January 2025

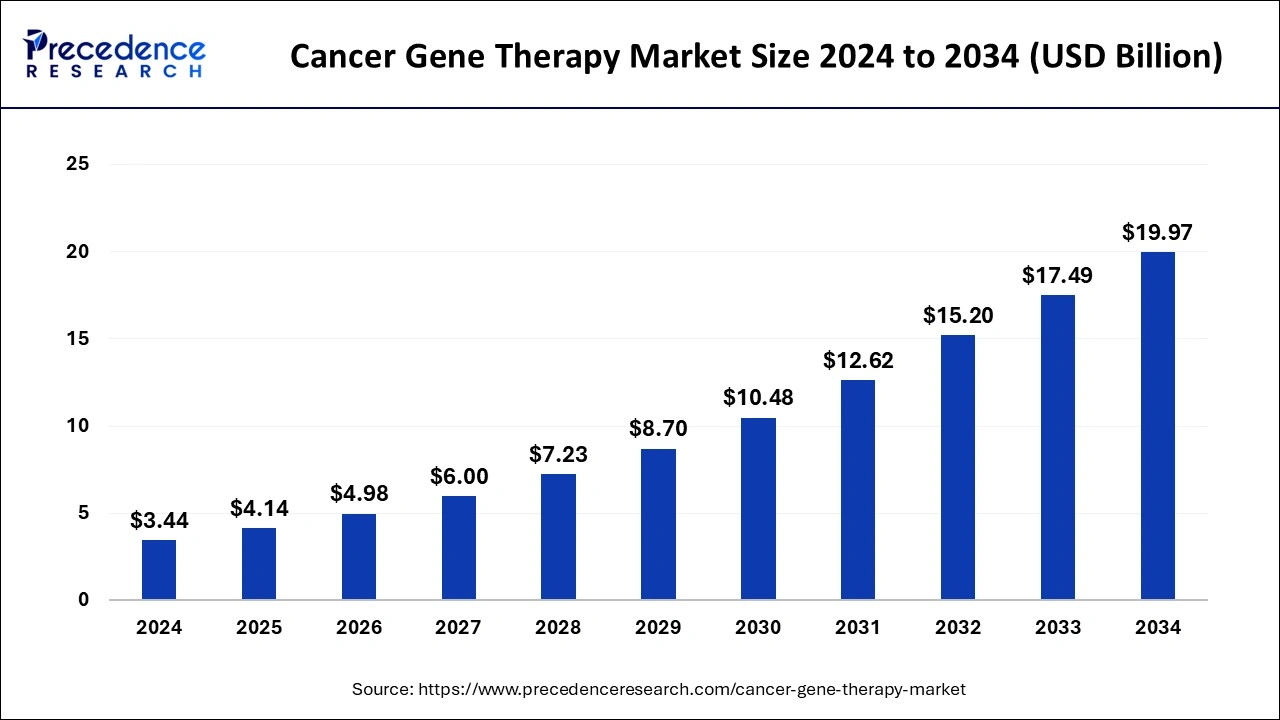

The global cancer gene therapy market size is calculated at USD 4.14 billion in 2025 and is forecasted to reach around USD 19.97 billion by 2034, accelerating at a CAGR of 19.23% from 2025 to 2034. The North America cancer gene therapy market size surpassed USD 2.13 billion in 2024 and is expanding at a CAGR of 19.24% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cancer gene therapy market size was estimated at USD 3.44 billion in 2024 and is projected to hit around USD 19.97 billion by 2034, poised to grow at a CAGR of 19.23% during the forecast period from 2025 to 2034.

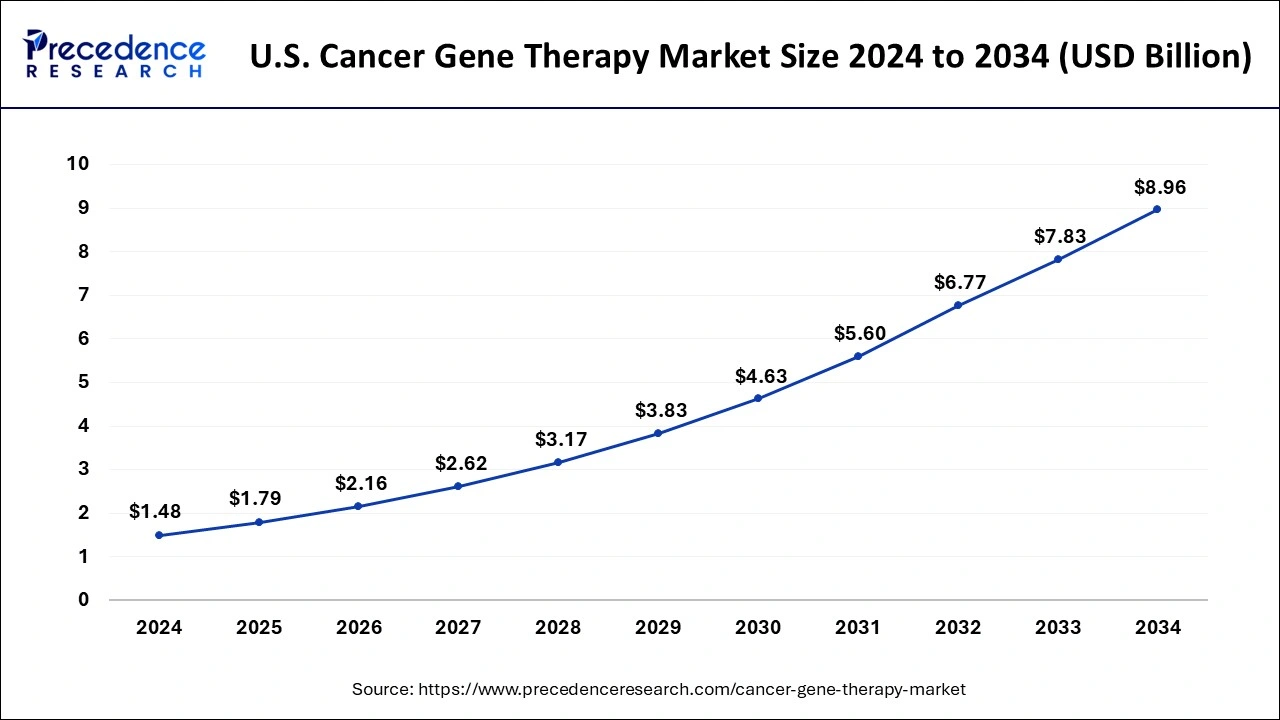

The U.S. cancer gene therapy market size was estimated at USD 1.48 billion in 2024 and is projected to surpass around USD 8.96 billion by 2034 at a CAGR of 19.73% from 2025 to 2034.

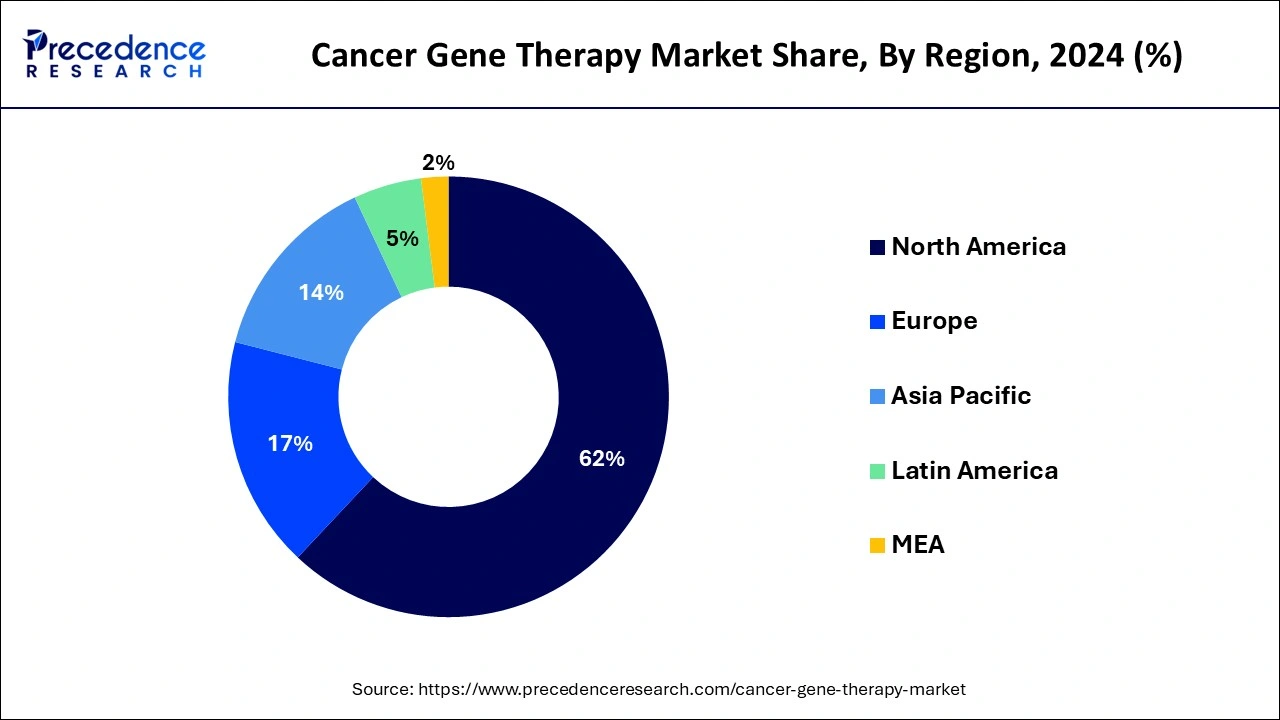

The cancer gene therapy market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America held the largest share of the global cancer gene therapy market in 2024. The U.S. held the largest share followed by Canada and Mexico in 2023. North America is the most technically advanced continent owing to the presence of nations with high gross domestic product (GDP), the existence of favorable economic policies, an ecosystem of well-established biopharmaceutical infrastructure, and early adoption of advanced medical technologies.

The European cancer gene therapy market is segmented into Germany, France, the United Kingdom, Italy, and the Rest of Europe. The awareness of the advantages of cancer gene therapies is considerably high across the European region. Germany is expected to hold the largest share in the Europen cancer gene therapy market during the study period. General government spending in the European Union (EU) on health accounted for $1,273.68 (€1,073 billion) or 8.0 % of the gross domestic product (GDP) in the financial year 2020. In June 2022, Elicera Therapeutics AB, a clinical-stage cell and gene therapy company received funding of $2.67 million (€2.5 million) from the European Innovation Council (EIC) Accelerator Programme. Rising funding in the medical domain is anticipated to support the cancer gene therapy market remarkably.

The cancer gene therapy market in the Asia Pacific (APAC) region is segmented into India, China, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. China dominated the Asia Pacific region followed by Japan and India in 2023.

The Latin America, Middle East, and African (LAMEA) cancer gene therapy market is segmented into North Africa, South Africa, Saudi Arabia, Brazil, Argentina, and the Rest of LAMEA. The Middle East and the Latin America region are anticipated to have notable growth in the cancer gene therapy market during the forecast period. Brazil held the largest share in the LAMEA region in 2023. Due to low literacy, uncertainty, and civil war in African countries, the cancer gene therapy market in Africa is expected to grow at a comparatively slow rate.

Cancer is a group of diseases that involve abnormal cell growth which can spread to respective parts of the body. Cancer can spread throughout the human body. Gene therapy is a kind of treatment in which the genes that are not normal or are missing in the patient’s cells are replaced with normal genes. Cancer gene therapy is a technique for treating cancers where the therapeutic DNA is introduced in the gene of the individual suffering from cancer.

Due to a high success rate in preclinical as well as clinical trials, cancer gene therapy is gaining high popularity all over the world. There are numerous techniques utilized in cancer gene therapy. In one of the gene therapy techniques, either the mutated gene is replaced with a healthy gene, or the gene is inactivated if its function is abnormal. In a newly developed technique, new genes can be introduced in the body of the patient to help fight against cancer cells.

Further, the ongoing extensive research and development (R&D) strategies implemented by biopharmaceutical firms for producing novel therapeutic drugs are driving the market growth notably.

The market players can aim towards expansions, collaborations, joint ventures, acquisitions, and partnerships to advance capabilities in gene therapy. This would help in yielding effective therapeutic drugs for treating different kinds of cancers. In April 2022, GSK plc announced the acquisition of Sierra Oncology for £1.6 billion ($1.9 billion). This acquisition would help GSK plc in enhancing its capabilities with respect to targeted therapies for treating rare forms of cancer.

Biotechnology firms are evaluating novel gene therapy vectors for increasing levels of protein production/gene expression, reducing immunogenicity, and improving durability.

The top cancers in terms of the count of new cases in 2020 all over the world were Lung Cancer (2,206,771 cases), Breast Cancer (2,261,419 cases), Prostate Cancer (1,414,259 cases), Colorectal Cancer (1,931,590 cases), Stomach Cancer (1,089,103 cases), and Liver cancer (905,677 cases). In 2018, there were around 134,632 new cancer cases and 89,042 cancer-related fatalities. Breast and liver cancers were among the most common tumors in terms of incidence and mortality. The high prevalence of breast cancer cases enhances the scope for CRISPR/Cas9-based gene editing for breast cancer therapy and VISA-claudin4-BikDD gene therapy.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.23% |

| Market Size in 2025 | USD 4.14 Billion |

| Market Size by 2034 | USD 19.97 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Therapy and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cancer is a leading cause of death all over the world. As per the Singapore Cancer Registry Annual Report 2019, there were 78,204 cancer cases reported in Singapore during the period from 2015 to 2019. Out of these 78,204 cancer cases, 12,940 females and 15,605 males died of cancer. Thus, such a high count of fatalities has created considerable scope for gene therapies needed for treating cancer.

The growth of the cancer gene therapy market is attributable to key factors such as the increasing demand for gene therapy and the rising incidence of cancer cases across the world. Also, with the advancements in gene therapy, it is expected to become a preferred choice for the treatment of all kinds of cancers as well as neoplastic disorders.

However, the high cost associated with respective gene therapies combined with undesirable immune responses is anticipated to hinder the cancer gene therapy market growth during the forecast period.

Moreover, in order to gain further access to the regional markets, companies can undertake various strategic initiatives including the expansion of existing product portfolio. These initiatives may result in more intensive rivalry over the forecast period. Additionally, rapidly evolving cancer gene therapies can make the existing cancer gene therapies obsolete very soon. This further intensifies the market competition among the prominent players.

Since the count of cancer gene therapy providers (suppliers) is much less in comparison to the count of buyers, the bargaining power of suppliers is notably higher as compared to the bargaining power of buyers. Owing to considerable profit margins, the threat of new entrants in the cancer gene therapy market is moderate as of now.

As per our research, the global gene therapy market was valued at $ 7.74 billion in 2023 and is predicted to account for over $38.76 billion by 2032. The global gene therapy market will grow at a CAGR of 20.2% from 2023 to 2032. Thus, with growing cancer cases and high growth in the overall gene therapy market, the cancer gene therapy market is expected to boost accordingly.

Based on therapy, the global cancer gene therapy market is segmented into gene-induced immunotherapy, oncolytic virotherapy, and gene transfer. The gene-induced immunotherapy segment held the largest market share in 2024. The gene-induced immunotherapy segment is expected to hold a significant market share during the forecast period.

The dominant share of the gene-induced immunotherapy segment is attributable to research activities aiming to decrease the prevalence of numerous forms of cancer by strengthening the immune system.

Most of the gene therapies for the treatment of cancers are structured on the basis of immunotherapy elements. For example, PROVENGE (by Dendreon Corporation) is an autologous cellular immunotherapy that is aimed at stimulating the patient’s immune system against prostate cancer.

Considering the level of efficacy and the favorable outcomes provided by oncolytic virotherapy, it is predicted to grow at the highest compounded annual growth rate (CAGR) over the study period. Among the most effective cancer treatments, oncolytic virotherapy has emerged as one of the top therapies. Oncolytic viruses are able to combat cancer cells without affecting healthy cells. Furthermore, lucrative funding for the research on oncolytic virotherapy is augmenting the oncolytic virotherapy segment growth. The researchers at the Center for Nuclear Receptors and Cell Signaling at the University of Houston got a grant of $1.8 million from the National Institutes of Health to work on oncolytic virotherapy in July 2022.

Based on end user, the global cancer gene therapy market is segmented into hospitals, biopharmaceutical companies, diagnostic centers, research institutes, and others. The biopharmaceutical companies segment had the highest revenue share in 2023. The biopharmaceutical companies segment is expected to dominate the market during the study period.

This growth of the biopharmaceutical companies segment is attributable to the rising global prevalence of distinct kinds of cancers owing to various environmental, hereditary, and lifestyle risk parameters.

The growing adoption of elemental gene therapy alternatives by biopharmaceutical firms to formulate cancer therapeutic regimes is propelling segment growth. Many novel gene therapies are under distinct phases of trials and biopharmaceutical companies are working to market them in different continents all over the world.

The biopharmaceutical companies segment is also estimated to be the fastest-growing segment over the forecast period. The rising prevalence of malignant tumors is a significant factor that is accelerating the market growth. Also, the growing interest in oncology therapeutics research and development (R&D) activities has led to an increase in the count of U.S. food and drug administration approvals of gene therapy drugs. Abecma, Tecratus, and Kymriah are some of the recently approved FDA gene therapy medications.

By Therapy

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

September 2024

October 2024