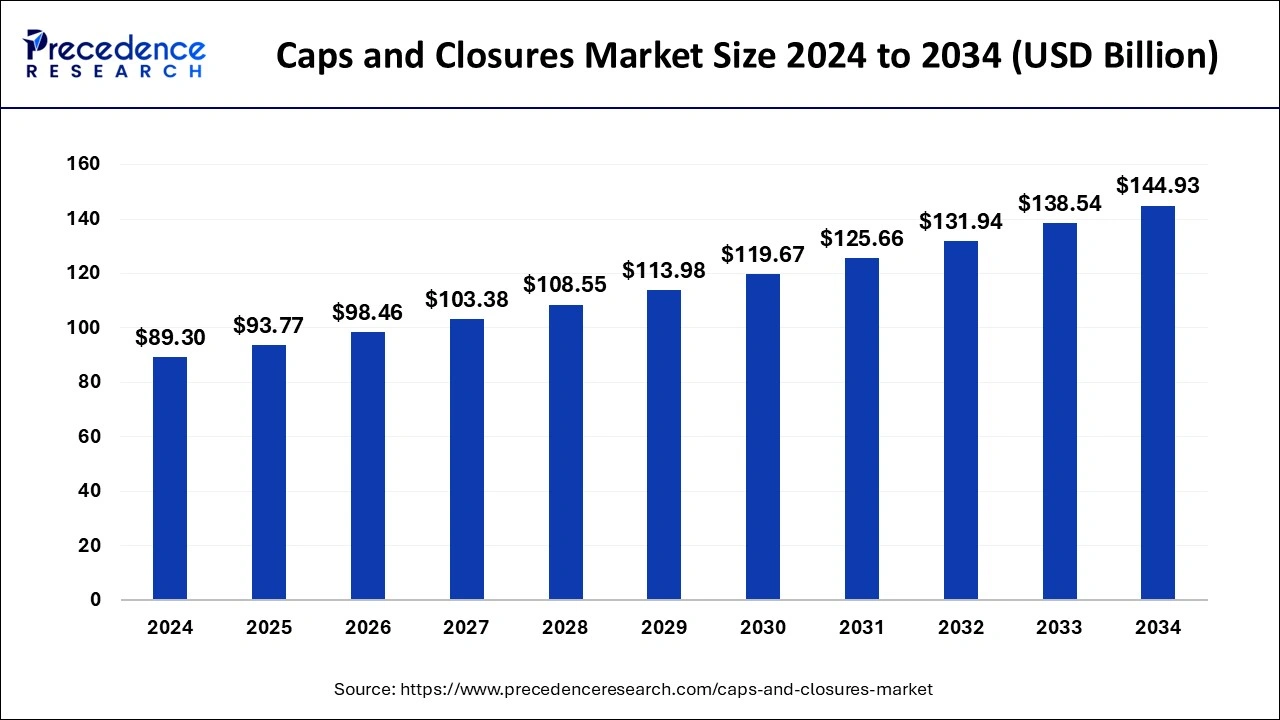

The global caps and closures market size is calculated at USD 93.77 billion in 2025 and is forecasted to reach around USD 144.93 billion by 2034, accelerating at a CAGR of 4.96% from 2025 to 2034. The Asia Pacific caps and closures market size surpassed USD 38.36 billion in 2025 and is expanding at a CAGR of 5.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global caps and closures market size was estimated at USD 89.30 billion in 2024 and is anticipated to reach around USD 144.93 billion by 2034, expanding at a CAGR of 4.96% from 2025 to 2034. The essential need of caps and closures in maintaining the ingredient safety, effectiveness, and quality in standard forms drives their demand in the growing caps and closures market.

Artificial intelligence has the potential to calculate the ideal thickness and weight of caps to minimize the usage of materials without compromising performance. Moreover, vision AI systems are involved in sorting and categorizing defective caps for recycling which promotes circular manufacturing practices. The incorporation of scannable codes and Near Field Communication Technology (NFC) is allowing caps to undergo digital experiences such as personalized messages, loyalty rewards, and games. AI algorithms can analyze consumer interaction data to make the process more engaging and effective. AI is improving quality control, enabling personalization, driving sustainability, and enhancing efficiency. AI is contributing to transform the beverage packaging industry by introducing bottle caps to consumers.

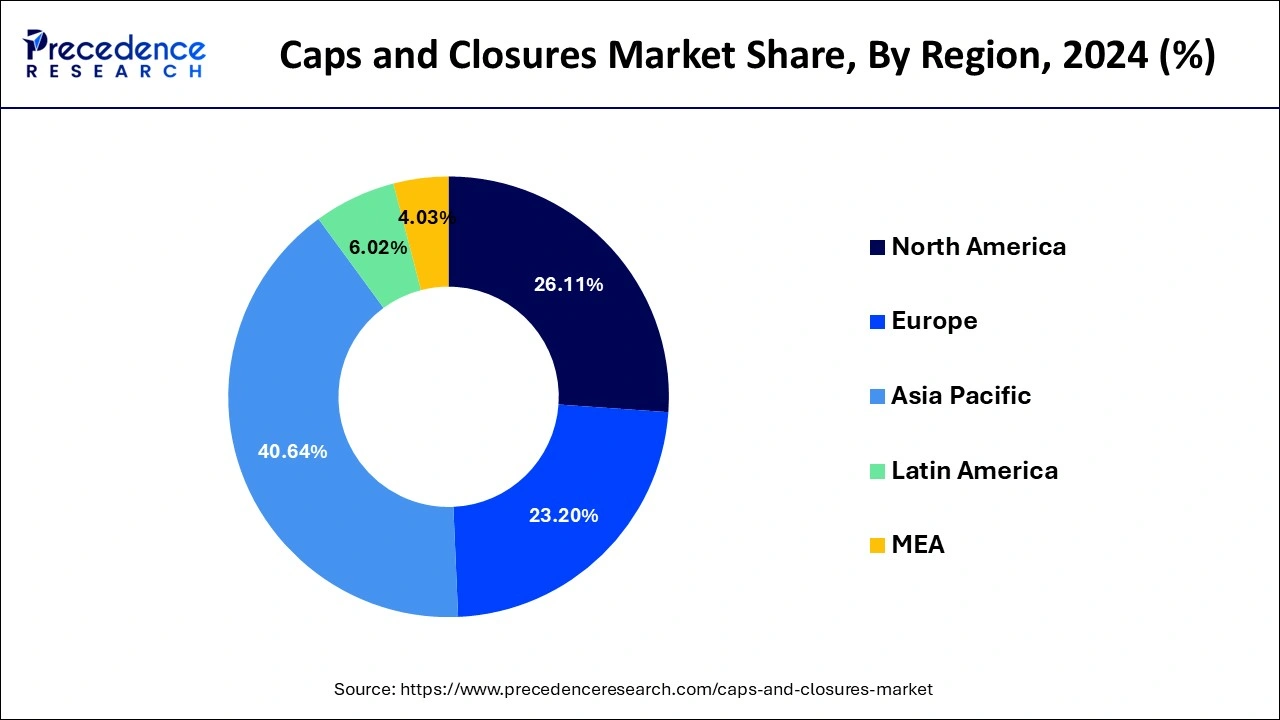

The Asia Pacific caps and closures market size was evaluated at USD 36.41 billion in 2024 and is predicted to be worth around USD 61.04 billion by 2034, rising at a CAGR of 5.30% from 2025 to 2034.

The Asia-Pacific segment accounted for 40.64% of revenue share in 2024. The Asia-Pacific caps and closures market is likely to be driven by the presence of highly populous nations like India and China, as well as the rising food and beverage industry. Moreover, the surge in demand for cosmetics and toiletries is likely to drive up use of caps and closures.

On the other hand, due to rising consumption of alcoholic and non-alcoholic beverages in nations such as the U.S. and Canada, the North America represented a major revenue share in 2024. The introduction of new types of beverages in the region is likely to boost the demand for the region’s packaging products even further.

The caps and closures serve the primary purpose of keeping the container closed and the contents contained for the designated shelf life. It also acts as a barrier against dirt, oxygen, moisture, as well as preventing the goods from being opened prematurely. In the packaging industry, the caps and closures are primarily used to protect items and extend their shelf life. The rubber, plastic, and metal are used in the caps and closures market to provide appropriate product packaging.

The caps and closures are in high demand due to the rise in demand for easy to open and sustainable packs, rapid urbanization, and demographic trends. These are commonly used in the food and beverage industry for alcoholic and non-alcoholic drinks. The caps and closures help to extend the shelf life of products, protect them from dirt and moisture, and keep the oxygen content of the packed product balanced. With the increasing demand for caps and closures, import and export have become more important.

The caps and closures market is primarily driven by the packaging industry. The major purpose of packaging is to give food and beverages a longer shelf life, as well as products that keep their texture, flavor, and test for a long period. The caps and closures aid in the process of extending product shelf life and brand promotion. Furthermore, the growing demand for packaging propels the global caps and closures market growth. The fast-moving consumer goods, cosmetics, toiletries, and pharmaceuticals contribute towards the growth of the caps and closures market. However, the price volatility of raw materials such as high-density polyethylene and polypropylene is a major constraint to the caps and closures market’s expansion.

The caps and closures are popular because of their user-friendly design, great degree of customization, and durability. The caps and closures are expected to see a significant increase in demand throughout the projection period due to their accurate closing, binding properties, and widespread popularity among consumers.

The key market players are emphasizing circular packaging with the inclusion of post-consumer resin and other recyclable materials in caps and closures. The manufacturers of caps and closures are updating their recycling initiatives as a result of this, reaching sustainability goals and attracting environmental conscious customers to the caps and closures market.

| Report Coverage | Details |

| Market Size in 2024 | USD 89.30 Billion |

| Market Size in 2025 | USD 93.77 Billion |

| Market Size in 2034 | USD 144.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.96% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product type, the plastics crew closures segment accounted largest revenue share 50.4% in 2024. The healthcare, food and beverage, personal care, and industrial products are all packaged using them. The different raw materials are used to make plastic caps and closures. The plastic caps and closures’ cost effectiveness, compatibility, and light weight all contribute to the caps and closures market’s growth.

The metal screw closures segment is estimated to be the most opportunistic segment during the forecast period. Metal screw caps and closures have threading inside that allows the container to be tightly sealed. For bottles of tonics, cough syrups, and tablets, the metal screw caps and closures are common. The moisture and infection are kept out of the medicines with these closures.

The food and beverage segment had the biggest revenue share 26.5% in 2024 and it will continue to lead the market during the forecast period. The caps and closures market is expected to develop due to increased consumption of packaged food products, ready to eat meals, and on the go snacks. The non-alcoholic beverage consumption is expected to rise, which will help the segment to expand. The introduction of functional beverages that may be packaged in plastic, metal, or glass cans is expected to fuel the expansion of the segment.

The pharmaceutical is estimated to be the most opportunistic segment during the forecast period. The caps and closures are used in the pharmaceutical industry to seal cans and bottles of vitamins, medications, and vaccinations injections. Over the forecast period, the demand for caps and closures in this segment is predicted to increase due to the rising need for senior friendly as well as child resistant closures that reduce the occurrences of unintentional consumption of over-the-counter medicines by children and infants.

The strategic partnerships, mergers and acquisitions, new product introduction and development, and agreements are among the techniques used by major companies in the business to increase their market share and presence. The key market players are also expanding existing product offers to increase competitiveness. The majority of market share is concentrated among large and medium-sized regional firms, though. To gain core competency in international and domestic markets, the majority of manufacturers are investing in product and technological innovation.

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client