September 2024

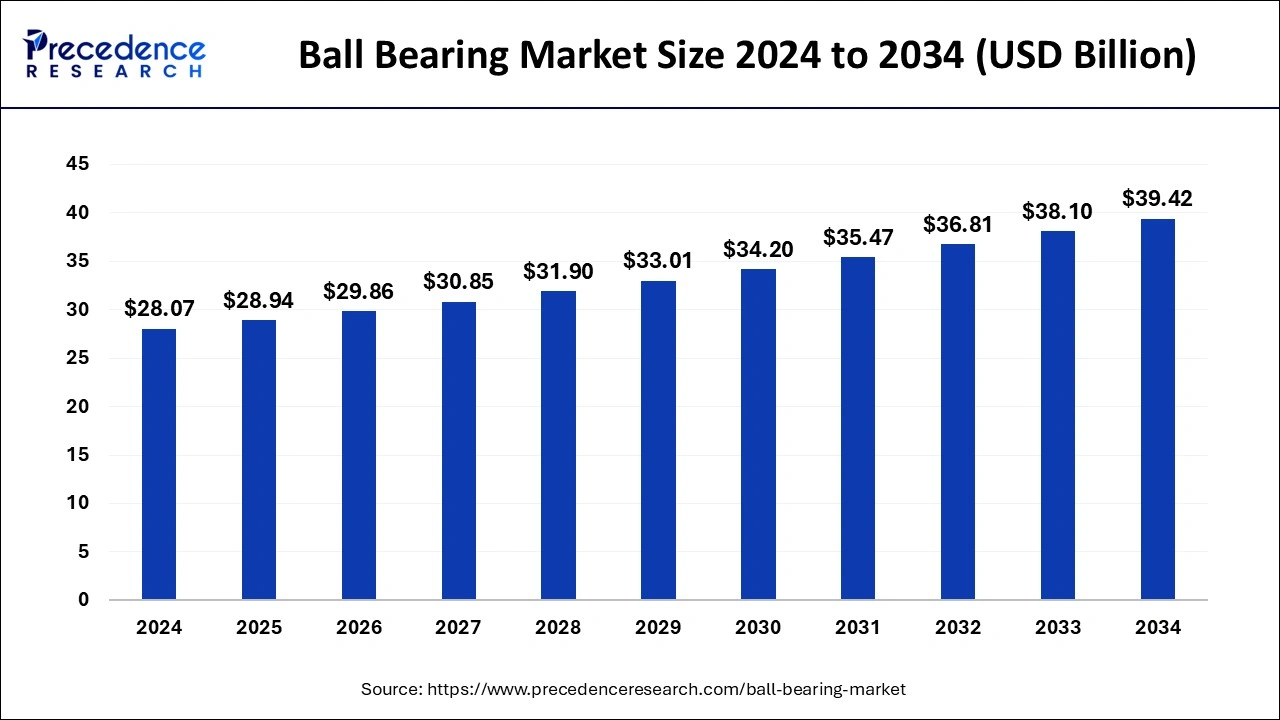

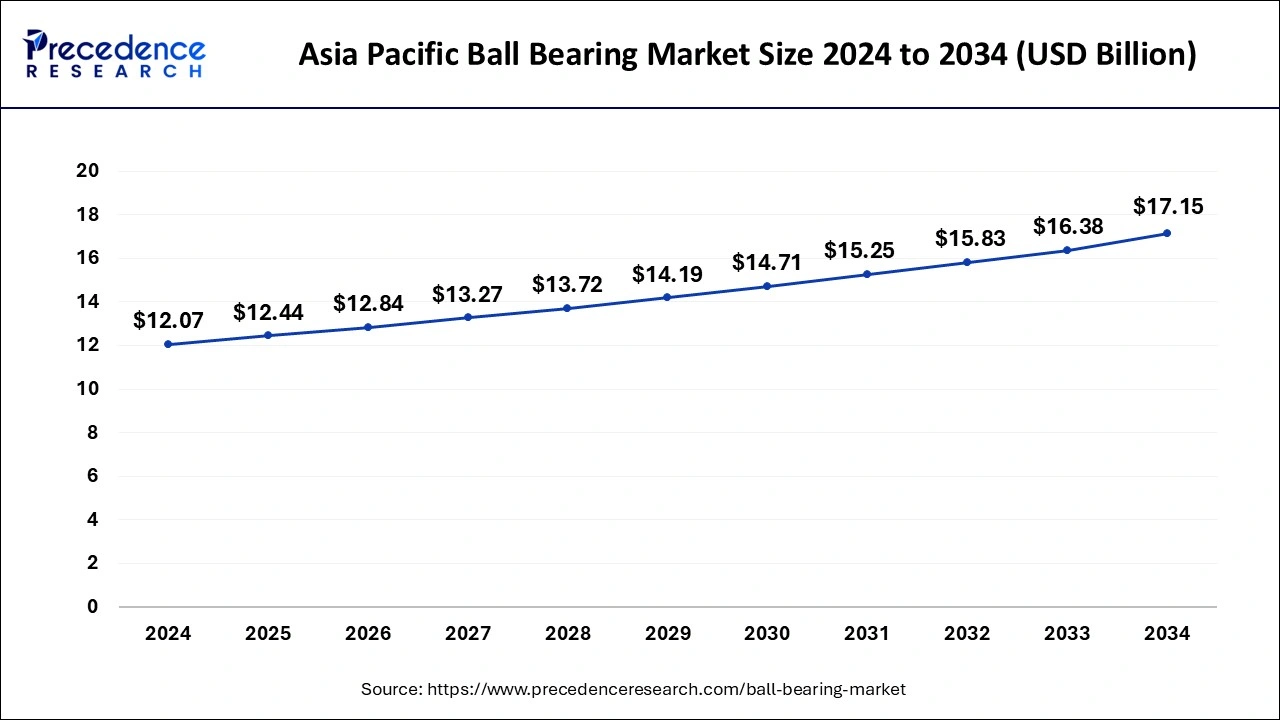

The global ball bearing market size is calculated at USD 28.94 billion in 2025 and is forecasted to reach around USD 39.42 billion by 2034, accelerating at a CAGR of 3.45% from 2025 to 2034. The Asia Pacific ball bearing market size surpassed USD 12.44 billion in 2025 and is expanding at a CAGR of 3.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ball bearing market size reached USD 28.07 billion in 2024 and is expected to be worth around USD 39.42 billion by the end of 2034, expanding at a compound annual growth rate (CAGR) of 3.45% during the forecast period from 2025 to 2034.

The Asia Pacific ball bearing market size reached USD 12.07 billion in 2024 and is anticipated to be worth around USD 17.15 billion by 2034, poised to grow at a CAGR of 3.58% from 2025 to 2034.

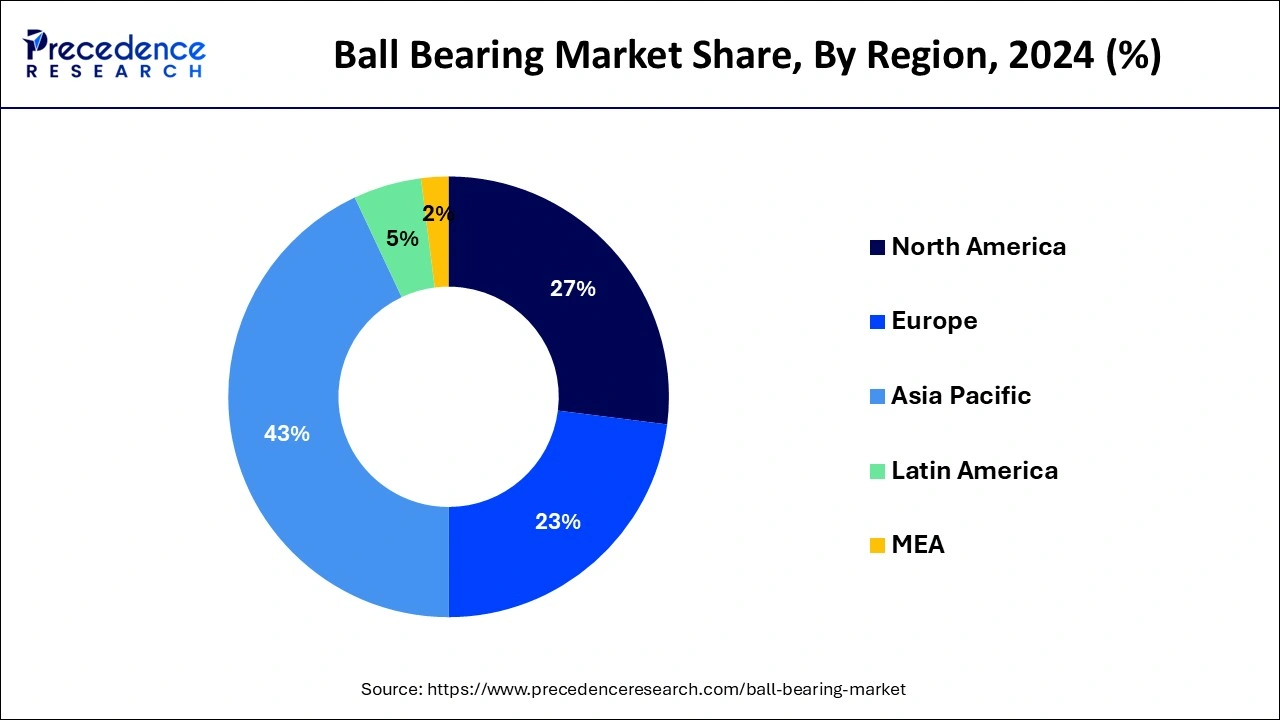

The Asia-Pacific region accounts for more than 43% of the revenue share by 2024. Countries such as China and Japan are driving the growth of the bearing market in Asia-Pacific, where sales numbers are expected to increase in the upcoming years due to robust expansion in automobile and machinery manufacturing, as well as an aftermarket for industrial equipment and auto repair. Sales of automotive bearings are expected to increase in Asia-Pacific countries, mainly in India, China, and Japan in the coming years. The growing demand for vehicles, especially passenger cars and two-wheelers by more than a third of the world's population concentrated in India and China, is supporting the sale of automotive bearings.

The ball bearings market is expected to witness steady growth of automotive bearings in the markets of Europe and North America. Emerging economies such as Brazil and South Africa are expected to record high growth rates during the forecast period. Europe is said to be experiencing favorable growth rates due to sustained economic growth and increased investment. The growth in the sales of electric vehicles, coupled with the growth and development of the automotive and automotive industries, is driving the bearing market growth in the European region.

In addition, demand in mature markets such as Western Europe, the United States, and Japan is expected to be driven by a recovery in motor vehicle production and a strong investment condition. Improved revenue from high-value bearings, including custom large-diameter bearings used in turbines and heavy machinery, is also expected to trigger market growth in North America.

Bearings are basically used in every kind of machine or equipment ranging from agricultural equipment, auto parts, and home machinery to aviation and safeguard equipment. Bearings are used in a number of automotive applications including interiors, wheel hubs, power trains, and engines. Continuously increasing vehicle production, growing demand from emerging countries, and growing demand for technology-enhancing solutions are enterprising the growth of the automotive industry bearings market worldwide. In recent years, there is an increasing demand for bearings with higher performance, less maintenance, and longer life. Ball bearings hold spherical rolling members and are used for smaller loads, while roller bearings have elliptical rolling elements and are used for big loads. Linear bearings are used to move linearly along the shaft and also rotate. Pre-assembled bearings are pre-assembled sets of bearings in racks that are attached to frames and other structures used to support shaft ends and other structures.

The requisition for electric vehicles will be driven mainly by the increase in car sales and the increase in the use of these vehicles. The average passenger car has 35 bearings, which varies considerably depending on the vehicle model and broadly used robotics. The most current technological elevation in dual-clutch automatic transmissions necessitates the induction of three more bearings, two main shafts from the second transmission, and one on the dual-clutch. In addition, the development of high-capacity bearings combined with transcending lubrication performance will drive the growth of the bearing market. Bearings are important in powering several rotating elements and maintaining the load characteristics of various mechanical devices. The elevated demand for a specialized system to meet specific industry needs such as airplane support systems, gas meters, and medical imaging equipment will significantly drive the market growth in the bearing industry.

Various industries are driving the ball bearing market growth interested in designing extremely low tolerance components, fixtures, and machines and stable over time under severe working conditions. Growing demand for ball bearing due to a spike in the usage of custom bearings is expected to drive market revenue growth. The rise of digitization and smart technologies embedded in bearings are driving the excrescence of the market Digitization is one of the key approaches to capture wireless options in the vertical. The bearing is digitized by moving its lubrication state and oscillation pattern. These measurements are dissected to take corrective action in the event of potential problems. The coalition of sensors with bearings has developed into smart bearings. For industrial operation, the sensor expedient the direction, temperature, speed, and vibration of these bearings. In addition, the advent of the Internet of Things (IoT) and Real-time Artificial Intelligence (AI) benefits end-users easily monitoring the form of their bearings at any time. In addition, the technological shift towards electric vehicles (EVs) is proving to be positive. Because ball-bearing electric vehicles are more technologically advanced than conventional vehicles using an internal combustion engine (IC).

| Report Coverage | Details |

| Market Size in 2025 | USD 28.94 Billion |

| Market Size by 2034 | USD 39.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.45% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Usage of advanced materials in manufacturing bearings - The market for precision mechanical bearings is growing in a variety of industries, where chromium steel is widely used in the bearing-making process. These chromium steel bearings improve the bearing's physical characteristics in terms of wear resistance, fatigue life hardness, stiffness, and other properties compared to traditional bearings. In addition, to meet industry-specific requirements for applications in harsh environments, bearing manufacturers are required to use tungsten carbide.

Rising demand for precision engineering - Various industries are driving the Ball bearing market growth interested in designing very low tolerance components, fixtures, and machines and stable over time under severe working conditions. Growing demand for ball bearing due to a spike in the usage of custom bearings will drive market revenue growth.

Development of precision bearings for power trains - The chromium steel bearings improve the bearing's physical properties in terms of hardness, wear resistance, stiffness, fatigue life, and other properties compared to traditional bearings. In addition, to meet industry-specific requirements for applications in harsh environments, bearing manufacturers are required to use tungsten carbide and ceramic materials.

The automotive segment dominates the bearing market in 2024 and accounts for 53% of the revenue share. The demand for motor vehicles with advanced technological solutions is increasing, necessitating the rise of the vehicle manufacturing industry. The increasing demand for modern automobiles coupled with the vehicle's ability to innovate has elevated the demand for bearings in the automotive sector. The rail and aerospace segment is the fastest-growing bearing market segment in 2020.

This is attributed to the growing interest in business travel, and the need to replace aging fleets of trains. The growth of the floating market is proportional to the growth of the industrial and automotive sectors. Increasing the production of corporate vehicles is one of the pressing drivers of the bearing market. In addition, the growing construction activities globally are also driving the growth of the global bearing market.

By Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

January 2024