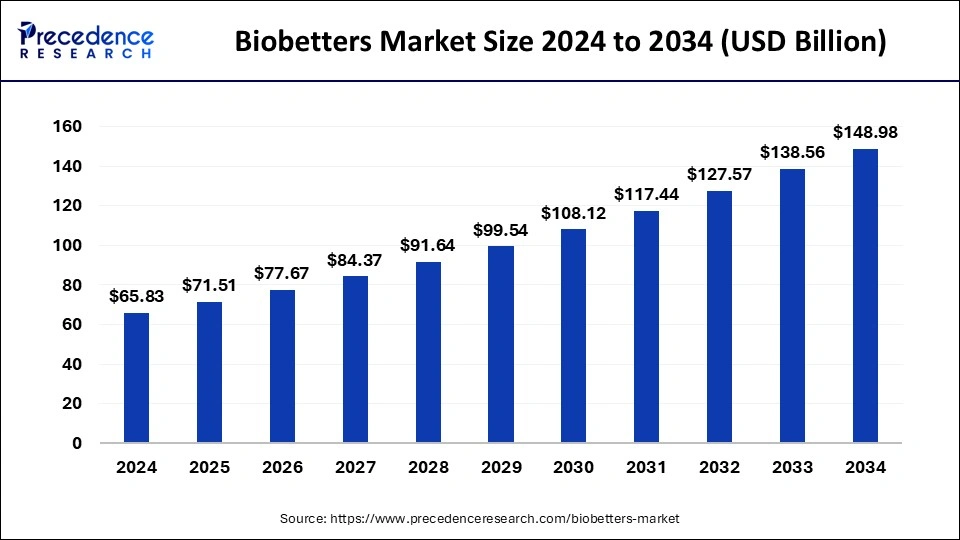

The global biobetters market size is calculated at USD 71.51 billion in 2025 and is forecasted to reach around USD 148.98 billion by 2034, accelerating at a CAGR of 8.51% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biobetters market size was estimated at USD 65.83 billion in 2024 and is predicted to increase from USD 71.51 billion in 2025 to approximately USD 148.98 billion by 2034, expanding at a CAGR of 8.51% from 2025 to 2034. The biobetters market is driven by the longer half-life of the product.

The biobetters market revolves around the biopharmaceutical industry segment that focuses on creating, manufacturing, and distributing biobetters. Biologic medications created from current biologics but altered to enhance their efficacy, safety, stability, or delivery are referred to as bio betters or biosuperiors. The creation of biobetters encourages innovation in the biopharmaceutical sector.

Businesses spend money on research and development to discover novel approaches to improving biologic medications currently on the market, advancing science and technology. By developing modified versions of already-existing biologics, businesses can prolong the lifecycle of their products beyond the original patent expiration. This allows them to retain market exclusivity and revenue streams for longer periods of time.

Biobetters Market Data and Statistics

| Report Coverage | Details |

| Market Size by 2034 | USD 148.98 Billion |

| Market Size in 2025 | USD 71.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.51% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule Type, Disease Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for biopharmaceuticals that offer improved efficacy, safety, and patient convenience

Biobetters are designed to offer higher therapeutic efficacy than original formulations. This enhancement could entail adjustments to lengthen the medication's half-life, improve target specificity, or improve dosage schedules. Biobetters are better than their predecessors at addressing unmet medical needs because they achieve better treatment outcomes. Biosimilars and biobetters are becoming increasingly competitive in the market as many biopharmaceutical patents are about to expire. Thereby, the growing demand for biopharmaceuticals with improved efficacy acts as a driver for the biobetters market. Biopharmaceutical businesses aim to provide a unique product offering and prolong product life cycles by developing biobetters that offer definite advantages over biosimilars in terms of convenience, safety, or efficacy.

Improved protein engineering techniques

With protein engineering, researchers can improve the effectiveness of biologic medications that are already on the market. Researchers can increase tissue penetration, prolong the half-life in circulation, and boost binding affinity to targets by fine-tuning molecular architectures. Because of these changes, biobetters exhibit better treatment effects than their predecessors. Pharmaceutical corporations are able to prolong the patent life of their current biologics by utilizing protein engineering to create biobetters. Because of their exclusivity, they can hold onto market share in the face of competition from biosimilars, which usually become accessible after the patent on the original biologic expires.

Stringent regulatory requirements for approval of biobetters

Biobetters need to show that they are safer and more effective than the original reference biologic. A lot of preclinical and clinical data are required for this, frequently including comparison trials with the original medicine. Regulatory bodies require substantial proof to guarantee that alterations or enhancements do not jeopardize patient safety or treatment efficacy. To demonstrate their superiority or noteworthy clinical benefit over current medicines, regulatory agencies frequently mandate that biobetters go through clinical studies.

These trials require a lot of time, resources, and sometimes a huge number of patients. It can also be difficult to plan them in a way that shows incremental advantages over current treatments. This limits the growth of the biobetters market.

Developing a biobetter can provide a strategic advantage in terms of intellectual property (IP) and market exclusivity

A business can frequently acquire or renew new patents when it creates a biobetter. This is significant because, for a set amount of time (usually 20 years from the filing date), patents grant the exclusive right to manufacture and market the product, shielding it from rivalry. Enhancing efficacy, decreasing adverse effects, or improving delivery systems on an already-existing biopharmaceutical will allow the corporation to get extra patent protection. This extension lengthens the exclusive market period, giving the business additional time to recover its costs and make money without rivalry.

The monoclonal antibodies biobetters segment dominated in the biobetters market in 2024. Monoclonal antibodies have a high specificity when used to target sick cells, enhancing therapeutic results. Biobetters are improved versions of current biologics that use technological advancements to boost patient compliance, decrease adverse effects, and improve efficacy.

Their market reach is increased by the fact that these biobetters are utilized in a variety of therapeutic fields, including infectious diseases, autoimmune disorders, and cancer. Favorable regulatory paths encourage the development and introduction of biobetters into the market. Better medicines that outperform original biologics in terms of safety and therapeutic advantages are highly sought after.

The insulin biobetters segment is observed to be the fastest growing in the biobetters market during the forecast period. Since insulin biobetters have better delivery systems and fewer injection frequency requirements, they frequently result in higher patient compliance. For instance, unlike regular insulins requiring several daily injections, some biobetters are intended to be given once a week or less frequently. Because of its simplicity of use, patients may adhere to treatment plans more closely, enhancing their general health and quality of life. Recent developments in biotechnology have made it possible to create insulin biobetters, which provide notable advantages over conventional insulin treatments.

Better pharmacokinetic and pharmacodynamic profiles result in more reliable blood glucose regulation, a lower chance of hypoglycemia, and more convenient dosing regimens. Some insulin bio betters, for example, reduce the need for frequent injections by delivering a longer and more constant insulin release.

The cancer segment dominated in the biobetters market in 2024. Improved pharmacokinetic and pharmacodynamic characteristics, such as longer half-lives, more stability, and enhanced receptor binding, are the goals of biobetters. They become increasingly appealing possibilities for cancer treatment because of their longer therapeutic effects and more effective drug delivery. The patents on several popular biologics are about to expire or have already done so. This presents a chance for biobetters to enter the market and take substantial market share by providing improved versions of currently available treatments. Newer trastuzumab variants, like trastuzumab emtansine (T-DM1), provide more effective and less systemic damage by delivering cytotoxic chemicals directly to cancer cells.

The neurological disorders segment shows a significant growth in the biobetters market during the forecast period. Worldwide, the prevalence of neurological conditions such as multiple sclerosis, epilepsy, Parkinson's disease, and Alzheimer's disease is rising. This growth can be attributed to factors such as an aging population, advancements in diagnostic methods, and increased public awareness of certain disorders. The need for novel and efficient therapies, such as biobetters, is growing in tandem with the prevalence of these ailments. Patients and doctors become more receptive to biobetters as they are safer and more effective than conventional biologics. The increasing amount of clinical research demonstrating the efficacy of biobetters in treating neurological illnesses lends credence to the concept and promotes its implementation in clinical settings.

The hospital pharmacy segment dominated in the biobetters market in 2024. Biologic medicine preparation, storage, and administration, including biobetters, is a common area of expertise for hospital pharmacists. Their knowledge guarantees the proper handling of these cutting-edge medications, preserving their efficacy and stability. Given the complexity of biologics and the strict storage and administration requirements, this knowledge is essential. Clinical trials and research are conducted in several hospitals as well. They are vital to the creation and evaluation of novel biobetters.

The online pharmacy segment shows a notable growth in the biobetters market during the forecast period. Due to the abundance of online health information, Customers are better informed about their health and available treatments, including biobetters. This awareness fuels the demand for these cutting-edge treatments via internet channels. The seamless consultation and prescription fulfillment made possible by integrating telemedicine services with online pharmacies improves patient satisfaction and biobetter adherence.

To meet the increasing demand for these cutting-edge medications, online pharmacies are diversifying their product offerings to include a wider variety of biobetters. To improve patient comprehension and adherence, several online pharmacies provide biobetters with educational materials and patient support services.

North America dominated in the biobetters market in 2024. The biopharmaceutical industry receives substantial investment in North America. This involves significant private investment from venture capital firms and biopharmaceutical businesses and government support from organizations like the National Institutes of Health (NIH). This funding is essential for the costly and drawn-out process of creating biobetters. The prevalence of chronic diseases and the growing need for effective treatments have created a significant demand for innovative therapies in North America. The established healthcare infrastructures in the area make it easier for patients to receive novel therapies and support the adoption and use of biobetters.

Asia-Pacific shows a significant growth in the biobetters market during the forecast period. Chronic illnesses like diabetes, cancer, and autoimmune disorders are on the rise in the area. Long-term treatment strategies are necessary due to the prevalence of these disorders, which makes biobetters that have better efficacy and safety profiles an appealing alternative. Japan is one of the several nations in the area that are struggling with an aging population. Chronic disease is more common in older populations, which is fueling the need for efficient biobetters.

By Molecule Type

By Disease Indication

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client