January 2025

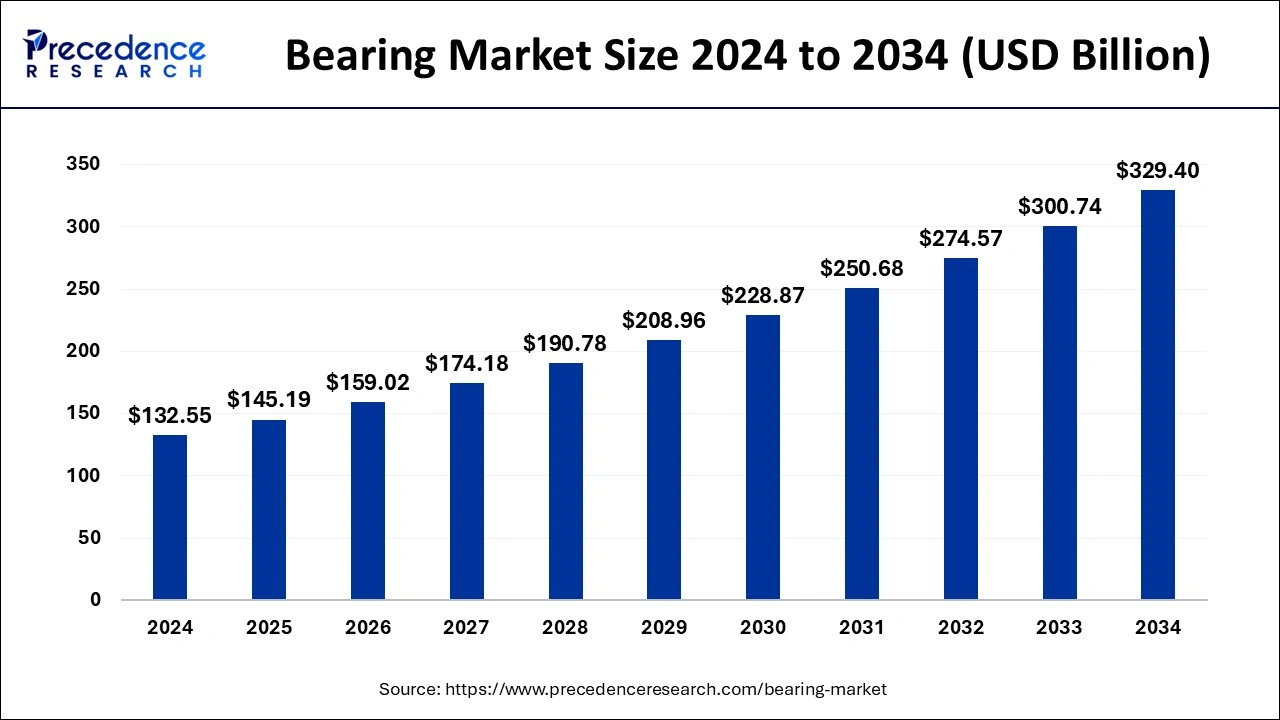

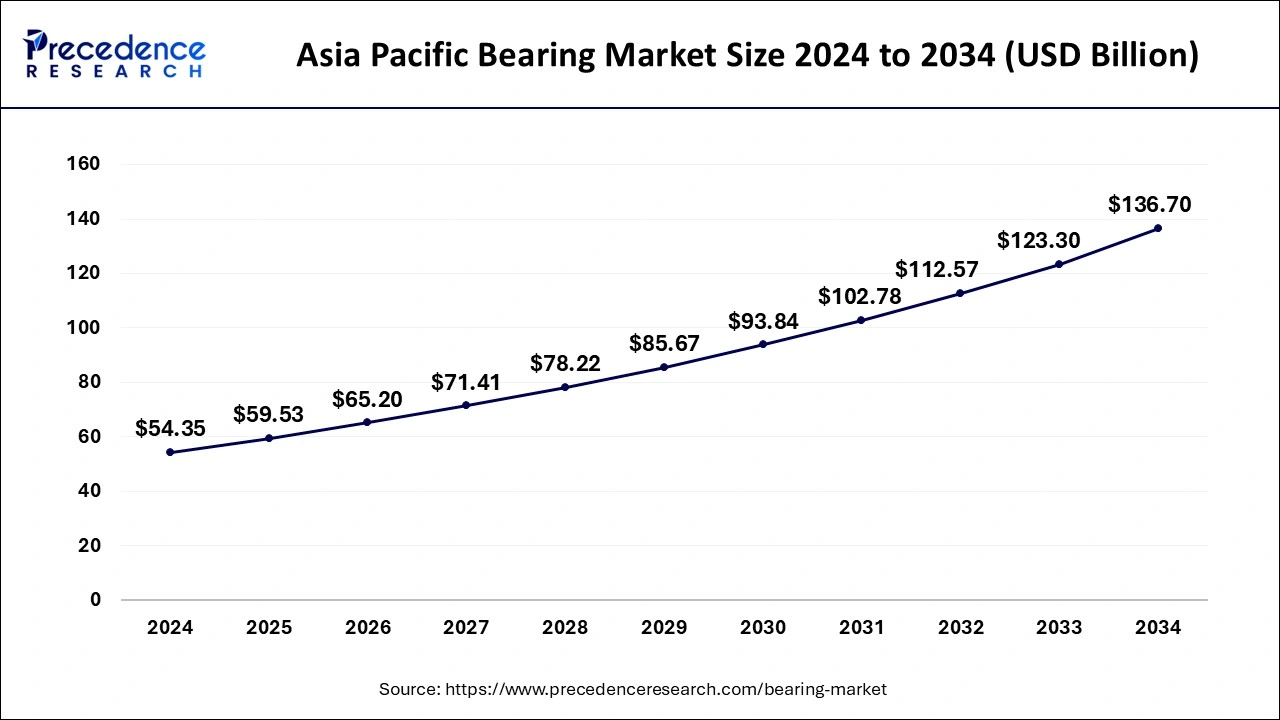

The global bearing market size was estimated at USD 145.19 billion in 2025 and is anticipated to reach around USD 329.40 billion by 2034, expanding at a CAGR of 9.53% from 2025 to 2034. The Asia Pacific bearing market size surpassed USD 59.53 billion in 2025 and is expanding at a CAGR of 9.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global bearing market size accounted for USD 132.55 billion in 2024 and is predicted to reach around USD 329.40 billion by 2034, expanding at a CAGR of 9.53% from 2025 to 2034.

The Asia Pacific bearing market size was evaluated at USD 54.35 billion in 2024 and is predicted to be worth around USD 136.70 billion by 2034, rising at a CAGR of 9.66% from 2025 to 2034.

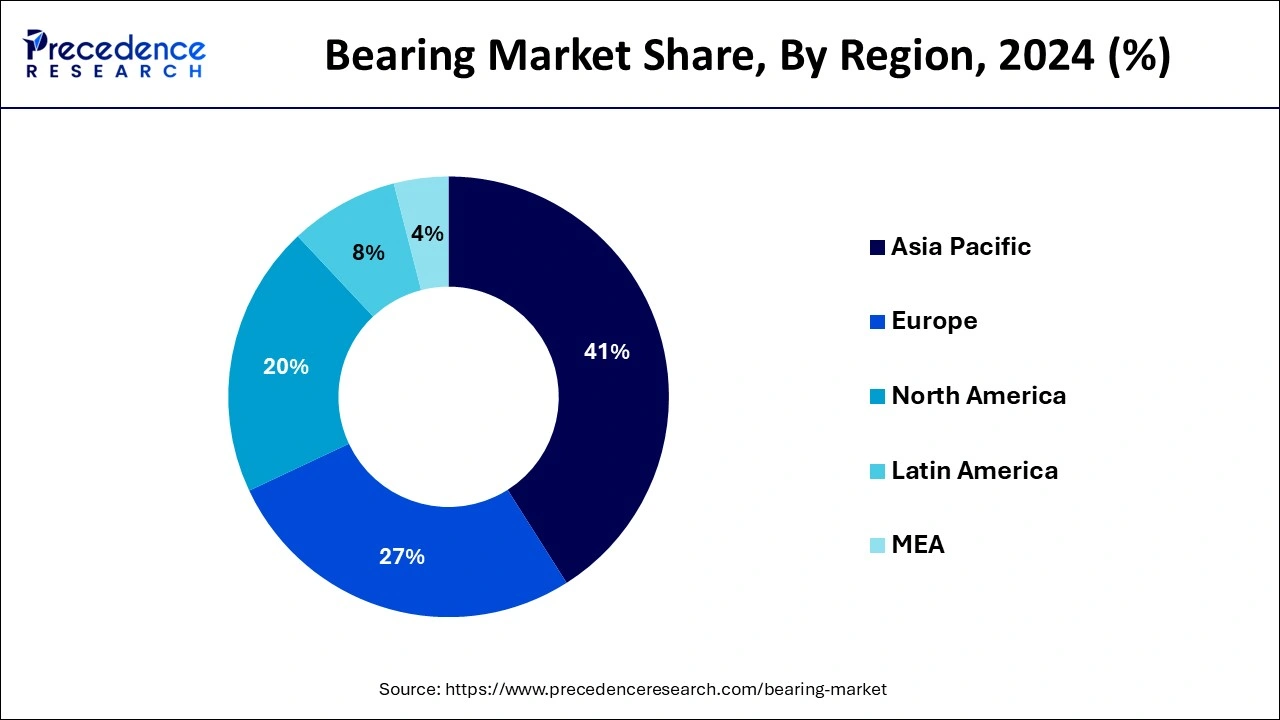

Asia-Pacific dominated the global market with the largest market share of 41% in 2024. The countries such as China and Japan are driving the bearings market growth in Asia-Pacific, where sales are predicted to surge in the next few years due to rapid expansion of machinery and automobile manufacturing, as well as a robust aftermarket for industrial equipment and automobile repair.

Sale of automotive bearings is projected to surge in the nations of Asia Pacific, primarily in India, China and Japan during coming years. Growing demand for vehicles specifically passenger cars and two-wheelers by more than 1/3rd of the world population concentrated in India and China supports the sale of automotive bearings in these nations. Bearing market is projected to experience steady growth for automotive bearings by matured markets of North America and Europe. Emerging countries such as South Africa and Brazil are anticipated to record high growth rate during forecast period.

Europe is estimated to observe favorable growth on account of supportable economic growth and augmented investment. The growing sales and production of electric and hybrid vehicles, along with the growth and development of automotive and automobile industries is driving of the growth of the bearing market in Europe region.

In North America, long-term market growth is anticipated as a result of the region's increased car production. It is expected that the need for bearings would rise across the United States as SUV and hatchback sales rise. An average of 60 bearings are installed in a hatchback, with more bearings installed in sedans and SUVs. Additionally, bearings significantly increase the weight of the vehicle; thus, OEMs are constantly aiming to create lighter components. Additionally, demand of bearings in mature markets of Western Europe, the U.S., and Japan, is predicted to fuel by recovering productions of motor vehicles and a strong fixed investment atmosphere. Improved sales of high value bearings including large-diameter, tailored built bearings employed in wind turbines and heavy machinery are also anticipated to trigger the growth of the market in North America.

The region has a significant demand for lightweight automobiles due to the implementation of the strict Environmental Protection Agency (EPA) rules and Corporate Average Fuel Economy (CAFE) standards. The North American automotive industry uses materials, including carbon fibre, plastic, and FRP composites, to reduce vehicle weight. All vehicle sales in the United States increased by 4%; this growth in sales across the nation is likely to present an opportunity for the automotive bearing market. The steel industry is also creating various alloys for processing combinations, steel with high tensile strength and flexibility, for bearings used in the automotive sector, showing the increased demand for improved and lighter bearings.

Bearings are basically employed in each type of machinery or equipment, ranging from farm equipment, automobile parts, and household machines to aerospace and defense equipment. Bearings find use in several applications in automotive sector including interior, wheel hub, transmission system and engine. Continuously rising vehicles production, augmented demand from the emerging nations and growing need for technologically enhanced solutions are driving the growth of bearing market in automotive industry across the world. Since, last few years, there has been escalating demand for bearings having greater efficiency, lesser maintenance, and extended service life.

The ball bearings contain spherical rolling elements and are used for lesser loads, whereas roller bearings have cylindrical rolling components and are used for larger loads. The linear bearings are used to travel linearly along shafts and may also be able to rotate. The mounted bearings are bearing assemblies that are pre-assembled in mountings that are fastened to frames and other structures, and are used to support the ends of shafts and other structures.

Aside from the ball and roller bearings in linear, radial, and mounted forms, bearings include slide bearings for civil engineering purposes, jewel bearings for small instruments, and very specialized bearings known as frictionless bearings, which include magnetic and air variations.

Bearings are a sort of machine element that help to reduce friction between moving parts by supporting relative motion. The automobiles, mining machinery, wind turbines, agricultural equipment, and machine tools all need bearings. It is used in automobiles to ensure that electric vehicles and other type of automobiles to run smoothly. Due to increased use of bearing materials in various end use sectors, electric vehicles and rolling mills, the global bearings market is growing at a rapid pace. The technological advancements have increased the overall efficiency and shelf life of bearing products in the automotive industry.

The demand for electric vehicles will be primarily driven by an increase in automobile sales and increased adoption of these vehicles. On average, a passenger automobile has 35 bearings, which vary substantially depending on the model of the vehicle and the widely used technology. The most recent technological advancements in automatic dual-clutch transmissions necessitates the installation of three additional bearings, two main shafts of the second gearbox and one on the dual-clutch. Furthermore, the development of high-capacity bearings in combination with better lubrication performance will boost the growth of the bearings market.

The bearings are important for delivering energy to a few spinning elements and sustaining load-bearing features of various mechanical devices. The increased demand for specialized solutions to satisfy industry specific needs such as aircraft support systems, gas meters, and medical imaging equipment will boost the growth of the bearings market significantly during the forecast period.

The factors such as increased bearing usage in railways and rolling mills followed by increased bearing usage in motor, desire for automotive electrification, and demand for bearing in continuously variable transmission have boosted the global bearings market’s demand. On the other hand, the global bearings market’s growth is hampered by bearing damage caused by electric automobiles, fluctuating raw material prices, increasing vehicle electrification, and expensive maintenance costs.

Furthermore, the rising concern about green vehicles and constant development in the automotive and automobile industry, as well as the emergence of sensor bearing units and the advancement and improvement of additive manufacturing technologies and materials to manufacture bearings, are factors that provide lucrative opportunities for the growth of the global bearings market over the projection period.

| Report Coverage | Details |

| Market Size by 2034 | USD 329.40 Billion |

| Market Size in 2025 | USD 145.19 Billion |

| Market Size in 2024 | USD 132.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.53% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Material, Distribution Channels, Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The Rising Demand for Bearings in the Food and Medical Industry:

Growing incomes and populations over time have led to a sharp spike in demand for food and beverages. To satisfy this demand, investments in food processing and packaging equipment that can boost output, cut costs, and eliminate waste while upholding all sanitary and FDA regulations are required. Choosing suitable bearings is essential for achieving these goals. Ball bearings are utilized in a wide range of industrial machinery, but they are crucial to the machinery and systems used in the food and beverage industry. They are frequently manufactured of food-grade stainless steel to guarantee their safety for usage in circumstances where contact with consumable foods is foreseen.

Additionally, numerous tools used in the medical sector require bearings to provide reliable power transmission and smooth operation. Miniature bearings are necessary for the rotating assembly of a number of electrical hand tools and devices used in the medical field. In addition, the bearing must meet a variety of requirements in order to be approved for proper usage and functionality. These include minimal noise, low friction, low maintenance, high speed, great dependability, resilience to chemicals and severe conditions, and long service life. Thus, these factors are anticipated to boost the market growth for bearings.

Lack of Bearing Clearance:

Only a small percentage of all used bearings experience failure, and the majority of them last longer than the equipment they installed. To ensure safety, as a preventative measure, several bearings are changed before it falls. A total of 0.05% of the bearings need to be replaced due to being damaged or defective. Accordingly, because of damage and failure, 50 000 000 bearings are changed each year. For instance, contamination and insufficient lubrication, rather than fatigue, are significant causes of bearing failure in the pulp and paper sector. Each of these occurrences leaves a distinct harm mark.

Consequently, it is typically possible to identify the underlying cause of damage by carefully inspecting a damaged bearing. Secondary damage to the machine and its parts may occur if a defective bearing is not identified and changed before it breaks catastrophically. Determining the primary cause of a severe bearing failure can be challenging, if not impossible.

Increasing the Use of Bearings for the Wind Turbine:

Renewable energy sources in the energy sector most directly benefit from the inventive and dynamic bearings industry. From tapered roller bearings to the more traditional ball bearings utilized in the turbine generators. For the propellers, shaft, and generating module of a wind turbine, bearings are necessary. As a result, bearings must be customized for each application. They must make movement frictionless, lessen thermal expansion, reduce heat energy loss, and boost the turbine's overall effectiveness. However, the ball bearing is constantly being reviewed and improved, which has revolutionized renewable energy sources. For forthcoming turbines, new developments with asymmetric spherical roller bearings can assist in increasing the effectiveness of power transmission between the engine and propeller.

Different product segment in global bearing market includes roller bearing, ball bearing, and plain bearing among others.

It is anticipated that the ball-bearing component would operate effectively for the anticipated time. Because they can support both radial and thrust loads but can only support a minimal amount of weight, ball bearings are quite popular. Another major strategy for implementing wireless choices across industrial verticals is digitalization. It is digitalized by assessing the ball bearing's lubrication level and vibration pattern. To take corrective action in the event of possible issues, these metrics are examined.

Innovative bearings are the result of the integration of sensors with bearings. The sensor measures these bearings' direction, temperature, speed, and vibration for industrial applications. Additionally, the development of the Internet of Things (IoT) with real-time capabilities and artificial intelligence (AI) enables end customers to easily monitor the state of their bearings at all times. Additionally, it is discovered that the technical change towards electrified automobiles is advantageous, and this is because internal combustion engine cars are less technologically advanced than electric vehicles.

Deep groove ball bearing adoption is anticipated to be fueled by the self-aligning ball bearing's high operational speed and efficiency in managing radial and axial loads. Furthermore, the angular contact ball bearing supports increased processing speed, accuracy, and rigidity.

In 2023, the roller bearings segment garnered the revenue share of over 45%. The roller bearings are more efficient than their alternatives in reducing rotational friction, supporting axial and radial loads, and sustaining restricted axial loads and strong radial loads.

The ball bearings segment is predicted to develop at the quickest rate in the future years. The ball bearings feature a lower surface contact area, which helps to minimize friction significantly. They can also be employed with axial and radial loadings, which is why these products are rapidly being used in four wheelers and two wheelers’ automobiles.

Among all segments demand for ball bearing is predicted to grow at substantial rate during forecast period due to rising use of ball bearings by light vehicle manufacturers. Global light vehicle production is projected to increase in the coming years, as a result of its feature of consuming less fuel. Ball bearings are presented at a lessercost and compact nature of this product segment further support their demand among various end-use sectors.

Global bearing market report analyses different material segments including ceramic, plastic, and metal. The 52100 chrome steel is frequently utilized material to manufacture the load carrying components in tapered roller bearings, roller bearings and precision bearings. It also finds application in outer rings, inner, rollers and balls.

Different kinds of bearings employed in automobiles are truck hub units, car hub unit bearings, belt tensioner units, propeller shaft centering bearings, clutch release bearings, water pump spindles, propeller shaft support bearings, free wheel clutches and suspension bearings.

Global bearing market is segmented on the basis of distribution channel into online and offline channels. North America has emerged as major bearing markets due to escalating online sales at a greater rate. Bulk online sellers are third party e-Commerce firms those offers discounts on bearings. Intensifying number of e-Commerce participants plus speedy product delivery feature is further supporting sales over the online channel.

Global bearing market has been bifurcated on the basis several applications into construction, aerospace, automotive, power transmission, agriculture, oil & gas among others.

More rotating components are found in less machinery than in a typical car. Ball bearings are used in various parts, including the engine, driveshaft, driveline, wheels, and steering column. By reducing the demands placed on the brakes while the vehicle is in motion, these bearings contribute to improved vehicle performance and increased efficiency. Additionally, bearings let a vehicle compensate when traveling over unlevel ground and reduce shocks and vibrations from abrupt braking. Ball bearings come in various varieties, including thrust ball bearings, deep groove ball bearings, and tapered roller bearings used in automobiles.

Furthermore, base isolation, an earthquake-resistant building technique, uses bearings in the construction business. With this method, oversized, frictionless bearings are installed in the base of a building. For instance, the ball bearings can separate the structure from the base, ensuring maximum construction stability. The foundation and bearings move during seismic ground motion, while the superstructure experiences little to no motion. Because the structure moves less, there is less need for seismic design, which improves safety and makes structural designs more practical.

The automotive segment dominated the bearings market in 2022 and garnered revenue share 50%. The demand for automobiles with technologically advanced solutions is growing, necessitating an increase in vehicle manufacturing. The rise in demand for modern automobiles, as well as the improvements in vehicle capabilities, has increased the demand for bearing in the automotive sector.

The railway and aerospace segment is fastest growing segment of the bearings market in 2023. This is attributed to rising interest in travel activities, the increasing need to replace aged fleets due to severe environmental regulatory framework, and rising fuel prices along with enhanced ways to aid transportation systems.

Bearing market growth is directly proportional to the development of industrial and automotive sector. Augmented commercial vehicles production is one of the imperative driving factors of the bearing market. Further, growing construction activities across globe also boosts the growth of the bearing market globally.

The mergers and acquisitions, partnerships, new product development, business expansions, collaborations, supply contracts, agreements, and contracts are some of the important marketing strategies used by the major market players to maintain their market position. The major market players are diversifying their product line by creating industry specific products and solutions.

Several market players are focusing on digital operations and connectivity in order to improve consumer interaction and automate processes throughout the value chain. With digital production equipment and automation, which contribute to automated and flexible production processes, digital processing enables for product creation and increases labor productivity.

Growing sale of high-performance bearings has forced companies to integrate cutting-edge sensor units in their product offerings. These sensor units aid in digital monitoring of deceleration, axial movement, acceleration, load carrying capacity and rotation spee of the product. Moreover, the initiation of Industrial Internet of Things (IIoT) has further fortified acceptance and continuous monitoring of connected machinery and equipment. This current trend has also affirmatively triggered the growth of bearing market. Extreme competition has led companies to capitalize in product improvements to meet customer requests. For instance, NTN Corporation has manufactured a Grease Lubrication Type High-Speed Deep Groove Ball Bearing that shows better rotational speed.

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2025 to 2034. This report includes market segmentation and its revenue estimation by classifying it on the basis of product, material, application, type, component, distribution channel, and regionas follows:

Market Segmentation

By Product Type

By Type

By Material

By Distribution Channel

By Size

By Application

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025