March 2025

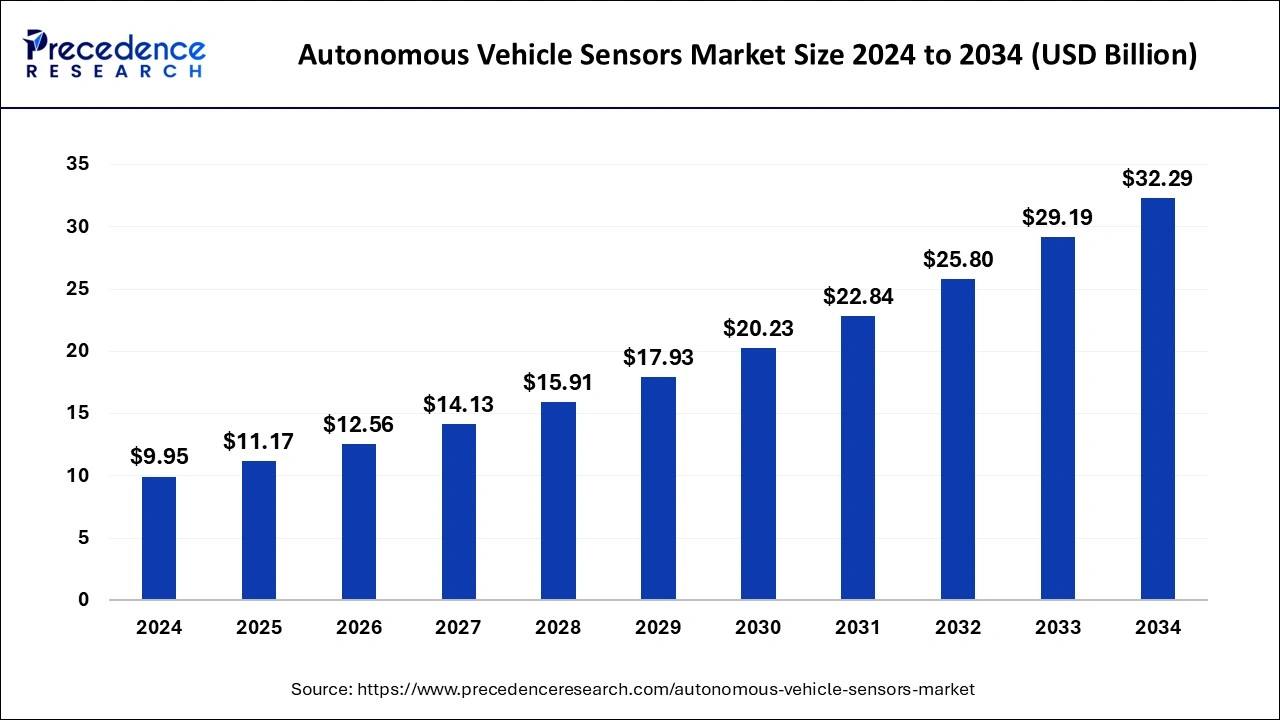

The global autonomous vehicle sensors market market size is calculated at USD 11.17 billion in 2025 and is forecasted to reach around USD 32.29 billion by 2034, accelerating at a CAGR of 12.49% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global autonomous vehicle sensors market size was estimated at USD 9.95 billion in 2024 and is predicted to increase from USD 11.17 billion in 2025 to approximately USD 32.29 billion by 2034, expanding at a CAGR of 12.49% from 2025 to 2034.

The autonomous vehicle sensors market offers services and products for monitoring and controlling a multitude of parameters, such as temperature, agent concentrations, pressure levels, pollution levels, and much more. These sensors are sufficiently sophisticated to take a large range of values, process them accurately, and validate that the right combination or level is present in each aspect. It is nearly difficult to imagine a car nowadays without sensors.

Autonomous sensors are now an essential component of the system due to advancements in recent years. In addition to being used to manage every component required for a seamless automobile performance, it is also utilized to handle headlamp and tail light operations, as well as temperature control within the vehicle.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.49% |

| Market Size in 2025 | USD 11.17 Billion |

| Market Size by 2034 | USD 32.29 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type of Sensor, By Vehicle Type, By Level of Automation, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Utilizing LiDAR sensors for road asset management

A current development in the autonomous vehicle sensors market is the application of measuring instrument sensors for road plus management, which is expected to propel market expansion. The measurement tool may be used in many different ways to maintain transportation infrastructure. One such initiative was the Traffic Speed Road Assessment Condition Survey (TRACS), which was put into place by the UK government. To evaluate the state of the network, the UK Highways Agency regularly monitors highroad pavement surfaces. This suggests that the technology of measuring instruments may be used to measure items that are located distant from the survey vehicle. These benefits of calculating instrument sensors may accelerate the expansion of the worldwide market for autonomous vehicle sensors.

Privacy concerns and lack of standardization

Privacy and data security are issues brought up by the massive volume of data produced by sensors in autonomous vehicles. Two major issues are securing communication between vehicles and infrastructure and protecting sensitive data. Furthermore, the lack of established protocols for sensors in autonomous vehicles might cause problems with interoperability and impede the smooth integration of various vehicles and systems. Thus, the privacy concern and lack of standardization are expected to hamper the global autonomous vehicle sensors market over the forecast period.

Growing partnership

The increasing partnership is expected to offer a lucrative opportunity for the global autonomous vehicle sensors market during the projected period. For instance, in January 2023, technology firm Continental and edge AI semiconductor maker Ambarella, Inc. established a strategic alliance at CES 2023. Together, the two businesses will provide scalable, all-in-one artificial intelligence (AI) hardware and software solutions for aided and automated driving (AD) in the transition to autonomous mobility.

Building on Continental's November announcement, the strategic partnership will include Ambarella's energy-efficient System-on-Chip (SoC) family into Continental's Advanced Driver Assistance Systems (ADAS). Ambarella's "CV3-AD" chip series outperforms competing domain controller SoCs, offering up to five times higher power efficiency while processing sensor data more quickly and thoroughly for improved environmental perception and safer mobility.

Apart from creating camera-based perception solutions for ADAS, Continental and Ambarella are concentrating on building scalable full-stack systems for vehicles ranging from Level 2+ to fully automated. Using a multi-sensor approach, these full-stack systems incorporate Continental's high-resolution cameras, radars, and lidars together with the necessary software and control units.

The LiDAR segment held the dominating share in 2024. LiDAR sensors offer high-resolution, 3D mapping of the environment, providing detailed information about the surroundings. This capability enhances the perception capabilities of autonomous vehicles, helping them navigate complex scenarios.

Moreover, LiDAR is often used as a redundant sensor alongside other technologies like radar and cameras. This redundancy helps ensure the reliability and safety of autonomous vehicles by providing multiple data sources for object detection and avoidance. Furthermore, the increasing product launches in the industry propel the segment growth.

The groundwork for the inventive Innoviz360 design is a novel method for overcoming the spinning LiDAR obstacles that are currently in place. These barriers are costly, have limited performance, and are too big for most applications.

The passenger segment is expected to capture a prominent market share during the forecast period in the autonomous vehicle sensors market due to the increasing consumer demand for advanced features. Consumers are increasingly demanding advanced features that enhance the driving experience and improve safety. This includes features enabled by autonomous vehicle sensors, such as parking assistance, collision avoidance, and semi-autonomous driving capabilities.

Additionally, safety is a primary driver for the integration of autonomous vehicle sensors in passenger cars. Sensors play a crucial role in detecting and responding to the vehicle's surroundings, helping prevent accidents and enhance overall safety. Thereby, driving the segment growth.

The Level 3 segment is expected to capture a substantial share over the forecast period in the autonomous vehicle sensors market. Advanced sensor suites including technologies like cameras, radar, LiDAR, ultrasonic sensors, and more are needed for Level 3 autonomy. These sensors work together to provide a vehicle with the capacity to sense its surroundings and make judgments while driving.

Furthermore, the expanding collaboration between automakers, technology firms, and sensor producers to create and incorporate the essential sensor technologies for Level 3 autonomy. Thus, propelling the segment expansion.

The obstacle detection segment held the largest share of the autonomous vehicle sensors market in 2024. The improvement of vehicle safety is the main reason behind obstacle detecting sensors. Real-time obstacle identification made possible by sensors enables the car to evade situations and prevent crashes. Regulatory agencies also emphasize how crucial obstacle detection is for self-driving cars. Advanced obstacle detection technologies are included in safety requirements and regulations.

Besides, the navigation segment is expected to grow at a significant rate over the forecast period owing to growing urbanization as urban populations grow and cities become more densely populated, the need for precise navigation in complex urban environments increases. Autonomous vehicles require sophisticated sensor systems to navigate safely through urban areas with dynamic traffic scenarios and infrastructure complexities.

In Europe, strict safety laws are anticipated to fuel demand for autonomous vehicle sensors. MEurope is expected to hold a prominent market share during the forecast period.ajor safety features including lane departure warning, automated emergency braking, and drowsiness & attentiveness monitoring in the latest automobiles are required by the strategic plan and have been in place since July 2022.

Several nations, like Germany, France, and the UK, have already permitted the deployment of driverless cars on specific routes. The market in this region will also be driven by OEM backing and the existence of several start-ups exploring autonomous vehicle technologies. To remain competitive, top European automakers provide cutting-edge safety features and powerful engines.

The need for sensors in the area will be fueled by the incorporation of advanced ADAS technologies in the passenger cars of major manufacturers including the Volkswagen Group, Mercedes-Benz, Renault, Hyundai, BMW, Toyota, and Stellantis, as well as by the sales of these cars. In Europe, L2+ versions are also being developed by Tesla, Nissan, Volkswagen, BMW, Mercedes, and Stellantis. Experts predict that throughout the projection period, strict emission laws and zero-emission objectives in Europe will have a significant impact on manufacturers of both passenger cars and commercial vehicles.

As a result, the majority of manufacturers will introduce autonomous vehicle technologies, mostly for electric cars in the area. Autonomous vehicle usage on public roads is already permitted in some nations, including Germany, France, and the UK. Over time, tests have been carried out to determine the practicality of this technology. The need for sensor systems in Europe has increased, which can be related to technical developments in driver assistance features like blind-spot recognition and traffic congestion help.

The adoption of features like DMS, AEB, and LCW in passenger cars is required starting in July 2022, which is anticipated to increase demand for sensors in Europe. Additionally, the EU intends to enact rules that will let automakers sell about 1,500 driverless vehicles annually to each automaker. Before approving their wider usage, the EU is ensuring that these cars are secure for use on its roads. This is expected to drive the autonomous vehicle sensors market over the projected period.

By Type of Sensor

By Vehicle Type

By Level of Automation

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

December 2024

November 2024