April 2025

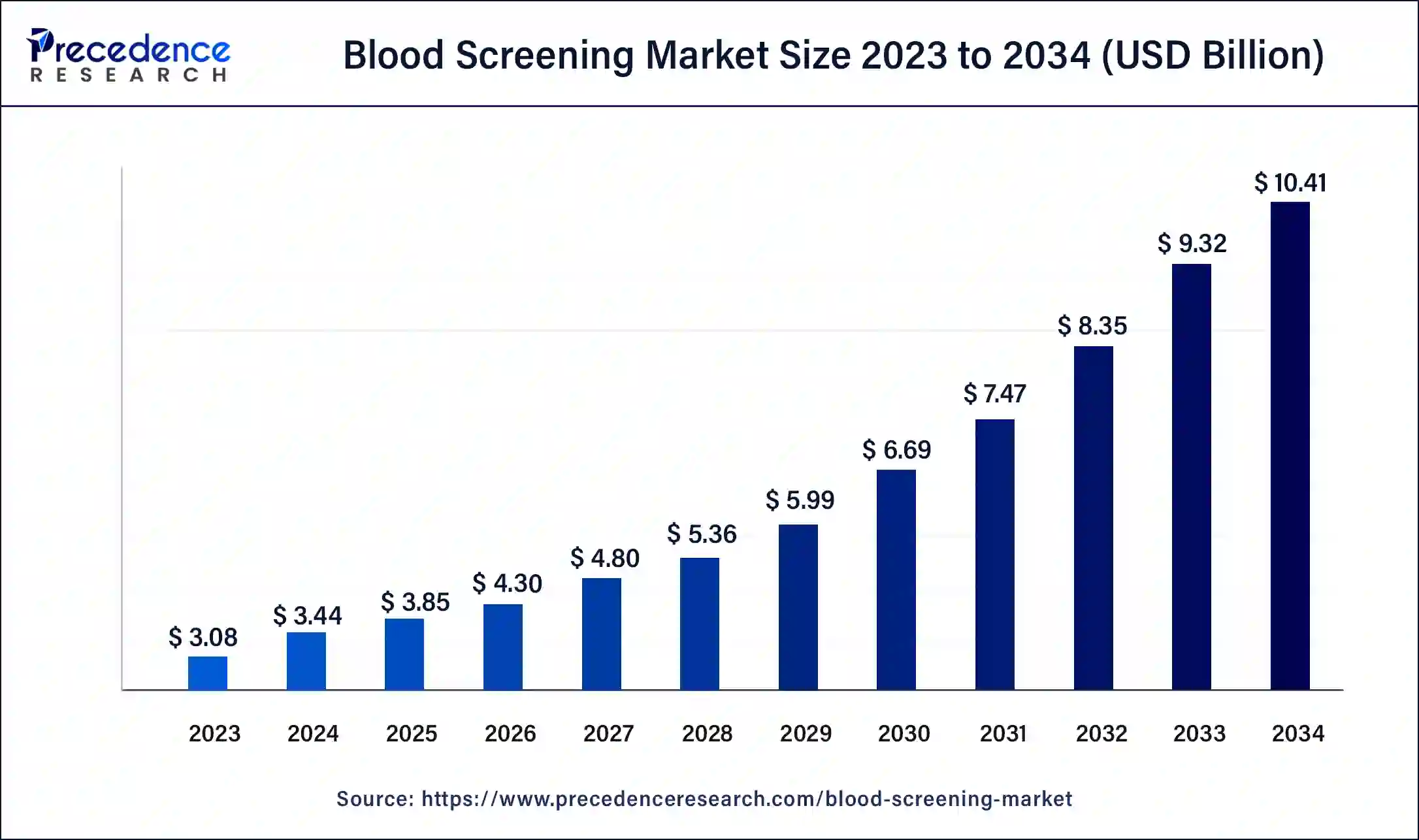

The global blood screening market size was USD 3.08 billion in 2023, calculated at USD 3.44 billion in 2024 and is projected to surpass around USD 10.41 billion by 2034, expanding at a CAGR of 11.7% from 2024 to 2034.

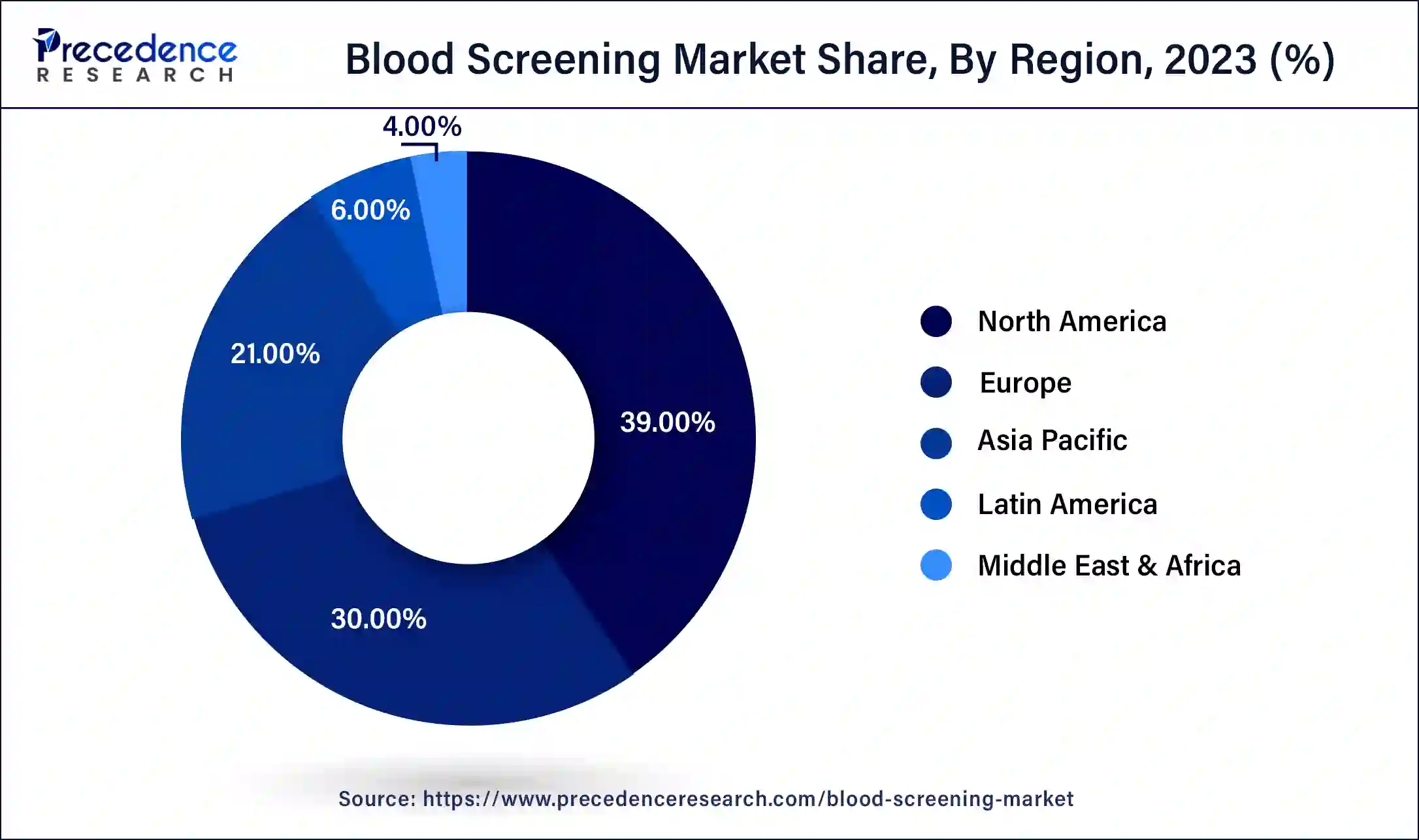

The global blood screening market size accounted for USD 3.44 billion in 2024 and is expected to be worth around USD 10.41 billion by 2034, at a CAGR of 11.7% from 2024 to 2034. The North America blood screening market size reached USD 1.20 billion in 2023.

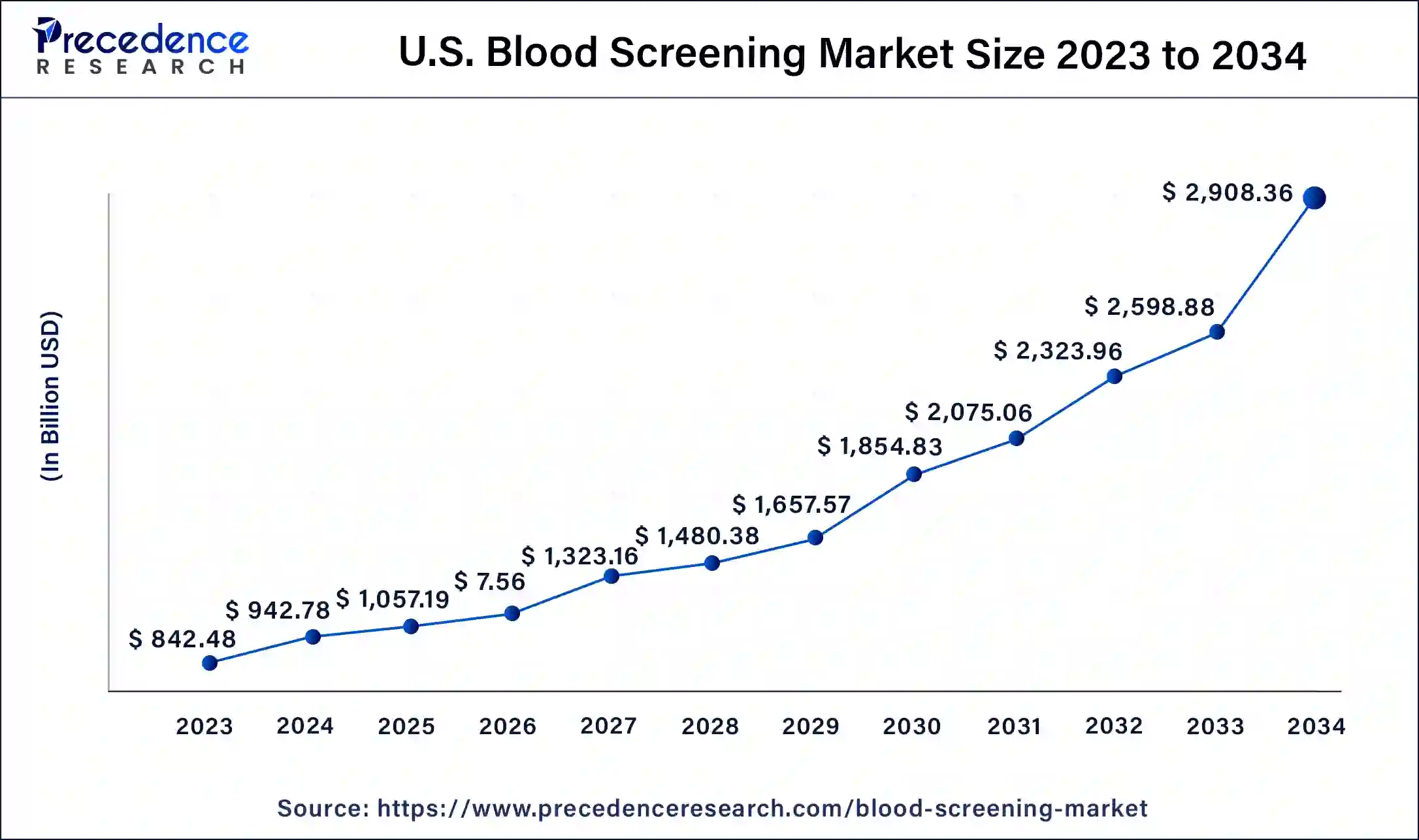

The U.S. blood screening market size was estimated at USD 842.48 million in 2023 and is predicted to be worth around USD 2,908.36 million by 2034, at a CAGR of 11.9% from 2024 to 2034.

North America has held the largest revenue share of 39% in 2023. North America holds a major share in the blood screening market due to a combination of advanced healthcare infrastructure, high healthcare expenditure, and robust regulatory frameworks. The region's emphasis on preventive healthcare and routine screenings, coupled with a well-established network of diagnostic laboratories and healthcare facilities, contributes to market dominance. Additionally, ongoing technological innovations and the presence of key market players further propel North America as a leader in blood screening, ensuring widespread adoption of advanced screening technologies and services.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the blood screening market due to its substantial population, rising healthcare awareness, and increasing prevalence of diseases. The region experiences robust economic growth, enabling greater healthcare investments. Moreover, government initiatives promoting preventive healthcare and the implementation of advanced technologies contribute to the market's expansion. The growing demand for diagnostic services, coupled with improving healthcare infrastructure, positions Asia-Pacific as a significant player in the blood screening market, with the potential for further growth and innovation in the coming years.

Blood screening is a vital medical procedure involving the analysis of blood samples to detect and pinpoint various health conditions and irregularities. This diagnostic method furnishes valuable insights into an individual's overall health, aiding in the early identification, prevention, and management of diseases. It encompasses the examination of blood cell counts, the identification of infectious agents like viruses and bacteria, and the measurement of different chemical levels, including cholesterol and glucose.

The significance of blood screening lies in its role as a comprehensive health evaluation tool, enabling healthcare professionals to spot potential issues before symptoms manifest. Routine blood screening is indispensable for diagnosing conditions such as anemia, diabetes, infections, and various cardiovascular diseases. Ongoing technological advancements and the development of specialized blood tests continually enhance the precision and efficiency of screening methods, contributing to improved patient outcomes. Regular blood screening is foundational in proactive healthcare, facilitating timely interventions and fostering overall health and wellness.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 11.7% |

| Market Size in 2023 | USD 3.08 Billion |

| Market Size in 2024 | USD 3.44 Billion |

| Market Size by 2034 | USD 10.41 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology and By Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing disease prevalence and government initiatives

Increasing disease prevalence and government initiatives play pivotal roles in surging the demand for blood screening in the healthcare market. As the global burden of diseases continues to rise, especially with the growing incidence of cardiovascular conditions, cancers, and infectious diseases, there is an escalating need for early detection and proactive healthcare measures. This trend is a key driver for the blood screening market, as routine screenings enable timely intervention and management of these health issues. Government initiatives further amplify market demand by promoting regular health check-ups and implementing screening programs.

Supportive healthcare policies, public health campaigns, and strategic investments contribute to creating awareness and facilitating easier access to blood screening services. Governments worldwide recognize the significance of preventive healthcare, and their proactive measures not only address the rising disease prevalence but also bolster the overall growth and accessibility of blood screening, thereby enhancing public health outcomes.

Ethical concerns and infrastructure challenges

Ethical concerns and infrastructure challenges pose significant restraints to the blood screening market. Ethical considerations, particularly regarding the use of genetic information, may lead to hesitancy among individuals, impacting their willingness to undergo certain blood screening tests. Concerns about potential discrimination based on screening results further contribute to reservations about participating in screening programs. Infrastructure challenges, especially in developing regions, hinder the seamless integration of advanced blood screening technologies. Inadequate healthcare infrastructure limits accessibility to screening services, particularly in rural areas where the availability of sophisticated diagnostic tools and trained healthcare professionals may be scarce. The lack of proper infrastructure also impedes the efficient collection, processing, and analysis of blood samples, affecting the overall effectiveness of screening programs. Addressing these ethical and infrastructural barriers is essential for ensuring equitable access to blood screening services and realizing the full potential of early disease detection and prevention.

Point-of-care testing expansion and disease-specific screening programs

The expansion of point-of-care testing (POCT) in the blood screening market creates significant opportunities by addressing the growing demand for convenient and immediate diagnostics. POCT enables real-time results, reducing turnaround times and facilitating quicker decision-making in healthcare settings. This trend opens avenues for increased accessibility to blood screening, especially in remote or resource-limited areas, and enhances patient engagement by providing timely and on-the-spot diagnostic information. Furthermore, the development of disease-specific screening programs is a strategic opportunity in the blood screening market. Tailoring screening initiatives to target specific diseases, whether genetic disorders or infectious diseases, allows for more precise and targeted diagnostic approaches. This not only enhances the effectiveness of blood screening but also contributes to a proactive healthcare approach, emphasizing early detection and intervention. The customization of screening programs aligns with the broader trend of personalized medicine, presenting opportunities for specialized diagnostic services that cater to the unique needs of individuals and specific health conditions.

In 2023, the NAT segment had the highest market share of 41% on the basis of the technology. The Nucleic Acid Amplification Test (NAT) segment in the blood screening market involves the detection of genetic material, providing highly sensitive and specific results. NAT has gained prominence due to its effectiveness in detecting infections, including HIV and hepatitis, with improved accuracy. As a trend, the increasing demand for early detection of infectious diseases and the continuous advancements in molecular diagnostics contribute to the growth of the NAT segment. Its ability to identify infections during the early stages enhances its utility in blood screening protocols, supporting comprehensive healthcare initiatives.

The ELISA segment is anticipated to expand at a significant CAGR of 12.1% during the projected period. Enzyme-Linked Immunosorbent Assay (ELISA) is a widely used technology in the blood screening market. It involves detecting antibodies, antigens, or proteins using an enzyme reaction. ELISA's high sensitivity and specificity make it valuable for disease detection and monitoring. A trend in ELISA technology involves continuous refinements, enhancing its precision and efficiency. Advancements such as automated ELISA systems and multiplexing capabilities are gaining prominence, allowing simultaneous analysis of multiple biomarkers. These trends contribute to the overall growth and utility of ELISA in blood screening applications.

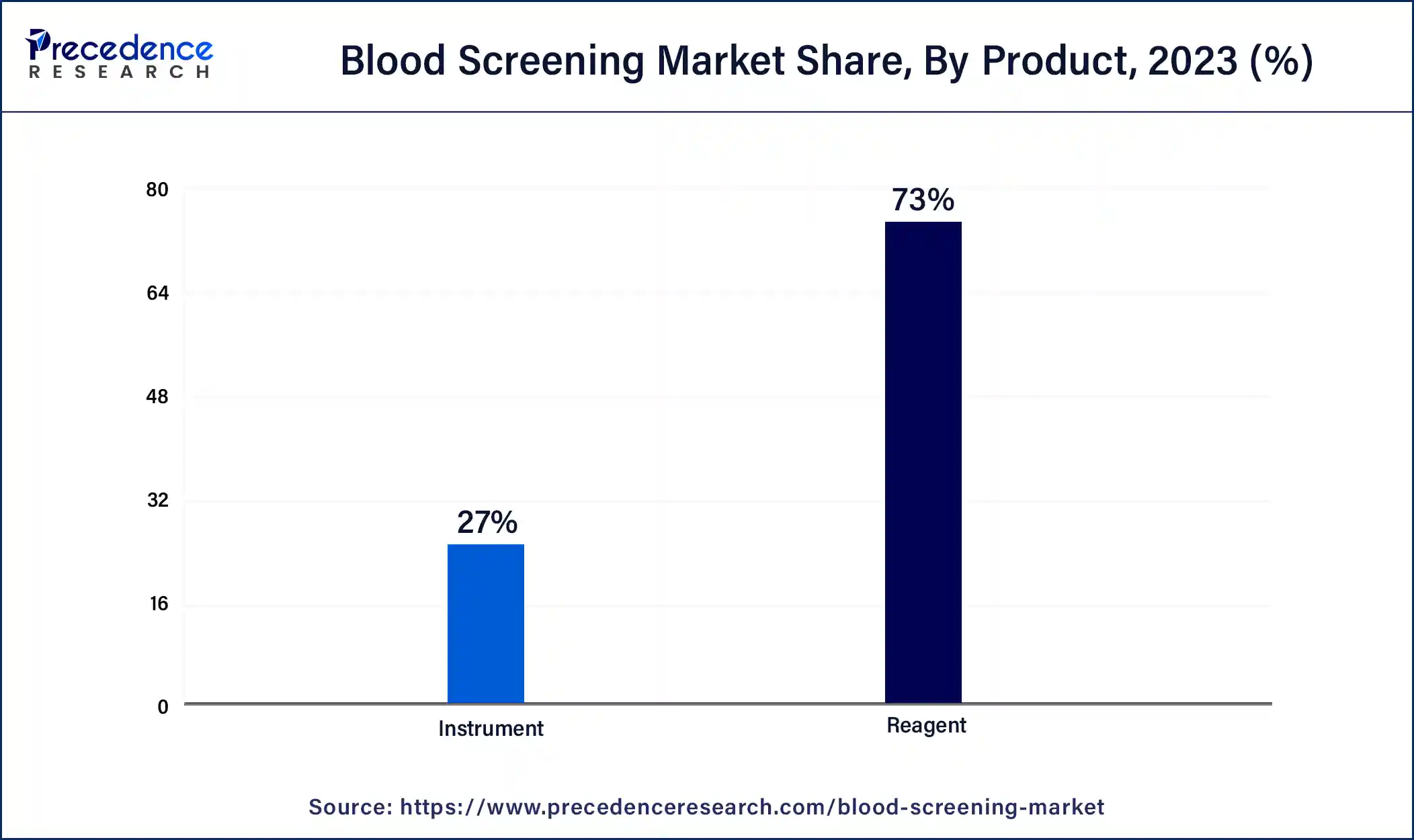

According to the product, the reagent segment has held a 73% revenue share in 2023. In the blood screening market, the reagent segment encompasses essential substances used in diagnostic tests to elicit specific reactions for accurate results. Reagents play a pivotal role in various blood screening assays, including those for infectious diseases and blood typing. A notable trend in this segment involves continuous advancements in reagent formulations to enhance sensitivity, specificity, and overall test performance. Manufacturers are focusing on developing innovative reagents that contribute to the precision and efficiency of blood screening processes, meeting the increasing demand for reliable diagnostic solutions in healthcare settings.

The instruments segment is anticipated to expand fastest over the projected period. In the blood screening market, the instruments segment refers to the hardware and equipment used for analyzing blood samples. This includes sophisticated analyzers, diagnostic tools, and testing devices essential for conducting various blood screening tests. A notable trend in this segment involves continuous technological advancements, leading to the development of high-throughput analyzers and point-of-care testing instruments. These innovations aim to enhance the accuracy, efficiency, and accessibility of blood screening, catering to the growing demand for rapid diagnostics and improving overall healthcare outcomes.

Segments Covered in the Report

By Technology

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

August 2024

March 2024