February 2025

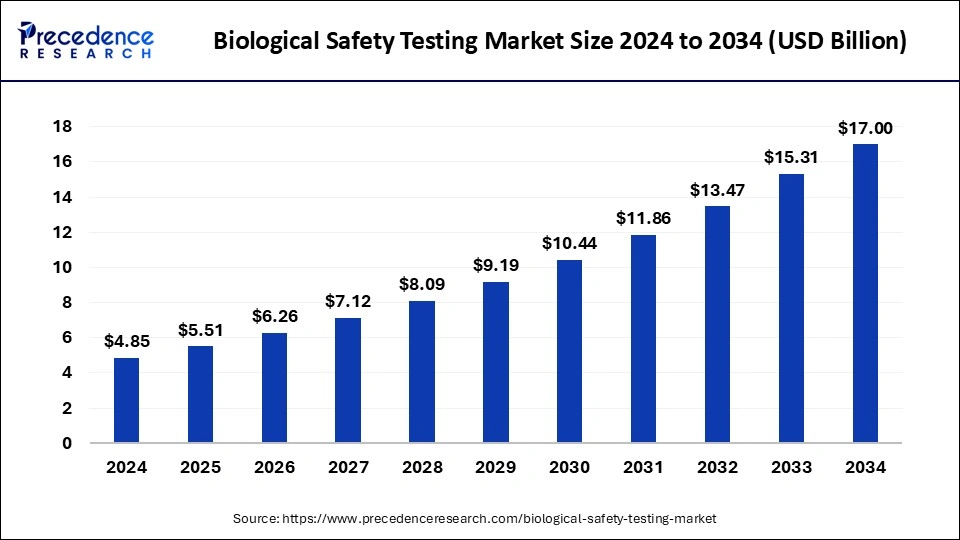

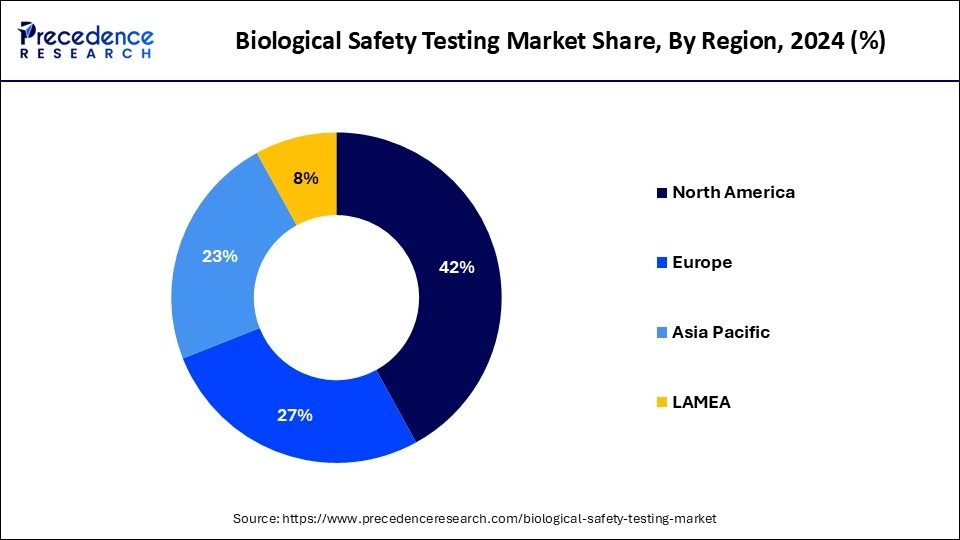

The global biological safety testing market size is calculated at USD 5.51 billion in 2025 and is forecasted to reach around USD 17.00 billion by 2034, accelerating at a CAGR of 13.36% from 2025 to 2034. The North America market size surpassed USD 2.04 billion in 2024 and is expanding at a CAGR of 13.35% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biological safety testing market size accounted for USD 4.85 billion in 2024 and is predicted to increase from USD 5.51 billion in 2025 to approximately USD 17.00 billion by 2034, expanding at a CAGR of 13.36% from 2025 to 2034.

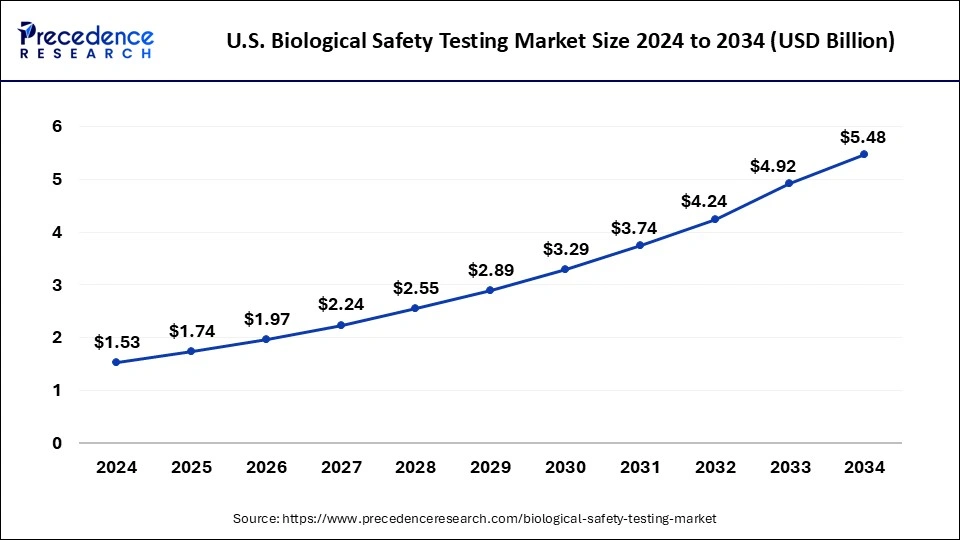

The U.S. biological safety testing market size was exhibited at USD 1.53 billion in 2024 and is projected to be worth around USD 5.48 billion by 2034, growing at a CAGR of 13.61% from 2025 to 2034.

North America held the dominant share of the biological safety testing marketin 2024. The region is observed to witness prolific growth during the forecast period owing to the presence of well-established healthcare infrastructure, robust growth of the pharmaceutical and biotechnology sector, increasing production of new biologics, rising investment in R&D activities by key market players, increasing healthcare spending, rapid adoption of innovative technologies, and supportive government framework. The United States is anticipated to contribute significantly to the growth of the region's market.

Moreover, enforcement of stringent safety standards by the United States FDA and other regulatory bodies necessitates extensive safety assessments, bolstering the market’s growth in the region. Furthermore, the rise in chronic incidences such as cancer, rheumatoid arthritis, diabetes, and others led to a rising demand for biologics products such as monoclonal antibodies, vaccines, and cell treatments, which in turn increases the need for rigorous safety testing. Such factors are propelling the region’s market revenue.

Europe is observed to expand notably during the forecast period. The region’s growth is attributed to the increasing healthcare expenses, increasing government funding for R&D activities, growing focus on the vaccine and therapeutics development by the key market players, presence of developed healthcare along with R&D infrastructure, and increasing burden of chronic diseases. The rapid growth of the biopharmaceutical sector considerably increases the demand for comprehensive safety testing services to ensure the safety of biological products.

Additionally, the presence of regulatory agencies such as the European Medicines Agency (EMA) imposes strict guidelines for biologics safety testing to verify the efficacy, dependability, and safety of biological products. Technological innovation improves the testing procedures for biologics safety testing and accelerates the market’s growth in European countries.

The biological safety testing market deals with testing and ensures the utmost safety of biological products, including vaccines, medical devices, therapeutics, and others. Biologics are widely used for treating several chronic diseases, and they are large and complex molecules. Biological safety testing carries out a series of various tests, including endotoxins tests, sterility tests, cell line authentication and characterization tests, residual host contamination detection tests, bioburden tests, and others. Biological safety testing assists in assuring their safety, purity, and efficacy. Several regulatory bodies, such as the FDA and EMA, have laid down stringent guidelines for the testing of biologics safety. Biological safety testing refers to the testing procedures to ensure the safety of biopharmaceuticals and vaccines by confirming that they are free from contamination and meeting regulatory requirements.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.00 Billion |

| Market Size in 2025 | USD 5.51 Billion |

| Market Size in 2024 | USD 4.85 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 13.36% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Test, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rapid growth of the pharmaceutical and biotechnology sector

The rapid expansion of the pharmaceutical and biotechnology sector is expected to drive the market’s growth during the forecast period. With the innovations surge in the pharmaceutical and biotechnological sector necessitating rigorous safety testing and stringent safety standards. Renowned regulatory bodies such as the FDA (Food and Drug Administration) and EMA (European Medicines Agency) have laid down stringent safety guidelines that mandate comprehensive biological safety assessments for contaminants, efficacy, and safety before any drug reaches the patient. Therefore, the expansion of pharmaceutical and biotechnology is fueled by rising investments in R&D activities, and these industries are developing pharmaceuticals, biologic drugs, and therapies for treating chronic diseases, driving the market’s growth.

High cost

The high cost associated with biologics safety testing is anticipated to hamper the market's growth. High capital is required for safety testing for the development of drugs. In addition, the lack of well-developed healthcare in middle-lower income countries, rising ethical concerns related to animal testing, and the time-consuming approval process are some of the factors that may restrict the expansion of the global ‘biological safety testing market.

Increasing prevalence of chronic disorders

The rising incidence of chronic disorders is expected to boost the growth of the biological safety testing market during the forecast period. The market has witnessed the rising production of new biologics due to the high burden of chronic diseases such as cancer, rheumatoid arthritis, diabetes, and other inflammatory diseases. The demand for biologics, such as vaccines, monoclonal antibodies, gene therapies, recombinant proteins, and cell-based therapies, is escalating, which drives the demand for comprehensive testing to verify their safety for human use. As a result, the increasing prevalence of chronic disorders is accelerating the growth of the market during the forecast period.

The reagents & kits segment accounted for the dominating share of the biological safety testing market in 2023 and is expected to continue its dominance over the forecast period. The rising improvements and modifications in the formulation of reagents and kits are anticipated to increase their acceptance by professional laboratory technicians, particularly in toxicology assessment. Moreover, the growing demand for high-throughput testing has accelerated the growth of the reagents and kits segment.

The instruments segment is expected to witness considerable growth in the global biological safety testing market over the forecast period. The segment’s growth is majorly driven by the increasing demand for instruments in biological safety testing laboratories. In addition, the enforcement of strict safety standards has compelled biopharmaceutical companies to comply with safety guidelines, which has spurred the demand for instruments.

The endotoxin tests segment dominated the biological safety testing market in 2024. Endotoxin testing is extensively used in monoclonal antibody testing, recombinant protein drugs, cell therapy, and pharmaceutical development. Endotoxin testing is a vital safety requirement for pharmaceutical and biomedical products. Bacterial endotoxins, such as gram-negative, can lead to very serious health complications if they are introduced into the human body.

During the manufacturing of pharmaceuticals, it is critical to test products for the presence of endotoxins. Testing, detection, and removal of endotoxins is a necessary quality control step to ensure that safe pharmaceuticals are given to patients. Additionally, regulatory bodies around the world enforce rigorous endotoxin testing protocols to ensure patient safety, thereby bolstering the segment’s growth.

The bioburden tests segment is expected to grow notably in the biological safety testing market during the forecast period. Bioburden testing or microbial testing plays an integral part in the quality control process. It is conducted to quantify microbial contamination in water systems, raw materials, and finished products. This test is performed as routine testing to ensure safety, quality, and regulatory compliance during pharmaceutical and biologics manufacturing. Bioburden testing also assists in keeping medical equipment safe for use by eradicating harmful microbes during the sterilization process. Bioburden Testing is widely used for quality control of pharmaceutical manufacturing water, process water testing (water for injection), raw material testing, medical devices, and others.

The vaccines & therapeutics segment held the largest share of the biological safety testing market in 2024 and is expected to sustain the position throughout the forecast period. The growth of the segment is attributed to the rising development of vaccines and therapeutics by major biopharmaceutical and pharmaceutical companies due to the rising burden of chronic diseases. The testing and trials of vaccines are crucial for safety checks. The demand for biological safety testing has significantly increased in vaccine development due to the rising need for safe and effective vaccines such as the COVID-19 vaccine, mRNA vaccines, and others. Regulatory bodies mandate comprehensive safety assessments to ensure that the vaccines are effective, free from contaminants, and overall safe for human use.

The cellular & gene therapy segment is expected to grow significantly in the biological safety testing market during the forecast period. Gene and cell therapy has made remarkable progress in the treatment of various diseases, such as cancer, genetic disorders, autoimmune, and others. Cellular and gene therapy requires safety testing for product safety and process understanding before patient use. Thereby fuelling the expansion of the segment.

By Product

By Application

By Test

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

February 2025

February 2025