August 2024

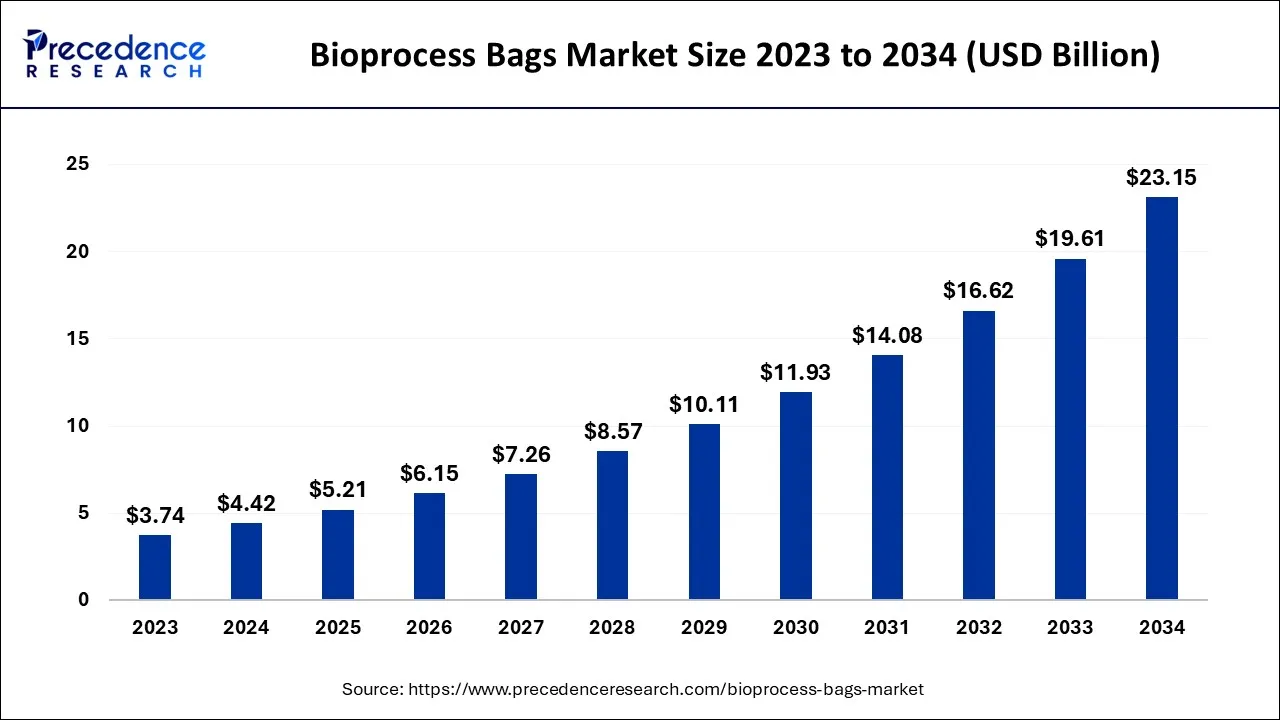

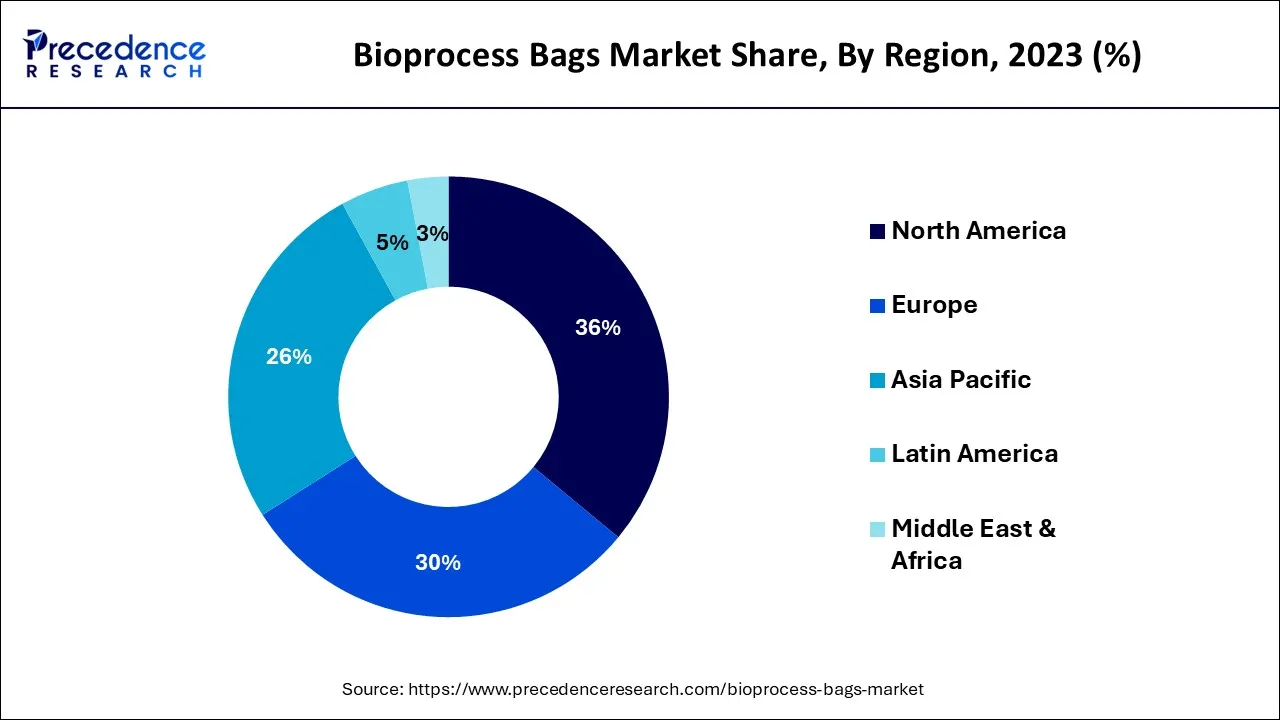

The global bioprocess bags market size accounted for USD 4.42 billion in 2024, grew to USD 5.21 billion in 2025, and is expected to be worth around USD 23.15 billion by 2034, registering a healthy CAGR of 18.01% between 2024 and 2034. The North America bioprocess bags market size is predicted to increase from USD 1.59 billion in 2024 and is estimated to grow at the fastest CAGR of 18.17% during the forecast year.

The global bioprocess bags market size is expected to be valued at USD 4.42 billion in 2024 and is anticipated to reach around USD 23.15 billion by 2034, expanding at a CAGR of 18.01% over the forecast period 2024 to 2034.

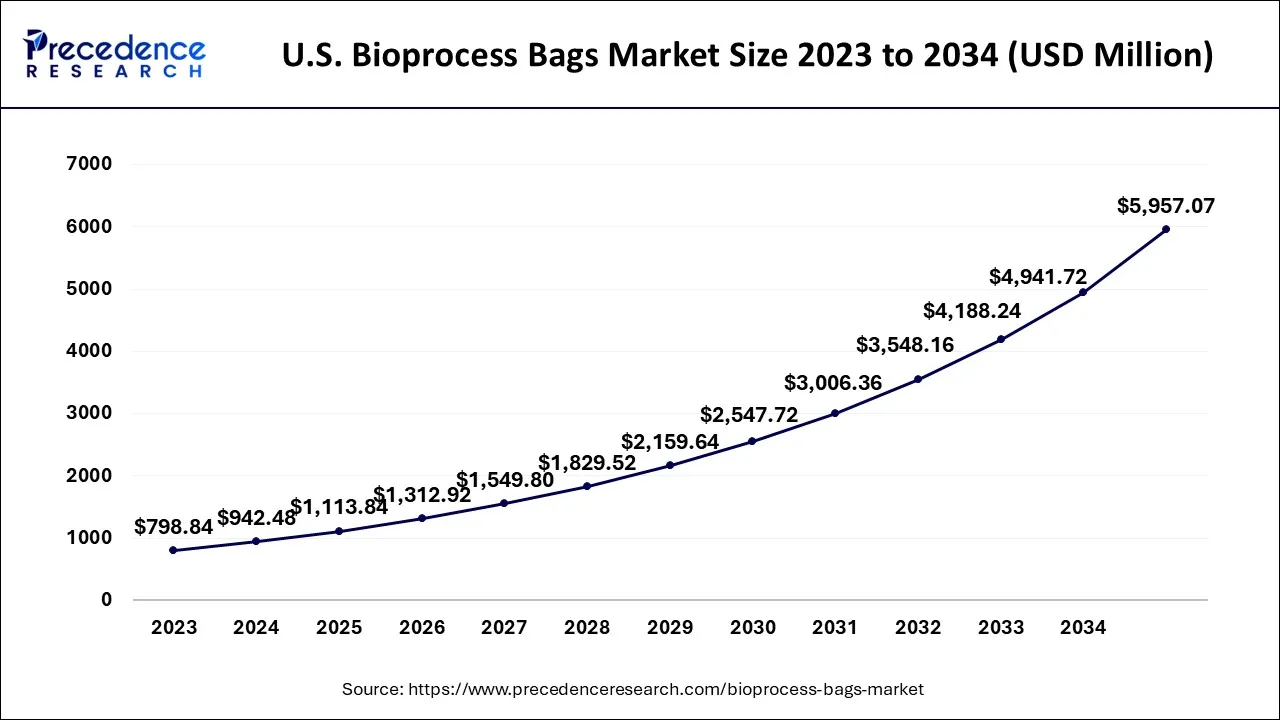

The U.S. bioprocess bags market size is exhibited at USD 1,113.84 million in 2024 and is projected to bebioprocess bags market worth around USD 5,957.07 million by 2034, growing at a CAGR of 18.26% from 2024 to 2034.

North America is dominating the bioprocess bags market with maximum revenue. North America is home to many major pharmaceutical companies, which has led to a significant investment in biopharmaceutical products with better handling of tissues, and cells where bioprocess bags come into action. This has resulted in the availability of a wide variations of bioprocess bags, including an increase in demand for monoclonal antibodies, vaccines etc. For instance, since bioprocess bags are used to generate biologics to prevent contamination, the American Cancer Society estimates that there will be 1,958,310 new cancer cases and 609,820 cancer deaths in the United States in 2023. This will lead to an increase in the market's need for bioprocess bags.

Asia-Pacific is the fastest growing region in the bioprocess bags market owing to the boosting life science research, emerging biopharmaceuticals industry, rising investments in pharmaceutical biotechnology businesses' & enormous demand for personalized medicine. The region has witnessed significant growth in the biopharmaceutical industry over the past few years, which has led to an increased demand for bioprocess bags. Moreover, the rising demand for personalized medicine, which requires the production of smaller batches of drugs, has led to an increased demand for single-use bioprocess bags. These bags offer a more flexible and cost-effective alternative to traditional stainless-steel bioreactors.

Bioprocess bags are products that have increasingly been used in biopharmaceutical manufacturing due to their convenience, ease of use, and cost-effectiveness. The bioprocess bags market focuses on the development, marketing & distribution of customizable & flexible solutions for safe handling of liquids in control & bioprocess environments.

The market is expected to continue expanding in the upcoming years as biopharmaceutical production becomes more widespread and demand for bioprocess bags increases.

The advantages of bioprocess bags include their flexibility, ease of use, and ability to reduce the risk of contamination and cross-contamination. They also offer cost savings and can be used in single-use and multi-use applications. Bioprocess bags have gained popularity in biopharmaceutical industries due to their convenience, safety, and efficiency in biologics production.

The biotech industry is overgrowing in emerging markets such as Asia-Pacific and Latin Americ, the improvements in the biotechnology sector is observed to propel the growth of bioprocess bags market. As more biotech companies are established, the demand for bioprocess bags is expected to increase.

Moreover, the pharmaceutical companies are more focused on the research and development of novel vaccines & drug. Bioprocess bags are used to store various liquids without the risk of contamination, the overall development of pharma industry is projected to drive the growth of bioprocess bags market.

Many biopharmaceutical companies outsource their operations to contract manufacturing organizations (CMOs). These CMOs often use bioprocess bags as part of their manufacturing process, driving demand for these products. The development of new bioprocessing technologies is driving demand for bioprocess bags. These bags are designed to work with various bioprocessing equipment, making them an essential component of biopharmaceutical manufacturing.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.42 Billion |

| Market Size by 2034 | USD 23.15 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.01% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for biologics

Increasing demand for biologics such as vaccines, monoclonal antibodies and gene therapies for example, in treating cancer have directly influenced the bioprocess bags market. Biologics are form of frug, medicine or therapeutics developed for treating multiple diseases. Rise in technological advancement in healthcare impacting in market growth exponentially. Bioprocess bags also contribute to minimizing the unnecessary usage of water. For instance, in 2021, Samsung Biologics and AstraZeneca have teamed to produce vast medicinal materials and bioprocessing machinery mainly for cancer therapy and COVID-19 in September 2020.

Increasing adoption of single-use technologies

The trend towards single-use technologies is gaining momentum in the biopharmaceutical industry, driven by the need for greater flexibility, faster turnaround times, and reduced risk of cross-contamination. Bioprocess bags are a vital component of single-use systems, driving their adoption in the industry, which is gaining popularity in the biopharmaceutical industry due to their many advantages over traditional stainless-steel bioreactors. As more biopharmaceutical companies adopt single-use technologies, the demand for bioprocess bags is expected to increase.

Environmental concerns

Using plastic materials in bioprocess bags raises concerns about waste and sustainability. Companies may prefer more environmentally friendly options like biodegradable materials or reusable containers. Bioprocess bags may have size, capacity, and shape limitations, which may limit their use in specific applications. Maintaining the sterility of bioprocess bags throughout manufacturing can be challenging and may require additional validation and testing. For instance, the bioprocess bags are typically made from plastic films and may not be compatible with all types of drugs or biologics, which may limit their use in certain applications.

Growing demand for biopharmaceuticals

The demand for biopharmaceuticals is increasing rapidly due to their effectiveness in treating various diseases and the growth of the downstream process in bioprocessing is likely to have a positive impact on the bioprocess bags market, as it creates a higher demand for specialized bags and increases the adoption of single-use technologies. They are used extensively in the production of biopharmaceuticals, and the growing demand for these products is driving the growth of the bioprocess bags market.

Single-use bioprocessing bags are leading the bioprocess bags market globally. As it is a one-time use of therapeutics product and then discarded. To avoid cleaning between the upcoming batches and even to omit cross-contamination. For instance, Meissner has announced that production of bioprocess bags for the biopharmaceutical industry has begun in its single-use bioprocess production facility in Ireland

The multi-use bioprocessing bags segment is expected to witness several challenges in the market during the forecast period. It is due to the maintenance expenses, time-consumption, chances of contamination as used for multiple purposes.

The upstream process in bioprocessing is dominating the bioprocess bags market, it involves the initial stages of cell culture, media preparation, and fermentation. Bioprocess bags, also known as single-use bags, are increasingly being used in upstream bioprocessing due to their ease of use, flexibility, and cost-effectiveness compared to traditional stainless-steel bioreactors.

The use of bioprocess bags in upstream processing has several advantages over traditional systems. Bioprocess bags are disposable, reducing the risk of cross-contamination and the need for costly cleaning and sterilization processes.

The downstream process can impact the bioprocess bags market in several ways. For instance, the downstream process may require the use of different types of bioprocess bags that are designed for specific purposes, such as holding and transporting different types of solutions, buffers, or final products. Therefore, the demand for specialized bioprocess bags may increase with the expansion of downstream processing.

The pharmaceuticals segment dominated the market in 2023, the segment is projected to maintain its dominance during the forecast period. Pharmaceutical companies are leading the bioprocess bags market as they are investing in the development of new drugs, which is driving demand for bioprocess bags.

The biopharmaceuticals segment of end-user is another promising segment for the market’s growth. Biopharmaceuticals are produced using living cells, such as bacteria or yeast, and require specialized equipment and materials to maintain their integrity and purity throughout the manufacturing process.

Bioprocess bags provide advantages over traditional stainless-steel tanks, including cost savings, improved product quality, and reduced risk of contamination. As the number of biopharmaceuticals in development increases, so does the need for specialized equipment and materials, such as bioprocess bags. For example, they may provide funding for research and development, collaborate with bag manufacturers, or invest in the development of new materials or production techniques.

Segments Covered in the Report

By Product Type

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024

February 2025

July 2024