January 2025

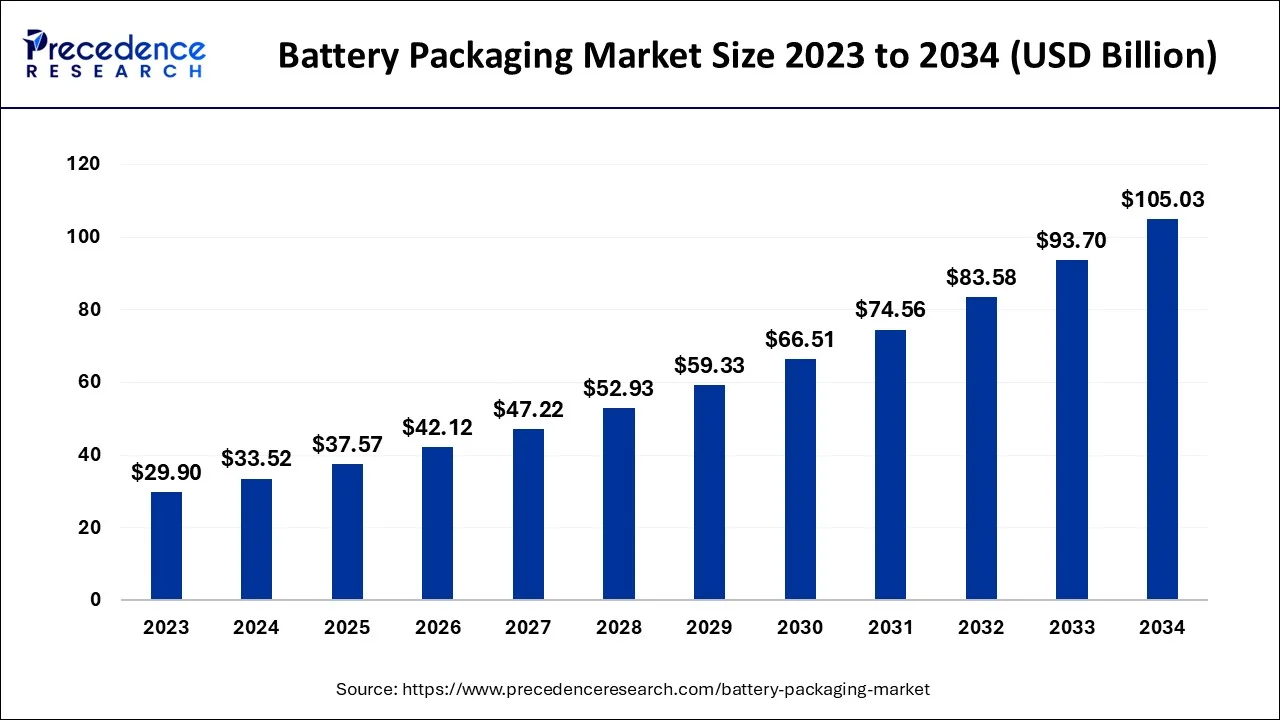

The global battery packaging market size is estimated at USD 33.52 billion in 2024, grew to USD 37.57 billion in 2025 and is predicted to surpass around USD 105.03 billion by 2034, expanding at a CAGR of 12.10% between 2024 and 2034.

The global battery packaging market size accounted for USD 33.52 billion in 2024 and is anticipated to reach around USD 105.03 billion by 2034, expanding at a CAGR of 12.10% between 2024 and 2034. The rising demand for renewable energy solutions is driving the growth of the battery packaging market. Additionally, the growing adoption of electric vehicles and increasing emphasis on sustainable and eco-friendly packaging solutions are expected to boost market growth during the forecast period.

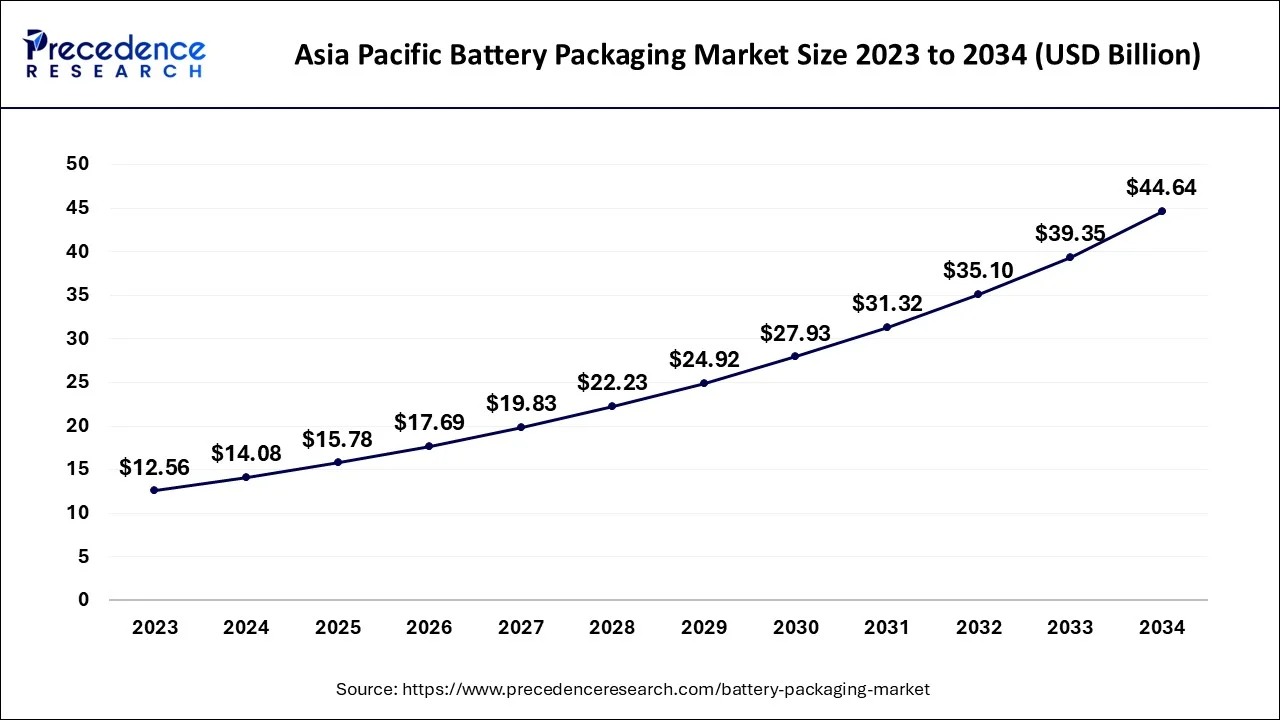

The Asia Pacific battery packaging market size is estimated at USD 14.08 billion in 2024 and is predicted to be worth around USD 44.64 billion by 2034, growing at a CAGR of 12.23% from 2024 to 2034.

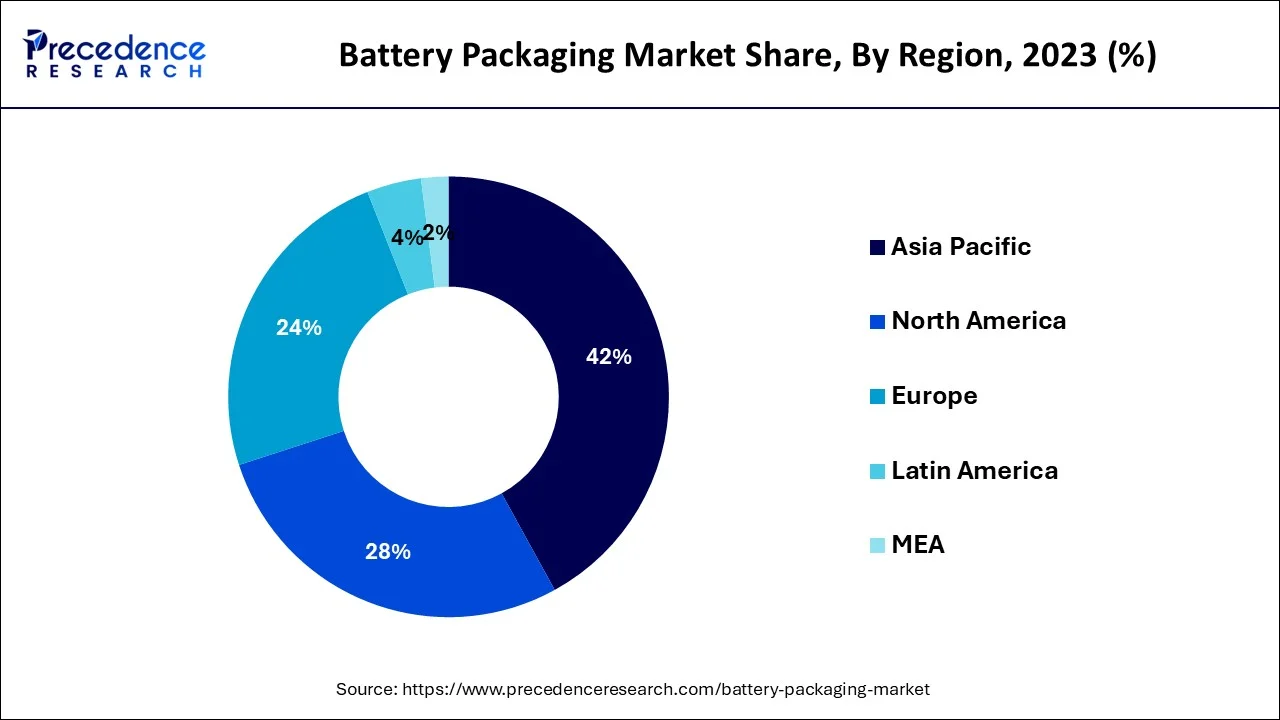

The Asia Pacific is expected to capture the largest market share over the forecast period. The growth in the region is owing to the growing automobile industry. By both annual sales and manufacturing output, China continues to be the world's largest market for automobiles. By 2025, domestic production is anticipated to reach 35 million automobiles. According to information from the Ministry of Industry and Information Technology, approximately 26 million vehicles, including 21.48 million passenger cars, were sold in 2021, an increase of 7.1% from the previous year. Sales of commercial vehicles totaled 4.79 million, a 6.6% decrease from 2020. China is the third-largest exporter of cars in the world, according to the China Passenger Car Association, with more than 2.5 million units exported in 2022. Furthermore, the increasing demand for consumer electronics such as smartphones, laptops, and others. For instance, according to secondary analysis, India's demand for smartphones is anticipated to grow at a CAGR of 6%, from 300 million in 2021 to around 400 million in 2026. Thus, the increasing automotive and consumer electronics sector is expected to drive the market growth.

The North American battery packaging market has experienced substantial growth in recent years and is expected to continue expanding. The increasing demand for batteries, particularly in the automotive sector, is a key driver of this growth. The automotive industry, including EVs and hybrid vehicles, represent a significant portion of the battery packaging market in North America.

The region is witnessing a rapid adoption of electric vehicles, driven by environmental concerns, government incentives, and improving charging infrastructure. Battery packaging plays a crucial role in ensuring the safety and efficient performance of the battery packs used in these vehicles. For instance, according to the Bureau of Labor Statistics, the sales of electric cars in the US spiked from 0.2% in 2011 to 4.6% in 2021.

Moreover, the market size is also influenced by factor such as battery technology advancements, government initiatives promoting clean energy, and consumer demand for portable electronics devices. North America has been actively deploying energy storage systems to support renewable energy integration, grid stability, and peak demand management. Battery packaging solutions are essential for large-scale energy storage projects, including utility scale installations, commercial buildings, and residential applications. The demand for battery packaging in this sector is expected to grow as energy storage deployments continue to rise. Thus, the aforementioned factor supports the market growth in the region.

Europe is expected to grow at a significant rate over the forecast period. The region commitment to decarbonization, renewable energy targets, and the transition to electric mobility are driving the demand for batteries, thereby boosting the battery packaging market. Europe is a leading market for electric vehicles, with several countries implementing policies and incentives to accelerate their adoption. For instance, the European Union introduced the Net Zero Industry Act in March 2023, which intends to supply 40% of the EU's strategic net zero technology demands with EU industrial capacity by 2030.

The growing EV market drives the demand for battery packs and necessitates reliable and safe packaging solutions. Battery packaging ensures the protection of battery cells during transportation, installation, and use in electric vehicles. Furthermore, the region is also experiencing a surge in renewable energy installations, such as solar and wind power. To overcome the intermittent nature of renewable energy sources, energy storage systems, including battery storage, are being deployed. Battery packaging solutions play a vital role in the safe storage and distribution of energy from these systems. Thereby, driving the market growth in the region.

The battery packaging market refers to the industry involved in the manufacturing, design, and distribution of packaging solutions specifically tailored for batteries. It encompasses the development of protective enclosures, containers, and materials used to safely package and transport different types of batteries, including lithium-ion batteries, lead-acid batteries, nickel-metal hydride (NiMH) batteries and others. Battery packaging serves multiple purposes including protection, safety, compliance, efficiency and environmental considerations. The battery packaging market caters to diverse sectors, including automotive, consumer electronics, renewable energy, energy storage systems, medical devices, and others. It is characterized by ongoing technological advancements, stringent safety regulations and a competitive landscape driven by the increasing demand for batteries and the need for reliable, efficient, and sustainable packaging solutions.

The global projection for the share of electric car sales based on current policies and company targets has climbed to 35% in 2030 under the IEA Stated Policies Scenario (STEPS), up from less than 25% in the prior outlook. According to the forecasts, China would continue to be the world's largest market for electric vehicles, accounting for 40% of all sales by 2030. By the end of the decade, the United States doubles its market share to 20% as recent policy pronouncements spur demand, while Europe keeps its present 25% share.

| Report Coverage | Details |

| Market Size in 2024 | USD 33.52 Billion |

| Market Size by 2034 | USD 105.03 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.10% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Battery Type, By Level of Packaging, By Type of Packaging, By Casing, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising adoption of electric vehicles across the globe

The rapid growth of the electric vehicle industry is a significant driver for the battery packaging industry. As electric vehicles gain popularity and government worldwide promote the transition to clean transportation, the demand for battery packs and associated packaging solutions rises. This packaging ensures the safety, installation and use of battery packs in electric vehicles. For instance, according to the International Energy Agency, sales of electric vehicles are anticipated to remain strong through 2023.

In the first quarter, more than 2.3 million electric vehicles were sold, which is nearly 25% more than during the same time previous year. By the end of 2023, the company projects 14 million in sales, a 35% growth year over year, with new purchases picking up speed in the second part of this year. As a result, 18% of all vehicle sales for the entire calendar year may be made up of electric vehicles. Therefore, the aforementioned facts rising the demand for battery packaging solutions.

Regulatory compliance

The battery packaging industry is subject to various regulations and standards, including transportation regulations and safety guidelines. Adhering to these regulations requires investments in research, testing, and compliance procedures. Keeping up with evolving regulations and ensuring compliance across different regions can be complex and time-consuming for manufacturers. Thus, this is expected to hamper the growth of the market during the forecast period.

Growth in consumer electronics

The proliferation of smartphones, laptops, tablets, wearables, and other portable electronic devices fuels the demand for small-sized batteries with efficient packaging. The consumer electronics sector presents significant opportunities for battery packaging manufacturers as the market for these devices continues to expand. For instance, as per the Australian Bureau of Statistics, 91% of homes with access to the internet use desktop or laptop computers. Like mobile or smartphones, 91% of connected households utilize them. 66% of households used tablets as their second most common type of internet-connected device. Thus, the growing use of electronic devices is expected to offer an enormous opportunity for market revenue growth over the forecast period.

The lithium-ion segment dominated the battery packaging market with the largest share in 2023. This is mainly due to the rising adoption of electric vehicles and electronic devices. Lithium-ion batteries are widely used in consumer electronics, electric vehicles, and energy storage systems. Packaging solutions for lithium-ion batteries focus on safety features such as thermal management, insulation, and protection against physical damage. The high energy density and long cycle life of lithium-ion batteries are contributing to the segment's growth.

On the other hand, the lead-acid batteries segment is expected to grow at a significant rate over the forecast period. Lead-acid batteries are commonly used in automotive applications and stationary power systems. The packaging for lead-acid batteries emphasizes durability, leak prevention, and protection against corrosion. Lead-acid batteries are cheaper compared to other battery types. Additionally, sustainability and recyclability of lead-acid batteries lead to their increased adoption, contributing to segmental growth.

The cell and pack packaging segment accounted for the highest share of the market in 2023 due to an increase in demand for lithium-ion batteries. This packaging reduces the risk of short circuits by providing better thermal protection. Advancement in lithium-ion batteries has increased their adoption in various industries, leading to enhanced adoption of cell and pack packaging. The rising demand for customized packaging solutions for different batteries according to their size and shape is the key factor driving the growth of the segment. Cell and pack packaging enhances the battery density and reduces costs.

The transport packaging segment is expected to witness rapid growth in the coming years due to the growing need for effective and robust packaging solutions during transportation. Batteries need to be protected from hazardous materials. Transport packaging prevents batteries from shocks, vibrations, and temperature impacts. The growing need for efficient and safe transportation of batteries further contribute to segmental growth.

The corrugated packaging segment held the largest market share in 2023. Corrugated packaging allows for printing, branding, and customization options. Companies can incorporate their logos, product information, handling instructions, or safety guidelines on the packaging to enhance brand visibility and communicate important messages to end-users. Therefore, these characteristics of corrugated battery packaging are driving segment dominance in the battery packaging market.

On the other hand, the blister packaging segment is expected to grow at a rapid pace in the coming years due to its secure and tamper-evident properties. Blister packaging provides enhanced protection, minimizing the risk of rapid discharge. The easy opening and closing of blister packs makes them easy to handle. Blisters are affordable and lightweight. Additionally, visual appeal and space-efficiency are shifting consumer preference toward blister packaging solutions.

The cylindrical segment held the largest share of the battery packaging market in 2023 due to the increased demand for consumer electronics like laptops, smartphones, and tablets. The cylindrical design provides enhanced protection against external impact. These batteries do not swell during charging-discharging processes. These batteries are affordable compared to other batteries. Additionally, advancements in cylindrical battery packaging designs for better stability and resistance capabilities are making them ideal options for electronic devices.

The prismatic segment is expected to expand at the fastest rate during the forecast period. This is mainly due to the increasing demand for portable consumer electronics. The small size and lightweight nature of prismatic batteries make them suitable for portable consumer electronics. Additionally, prismatic batteries provide high energy density.

The cardboard segment captured the largest share of the market in 2023. Cardboard battery packaging provides a sustainable and cost-effective solution for protecting and transporting batteries. It aligns with eco-friendly practices and offers versatility in design and customization, allowing manufacturers to meet the specific requirements of different battery types and applications.

On the other hand, the plastic segment is anticipated to witness significant growth in the coming years due to its flexibility and excellent durability. Plastics are easy to mold in any shape and size. The lightweight properties of plastics help to reduce battery weight. Polyethylene (PE) plastic is a highly used material in battery packaging. Customizable design, recyclability, and cost-effectiveness make polyethylene plastic material a popular choice for various battery applications. Advancements in plastic materials and designs are likely to boost segmental growth.

By Battery Type

By Level of Packaging

By Type of Packaging

By Casing

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025