January 2025

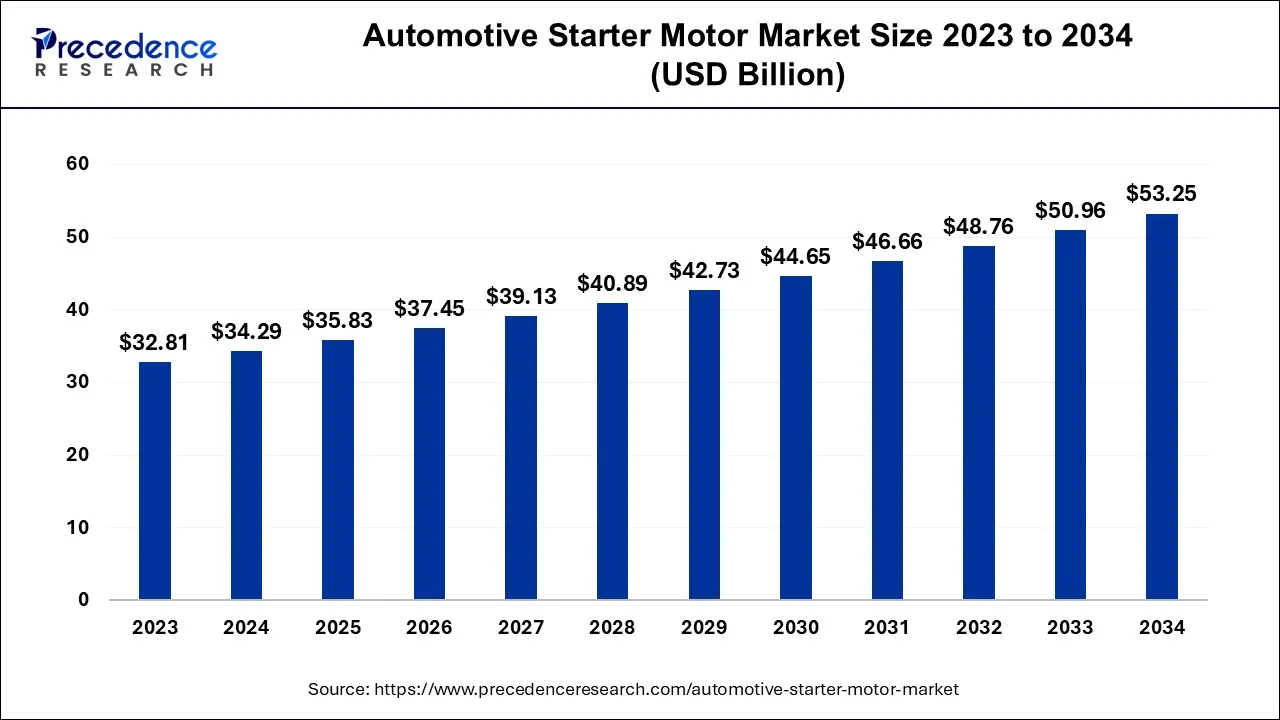

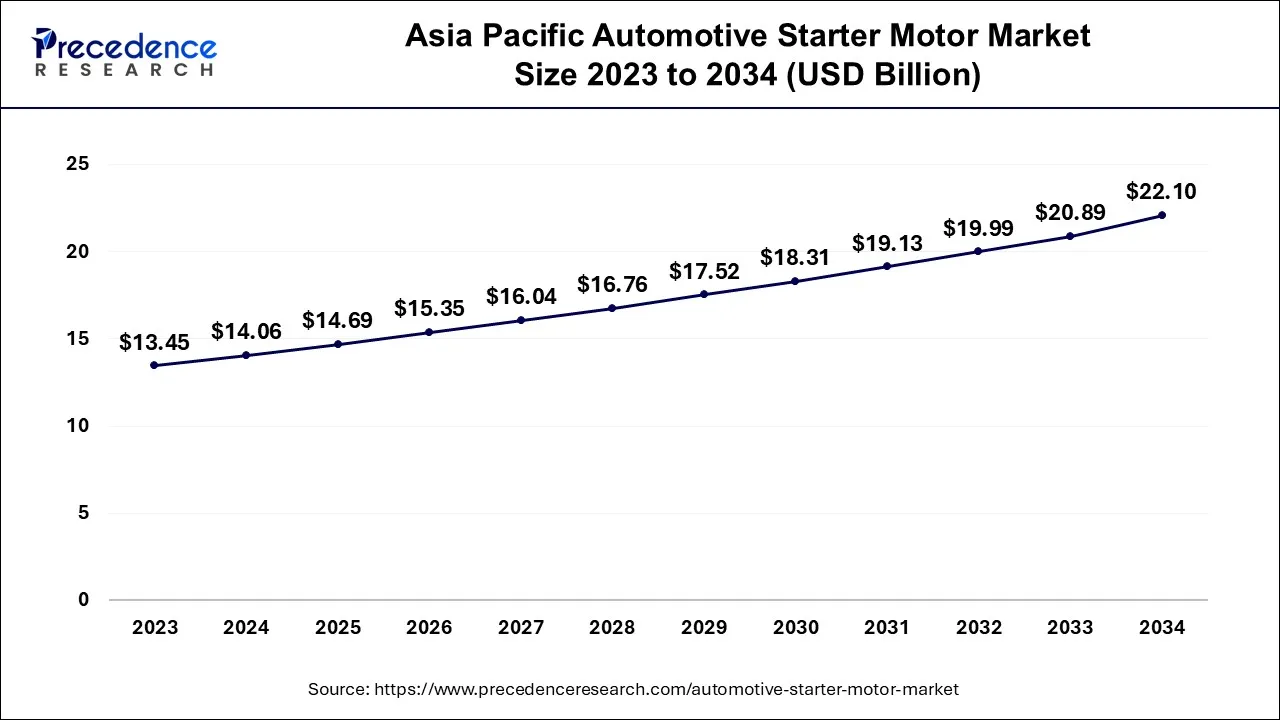

The global automotive starter motor market size is calculated at USD 34.29 billion in 2024, grew to USD 35.83 billion in 2025, and is predicted to hit around USD 53.25 billion by 2034, expanding at a CAGR of 4.5% between 2024 and 2034. The Asia Pacific automotive starter motor market size accounted for USD 14.06 billion in 2024 and is anticipated to grow at the fastest CAGR of 4.63% during the forecast year.

The global automotive starter motor market size is expected to be valued at USD 34.29 billion in 2024 and is anticipated to reach around USD 53.25 billion by 2034, expanding at a CAGR of 4.5% over the forecast period from 2024 to 2034.

The Asia Pacific automotive starter motor market size is accounted for USD 14.06 billion in 2024 and is projected to be worth around USD 22.10 billion by 2034, poised to grow at a CAGR of 4.63% from 2024 to 2034.

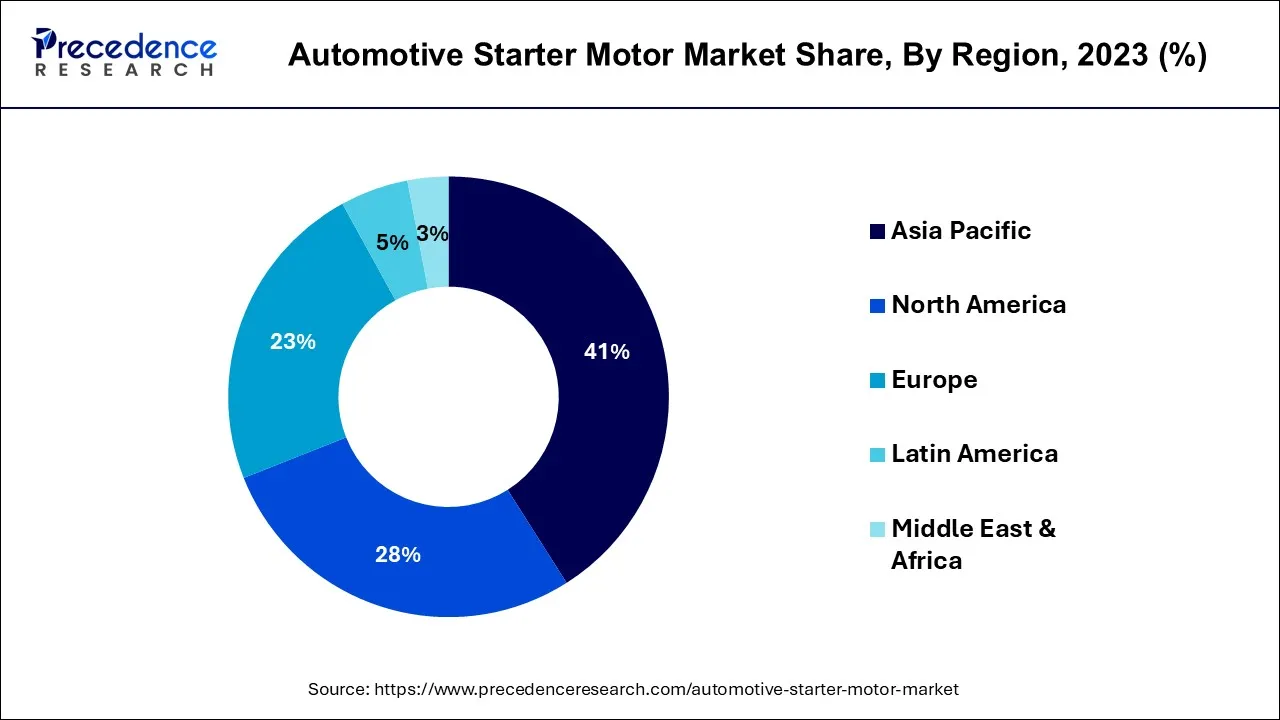

Asia-Pacific held the largest revenue share 41% in 2023. The preeminence of the region in the automotive starter motor market can be attributed to a constellation of distinctive factors. This geographical domain encompasses some of the globe's most expansive and swiftly advancing automotive markets, with China and India serving as prime examples. The burgeoning middle-class population and ongoing urbanization in this territory have engendered an escalating appetite for vehicles, thereby propelling the demand for starter motors. Furthermore, the Asia-Pacific region boasts major automotive manufacturing centers and exhibits a notable inclination towards electric mobility, both of which converge to bolster its dominance in the automotive starter motor market. In essence, it stands as an automotive epicenter, wielding considerable influence in the industry.

North America is estimated to observe the fastest expansion. North America maintains significant growth in the automotive starter motor market due to several key factors. The region boasts a well-established automotive industry with a substantial number of vehicles on the road, creating a continuous demand for starter motor replacements. Stringent environmental regulations have prompted automakers to adopt advanced starter motor technologies. Moreover, a higher consumer preference for larger vehicles like trucks and SUVs in North America contributes to greater starter motor usage. The presence of prominent automotive manufacturers, coupled with a growing market for electric vehicles, further solidifies North America's prominent growth in the automotive starter motor market.

The automotive starter motor market represents the domain dedicated to the production and distribution of initiation mechanisms for internal combustion engines in vehicles. These crucial components kickstart the rotational action of the engine, enabling the vehicle's ignition. This realm encompasses a diverse array of starter motor varieties, ranging from conventional electric starters to cutting-edge, eco-conscious designs. Its dynamics are shaped by factors such as evolving trends in automotive production, technological innovations, and consumer preferences for eco-friendly, energy-efficient options. This arena is characterized by fierce competition, as numerous manufacturers and suppliers vie to offer dependable and cost-effective starter motor solutions to the automotive sector.

| Report Coverage | Details |

| Market Size in 2024 | USD 34.29 Billion |

| Market Size by 2034 | USD 53.25 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.5% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Vehicle Type, By Type, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing vehicle production

The inexorable upswing in vehicle production serves as a pivotal catalyst propelling the growth of the automotive starter motor market. The incessant global population expansion coupled with the pervasive wave of urbanization fuels an unyielding appetite for a diverse array of vehicles. This escalating demand transcends the automotive spectrum, encompassing passenger cars, heavy-duty trucks, and various modes of transportation, all of which rely on starter motors as the crucial ignition enabler.

Furthermore, the emergence of burgeoning economies, especially in the likes of India, China, and Brazil, where a burgeoning middle class craves personal and commercial vehicles, intensifies the clamor for starter motors. These dynamic economies emerge as epicenters of automotive manufacturing, magnifying the market's reach and influence. Additionally, the aftermarket segment for starter motors, driven by the surge in vehicle production, takes on a profound significance.

With a mounting population of vehicles on the road, the inevitable wear and tear on incumbent starter motors spark a perpetual demand for replacements and enhancements, thereby ensuring the market's continuous expansion. In essence, the automotive starter motor market derives its vital impetus from the relentless escalation in vehicle production, solidifying its enduring growth and relevance.

Shift to electric vehicles (EVs)

The shift to electric vehicles (EVs) is serving as a prominent restraint on the growth of the automotive starter motor market. As EVs gain traction and market share, they pose a significant challenge to the traditional automotive starter motor industry. Unlike internal combustion engine (ICE) vehicles, electric vehicles do not rely on conventional starter motors for engine ignition. This fundamental difference in propulsion systems reduces the demand for traditional starter motors, particularly in the segment of the automotive market that transitions to electric mobility.

As governments worldwide emphasize sustainability and offer incentives for EV adoption, consumers are increasingly drawn to electric vehicles. This transition away from ICE vehicles limits the growth prospects of starter motor manufacturers, as they face a shrinking market for their products. Consequently, the automotive starter motor industry must adapt by diversifying its product offerings, exploring alternative markets, and innovating in response to the changing landscape of the automotive industry to mitigate the impact of the EV shift.

Innovation in start-stop systems

The innovation in start-stop systems unfolds a substantial canvas of opportunities within the automotive starter motor market. The advent of start-stop technology, a design aimed at augmenting fuel efficiency and curbing emissions, has taken center stage in contemporary vehicles. This system orchestrates the automatic halting of the engine when the vehicle idles, only to reignite it seamlessly upon the driver's acceleration. This recurrent cycle of engine stoppage and reactivation places distinct demands on the starter motor, necessitating the development of sturdier and more resilient solutions.

Hence, a burgeoning requirement arises for advanced starter motor systems, adept at efficiently managing the increased frequency of engine starts. Manufacturers are positioned to embark on the creation of starter motors featuring heightened durability, expedited response times, and optimized thermal regulation. These innovations not only bolster the efficacy of start-stop systems but also contribute to the overarching goal of vehicle efficiency and environmental sustainability. As the automotive sector persistently champions fuel economy and emissions mitigation, the crafting of starter motors tailored to these technological strides unfolds as a significant avenue for expansion for manufacturers.

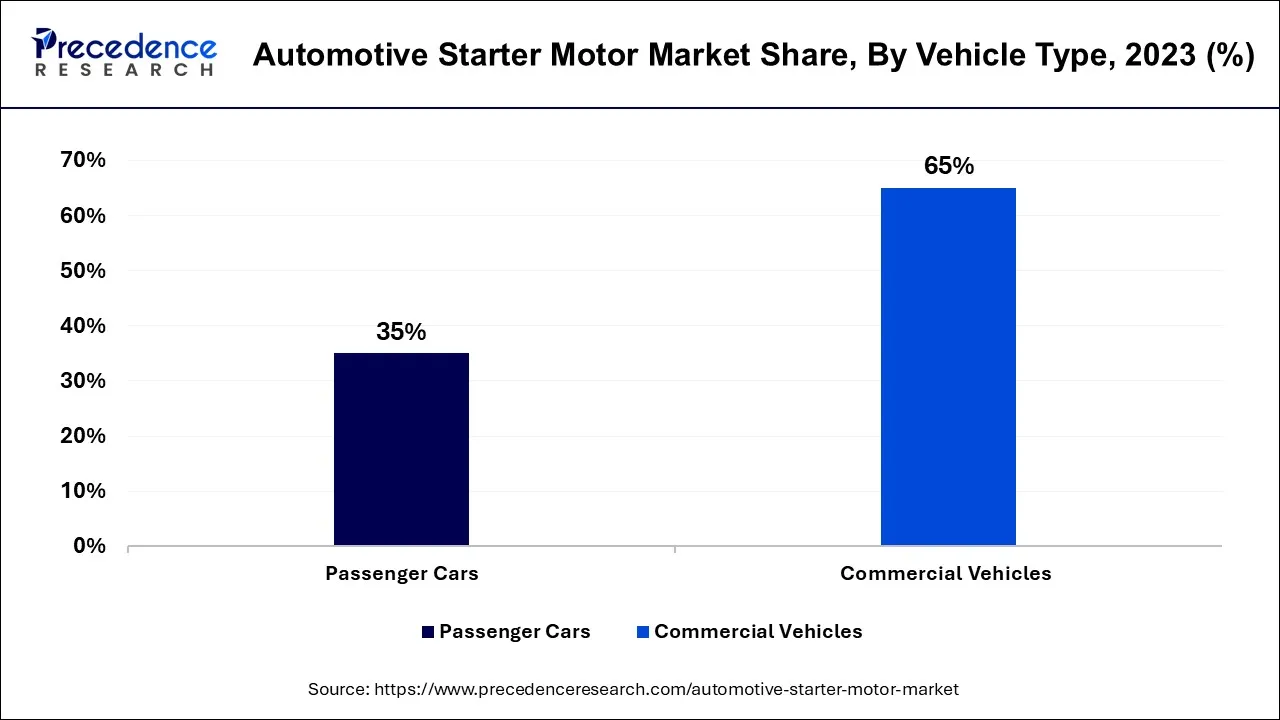

According to the vehicle type, the commercial vehicles segment has held a 65% revenue share in 2023. The commercial vehicles segment commands a significant share in the automotive starter motor market due to the distinctive demands of heavy-duty applications. Commercial vehicles, such as trucks and buses, require robust and durable starter motors capable of handling larger engines and frequent starts. They operate under demanding conditions, often in harsh environments and with higher load capacities, necessitating dependable starter motor systems. As a result, manufacturers have developed specialized starter motors for commercial vehicles, making this segment a major contributor to the market's overall revenue, driven by the substantial global presence of commercial fleets and logistics operations.

The passenger cars segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. The passenger car segment is expected to witness significant growth in the automotive starter motor market due to their sheer volume and broad consumer base. Passenger cars are the most commonly owned and driven vehicles, making them a dominant force in the market. Additionally, modern passenger cars often feature advanced starter motor technology, including start-stop systems, which require reliable and efficient starter motors. As fuel efficiency and emission standards continue to shape the automotive industry, the development of starter motors tailored to passenger cars is essential. This segment's substantial market growth is further reinforced by urbanization trends and increasing global car ownership.

Based on the application type, the Internal Combustion Engine (IC Engine) segment is anticipated to hold the largest market share of 60% in 2023. The Internal combustion engine (IC Engine) segment retains a major share in the automotive starter motor market due to the prevalence of traditional combustion engine vehicles. Despite the rise of electric vehicles, IC engine vehicles still dominate global roads. These vehicles require starter motors for engine ignition, ensuring a continuous demand for these components. Furthermore, the extensive existing IC engine vehicle fleet in mature markets and the ongoing production of such vehicles in emerging economies sustain the prominence of this segment in the starter motor market.

On the other hand, the hybrid/micro-hybrid powertrain segment is projected to grow at the fastest rate over the projected period. The dominant growth of the hybrid/micro-hybrid powertrain segment within the automotive starter motor market is primarily attributed to the burgeoning acceptance of hybrid and micro-hybrid vehicles. These innovative transportation solutions rely on cutting-edge starter motor technology to adeptly manage the frequent cycles of engine start and stop.

The surging global demand for environmentally conscious and fuel-efficient modes of transportation serves as a potent catalyst propelling this segment to the forefront. Additionally, the rigorous emissions regulations imposed by governing bodies have further thrust this sector into the spotlight, as hybrid and micro-hybrid powertrains emerge as a compelling strategy for curbing carbon emissions. As the automotive industry steadfastly advances in the pursuit of sustainable technologies, the hybrid/micro-hybrid powertrain segment maintains its commanding growth within the starter motor market.

Based on the type, the electric segment is anticipated to hold the largest market share of 32% in 2023. The electric segment holds a major share in the automotive starter motor market primarily due to the rising adoption of electric vehicles (EVs). Unlike traditional internal combustion engine (ICE) vehicles, EVs require starter motors for auxiliary systems, such as power steering and air conditioning, thereby contributing significantly to the demand. The growing global emphasis on environmental sustainability and stringent emissions regulations is driving the shift towards electric mobility, further boosting the electric starter motor segment. As EVs continue to gain popularity, this segment is expected to maintain and potentially expand its substantial market share in the automotive starter motor industry.

On the other hand, the hydraulic segment is projected to grow at the fastest rate over the projected period. The hydraulic segment holds a significant share in the automotive starter motor market due to its reliability and robust performance. Hydraulic starter motors are widely used in heavy-duty applications, such as commercial trucks and industrial machinery, where consistent and powerful engine ignition is crucial. Their ability to generate high torque even in harsh conditions makes them the preferred choice. Additionally, hydraulic starter motors require less maintenance and have a longer lifespan, reducing operational costs. As industries continue to rely on heavy machinery, the demand for reliable and durable hydraulic starter motors remains strong, sustaining their major market share.

Based on the sales channel, the OEM segment is anticipated to hold the largest market share of 55% in 2023. The OEM (Original Equipment Manufacturer) segment holds a major share in the automotive starter motor market primarily due to its direct integration into the manufacturing process of new vehicles. OEMs are the initial suppliers of starter motors to automakers, ensuring that each vehicle is equipped with a compatible and high-quality starter motor system. This strategic positioning grants them a significant share as they establish long-term partnerships with automotive manufacturers, benefiting from the consistent demand generated by the production of new vehicles. Additionally, OEMs are often at the forefront of innovation, offering advanced starter motor solutions tailored to modern vehicle requirements.

On the other hand, the replacement/aftermarket metal segment is projected to grow at the fastest rate over the projected period. The replacement/aftermarket segment commands a significant share in the automotive starter motor market due to several factors. As vehicles age and require maintenance, there's a sustained demand for starter motor replacements. Additionally, consumer preferences for vehicle upgrades, enhanced performance, and customization contribute to this segment's prominence.

The availability of advanced and high-quality aftermarket starter motor options, often at competitive prices, offers consumers a cost-effective alternative to purchasing brand-new vehicles. Moreover, the increasing average age of vehicles on the road in mature markets further bolsters the Replacement/Aftermarket segment's importance, making it a substantial and enduring component of the automotive starter motor market.

Segments Covered in the Report

By Vehicle Type

By Application Type

By Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025