October 2024

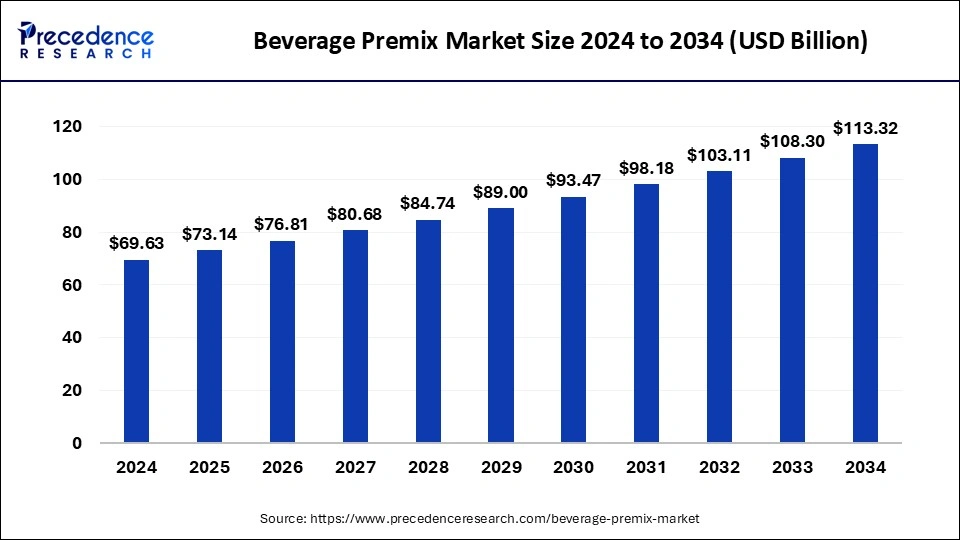

The global beverage premix market size is calculated at USD 73.14 billion in 2025 and is forecasted to reach around USD 113.32 billion by 2034, accelerating at a CAGR of 4.99% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global beverage premix market size was estimated at USD 69.63 billion in 2024 and is predicted to increase from USD 73.14 billion in 2025 to approximately USD 113.32 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The beverage premix market is driven by the rising consumer demand for quick-to-drink and handy products.

The beverage premix market is the area of the beverage business where concentrated ready-to-drink (RTD) formulations are created. Usually, these premixes come with all the ingredients needed in precise amounts; all that's needed to make the finished beverage is to dilute or combine them with water or other liquids. They are frequently employed to satisfy consumer convenience needs, guarantee consistency in flavor and quality, and expedite production processes.

Premixes are made under carefully regulated circumstances to guarantee uniformity in flavor, taste, and nutritional value throughout batches. Customer loyalty and brand reputation depend heavily on this dependability. Premixes can reduce a company's overall manufacturing costs by lowering labor expenses, waste from raw materials, and operational complexity in the beverage production process.

| Report Coverage | Details |

| Market Size by 2034 | USD 113.32 Billion |

| Market Size in 2025 | USD 73.14 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Type, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Appreciation options for customization

The appreciation for personalization fosters opportunities for market segmentation. Beverage firms can target niche consumer segments more successfully by providing specialized goods that fit demands and preferences. For example, health-conscious consumers might choose natural sweeteners or organic components, yet sports fans would prefer premixes high in electrolytes. Providing alternatives for customization can improve a business's financial sustainability.

By recognizing and catering to customer preferences, businesses can reduce waste, enhance inventory management, and optimize manufacturing processes. Additionally, coordinating product offers with sustainability trends, like locally sourced products or eco-friendly packaging, can improve the company's reputation and appeal to consumers. This drives the growth of the beverage premix market.

Intense competition among existing players

The market for beverage premixes is becoming increasingly crowded with brands selling identical goods. Due to this saturation, new competitors have fewer prospects, and those already in the market must stand out. As a result, businesses must invest significantly in marketing, promotions, and brand development to draw in new business and maintain existing clientele. Strong customer loyalty from well-known brands can make them dominate shelves and retail channels, making it harder for smaller or more recent companies to become visible and take market share.

Rising demand for healthier beverage options

Globally, consumers are placing a higher priority on their health and well-being, which is causing a move away from sugary, calorie-dense beverages and toward healthier options. Growing public knowledge of the health hazards, such as obesity and diabetes that come with consuming large amounts of sugar supports this trend. Beverage premixes can profit by providing formulas that appeal to health-conscious consumers, such as low-sugar, sugar-free, or beverages enhanced with vitamins, minerals, and valuable components like probiotics or antioxidants.

Convenient and healthier beverage options are in greater demand as emerging nations see economic expansion and rising disposable incomes. The desire for on-the-go beverages that are thought to be healthier is further increased by this demographic change toward urbanization and hectic lifestyles. This opens an opportunity for the growth of the beverage premix market.

Proliferation of online shopping provides a direct route to consumers

Due to online platforms, beverage premix brands can now reach a worldwide audience without being limited by traditional distribution networks. This worldwide accessibility is essential for extending market reach beyond conventional retail limits. In contrast to physical storefronts, online retailers are open around the clock. This availability satisfies customers' growing need for quick product access and convenience.

Employing digital marketing and search engine optimization (SEO) techniques increases online brand visibility. In a competitive market, this visibility is essential for drawing in new clients. Online platforms also make it easier to upsell and cross-sell by recommending similar or complementary products based on user behavior and past purchases.

The powder segment dominated the beverage premix market in 2024. Beverage premixes in powder form provide unmatched convenience. Usually, they come in single-serve sachets or jars that are convenient to use, store, and carry. To create their preferred beverage, be it coffee, tea, a health drink, or a flavored beverage, customers only need to combine the powder with water or milk. This convenience feature appeals greatly to time-pressed people looking for easy, hassle-free fixes.

Powdered beverage premixes are very popular worldwide. Producers have modified their goods to accommodate a range of regional and cultural inclinations. Effective distribution networks and well-thought-out marketing initiatives that build customer confidence and brand awareness support this worldwide reach.

The granules segment is observed to be the fastest growing in the beverage premix market during the forecast period. Granules provide consumers with convenience and usability, which they appreciate. They are convenient to eat on the run because they dissolve quickly in water. This convenience feature appeals to people with hectic schedules looking for quick fixes without sacrificing nutrients or taste. Technological developments have produced granules with better flavor characteristics and solubility. Manufacturers have spent money on research and development to develop formulations that dissolve fast in hot or cold beverages while preserving the beverage's natural flavor and aroma. This improves the general satisfaction and experience of the customer.

The coffee premix segment dominated in the beverage premix market in 2024. Premixed coffee is quite convenient. All you need to do to make coffee with them is combine the premix powder with hot water, which makes the process quick and easy. Customers looking for quick satisfaction without sacrificing quality or taste will find this ease appealing. Businesses in the coffee premix industry use innovative marketing techniques to focus on customer groups. This entails advertising their goods in public areas, workplaces, and convenience stores where customers go to get quick snacks. Strategic alliances with eateries also broaden the market reach and visibility of brands.

The tea premix segment is observed to be the fastest growing in the beverage premix market during the forecast period. In today's fast-paced world, convenience plays a significant role in customer decision-making. Tea premixes meet this demand by offering a quick and simple method of making a cup of tea. These premixes are usually packaged in sachets or pods easily prepared with hot water. This makes them the perfect choice for homes, students, and working professionals who want convenience without sacrificing flavor. Tea premixes are becoming more widely available through various channels, including supermarkets, convenience stores, specialized tea shops, and online retailers. E-commerce platforms, which provide convenience, affordable prices, and a wide selection of products, are essential for expanding the consumer base.

The hypermarket & supermarket segment dominated in the beverage premix market in 2024. Supermarkets and hypermarkets usually carry a large selection of beverage premix items. This includes coffee and tea premixes to flavored drink powders and ready-to-drink alternatives. This wide range of options suits a wide range of consumer preferences, nutritional needs, and tastes. These retailers use loyalty programs, discounts, and special offers as effective promotional techniques. These strategies draw customers and promote brand loyalty and recurring business. Promotions may also involve samples or in-store trials to further pique potential customers' interest.

The online channels segment shows a significant growth in the beverage premix market during the forecast period. Online stores frequently feature a range of beverage premix goods from different producers and brands. Customers looking for certain flavors, dietary restrictions (such as sugar-free or organic options), or novelty items that might not be easily found in conventional retail stores will find this wide selection appealing. Online purchasing for beverage premixes is becoming increasingly popular, due in part to the growing acceptance of safe digital payment methods. Customers can deal quickly and securely, removing obstacles associated with using cash or waiting for payments.

North America had dominated in the beverage premix market in 2024. North America's established infrastructure and manufacturing capabilities support the large-scale manufacture of beverage premixes. This comprises sophisticated manufacturing plants, effective supply chains, and robust quality assurance protocols that guarantee uniformity and dependability in product offers. With an increasing focus on health and wellness, North American consumers are seeking beverages that taste good and offer nutritional benefits. These trends frequently make beverage premixes cater to health-conscious consumers by adding natural ingredients, vitamins, minerals, and other useful additives.

Asia-Pacific is observed to be the fastest growing in the beverage premix market during the forecast period.

Rapid economic expansion, rising disposable incomes, and urbanization have all been observed in Asia-Pacific. The need for convenience goods like beverage premixes, which provide consumers with quick and simple solutions, is rising as more people migrate into cities. Consumers are looking for beverages with functional benefits such as vitamins, minerals, and herbal extracts as their awareness of health issues grows. These components can be added to beverage premixes to appeal to health-conscious consumers searching for easy ways to increase their food intake.

Global beverage corporations and regional participants are collaborating strategically and investing in the Asia-Pacific market. The market expansion, product innovation, and marketing initiatives bolstered by this capital infusion further propel the beverage premix industry's growth.

By Form

By Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

March 2025

February 2025