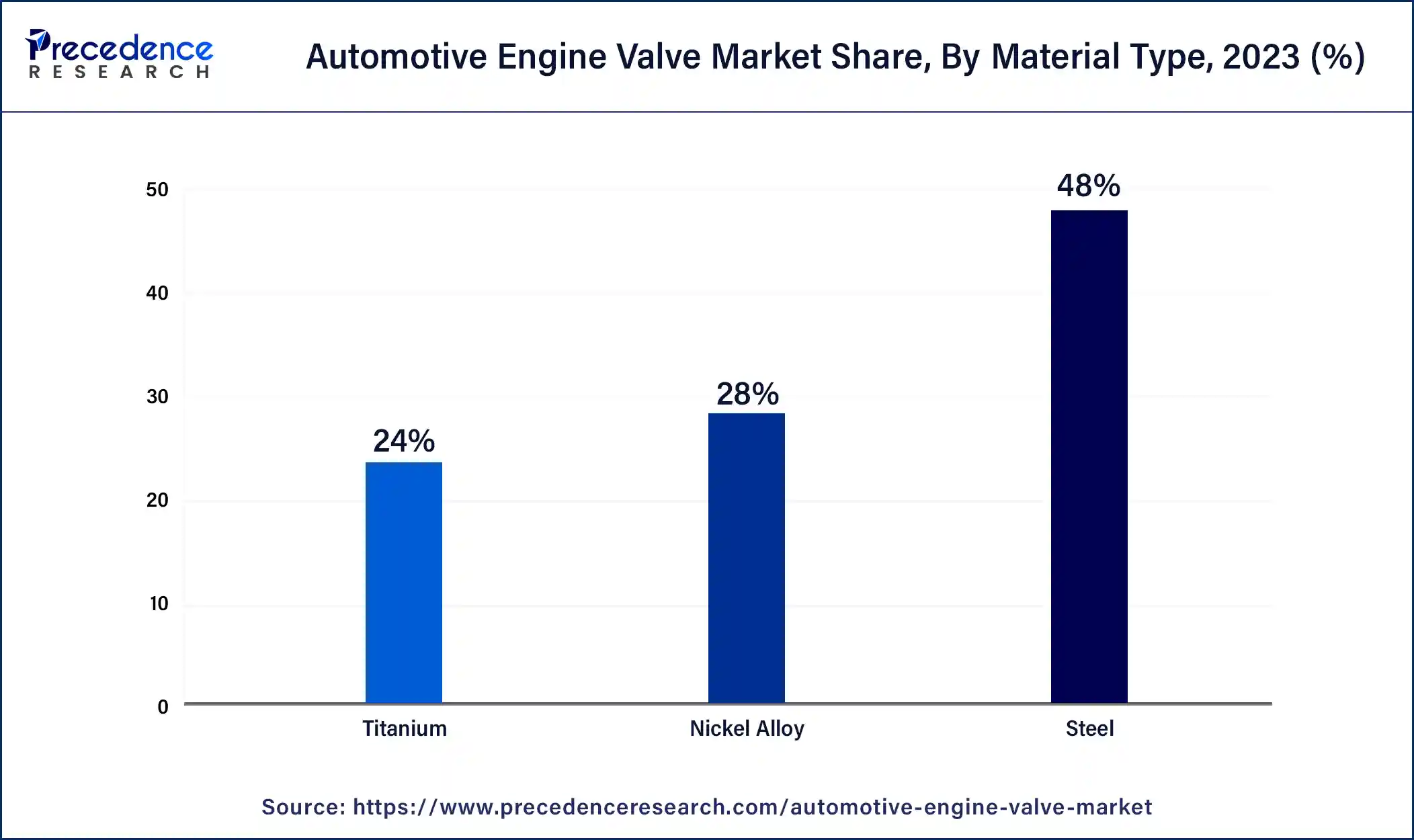

The titanium segment is expected to have the largest share of the automotive engine valve market during the forecast period. The rising demand for titanium material automotive engine valves is due to their higher tensile strength and heat and corrosion resistance properties. Titanium material is used in several automotive applications, primarily for internal combustion engine components like valve springs, valves, connecting rods, and retailers.

Titanium logically offers higher tensile strength, lower modules, lower density, and excellent oxidation and corrosive properties. Titanium has various beneficial properties, such as being more durable and longevity, lightweight in design, and corrosion resistant. Its lightweight properties make it easy to handle and install in automotive parts; as compared to stainless steel or other materials, titanium has higher strength and corrosion resistance.

The compact passenger cars segment is expected to have the largest share of the automotive engine valve market during the forecast period. The rising population, the increasing economic stability in the countries, and the rising disposable income are collectively raising the living standards of the population, tending to the higher demand for passenger cars for self-owned mobility and luxury.

The rising demand for passenger cars and the continuous launch and innovations in passenger cars with more accurate features and luxury are driving the sales of passenger cars. Additionally, the rising number of major automobile market players are investing in the further development and launch of new passenger vehicles, which boosts the growth of the passenger cars segment.

The OEM segment is expected to hold the largest share of the automotive engine valve market during the forecast period. The OEM sales channel is the original manufacturer of the vehicle parts and it is designed by themselves only those it provide more accurate and original part of vehicle which reduces the time to quality check.

Segment Covered in the Report

By Product Type

By Vehicle Type

By Material Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025