September 2024

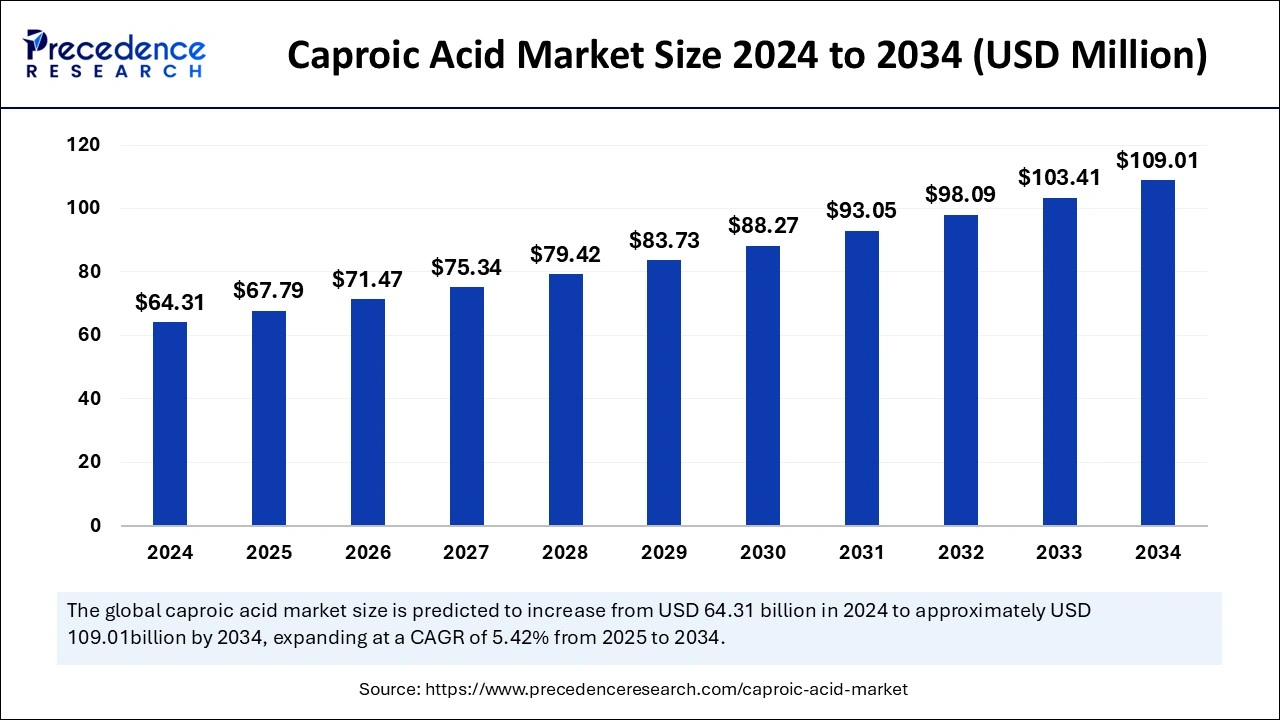

The global caproic acid market size is accounted at USD 67.79 million in 2025 and is forecasted to hit around USD 109.01 million by 2034, representing a CAGR of 5.42% from 2025 to 2034. The Asia Pacific market size is estimated at USD 35.37 million in 2024 and is expanding at a CAGR of 5.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global caproic acid market size was estimated at USD 64.31 million in 2024 and is predicted to increase from USD 67.79 million in 2025 to approximately USD 109.01 million by 2034, expanding at a CAGR of 5.42% from 2025 to 2034. The caproic acid market is growing due to rising requirements from food, animal feed sectors, personal care applications, pharmaceutical uses, industrial needs, and the conversion to bio-based sustainable production methods.

Artificial intelligence and machine learning (ML) techniques transform the caproic acid market which enhances manufacturing methods and improves sustainability practices. Machine learning algorithms process big data series to establish important production elements including hydraulic retention period (HRT) and butyric acid content necessary for effective caproic acid synthesis. ML enables precise variable predictions and optimization allowing improved efficiency of bio-production processes while helping to reduce waste and decrease costs. The development of eco-friendly manufacturing procedures is possible due to AI-driven solutions that maintain organizations with escalating requirements for sustainable methods. The market experiences increased innovation and growth due to this technological development.

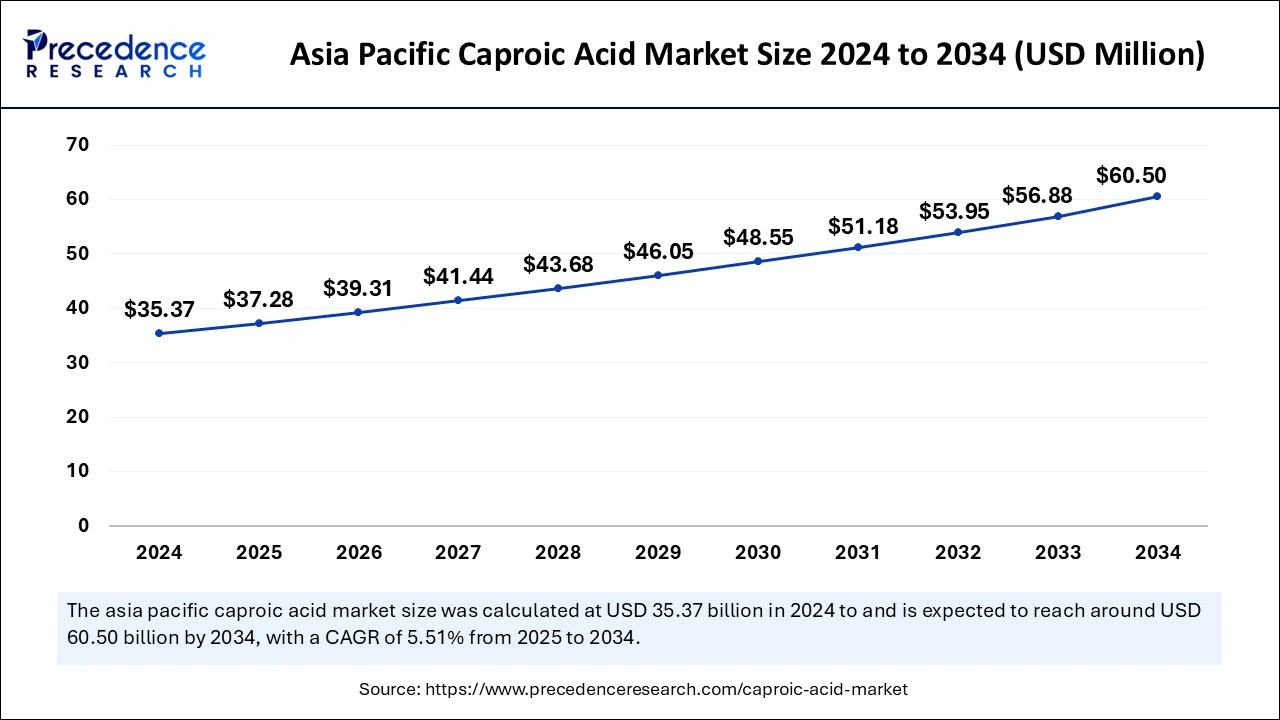

The Asia Pacific caproic acid market size was exhibited at USD 35.37 million in 2024 and is projected to be worth around USD 60.50 million by 2034, growing at a CAGR of 5.51% from 2025 to 2034.

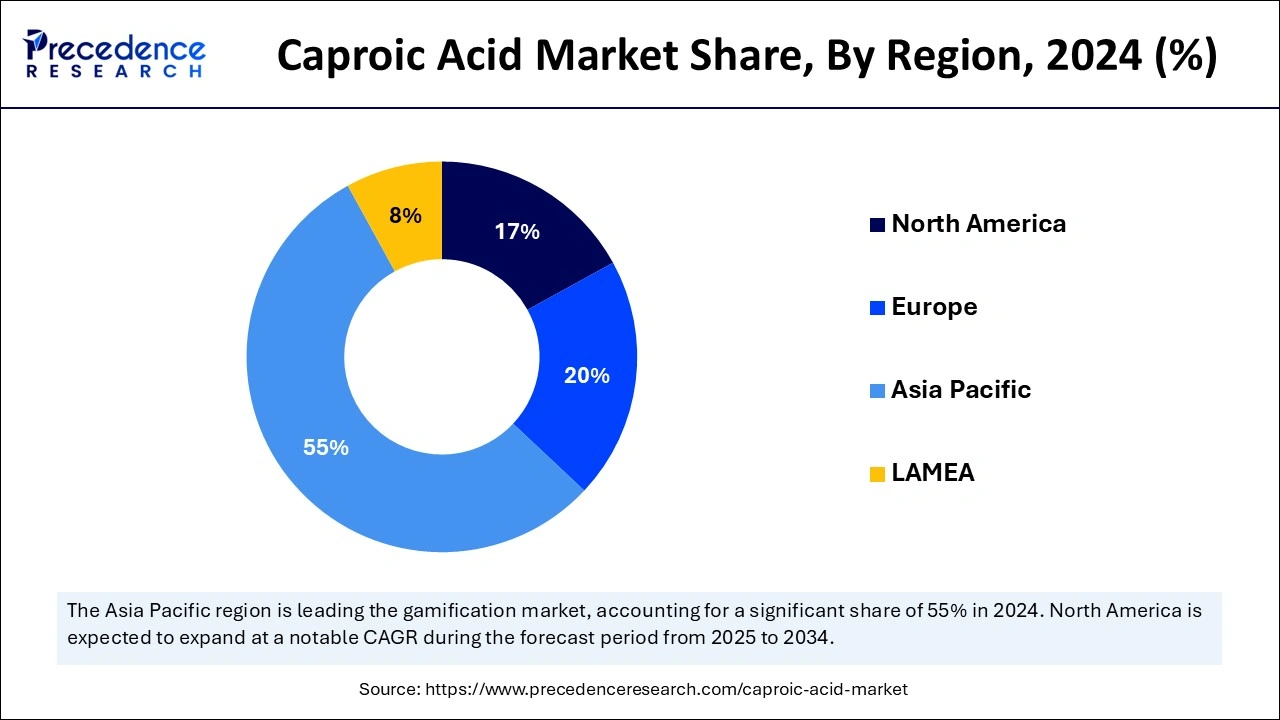

Asia Pacific accounted for the largest caproic acid market share in 2024. The local access to raw materials makes the production of caproic acid more strategic inside this region. Manufacturers who operate from this region create competitive pricing for caproic acid through their established production facilities and their low operational costs which attract both domestic and international customer base. A growing market emerged for caproic acid products because APAC consumers prioritize environmental awareness alongside their health needs. This growth has provided opportunities for the utilization of caproic acid in several end-user industries, such as personal care, pharmaceuticals, food and beverage, fertilizers, and chemicals. Various market factors will propel APAC market expansion throughout the forecast period.

North America is anticipated to witness the fastest growth in the caproic acid market during the forecasted years. The well-established food processing sector and growing consumer preference for natural sustainable ingredients contribute to market expansion in this region. Increased demand for processed and flavored food combined with the market trend toward clean-label ingredients drives caproic acid use in food and beverage production. The personal care sector within this region has started integrating caproic acid because of its dual antimicrobial and moisturizing effects leading to its essential role in natural cosmetics and personal hygiene products.

Eco-friendly and sustainable products have gained growing acceptance which stimulates manufacturers to use caproic acid throughout various industries. North American manufacturers with a strong commitment to innovation and sustainability have developed bio-based caproic acid to meet both environmental objectives and market preferences. The North American market focus on natural ingredients and sustainable practices creates a favorable environment for substantial growth in the caproic acid market throughout the upcoming years.

The fatty acid compound caproic acid serves in several industrial applications. The commercial action of the caproic acid market creates synthetic flavoring agents and perfume bases while aiding the production of bio-lubricants and personal care products using its raw material function. The need for caproic acid stems from its ability to act as an intermediate chemical, improving product formulations in fragrances and pharmaceuticals. The global demand for caproic acid depends on evolving market dynamics affecting distinct sectors through consumer shifts towards environmentally friendly natural ingredients including a rising consumer focus on biobased solutions.

The caproic acid market advances through main growth factors, personal care product requirements, and food additives demand alongside soaps and detergents and their utilization of caproic acid. The rising use of hexanoic acid as a preservative in packaged and processed foods has become the driver of market expansion because of steady market demand growth for processed food products. This demand grows because improving economic situations together with rising disposable incomes are driving consumers to choose packaged foods in developed and developing nations.

| Report Coverage | Details |

| Market Size by 2024 | USD 64.31 Million |

| Market Size in 2025 | USD 67.79 Million |

| Market Size in 2034 | USD 109.01 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.42% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising demand for processed food

Process food products continue to drive the caproic acid market expansion. Industries that generate packaged and processed food utilize this agent extensively to preserve their products. Supply and demand patterns for packaged food products from consumers within developed and developing nations drive the market growth for hexanoic acid formulation. Market growth becomes stronger due to rising food and beverage industries’ adoption of caproic acid for flavoring chemicals and as preserving agents. The market demand for frozen foods together with packaged products has steadily grown during the forecast year.

Higher demand for processed foods arises from the growth of middle-class status worldwide and the increasing number of employed women. There is a rise in the use of preservatives, including this formulation, in frozen food products. Such factors are projected to drive the market growth during the forecast period.

Rising applications in personal care products

Substantial growth in demand for natural personal care products drives manufacturer interest in incorporating the caproic acid market products into cosmetics and skincare products. The personal care segment will present a substantial growth rate throughout the forecast period. The personal care product industry takes advantage of caproic acid along with its derivatives as hexanoic acid because of its distinct characteristics. Esters made from caproic acid function as emollients in skin care products to achieve smoother textures that help skin become softer. The skin-care industry adds lotions, creams, and moisturizers with these materials to create better product texture as well as sensation on the skin surface.

As a fragrance component caproic acid along with its esters gives personal care items like perfumes, fragrances, and scented lotions their aromatic qualities. Also, hair care products where the caproic acid derivatives can be integrated into hair care formulations, including shampoos and conditioners, to provide conditioning properties and increase the texture of hair.

Stringent regulations

The caproic acid market faces obstacles because of strict industry regulations. The market is influenced by a plethora of factors, comprising stringent regulations aimed at ensuring safety and quality standards for organic compounds like caproic acid. Market growth faces obstacles from rigorous environmental laws that control chemical product manufacturing and waste management practices. These specifications demand substantial investment toward the development of eco-friendly methods and technological solutions. Manufacturers face major difficulties in complying with protective regulations that require strategies to preserve high-quality standards.

Sustainability and Innovation

The rising demand for bio-based chemicals, increasing applications in developing industries, and growing focus on sustainability. The rapidly developing green chemistry and biotechnology sectors are opportunities for the caproic acid market. The production growth in bio-based caproic acid from renewable feedstocks became a dominant force since companies adopted eco-friendly manufacturing practices. Companies need to develop these advancements because consumers demand environment-friendly products while businesses need to stay competitive. Market advancement can be accelerated by strategic investments into health-related product research and formulation development coupled with business partnerships.

The 99% caproic acid segment generated the largest caproic acid market share in 2024. Caproic acid exists in its 99% pure form with 1% of additional substances. High-purity caproic acid production occupies a critical role in food industry manufacturing because it efficiently generates desirable flavor compositions. The application of caproic acid throughout artificial flavor and fragrance production secures its leading position in industry markets.

The 98% caproic acid segment is projected to witness the fastest growth during the forecast period. With 98% purity alongside 2% impurities, the functional characteristics remain strong in this diluted 98% caproic acid formulation. The chemical properties of hexanoic acid support its function as a manufacturing base for hexyl derivatives and esters providing essential components for fragrance production and industrial manufacturing needs. The uses of 98% caproic acid include milk and cheese and manufacturers select this type of acid because of its cost-effectiveness when focusing on markets where affordability remains the primary driver of customer choice.

The flavoring and perfuming agent segment held the dominating caproic acid market share in 2024. The esterification capability of caproic acid generates hexyl acetate with other esters suitable for perfumery and flavoring applications. The characteristic odor profile of caproic acid makes it a fundamental raw material for flavor and fragrance manufacturing operations. The food and beverage sector utilizes it more frequently for dairy product flavoring agents and agents that determine flavors in baked foods and beverages. The heightened interest in organic and natural flavors among consumers continues to drive its market demand forward.

The metalworking fluid segment is estimated to witness the fastest growth in the market during the forecast period. The application of caproic acid in metalworking fluids enables better metal-cutting process cooling and provides lubrication benefits. A combination of caproic acid with metalworking fluid produces a corrosion inhibitor which protects metal surfaces from rusting while machining because its fatty acids create a protective layer on metal surfaces. The chemical adhesion of caproic acid against metal surfaces enables it to push out water molecules and oxygen which prevents rust formation.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

December 2024

August 2024