January 2025

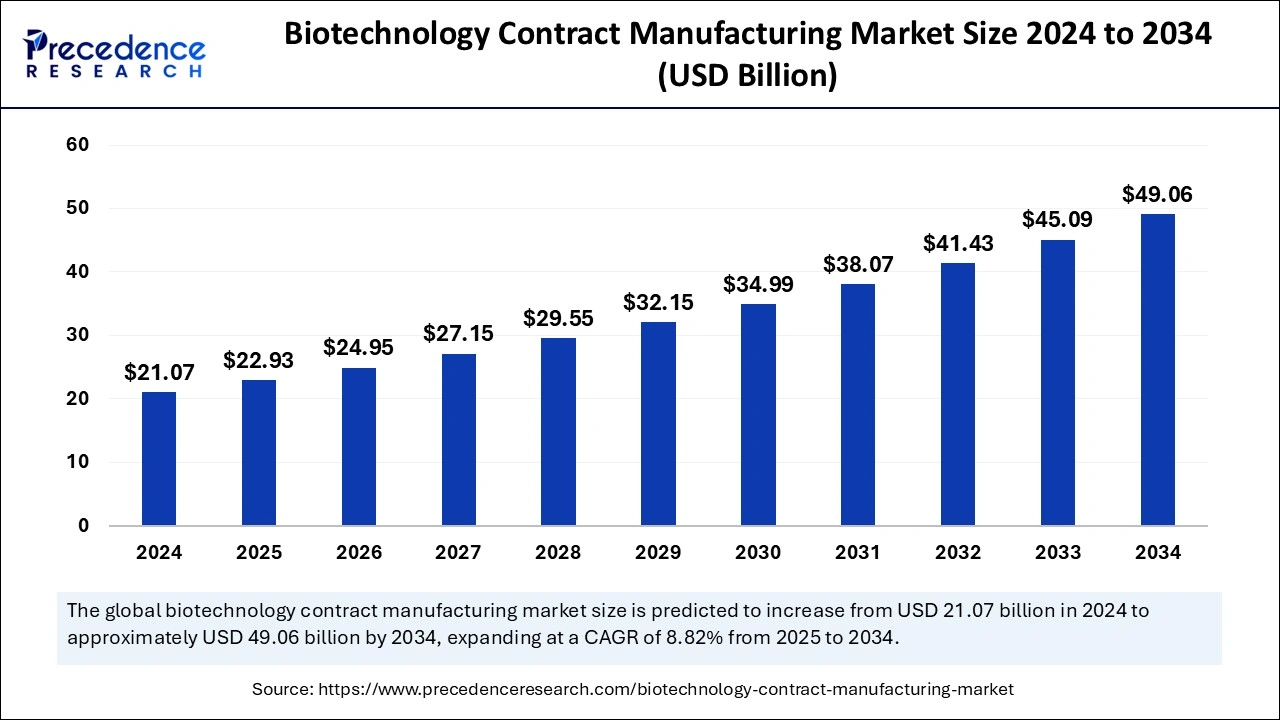

The global biotechnology contract manufacturing market size is accounted at USD 22.93 billion in 2025 and is forecasted to hit around USD 49.06 billion by 2034, representing a CAGR of 8.82% from 2025 to 2034. The North America market size was estimated at USD 7.16 billion in 2024 and is expanding at a CAGR of 8.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biotechnology contract manufacturing market size was estimated at USD 21.07 billion in 2024 and is predicted to increase from USD 22.93 billion in 2025 to approximately USD 49.06 billion by 2034, expanding at a CAGR of 8.82% from 2025 to 2034. The demand for biotechnology is increasing due to the rising need for biopharmaceutical products, marking significant growth in product development.

The rise of technologies like artificial intelligence and machine learning (ML) is playing a crucial role in the advancements in the biotechnology contract manufacturing market. The rise of robotics is helping optimize production, where technology is playing a crucial role in making real-time adjustments for more efficient processes. AI is also being implemented in predictive modeling to improve yield. The use of technologies in drug discovery also helps in innovation, reducing development time and increasing stability. Additionally, the use of ML in quality control is also significantly helping in preventing disruptions in the production cycle.

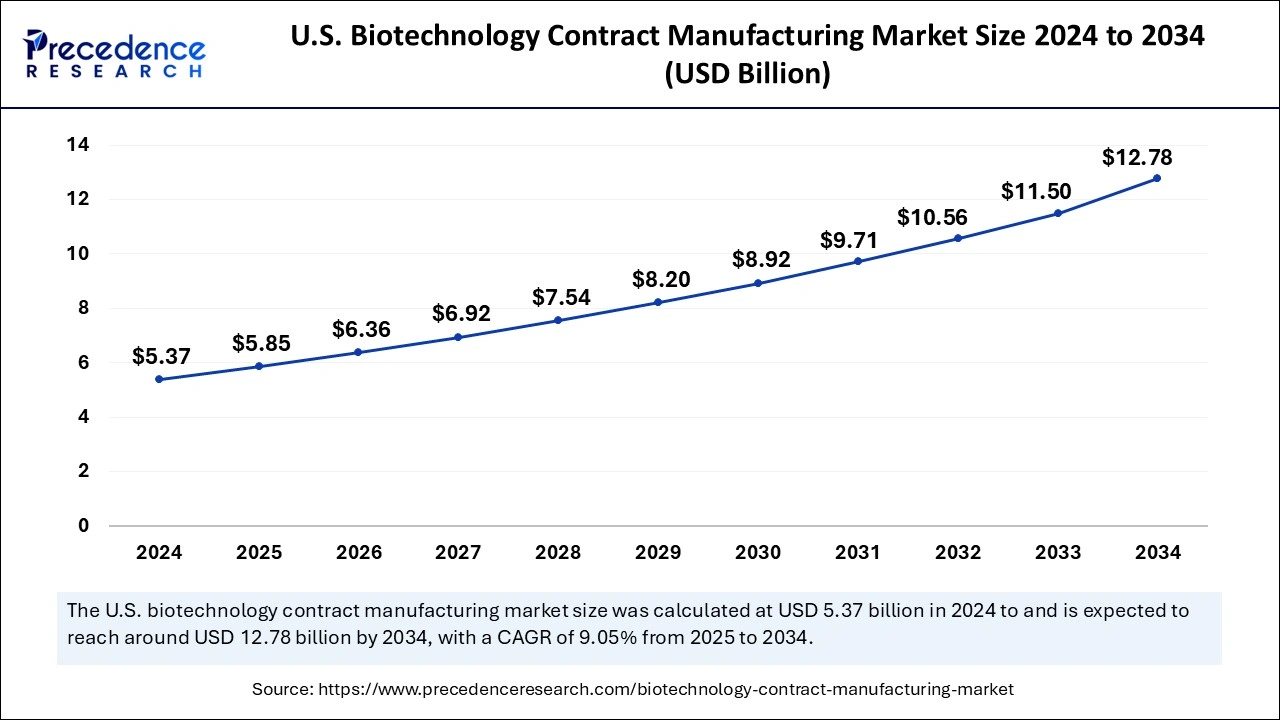

The U.S. biotechnology contract manufacturing market size was exhibited at USD 5.37 billion in 2024 and is projected to be worth around USD 12.78 billion by 2034, growing at a CAGR of 9.05% from 2025 to 2034.

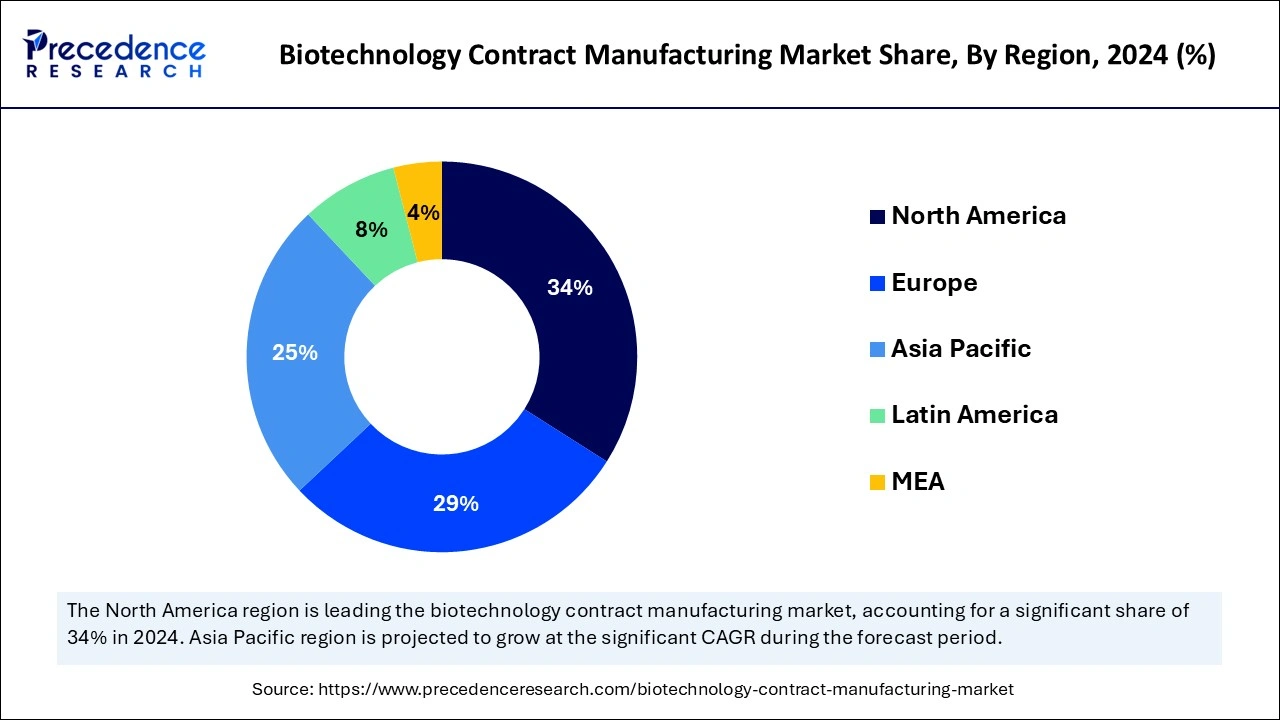

North America dominated the global biotechnology contract manufacturing market in 2024. The growth of the region is attributed to the rising approval of regularity in countries like the United States and Canada. Additionally, these countries are known for their technological presence, which enhances the adoption of advanced biomanufacturing technologies. These countries often focus on the adoption of skilled healthcare professionals, which provides significant opportunities for new drug innovation and healthcare solutions.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The growth of the region is attributed to the growth of biopharmaceutical manufacturing capacities in countries like China, Japan, and India. Additionally, large-scale production is often considered cost-effective as compared to other regions. The rising R&D investments are also anticipated to attract more market demand in the upcoming years.

Biotechnology contract manufacturing (CMO) deals with outsourcing biopharmaceuticals, biologics, and other biotech products to third-party companies. These companies provide the infrastructure and expertise required for the production of these products, which include manufacturing services and many more. The biotechnology contract manufacturing market is growing rapidly due to the growing demand for pharmaceuticals. This helps biotech companies execute the manufacturing process with these facilities without the need for additional things.

| Report Coverage | Details |

| Market Size by 2034 | USD 49.06 Billion |

| Market Size by 2025 | USD 22.93 Billion |

| Market Size in 2024 | USD 21.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.82% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Type, Scale, Source, Molecule, Therapeutic Area, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth in bioprocessing technologies

The use of living organisms and their components is playing a significant role in providing higher efficiency in the production of biopharmaceuticals. The biotechnology contract manufacturing market is growing rapidly due to the growth in single-use bioprocessing systems, which lower operational costs and increase flexibility in production. The technologies have also developed continuous processing that increases the productivity rate and fulfills the market demand. The market is also witnessing several investments in downstream processing that can increase the purity of the biologics.

Rising demand for cost-effective solutions

Biologics are one of the fastest-growing drugs that are witnessing significant market demand, which often increases the competitiveness of the pharmaceutical industry. The biotechnology contract manufacturing market stands out with several benefits that allow the companies to eliminate the upfront costs and focus on the development of solutions. This helps them innovate several solutions without the need for in-house infrastructure that helps the companies access advanced technologies and increase their production capacity.

Intellectual property challenges

The biotechnology contract manufacturing market relies on third-party companies, which often increases the risk of property misuse or other thefts. These factors are often acting as a market restraint that can hamper the adoption of CMOs. This increases the requirement for safeguards, which often increases overall operational costs.

Adoption of personalized therapy

The rising prevalence of various health conditions demands specific therapies in different fields like oncology, rare genetic disorders, and many more. The demand for specific therapies is being adapted based on lifestyles, medical history, and other factors. The biotechnology contract manufacturing market is growing rapidly due to the rising demand for various therapies like gene therapy, cell therapy, and many more. These therapies are considered personalized therapies due to the involvement of special facilities in gene editing and the production of biologics.

Increasing regulatory support

The rising demand for pharmaceuticals is attracting significant attention from regulatory bodies like the FDA, EMA, and others, which are focusing on the development of biologics and gene and cell therapies. The biotechnology contract manufacturing market is anticipated to expand significantly due to technological advancements that increase the development of personalized solutions. Additionally, the rising health conditions are also enhancing the rules and regulations in the healthcare industry that support risk management.

The manufacturing segment marked its dominance by registering the highest share in 2024. The segment involves the production of biologics like monoclonal antibodies, biosimilars, and vaccines on a large scale. The biotechnology contract manufacturing market is witnessing rapid demand due to the rise of biologics that are attracting significant advancements in biopharmaceuticals. These advancements in the manufacturing sector are enhancing the capabilities to perform in various domains. The increasing demand plays an impactful role in reducing manufacturing costs, making it affordable for businesses.

The formulation and fill-finish segment is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The segment deals with the final stage of drug manufacturing which provides the drugs for patients to use. The market is growing due to the rising demand for personalized medicines like gene and cell therapy that require enhanced packaging and formulation. The rising safety standards lead to the enhancement of the formulation processes.

The biologic drug substance manufacturing segment stood dominant over the global biotechnology contract manufacturing market in 2024. The dominance of the segment is attributed to the growing production demand for substances like recombinant proteins, which are produced by expertise and skilled professionals. The demand for bioreactors plays a significant role in the growth of the market.

The biologic drug product segment is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The demand for biologic drug products is attributed to the rising regulatory approval, which requires stabilizers and preservatives to finalize the creation of the product. The adoption of CMOs is rapidly increasing, and these procedures are used to avoid higher investments that can be effective and profitable for the companies. Additionally, the growing demand for injectables is anticipated to attract more revenue for the companies in the coming years.

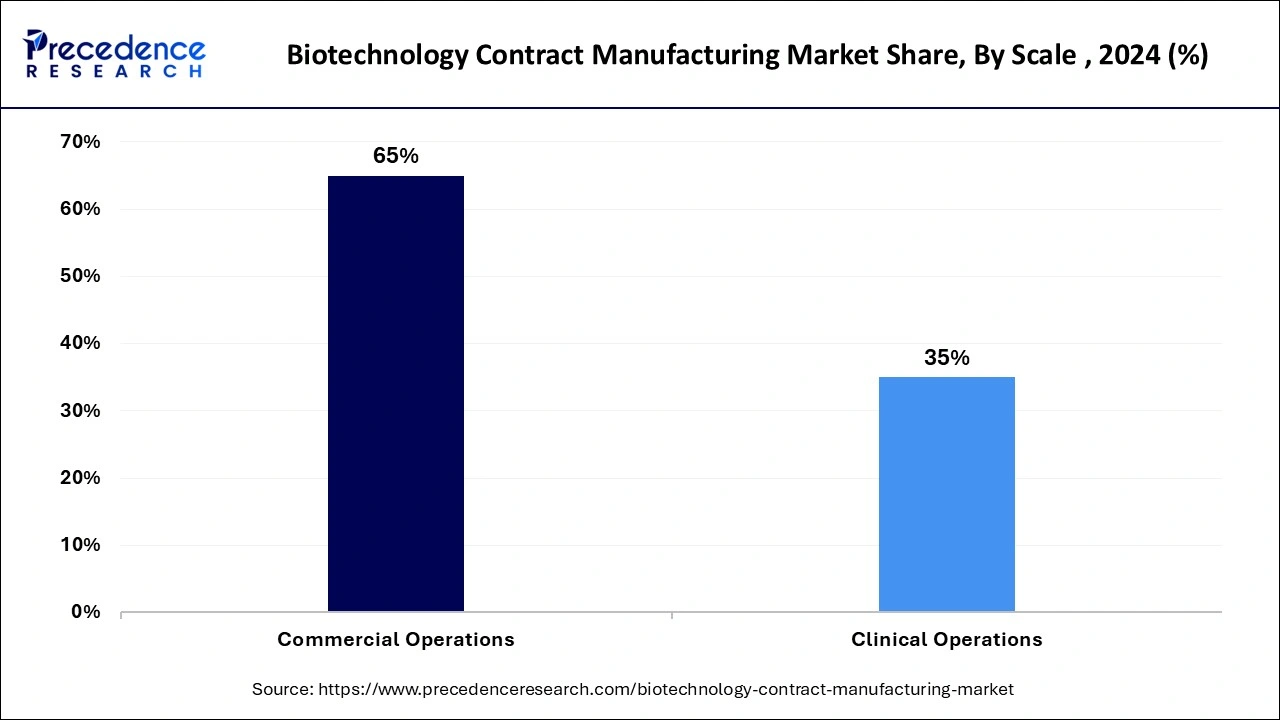

The commercial operations segment marked its dominance by registering the highest revenue share in 2024. The segment deals with the production of medical drugs that have already been approved by regulatory bodies. The biotechnology contract manufacturing market is growing rapidly due to the growth in demand for biologics. Additionally, the brands mark a significant image among the patients, which enhances their sales and leads to long-term contracts. The rise of e-commerce also plays a significant role in the expansion of these businesses, which helps increase market growth.

The clinical operations segment is anticipated to grow at the highest CAGR during the forecast period 2025 to 2034. The segment refers to the manufacturing of biologics that are only to be used for clinical trial purposes. The market is growing rapidly due to the rising investment in R&D that focuses on biologic drug innovation. The healthcare sector is witnessing significant demand due to the expansion of laboratories that focus on innovating new medicines as per the industry demand.

The mammalian expression segment marked its dominance by contributing to the highest revenue share in 2024. The segment refers to the use of various cells like HEK, NS0, CHO, and others to produce biological drugs. There is a rising demand for monoclonal antibodies, which are used in these cells for production. Additionally, the rising requirement for glycosylation and folding is playing a crucial role in contributing to the growth of the biotechnology contract manufacturing market. The growing advancements also help in the acceptance from the regulatory body, which is marking more advancements.

The non-mammalian expression segment is anticipated to grow at the highest CAGR from 2025 to 2034. The segment refers to the use of bacteria like insect cells and plant-based systems to produce biological drugs. The reason behind the rapid growth is attributed to the cost-effectiveness of these sources, which makes them more affordable for use in various fields. The market is anticipated to gain more popularity due to the advancements in protein folding.

The monoclonal antibodies segment stood the dominant as it generated the highest revenue share in 2024. These molecules are produced in labs and are used to fight diseases like cancer through the improvement of the immune system. The biotechnology contract manufacturing market is growing rapidly due to the rising prevalence of cancer and autoimmune diseases.

The cell and gene therapy segment is anticipated to grow at the highest revenue share in 2024. These therapies use live cells and genetic material to cure diseases. The growing demand for CAR-T cell therapies is playing a significant role in attracting demand for personalized therapies. This demand is anticipated to attract more investments, which will help the market grow in the upcoming years.

The oncology segment stood the dominant by generating the largest share of the biotechnology contract manufacturing market in 2024. The segment is growing rapidly due to the rising prevalence of cancer among individuals, which boosts the demand for biologic therapies. For instance, according to the American Cancer Society, around 2 million Americans are estimated to be diagnosed in 2025. This is attracting several investments towards the growth of these drugs that can be used to cure these patients.

The infectious diseases segment is expected to grow at the highest CAGR from 2025 to 2034. The growth of the segment is attributed to the rising government focus on developing drugs and healthcare solutions for infectious diseases. This is helping the companies to adopt and innovate new solutions that will help them in their business growth.

By Service

By Type

By Scale

By Source

By Molecule

By Therapeutic Area

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

January 2025