January 2025

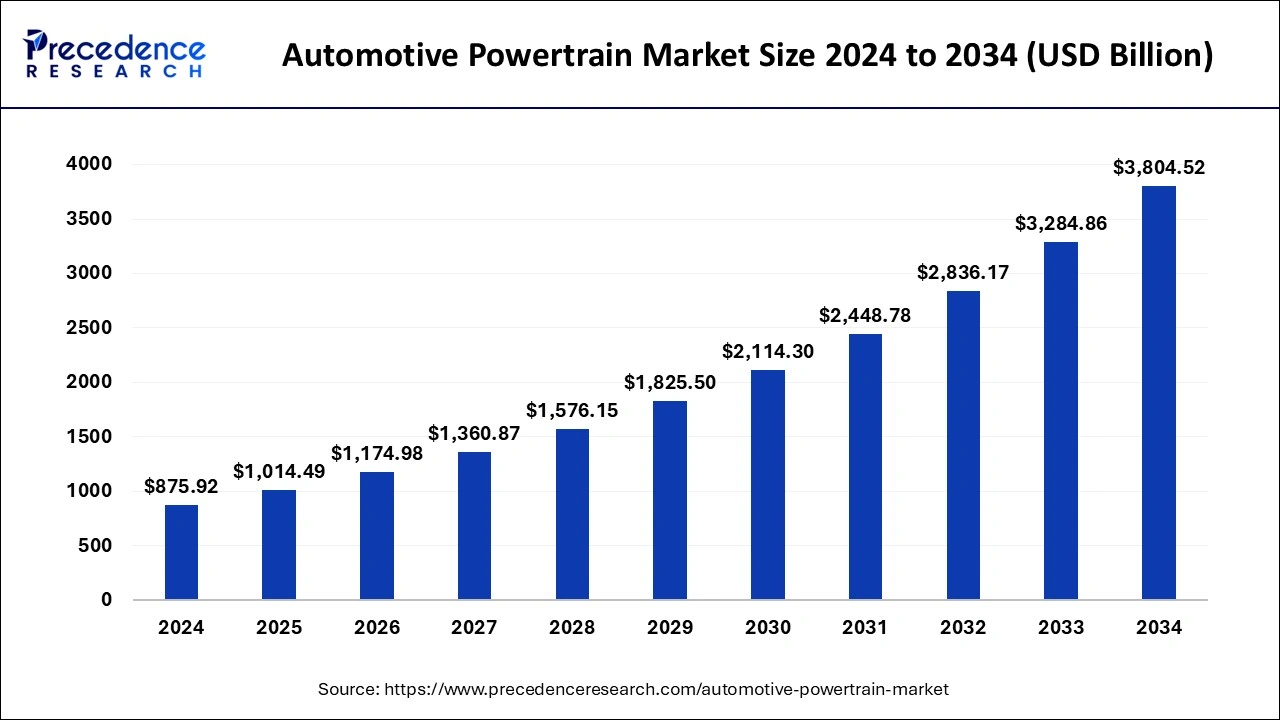

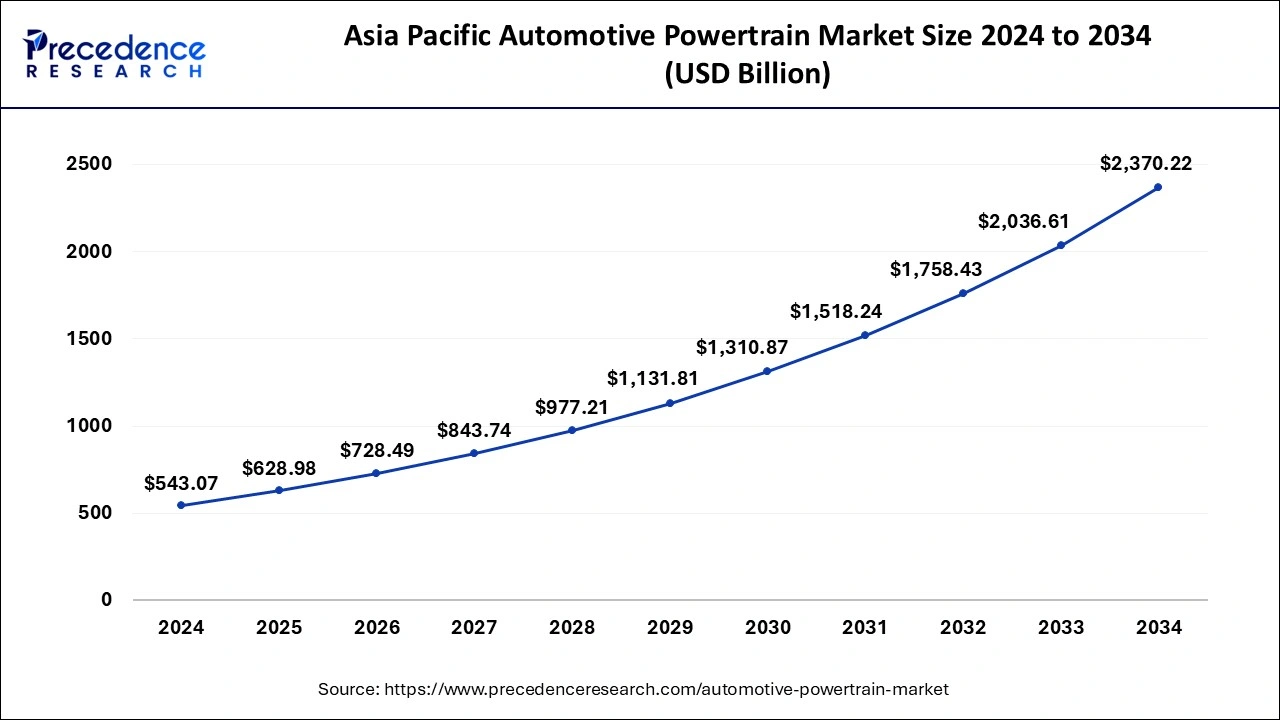

The global automotive powertrain market size is calculated at USD 1014.49 billion in 2025 and is forecasted to reach around USD 3804.52 billion by 2034, accelerating at a CAGR of 15.82% from 2025 to 2034. The Asia Pacific automotive powertrain market size surpassed USD 628.98 billion in 2025 and is expanding at a CAGR of 15.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive powertrain market size was accounted for USD 875.92 billion in 2024 and is anticipated to reach around USD 3804.52 billion by 2034, growing at a CAGR of 15.82% from 2025 to 2034. The increasing vehicle production, growing demand for environmental sustainability, and technological advancements drive the automotive powertrain market.

Artificial intelligence (AI) and machine learning (ML) have found immense potential in the automotive sector to improve vehicle performance, driver safety, and passenger experience. AI and ML can be used to select appropriate powertrains for vehicles by identifying the perfect combination for motor size, winding configuration, and inverter topology. AI can optimize every component of the powertrain for maximum efficiency and performance. Additionally, AI and ML can play a vital role in designing and developing powertrains based on vehicle requirements. AI can streamline the entire development process, improving efficiency and reducing overall costs. AI algorithms can also be used for powertrain control, adapting to the dynamic environment.

The Asia Pacific automotive powertrain market size was evaluated at USD 543.07 billion in 2024 and is predicted to be worth around USD 2370.22 billion by 2034, rising at a CAGR of 15.87% from 2025 to 2034.

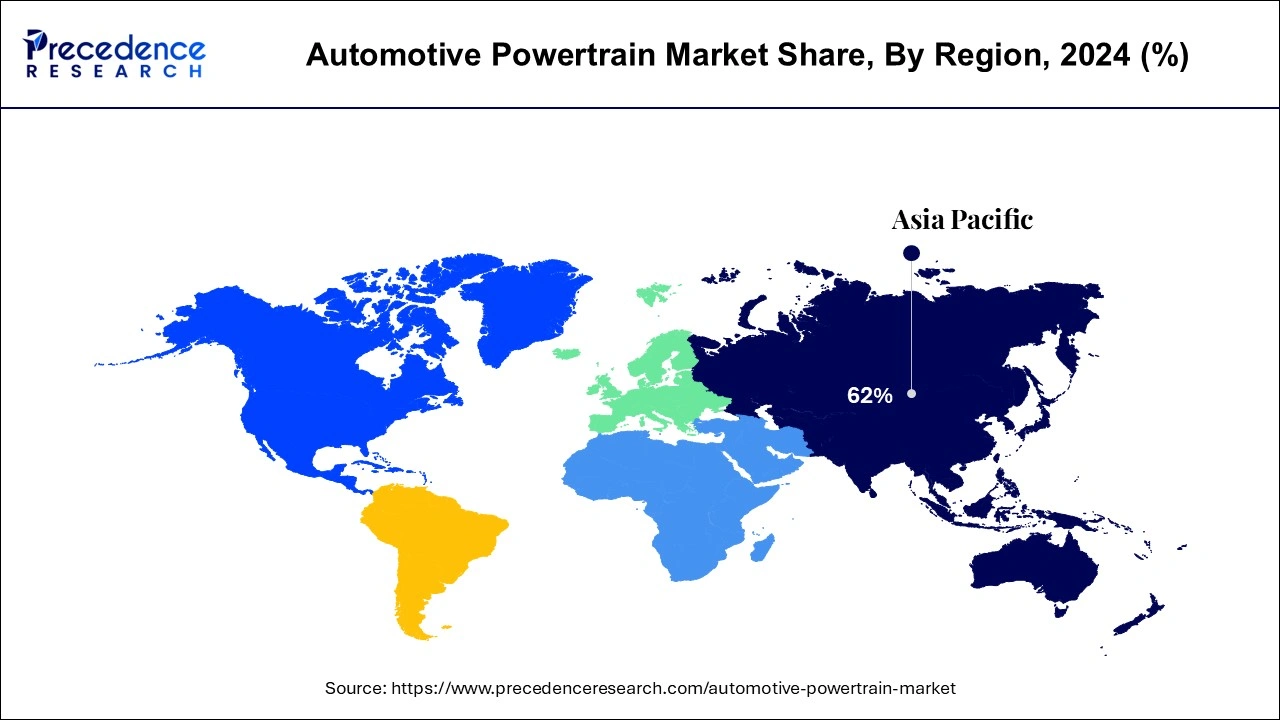

By geography, the global automotive powertrain market is studied for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The Asia Pacific is the major revenue contributor for the year 2024 and anticipated to maintain the same trend over the analysis period. This is mainly attributed to the increasing sale of vehicles along with surge in demand for automated transmission in Asian countries that include India and China. Besides this, rising purchasing power of consumers in the developing nations is likely o augment the demand for state-of-the-art vehicles that in turn propels the demand for upgraded powertrains in the vehicles. Furthermore, Chinese government has introduced several energy saving programs for the automotive industry such as new energy vehicle development program that has significantly transformed the automotive industry in the Asia Pacific region.

Europe is projected to expand at the highest CAGR in the automotive powertrain market during the forecast period. Europe produces the largest number of vehicles globally. The increasing vehicle production promotes the demand for automotive powertrains. The rising sales of electric vehicles in the region also contribute to the market. Approximately 3.2 million electric cars were registered in 2023, an increase of 20% from 2022. Favorable government policies on environmental sustainability augment the market in Europe. The European Union recently launched the European Green Deal and the 8th Environment Action Programme (8EAP), setting out specific objectives and conditions to drive sustainability.

Powertrain is one of the important components for an automobile that produces power to drive the vehicle by transferring it to the wheels. Some of the main components of powertrain include transmission, engine, driveshaft, and differentials. The performance as well as efficiency of a vehicle depends on powertrain properties.

| Report Coverage | Details |

| Market Size in 2024 | USD 732 Billion |

| Market Size in 2025 | USD 732 Billion |

| Market Size by 2034 | USD 1,380.48 Billion |

| Growth Rate from 2025 and 2034 | CAGR of 6.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Position, Engine, Vehicle |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Increasing Vehicle Production

The increasing number of vehicle production is a major driver of the automotive powertrain market. According to the European Automobile Manufacturers’ Association, approximately 76 million units of cars were produced globally in 2023. The rising demand for vehicles increases the use of powertrains. Powertrains are used in all types of vehicles including internal combustion engines (ICE), hybrid vehicles, and electric vehicles. The rapid advancements in vehicle features have driven the demand for vehicles, impacting their sales. More than 72 million cars were sold globally in 2023.

Reliability of Powertrain Components

The major challenge of the automotive powertrain market is the reliability of powertrain components on the road. Components like the battery, motor, and power electronics are vulnerable to environmental stresses such as temperature variation and mechanical shocks.

Growing Investments

The future of the automotive powertrain is promising, driven by the increasing investments in automotive R&D. Major automotive giants are increasing their investments in automotive R&D to promote the development of advanced motor vehicle components. The amalgamation of automobile R&D investments and technological advancements drive the latest innovations in powertrains with an aim to improve vehicle performance. The changing consumer demands and the surge in market competition lead to increased investments in R&D. This enables key players to stand out in the market and strengthen their position as leaders.

Based on position, the global automotive powertrain market is classified into All-wheel Drive (AWD), Rear-wheel Drive (RWD), and Front-wheel Drive (FWD). AWD captured the majority of revenue share in the year 2024 as well as estimated to grow at the highest rate during the forthcoming years. This is mainly attributed to the benefits offered by AWD over other positions that include RWD and FWD. The AWD system distributes the power and torque equally to all wheels particularly while turning a vehicle provides more grip along with traction. Further, increasing demand for high-end vehicles and luxury cars are likely to prosper the growth of AWD in the automotive powertrain market during the upcoming period.

On the basis of engine type, gasoline engines capture majority of market revenue share in the year 2024 and expected to grow at a steady pace during the forecast timeframe. However, other engine types that include electric and hybrid powered engines are gaining prominent pace owing to rapid rise in the sale of electric vehicles.

The global automotive powertrain industry is highly competitive owing to rising investments for research & development by the major industry participants such as Aisin Seiki, Tata Motors, BMW, CNH Industries, and many others. For instance, in February 2018, BMW introduced its new line of production for powertrains that include i-lineup for Roadster edition of the i8 as well as the i3s powered by electric and plug-in hybrid powertrains.

By Position

By Engine Type

By Vehicle Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025