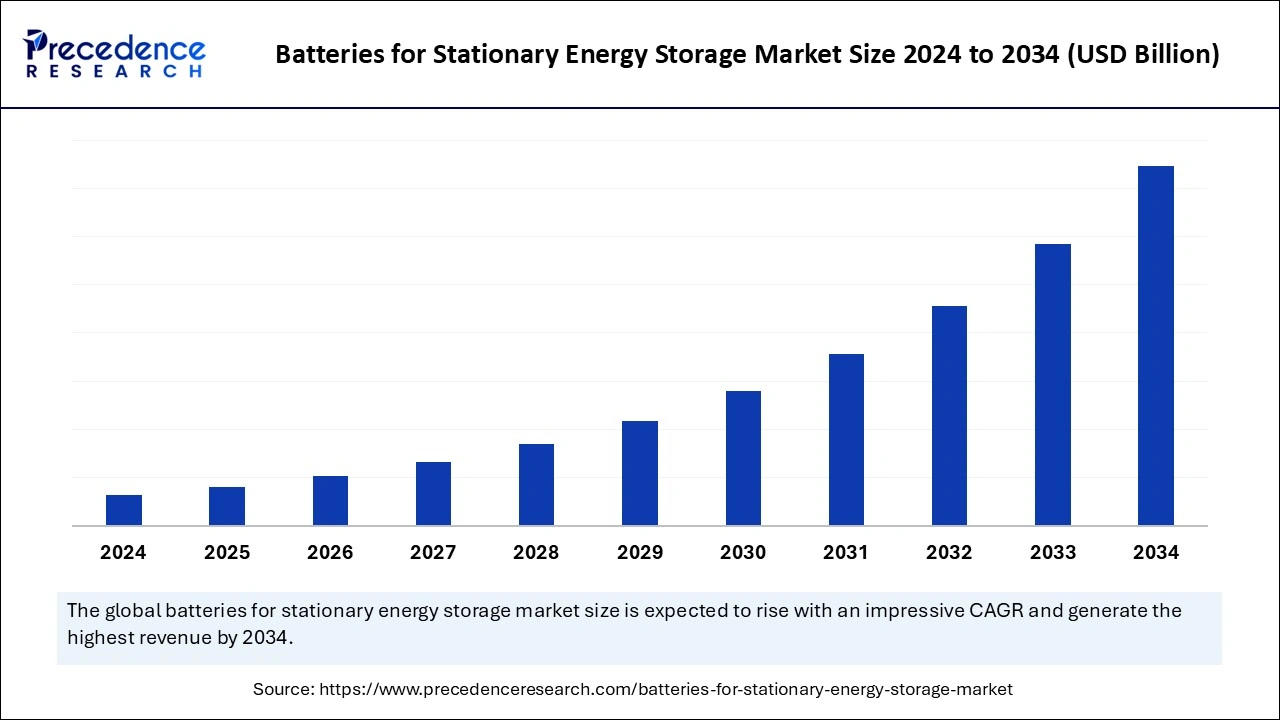

Batteries for Stationary Energy Storage Market Size and Forecast 2025 to 2034

The global batteries for stationary energy storage market is experiencing strong growth, driven by eco-friendly innovations, increasing demands, and industry-wide sustainability efforts. The increasing demand for efficient energy storage systems for excessive power generation drives the growth of the market.

Key Takeaways

- North America dominated the global batteries for stationary energy storage market in 2024.

- Asia Pacific expects significant growth in the market during the forecast period.

Market Overview

Stationary energy storage is one of the important technologies for the future energy infrastructure. These are the efficient technologies that are used in storing excessive power storage and can be used when it is needed. The batteries for stationary energy storage systems are used in renewable resources and can be used to save the consumer money, increasing resilience, reliability, power generation, and minimizing environmental impacts. The increasing demand for power storage in wide applications drives the growth of the batteries for stationary energy storage market.

How Can Artificial Intelligence (AI) Impact the Batteries for Stationary Energy Storage Market?

The integration of Artificial Intelligence into the energy storage system offers several advancements in the power storage and generation infrastructure. AI enables smart energy usage and a reduction in the cost of operations. AI offers different advancements in the energy storage system and makes it smarter by integrating different applications like energy demand management, arbitrage, weather forecasts, and predictive maintenance.

- In January 2025, SolarEdge, an Israel-based firm, launched the smart energy manager, the latest controller product in Europe, focusing on target energy management systems (EMS) segment opportunities.

Batteries for Stationary Energy Storage Market Growth Factors

- Rising demand for power: The increasing population and industrial development across the world are driving the demand for energy generation and power supply, boosting the demand for batteries for stationary energy storage.

- Technological advancements: The technological advancements in the power generation and supply system for increasing the duration of energy storage, achieving sustainability, and battery capacity are accelerating the growth of the market.

- Government initiatives: The rising government into power generation and initiative policies in the renewable source deployment, such as providing subsidies in the installation of solar power plants into the residential and commercial solar units, accelerating the growth of the batteries for stationary energy storage market.

Market Trends

| Region |

Trend |

| Global |

- The global renewable electricity generation is expected to increase by over 17,000 terawatt-hours (TWh) by the end of this forecast period, with an increase of almost 90% from 2023. The expected value will meet the integrated power demand of China and the United States.

- The global renewable capacity is anticipated to expand by 2.7 times by 2030.

|

| The U.S. |

- The United States and the European Union are both expected to double the renewable capacity growth in 2024 and 2030, while India is forecasted to have the fastest growth in renewable capacity expansion among the large economies.

- The Inflation Reduction Act’s tax credits contributed to the expansion of renewable capacity growth in the United States, while the corporate power purchase and competitive auction agreements increased the growth in the United States.

|

| China |

- China added 23 gigawatts in its energy storage capacity in 2023, which is a 221% increase from 2022. The country installed new energy storage systems, which amounted to over 31 gigawatts in 2023, and the installation of new energy capacity systems is expected to reach 36 gigawatts by 2024.

|

| India |

- India has set a target to achieve the installed capacity of non-fossil fuel-based energy resources by 2030 and plans to reduce the emission intensity of GDP by 45% by 2030.

- According to the National Electricity Plan (NEP) 2023 of the Central Electricity Authority (CEA), the requirement of the energy storage capacity is expected to be 82.37 GWh (47.65 GWh from PSP and 34.72 GWh from BESS) in the year 2026-27. The demand is further expected to increase to 411.4 GWh (175.18 GWh from PSP and 236.22 GWh from BESS) in the year 2031-32.

- According to the IESA, the India Energy Storage Market was USD 2.1 billion in 2019 and expected a CAGR of 8% by 2027.

- The Renewable integration into the grid is expected to increase at the CAGR of 32% by 2027 due to the rising focus on the solar-wind hybrid tenders by Solar Energy Corporation of India (SECI) and other government agencies setting a high renewable target of 450 GW by 2030.

|

Market Scope

| Report Coverage |

Details |

| Dominating Region |

North America |

| Fastest Growing Region |

Asia Pacific |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Regions. |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing consumption of renewable energy sources

The rising awareness regarding global warming due to the increased use of non-renewable energy sources and their production causes intense levels of carbon emission in the environment, which may cause severe adverse effects on the environment and living bodies. The rising development and awareness in the population regarding renewable sources of energy as an efficient and environmentally friendly alternative to non-renewable energy sources boosts the demand for efficient batteries for energy storage. The battery energy storage system can effectively store the energy and release it in the form of electricity when it is required.

The batteries for stationary energy storage play a significant role in storing renewable sources of energy for several applications. The batteries enable the smooth transfer of renewable energy from solar and wind power technologies. Battery storage can help store excess renewable electricity, which can be used further with the increase of grid congestion. The rising government and private sector policies and investment in the expansion of renewable energy consumption are contributing to the growth of the batteries for stationary energy storage market.

- The renewable energy sector holds a 30% share in the electric sector and is expected to expand to 46% in 2030, with solar and wind energy being the largest contributors to this growth.

Restraint

Cost of batteries

The high cost of stationary energy storage batteries and some of the technical issues, like the short duration of energy storage, limit the growth of the batteries for stationary energy storage market.

Opportunity

Evaluation of the electric vehicles

The rising advancements in the automotive industry and the evaluation of electric vehicles drive the demand for advanced battery technology and different electric components that need an efficient energy storage system, which drives the demand for batteries for stationary energy storage systems. Stationary energy storage is also known as second life to the electric vehicle battery. There are diverse types of batteries that are used in electric vehicles for stationary energy storage, including Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Lead-Acid Batteries, and Ultracapacitors.

- The rise in electric vehicle demand is contributing to the increased demand for batteries (terawatt-hours) in the upcoming period. As per the statistics by Hyundai, 29 GWh of second-life EV batteries will be available in 2025.

Regional Insights

North America dominated the global batteries for stationary energy storage market in 2024. The growth of the market is attributed to the rising awareness about renewable sources of energy and the robust initiative by the government for the development of the renewable energy source infrastructure to accelerate the demand for efficient batteries for stationary energy storage in wind energy and power energy technologies.

The rising concern is that in terms of carbon footprint, excessive pollution caused by non-renewable energy development drives the consumption of renewable energy sources as their major alternative. The rising presence of the major automotive firms focusing on sustainability and electric vehicle development collectively boosts the growth of the battery for stationary energy storage market across the region.

- The United States has seen continuous growth in battery storage capacity from 2021, and there will be an 89% increase in 2024. Currently, its active utility-scale battery capacity is around 16GW in 2023, and the developers plan to add 15 GW in 2024 and around 9 GW in 2025.

- The developers of the United States are planning to bring more than 300 utility-scale battery storage projects in the United States by 2025, of which 50% are planned to be installed in Texas.

- The United States expands its battery storage to its electric capacity of 7 gigawatts, an increase of 2.5 gigawatts in 2023 compared to 2022. The developers are planning to expand their capacity by 14.3 gigawatts by 2024.

Asia Pacific expects significant growth in the market during the forecast period. The growth of the market is attributed to the rising technological advancements in the regional countries. The evaluation of the renewable energy supply and the demand for the related technologies contributed to the demand for batteries for energy storage. The continuously growing population and the industrial infrastructure drive the demand for electricity and boost the demand for an efficient storage system for seamless energy supply that contributes to the growth of the batteries for stationary energy storage market in the region.

- China accounted for over 40% of global renewable capacity expansion between 2019 and 2024; the expansion of the industry is driven by lower curtailment rates, improved system integration, and rising competition between solar PV and onshore wind.

Batteries for Stationary Energy Storage Market Companies

- Samsung SDI

- Fluence Energy

- Saft

- Panasonic

- VARTA

- Eos Energy Enterprises

- Sharp Corporation

Latest Announcement by Industry Leaders

- In September 2024, SAMSUNG SDI announced the company's participation in Renewable Energy Plus 2024, North America’s largest renewable energy exhibition for the introduction of the latest battery solutions for energy storage systems (ESS).

- In December 2024, Fluence Energy, Inc., a leading player in delivering intelligent energy storage, asset optimization software, and operational services, announced closing the priorly announced offering of USD 400 million aggregate principal amount of 2.25% convertible senior notes due 2030.

Recent Developments

- In January 2024, JSW MG Motor India introduced Project Revive’s fourth pilot project for sustainable EV battery usage and recycling. The project is to develop transformative initiatives for the recycling, reuse, and repurposing of electric vehicle (EV) batteries and work as the major solution for the EV industry's waste management.

- In October 2024, GM Energy subsidiary General Motors Co. launched the “GM Energy PowerBank” stationary energy storage unit designed for residential charging products. The product allows the EV consumer to transfer and store energy from the grid.

- In April 2024, TotalEnergies launched the new battery storage project in Belgium, which will be operational in 2025. The project will have a rating of 25MW and a capacity of 75MWh.

- In October 2024, Vision Mechatronics collaborated with JSW MG Motors India to launch India’s first high-voltage second-life battery. The battery was initially deployed in a Pune-based facility.

Segments Covered in the Report

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa