January 2025

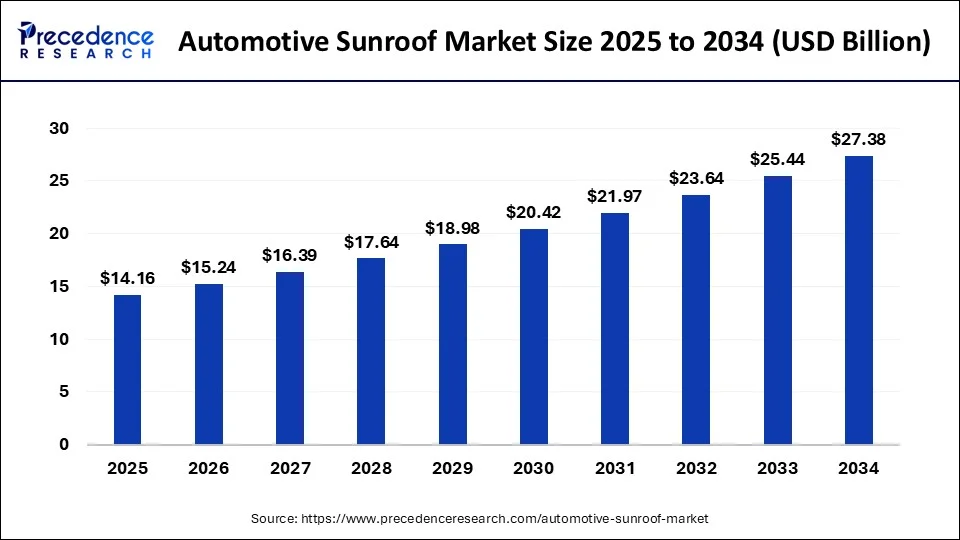

The global automotive sunroof market size accounted for USD 13.16 billion in 2024, grew to USD 14.16 billion in 2025 and is predicted to surpass around USD 27.38 billion by 2034, representing a healthy CAGR of 7.60% between 2024 and 2034.

The global automotive sunroof market size is estimated at USD 13.16 billion in 2024 and is anticipated to reach around USD 27.38 billion by 2034, expanding at a CAGR of 7.60% from 2024 to 2034.

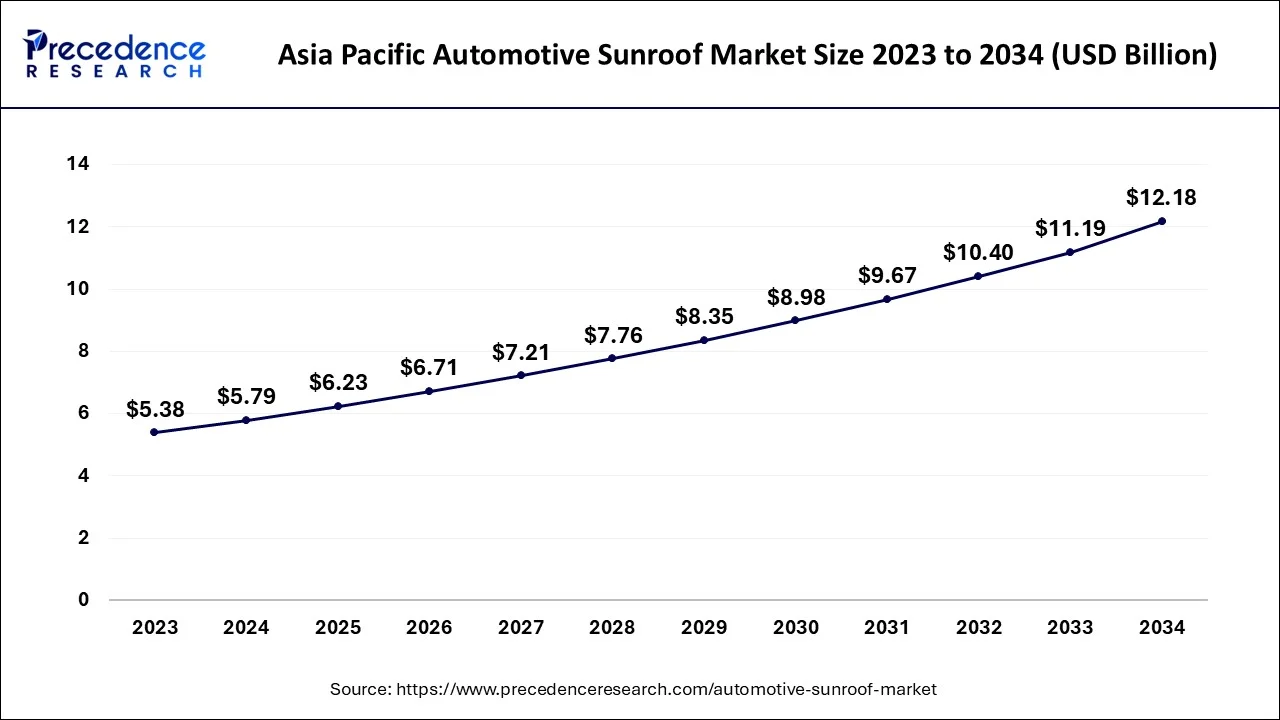

The Asia Pacific automotive sunroof market size is estimated at USD 5.79 billion in 2024 and is expected to be worth around USD 12.18 billion by 2034, rising at a CAGR of 7.71% from 2024 to 2034.

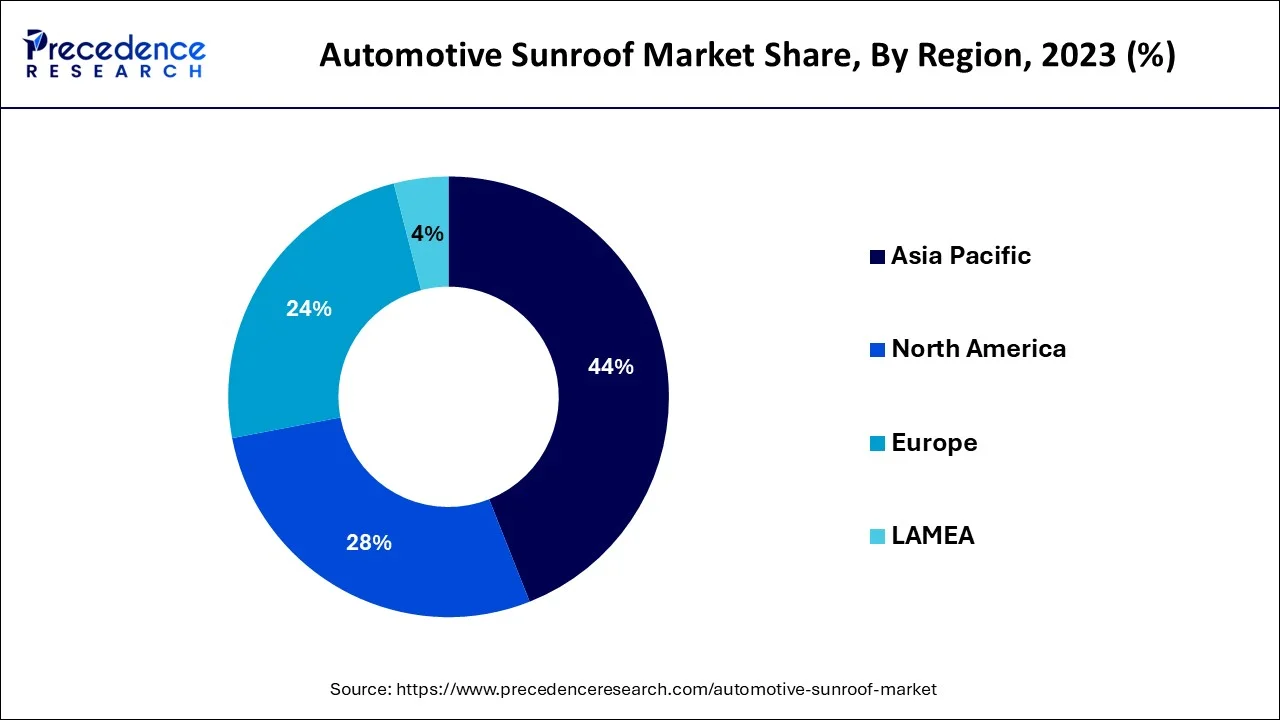

Asia Pacific dominated the global automotive sunroof market.

The Asia-Pacific market is expected to report a sizable portion of the global automotive sunroof industry, and the primary reason for this is improved automobile production. The presence of competitors in nations such as China and India and novel vehicle introductions with innovative features are expected to propel the automotive sunroof industry forward.

The Society of Indian Automobile Manufacturers (SIAM) reports that in December 2021, automakers marketed 219,421 passenger vehicles in the local market, a 13% decline from the prior year.

Europe is the second-largest market and will continue to grow rapidly in the coming years. This is primarily due to the growing popularity of luxury vehicles and OEMs' tendency to include features that enhance the driving experience. Germany is anticipated to provide a favorable growth environment for the automotive sunroof market throughout the forecast period.

According to the German Trade & Invest report, in 2021, Germany produced 3.1 million passenger vehicles, producing it Europe's leading producer. Germany's market development is fueled by increased production of luxury automobiles, SUVs, and sales.

The demand for automotive sunroofs is increasing due to the development of advanced technologies by original equipment manufacturers (OEMs). The innovation in glass technology and an increase in demand for safety, comfort, and convenience are the primary factors fueling the global automotive sunroof market growth. Sport utility vehicles have become one of the most popular automobile segments due to a wide variety of cars with unique adaptability in range, power output, and features.

The glass sunroof segment had the largest market share in 2023 and is expected to expand rapidly throughout the projected period. In terms of sunroof type, the panoramic segment held a significant market share in 2023. The passenger car segment is expected to expand significantly in the market due to the introduction of cost-effective options and features such as natural ventilation and increased comfort. The high cost of the vehicle and the complex design and manufacturing process is expected to halt the growth of the global automotive sunroof market.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.16 Billion |

| Market Size by 2034 | USD 27.38 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.60% |

| Base Year | 2023 |

| Largest Market | Asia Pacific |

| Second Largest Market | Europe |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Sunroof Type, By Operation, By Material Type, By Distribution Channels and By Vehicle Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for passenger comfort, safety features, and convenience

Sunroof manufacturers are financing the advancement of solar panels, switchable glazing, and ambient lighting technologies. Polycarbonate incorporates more sensors and light sources than glass to reach properties such as transparency and 3D formability. Traditional technology has a high penetration rate in emerging countries due to its low expense and widespread accessibility.

Growth in glass technology innovations that support sunroof glassmakers in designing various forms of glasses is one of the key factors driving the global automotive sunroof market growth. Laminated glass, tempered glass, and green glass are UV-protective glasses. Mercedes-Benz, for example, equips the SLK model with a panoramic Vario-roof with magic sky control, which generates a comfortable environment inside the vehicle.

Moreover, this technology uses innovative new glass properties, like darker or translucent glass, to provide an open-air experience during cold weather while preventing direct sunlight from using shades. Furthermore, Webasto's novel, unique solar sunroof, combined with the new convertible panoramic sunroof used in the Volkswagen Eos, allows for greater flexibility in regulating natural light.

High repair costs and reduction in fuel efficiency restrain the market growth.

The main focus of the manufacturers is on lowering weight in vehicles as it allows improved acceleration, braking, and fuel economy. Bulky items, which include the fuel tank, engine, and others, are generally positioned low to improve handling and vehicle stability. For example, panoramic glass roofs weigh greater as the glass is thicker and heavier than steel or aluminum roof panels. Therefore, the extra weight affects fuel efficiency significantly. Sunroofs are considerably expensive to integrate and fix in case of failure. Thus, these issues are anticipated to hamper the market growth.

Solar energy generation

Growing solar sunroof penetration in EVs and rising vehicle sales globally are expected to provide the market participants with abundant development opportunities in the global automotive sunroof industry throughout the projected period.

In the automotive industry, several manufacturers are concentrating on sustainability. Along with solar sunroofs, electric vehicles utilize the energy harvested from the sunroof to power some of the vehicle's features. For example, in January 2022, Mercedes-Benz unveiled the Vision EQXX, a novel electric car with thin crystalline solar cells on the roof that generate energy to power the car's lights, infotainment system, climate blower, and other characteristics.

Fault in operational or setup procedures

The high integration and maintenance expenses are significant challenges to the global automotive sunroof market growth. A sunroof leaks or stops working due to various factors, such as faulty tracks, faulty motors, and chipped or cracked glass. Power-operated, aluminum or plastic handles, rain sensors, sliding glass panels, and other accessories cost less than carbon or steel fiber.

These parts are assembled on a single plate, adding to the sunroof's weight. Furthermore, they require regular maintenance, which is anticipated to limit the global automotive panoramic sunroof industry growth during the projected period.

Covid 19 Impact:

Due to the outbreak of COVID-19 in 2020, the automotive sunroofs market had an adverse impact. The pandemic severely affected nations such as China, Australia, and India. According to the ECDC, the number of COVID-19 cases reported in China, India, and Malaysia in January 2022 was 135,299 confirmed with 5,700 deaths, 36,582,129 confirmed with 485,350 deaths, and 2,798,917 confirmed with 31,750 deaths, respectively.

However, the situation is anticipated to improve during the forecast period due to various factors, such as automobile manufacturers' increased focus on developing new vehicles with advanced features, the rising adoption of advanced technologies, and an increase in the number of automobile manufacturers in countries throughout the region.

The post-COVID recovery of automobile sales in various regions is anticipated to push the automobile industry for newly developed adaptations and features from which sunroofs, a unique selling proposition, benefit from this revival.

Glass automotive sunroof to gain power amid the adoption of premium and luxury cars

The glass sunroof sector held the most significant market share of around 80% in 2023 and is prone to rise at an impressive rate throughout the projected period. The segment's rise is attributed to advancements in technology, which supported the manufacturing of various forms of glassware, including tempered glass, laminated glass, and glass that protect against the ultraviolet rays of light.

Consequently, the market for the fabric segment is anticipated to decline over the anticipated period with falling sales of convertible cars. The sale of cars declines due to high maintenance costs and safety issues.

Panoramic automotive sunroof rules the automotive sunroof market over the projected years.

In terms of sunroof type, the panoramic segment accounted for a sizable market share in 2022. To improve ventilation, several car manufacturers offer panoramic sunroofs. Hyundai, for example, introduced the Tucson model with panoramic sunroofs in 2020. In 2022, Inteva developed panoramic sunroofs and a 10% weight reduction. As a result of improved airflow and product improvements with sun-protective coatings, the category market share will increase. The expanding implementation of pop-up sunroof systems with automobile manufacturers for improved aesthetics is a key factor responsible for the growth. A more extensive consumer base is attracted to the aesthetic features, and hence the vehicle manufacturers are updating their vehicles.

The inbuilt segment is expected to increase owing to the additional functions such as sunshades, vents, and auto close, which enhance the comfort level of the vehicles. Inbuilt sunroofs are a kind of automotive sunroof built into the vehicle's roof and are also referred to as flush-mount sunroofs. Inbuilt sunroofs give the vehicle a sleek and stylish appearance as they are constructed to integrate seamlessly with the roof. Electric motors open and close these sunroofs, controlled by switches on the vehicle's ceiling or door panel. Inbuilt sunroofs come in various sizes and designs to fit multiple vehicle models.

The automatic segment will boost the market over the predicted period owing to its smooth functionality.

Based on operation, the automatic sector is expected to grow drastically in the industry over the following period. This is because of the increasing demand for easy-to-use automobile technologies. The device operates with negligible driver intervention and is used remotely or in conjunction with a power system mounted in a vehicle. Additionally, integrated safety systems in sunroofs use sensors to distinguish an object or rain, which primarily increases its growth.

The manual sunroof is operated by hand using a lever or a crank to assist the sliding motion of the glass. The main issue related to manual sunroofs is the storage which might hamper the segment growth. Due to this, the demand for manual sunroofs has declined over the years.

OEM, the ruler of the automotive sunroof market

The OEM sector ruled the market based on the distribution channel. The source of safety, higher durability, and excellent facility with decreased maintenance are important factors driving demand for the OEM segment. Furthermore, the market is expected to be caused by consumer preferences for dependability, product quality, and good after-sales services. Rising automobile manufacturing is another significant factor propelling the OEM automotive sunroof industry growth.

The aftermarket segment is also anticipated to grow significantly due to the high demand for aftermarkets due to accidents caused by electrical faults or damage to sunroof parts. A sunroof is incorporated into some car models after they are built, and it is an aftermarket item that the automaker does not provide. Some key factors driving the market for sunroofs are growing car customization trends and a younger population demanding aftermarket sunroof installations.

Passenger cars are the major segment based on the vehicle type

The industry is divided into light commercial vehicles, passenger cars, and electric vehicles based on the vehicle type. The passenger car sector is projected to grow significantly in the market owing to cost-effective options being launched along with facilities such as natural ventilation and increased comfort.

The light commercial vehicle is predicted to grow over the projected period owing to the increased adoption of sports utility vehicles, particularly in developing nations. The adoption of light commercial vehicles is noticeable in many emerging markets due to tremendous growth in logistics and supply chain industries. In 2021, the e-commerce sector in the United States reached a Gross Merchant Value (GMV) of USD 870 billion, representing a 14.2% increase over 2020.

By Sunroof Type

By Operation

By Material Type

By Distribution Channels

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025