January 2025

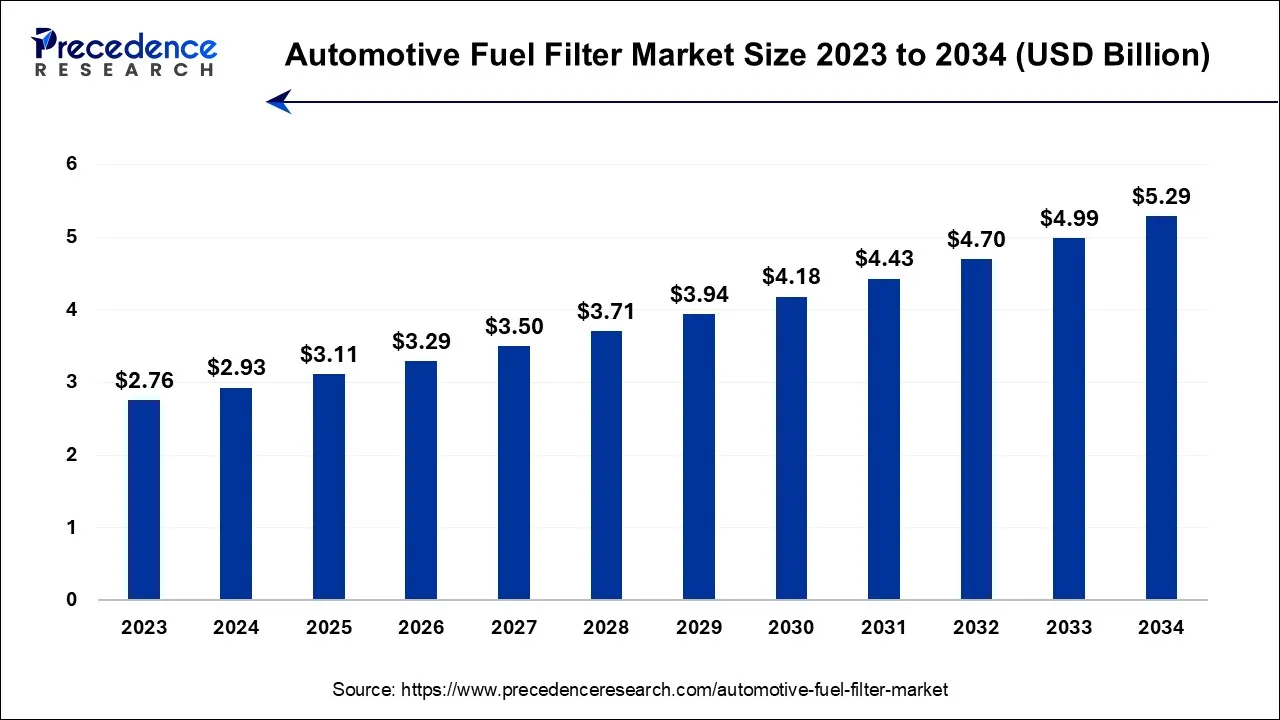

The global automotive fuel filter market size is calculated at USD 2.93 billion in 2024, grew to USD 3.11 billion in 2025, and is predicted to hit around USD 5.29 billion by 2034, poised to grow at a CAGR of 6.1% between 2024 and 2034. The North America automotive fuel filter market size accounted for USD 1.11 billion in 2024 and is anticipated to grow at the fastest CAGR of 6.27% during the forecast year.

The global automotive fuel filter market size is expected to be valued at USD 2.93 billion in 2024 and is anticipated to reach around USD 5.29 billion by 2034, expanding at a CAGR of 6.1% over the forecast period from 2024 to 2034.

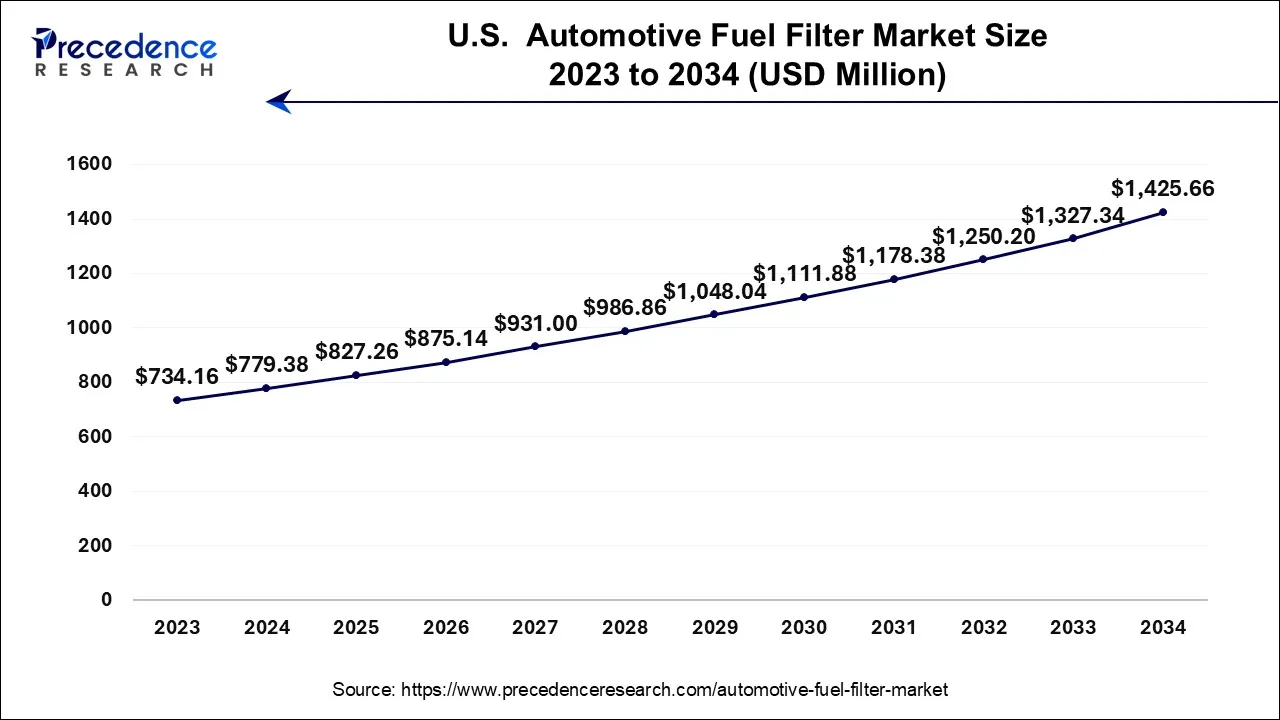

The U.S. automotive fuel filter market size is accounted for USD 779.38 million in 2024 and is projected to be worth around USD 1,425.66 million by 2034, poised to grow at a CAGR of 6.25% from 2024 to 2034.

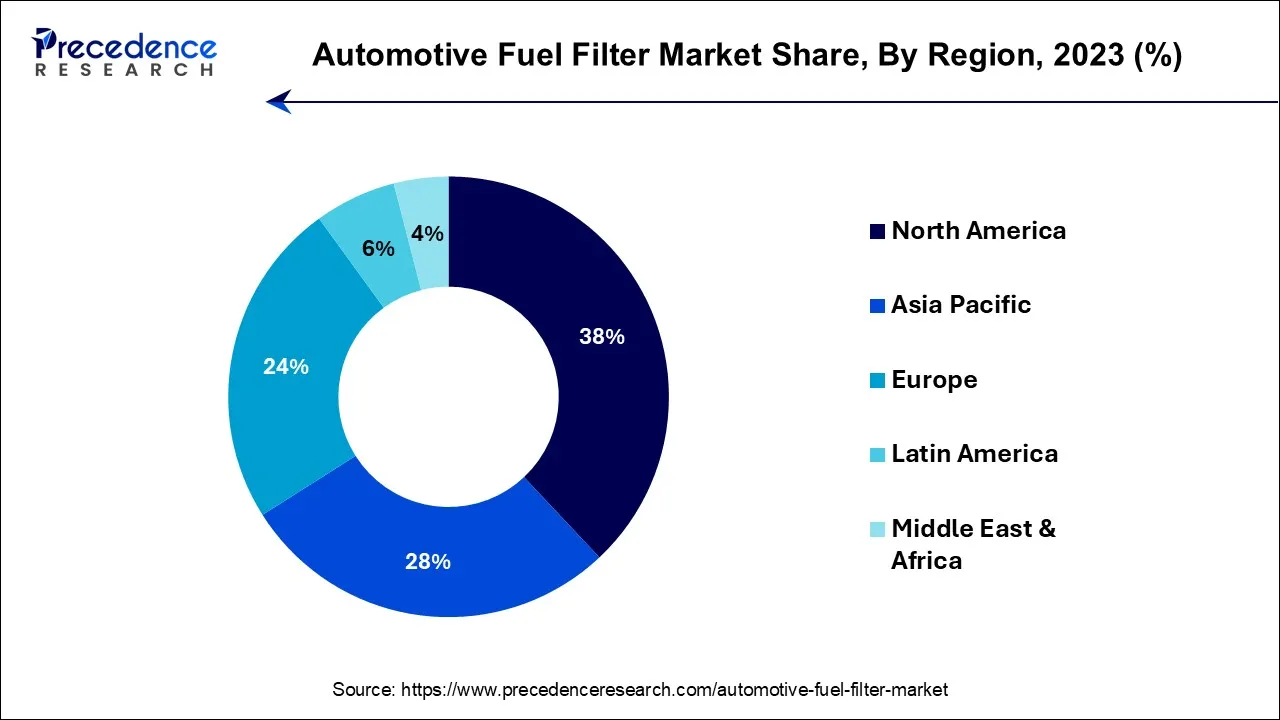

North America has held the largest revenue share 38% in 2023. North America commands a significant portion of the automotive fuel filter market for several compelling reasons. To start, the region boasts a substantial automotive industry with a considerable fleet of vehicles in operation. Furthermore, the rigorous emissions standards in North America have spurred a heightened need for sophisticated fuel filtration systems to ensure compliance. Additionally, a growing consciousness among consumers about environmental preservation and fuel economy has resulted in greater acceptance of top-tier fuel filters. Moreover, the region's robust aftermarket sector plays a pivotal role, as the demand for replacement filters remains steady, driven by routine vehicle upkeep.

Asia-Pacific is estimated to observe the fastest expansion with the highest CAGR of 8.3% during the forecast period. Asia-Pacific holds a major growth in the automotive fuel filter market due to several key factors. Firstly, the region boasts a large and growing automotive industry, with countries like China and India experiencing robust vehicle production and sales. Secondly, Asia-Pacific's rapid urbanization and industrialization have led to increased vehicle ownership, driving the demand for automotive components, including fuel filters. Moreover, stringent emissions regulations in countries like China have propelled the adoption of advanced filtration systems. Finally, the region's economic growth has spurred investments in vehicle maintenance and aftermarket services, further consolidating its dominance growth in the automotive fuel filter market.

The automotive fuel filter market pertains to the sector engaged in the manufacturing and distribution of filtration systems designed to eliminate impurities and foreign substances from the fuel utilized in automobiles. These filters play a pivotal role in preserving the efficiency and durability of a vehicle's engine by preventing debris and contaminants from infiltrating the fuel delivery system.

This market encompasses a diverse array of fuel filter types, such as inline, cartridge, and spin-on variants, and primarily serves the automotive industry, catering to cars, trucks, and other motor vehicles. Driving forces behind this market's growth include the rising demand for cleaner and more fuel-efficient engines, stringent emission standards, and the quest for enhanced fuel economy.

The automotive fuel filter market serves as a crucial facet within the automotive industry, concentrating on the fabrication and distribution of filtration systems engineered to eliminate contaminants and impurities from vehicle fuel. These filtration mechanisms are essential for preserving engine efficiency and longevity by acting as a barrier against foreign particles infiltrating the fuel system. The market encompasses a diverse range of filter varieties, encompassing inline, cartridge, and spin-on filters, with its primary clientele composed of automobiles, trucks, and other motorized vehicles.

The sector's trajectory is profoundly influenced by several pivotal factors, including the escalating demand for cleaner, more fuel-efficient engines, the imposition of stringent emission standards, and the quest for enhanced fuel economy.

Within the automotive fuel filter market, an array of trends and growth stimulants are making their presence felt. One notable trend centers on an escalating commitment to environmental sustainability and emission curtailment. Stringent global emission regulations have prodded vehicle manufacturers into adopting sophisticated filtration systems to ensure compliance and reduce their environmental impact, thereby elevating the demand for high-efficiency fuel filters.

Another significant driving force is the burgeoning desire for fuel-efficient automobiles. As consumers increasingly aspire to economize on fuel expenses and lessen their ecological footprint, automakers are investing in technologies that amplify fuel economy. Fuel filters constitute an indispensable element in attaining peak engine performance, rendering them indispensable in facilitating this trend.

However, despite its promising outlook, the automotive fuel filter market confronts its fair share of challenges. One of the primary challenges revolves around the rapid ascent of electric vehicles (EVs). As the EV market surges, the reliance on traditional internal combustion engines wanes, potentially diminishing the long-term demand for fuel filters. Industry participants must navigate this transformation by delving into opportunities within the realm of electric vehicle filtration systems or by diversifying their product portfolios.

Simultaneously, the automotive fuel filter market offers fertile ground for business prospects. The surging popularity of hybrid vehicles represents a noteworthy opportunity. Hybrid vehicles combine conventional internal combustion engines with electric propulsion, necessitating advanced filtration solutions to optimize fuel efficiency and reduce emissions. Enterprises can harness this burgeoning segment by pioneering innovative filtration systems tailored for hybrid vehicles.

Furthermore, venturing into burgeoning markets with expanding automotive sectors presents another avenue for growth. Developing nations are witnessing a surge in vehicle ownership, translating into heightened demand for automotive components, including fuel filters. Penetrating these markets with cost-efficient and efficient filtration solutions could prove to be a lucrative opportunity for industry players.

In conclusion, the automotive fuel filter market is undergoing significant transformations, propelled by ecological concerns, fuel efficiency requirements, and technological advancements. While challenges are evident, enterprises within this sector can prosper by demonstrating adaptability, exploring fresh opportunities, and acclimating to the ever-evolving automotive landscape.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.1% |

| Market Size in 2024 | USD 2.93 Billion |

| Market Size by 2034 | USD 5.29 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Fuel Type, By Sales Channel, and By Vehicle Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for fuel efficiency

The automotive fuel filter market is experiencing substantial growth due to the increasing demand for fuel efficiency. This demand is a powerful catalyst driving the automotive industry to adopt technologies and components that enhance vehicle fuel economy. Fuel filters, in particular, are pivotal in achieving and sustaining optimal fuel efficiency.

Effective fuel filters ensure that the fuel entering the engine is devoid of contaminants and impurities, facilitating peak engine performance. Cleaner fuel combustion resulting from efficient filtration leads to improved fuel mileage and reduced fuel consumption. This not only translates into financial savings for consumers but also aligns with environmental objectives by curbing greenhouse gas emissions.

Furthermore, fuel efficiency plays a vital role in meeting stringent emissions standards imposed by governments worldwide. To comply with these regulations and reduce their environmental impact, automakers are investing in advanced filtration systems. Consequently, there is an escalating demand for top-tier fuel filters, fostering growth within the automotive fuel filter market. As long as fuel efficiency remains a central concern for consumers and regulatory authorities, the market for fuel filters will continue to thrive.

Electric vehicle (EV) adoption

The increasing adoption of electric vehicles (EVs) is acting as a significant restraint on the growth of the automotive fuel filter market. Unlike traditional internal combustion engine (ICE) vehicles, EVs operate without conventional fuel systems, rendering fuel filters unnecessary in the same capacity. This fundamental shift in vehicle propulsion reduces the overall demand for fuel filters, particularly in the EV segment.

As consumers and manufacturers increasingly favor EVs for their environmental benefits and energy efficiency, the market for traditional fuel filters faces a potential decline. Manufacturers of fuel filters must adapt to this changing landscape by exploring new filtration solutions specific to EVs or diversifying into other areas of filtration technology. While the transition to EVs is beneficial for reducing greenhouse gas emissions and dependency on fossil fuels, it presents a formidable challenge for the traditional automotive fuel filter market, necessitating strategic adjustments to remain relevant in a rapidly evolving automotive industry.

Advanced materials and technologies

Advanced materials and technologies are paving the way for substantial opportunities in the automotive fuel filter market. With ongoing research and development, innovative materials like advanced filter media and cutting-edge filtration technologies are enhancing the performance and efficiency of fuel filters. These developments enable filters to not only remove impurities effectively but also to extend their lifespan, reducing maintenance costs for vehicle owners. Nano-engineered filter media, composite materials, and specialized coatings are among the advancements driving the market forward.

These materials can provide finer filtration, better resistance to contaminants, and improved durability, meeting the demands of modern engines and stricter emission regulations. Additionally, the integration of smart sensors and IoT (Internet of Things) technology into fuel filter systems offers real-time monitoring and diagnostics, creating opportunities for predictive maintenance and enhanced overall vehicle performance. As automakers seek to optimize fuel efficiency and reduce environmental impact, the adoption of advanced materials and technologies in fuel filters is a key pathway for innovation and growth in the industry.

According to the fuel type, the petrol segment has held a 57% revenue share in 2023. The petrol (gasoline) segment holds a significant share in the automotive fuel filter market primarily due to the widespread use of gasoline-powered vehicles globally. Petrol engines remain popular for their affordability, ease of maintenance, and established infrastructure.

As internal combustion engines continue to dominate the automotive landscape, fuel filters for petrol engines are in constant demand to ensure engine efficiency and compliance with emission standards. Additionally, the increasing focus on fuel efficiency in petrol engines and the need to reduce emissions further bolster the demand for high-quality fuel filters in this segment, maintaining its substantial market share.

The alternative fuels segment is anticipated to expand at a significantly CAGR of 7.7% during the projected period. The Alternative Fuels sector's prominent growth within the automotive fuel filter market results from the increasing acceptance of alternative fuel sources such as hydrogen, natural gas, and propane. These environmentally friendly fuel options are gaining momentum due to their reduced environmental impact.

However, their distinct composition requires specialized filtration solutions to uphold peak engine performance and minimize emissions. As the world's focus on cleaner and sustainable transportation intensifies, the requirement for fuel filters designed specifically for alternative fuels expands, solidifying its substantial portion of the market growth.

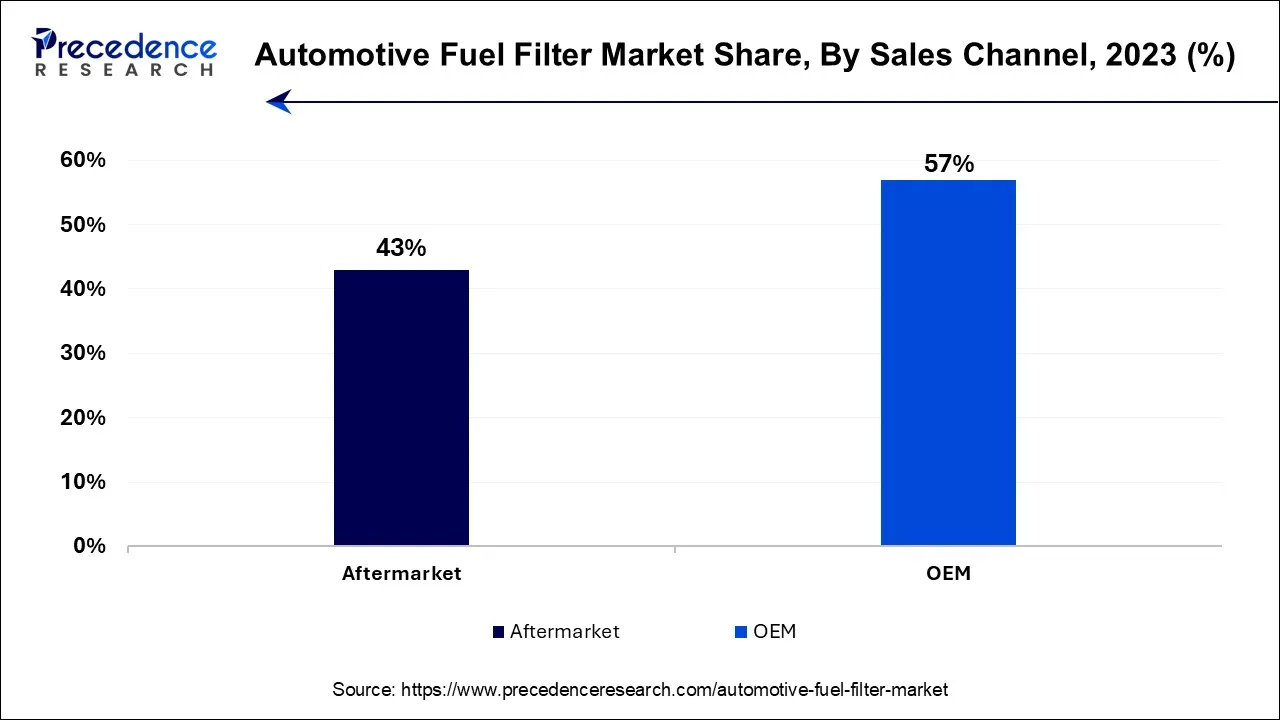

In 2023, the OEM segment had the highest market share of 57% on the basis of the sales channel. The OEM (Original Equipment Manufacturer) segment holds a major share in the automotive fuel filter market due to its inherent advantage of being the primary supplier to new vehicles during manufacturing. OEMs provide filters that are integrated into vehicles during production, ensuring high-quality and customized filtration systems tailored to specific models. This strategic positioning allows OEMs to establish long-term contracts with automakers, benefiting from economies of scale. Additionally, consumers tend to trust OEM-branded filters for their reliability and compatibility, further cementing the OEM segment's dominance in the market.

The aftermarket segment is anticipated to expand at the fastest rate over the projected period. The aftermarket segment holds significant growth in the automotive fuel filter market due to several factors. First, as vehicles age, their fuel filters require replacement to maintain optimal engine performance and fuel efficiency, creating a consistent demand. Second, consumers are increasingly conscious of vehicle maintenance, and they often seek high-quality replacement filters to ensure reliability. Lastly, the aftermarket offers a competitive landscape with multiple manufacturers providing a wide range of filter options, allowing consumers to choose based on price, quality, and specific vehicle needs, contributing to its substantial market growth.

In 2023, the commercial vehicle segment had the highest market share of 54% on the basis of the vehicle type. The dominance of the commercial vehicle segment in the automotive fuel filter market can be attributed to various factors. Commercial vehicles, including trucks and buses, often feature larger engines and cover extended distances, resulting in increased fuel consumption. Consequently, there is a heightened demand for effective fuel filtration systems to ensure optimal engine functionality and adherence to stringent emission standards.

Furthermore, commercial vehicles frequently encounter more challenging operational conditions, leading to the need for frequent filter replacements. Coupled with the considerable size of the commercial vehicle fleet, these elements collectively establish the segment's prominent role in the fuel filter market.

The passenger car segment is anticipated to expand at the fastest rate over the projected period. The passenger car segment holds major growth in the automotive fuel filter market primarily due to the sheer volume of passenger vehicles on the road globally. Passenger cars are a ubiquitous mode of transportation, leading to consistent demand for fuel filters. Additionally, stricter emissions standards have prompted automakers to equip their passenger cars with advanced filtration systems to comply with regulations. As consumers prioritize fuel efficiency and environmental concerns, passenger car manufacturers invest in high-quality fuel filters to ensure optimal engine performance, further bolstering the segment's growth in the market.

Segments Covered in the Report

By Fuel Type

By Sales Channel

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025