January 2025

Automotive Glass Market (By Product: Tempered Glass, Laminated Glass, Others; By Vehicle Type: Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles; By End-use: Original Equipment Manufacturer (OEM), Aftermarket) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-20334

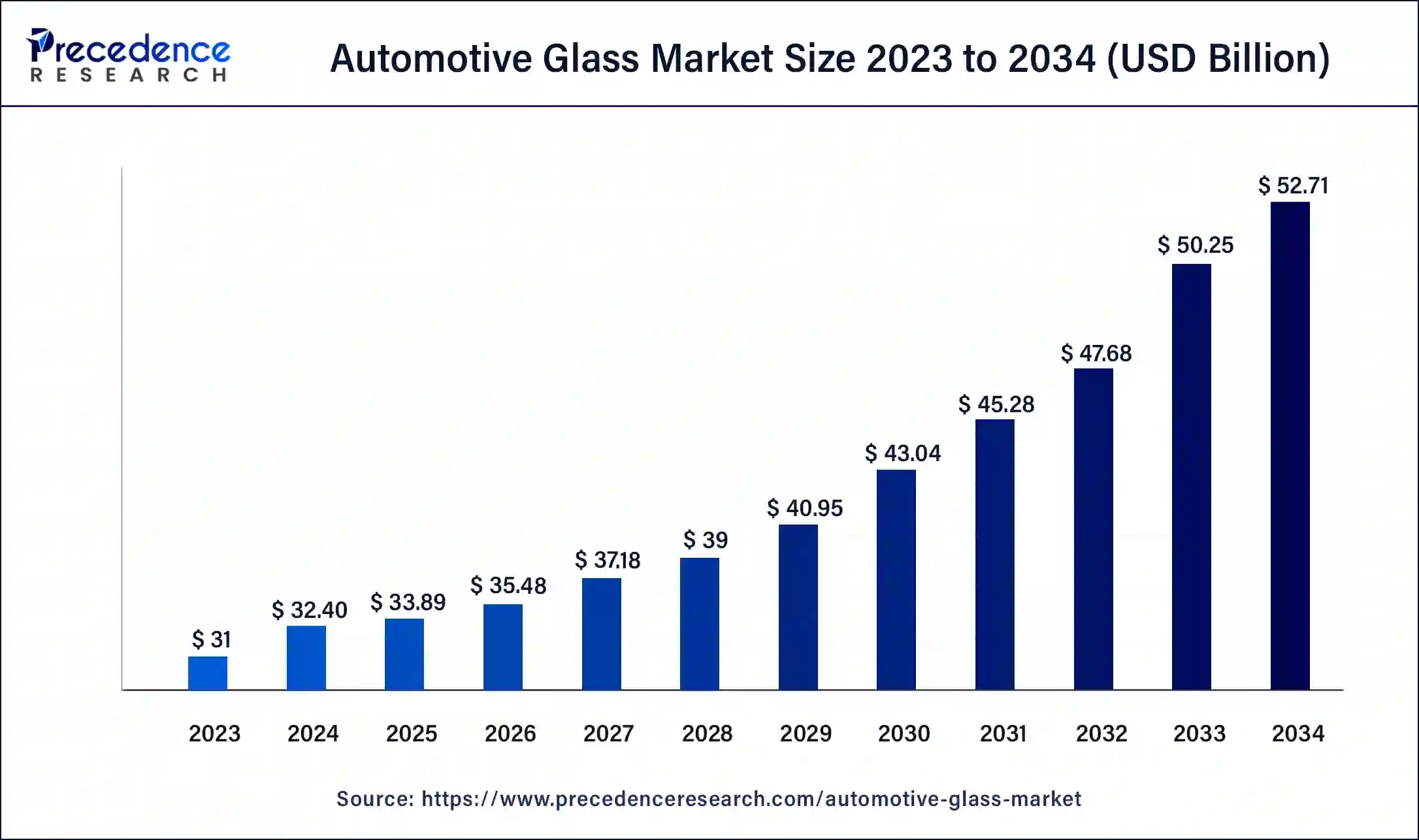

The global automotive glass market size was USD 31 billion in 2023, calculated at USD 32.40 billion in 2024 and is expected to reach around USD 52.71 billion by 2034, expanding at a CAGR of 4.99% from 2024 to 2034.

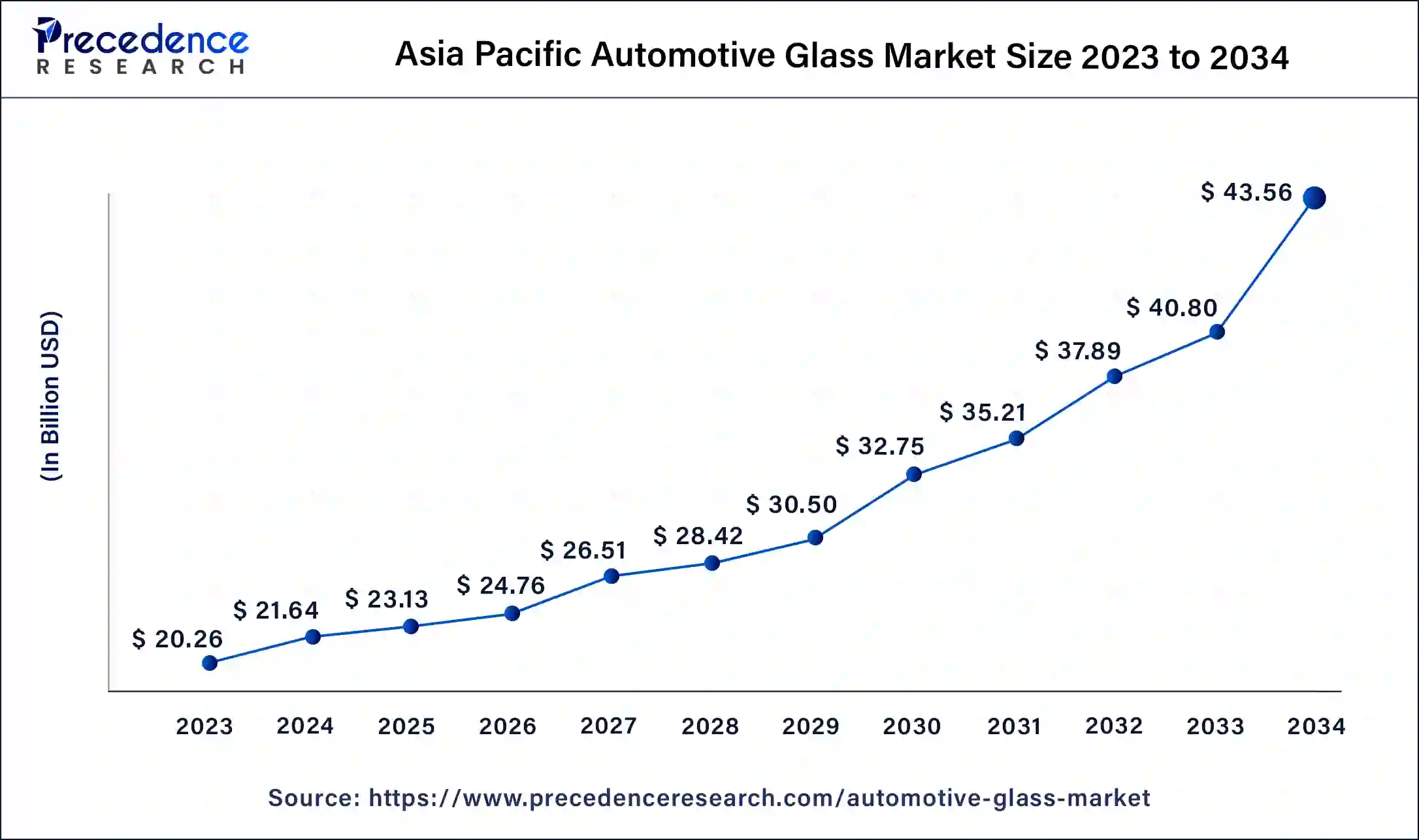

The Asia Pacific automotive glass market size was valued at USD 20.26 billion in 2023 and is expected to reach around USD 43.56 billion by 2034, growing at a CAGR of 5.20% from 2024 to 2034.

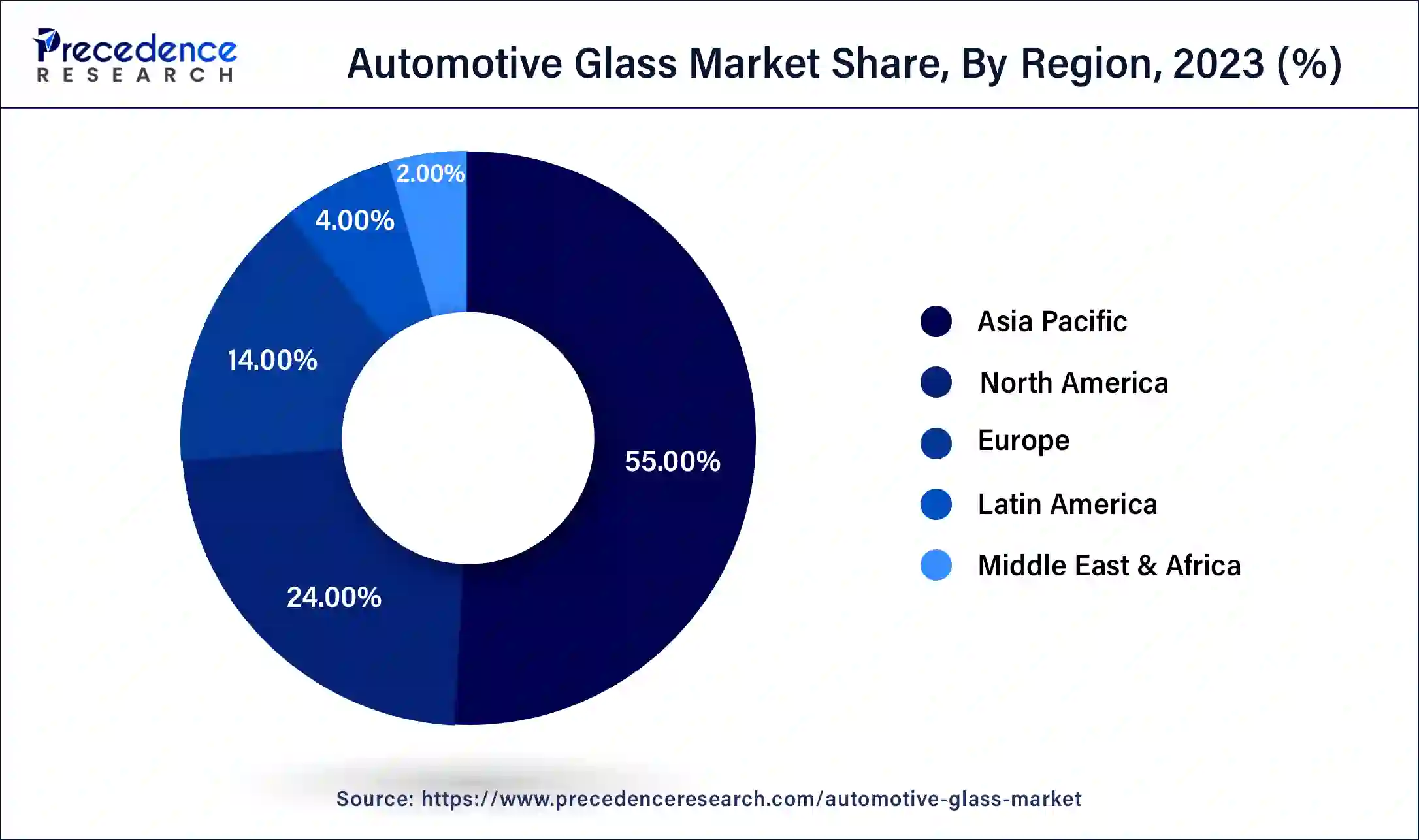

Asia-Pacific held the largest share of 55% in 2023 due to several factors. The region experiences robust growth in the automotive industry, with a high demand for vehicles across various segments. Rapid urbanization, increasing disposable income, and a growing population contribute to the rising demand for automobiles. Additionally, the emphasis on technological advancements and the adoption of electric vehicles in countries like China further boost the automotive glass market in the Asia-Pacific region, making it a key player in the global automotive glass industry.

North America is poised for rapid growth in the automotive glass market due to several factors. The region is experiencing a surge in electric vehicle adoption, driving demand for specialized glass. Stringent safety regulations also contribute to the growing market, necessitating advanced glass technologies. Moreover, the region's focus on lightweight materials to enhance fuel efficiency provides opportunities for innovative glass solutions. With a robust automotive industry and increasing emphasis on vehicle aesthetics and safety, North America is positioned for substantial growth in the automotive glass market.

Meanwhile, Europe is experiencing notable growth in the automotive glass market due to several factors. The region's commitment to stringent safety standards drives demand for advanced automotive glass technologies. Additionally, the emphasis on sustainability and the growing adoption of electric vehicles contribute to the need for specialized glass solutions. With a focus on lightweight materials for fuel efficiency and increasing consumer preferences for advanced safety features, Europe has become a thriving market for automotive glass, presenting opportunities for innovation and market expansion.

Automotive glass, commonly known as car windows, is a crucial component of vehicles designed to provide visibility, protection, and structural support. It serves as a barrier between the occupants and external elements, such as wind, rain, and debris, ensuring a safe and comfortable driving experience. Typically made of laminated or tempered glass, automotive glass undergoes specific manufacturing processes to enhance durability and safety.

In addition to windshields, automotive glass includes side windows, rear windows, and sometimes glass elements in side mirrors. Modern automotive glass often incorporates advanced technologies like UV coatings for sun protection and defrosting capabilities. Beyond its functional role, automotive glass can also contribute to the aesthetics of a vehicle, making it an integral part of both safety and design considerations in the automotive industry.

Automotive Glass Market Data and Statistics

| Report Coverage | Details |

| Global Market Size by 2034 | USD 52.71 Billion |

| Global Market Size in 2023 | USD 31 Billion |

| Global Market Size in 2024 | USD 32.40 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.99% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Vehicle Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising global vehicle production

The surge in global vehicle production has a significant impact on the demand for automotive glass, driving market growth. As more cars are manufactured worldwide, the need for various types of automotive glass, including windshields, side windows, and rear windows, increases proportionately. The automotive glass market is closely linked to the overall expansion of the automotive industry, as these glass components are essential for providing visibility, safety, and structural support in vehicles. With rising global vehicle production, original equipment manufacturers (OEMs) and automotive glass suppliers experience a heightened demand for their products.

This increased demand is not only driven by the sheer volume of vehicles being produced but also by the need for advanced technologies and materials in automotive glass to meet evolving safety standards and consumer preferences. As the automotive sector continues to grow, the automotive glass market is poised to thrive, playing a crucial role in ensuring the safety, aesthetics, and functionality of vehicles on a global scale.

Complex manufacturing processes

The complexity of manufacturing processes in the automotive glass industry poses a restraint on market demand. The intricate methods involved in producing specialized automotive glass, such as laminated and tempered glass, contribute to challenges in terms of time and cost. The detailed procedures require precision and expertise, leading to longer production times and increased manufacturing expenses. This complexity can potentially slow down the overall production capacity of automotive glass, impacting the timely supply to meet market demands.

Moreover, the sophisticated manufacturing processes also necessitate a higher level of technical know-how and investment in advanced machinery. Smaller manufacturers or those with limited resources may face barriers to entry, limiting their ability to compete effectively in the market. As a result, the intricacies of manufacturing pose a significant hurdle for some players, affecting the overall growth and dynamics of the automotive glass market.

Focus on lightweight materials

The automotive industry's heightened focus on lightweight materials is creating significant opportunities in the automotive glass market. As manufacturers strive to improve fuel efficiency and reduce emissions, there is a growing demand for innovative glass solutions that contribute to overall vehicle weight reduction. This emphasis on lightweight materials presents an opportunity for automotive glass manufacturers to explore and develop advanced glass technologies that meet both safety standards and the industry's weight-saving objectives.

In response to this trend, manufacturers can invest in research and development to create thinner and lighter glass options without compromising on strength or safety. These innovations not only align with the industry's sustainability goals but also position automotive glass as a crucial element in achieving overall vehicle weight reduction. As automakers increasingly seek ways to enhance fuel efficiency, the development of lightweight glass solutions represents a strategic opportunity for growth and differentiation in the automotive glass market.

The tempered glass segment held the highest market share of 60% in 2023. Tempered glass is a type of automotive glass that undergoes a controlled thermal treatment to enhance its strength. In the automotive glass market, the tempered glass segment involves the production of durable and shatter-resistant glass, primarily used for side windows and rear windows. A significant trend in this segment is the increasing preference for tempered glass due to its safety features. Automakers and consumers alike favor tempered glass for its ability to crumble into small, blunt pieces upon impact, minimizing the risk of injuries during accidents, and contributing to overall safety trends in the automotive industry.

The laminated glass segment is anticipated to witness rapid growth at a significant CAGR of 7.3% during the projected period. Laminated glass is a key segment in the automotive glass market, known for its safety features. Comprising two layers of glass bonded with a layer of polyvinyl butyral (PVB) or similar material, it remains intact upon impact, reducing the risk of shattering. A notable trend in this segment is the increasing adoption of laminated glass for windshields, driven by stringent safety regulations. Manufacturers are continually innovating, enhancing laminated glass to provide improved protection, UV filtering, and acoustic insulation, contributing to its rising prominence in the automotive industry.

The passenger cars segment has held 59% market share in 2023. The passenger cars segment in the automotive glass market refers to glass products designed specifically for use in cars meant for personal transportation. This includes windshields, side windows, and rear windows for traditional sedans, hatchbacks, and SUVs. A key trend in this segment involves the integration of advanced technologies, such as heads-up displays and smart glass, to enhance the driving experience. Additionally, there's a growing demand for lightweight glass solutions to contribute to fuel efficiency and comply with the automotive industry's focus on sustainability.

The light commercial vehicles segment is anticipated to witness rapid growth over the projected period. The light commercial vehicles (LCV) segment in the automotive glass market encompasses vehicles designed for commercial purposes, such as vans and pickup trucks. A notable trend in this segment involves a growing demand for durable and impact-resistant automotive glass to ensure safety and longevity. Manufacturers are increasingly focusing on developing specialized glass solutions for LCVs, emphasizing both safety features and cost-effectiveness. This trend aligns with the rising use of light commercial vehicles across various industries, driving the need for reliable and high-quality automotive glass products.

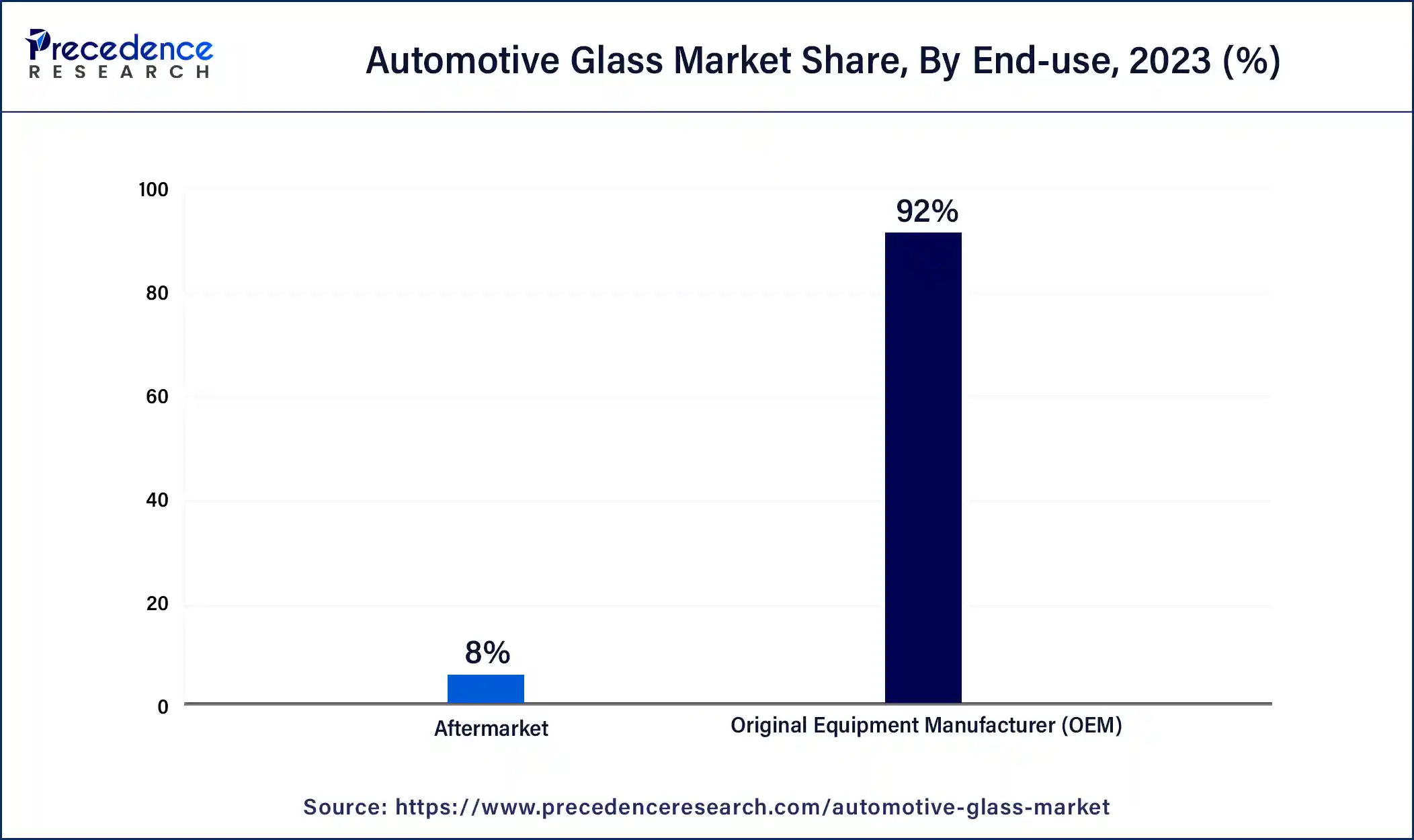

The original equipment manufacturer (OEM) segment held a 92% market share in 2023. The original equipment manufacturer (OEM) segment in the automotive glass market refers to the production and supply of glass directly to vehicle manufacturers for original installations. In this segment, manufacturers collaborate with automakers to provide customized glass solutions tailored to specific vehicle models. A notable trend in the OEM segment involves an increasing demand for advanced technologies, such as heads-up displays and smart glass, as automakers seek to incorporate innovative features that enhance safety, aesthetics, and overall driving experiences in newly manufactured vehicles.

The aftermarket segment is anticipated to witness rapid growth over the projected period. The aftermarket segment in the automotive glass market refers to the replacement and customization of glass components in vehicles that have already been sold. It includes services such as windshield replacements and upgrades for aesthetics or improved features. A notable trend in this segment is the increasing demand for replacement glass due to wear, accidents, or evolving safety standards. As vehicles age, there is a consistent need for automotive aftermarket glass services, creating a steady market for manufacturers and service providers to offer replacement solutions and cater to consumer preferences.

Segments Covered in the Report

By Product

By Vehicle Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025