List of Contents

Cardiovascular Clinical Trials Market and Forecast 2025 to 2034

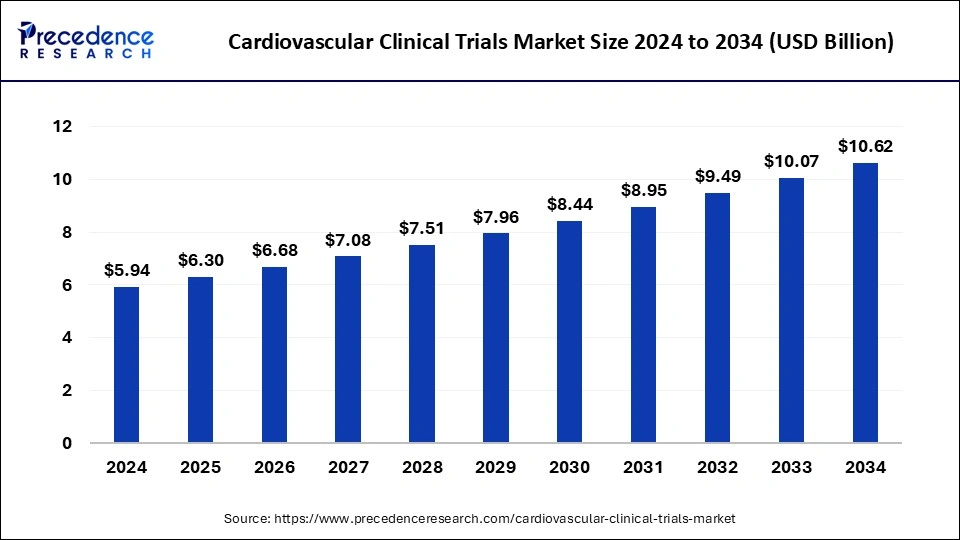

The global cardiovascular clinical trials market size accounted for USD 5.94 billion in 2024 and is predicted to increase from USD 6.30 billion in 2025 to approximately USD 10.62 billion by 2034, expanding at a CAGR of 5.98% from 2025 to 2034. The rising prevalence of cardiovascular diseases can boost the cardiovascularclinical trials market.

Cardiovascular Clinical Trials Market Key Takeaways

- The global cardiovascular clinical trials market was valued at USD 5.94 billion in 2024.

- It is projected to reach USD 10.62 billion by 2034.

- The market is expected to grow at a CAGR of 5.98% from 2025 to 2034.

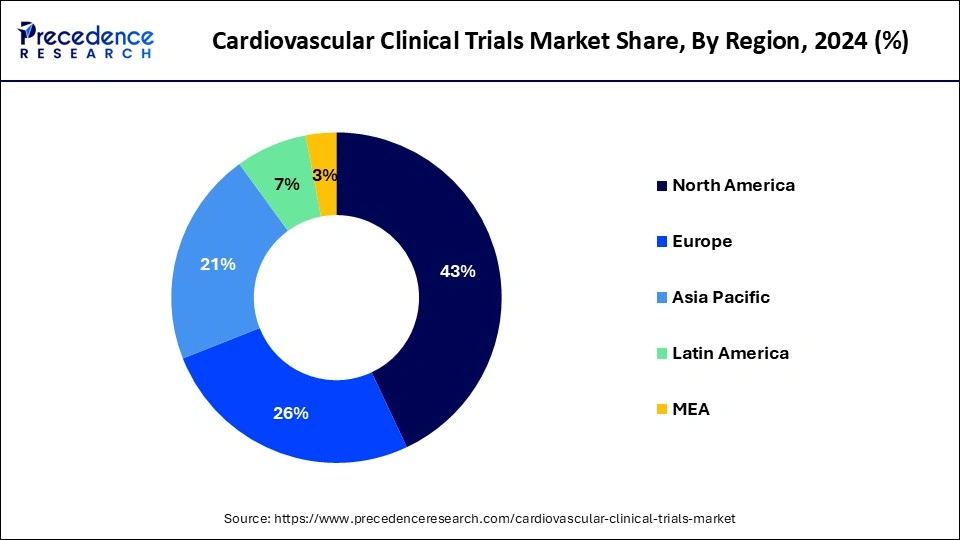

- The North America cardiovascular clinical trials market reached USD 2.55 billion in 2024 and is expected to expand around USD 4.57 billion by 2034, at a CAGR of 6.01% from 2024 to 2033.

- North America dominated the cardiovascular clinical trials market with the largest revenue share of 43% in 2024.

- Asia Pacific is expected to grow at the highest CAGR of 6.83% during the forecast period.

- By phase, the phase IV segment has generated more than 36% of revenue share in 2024.

- By phase, the Phase I segment is expected to grow at a solid CAGR of 6.82% during the forecast period.

- By study design, the interventional segment accounted for the biggest revenue share of 66% in 2024.

- By study design, the observational segment is expected to expand at the highest CAGR of 6.42% during the forecast period.

- By indication, the coronary artery disease segment has recorded more than 22% of revenue share in 2024.

- By indication, the stroke segment is projected to grow at a notable CAGR of 6.52% during the forecast period.

U.S. Cardiovascular Clinical Trials Market Size and Growth 2025 to 2034

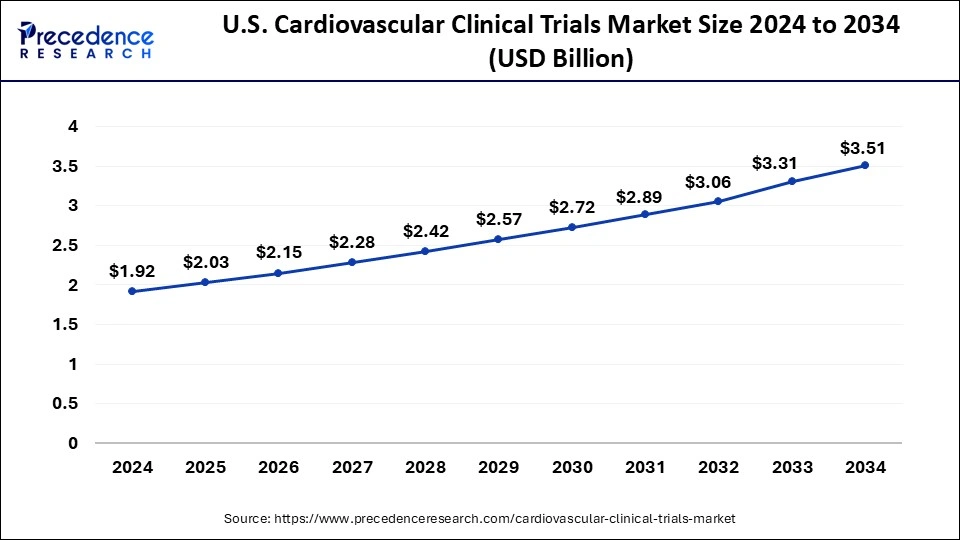

The U.S. cardiovascular clinical trials market was exhibited at USD 1.92 billion in 2024 and is projected to be worth around USD xx billion by 2034, growing at a CAGR of 6.22% from 2025 to 2034.

North America dominated the cardiovascular clinical trials market in 2024. The highly developed healthcare system in North America, especially in the U.S. and Canada, facilitates a large amount of clinical research. This comprises highly qualified medical personnel, cutting-edge medical technologies, and cutting-edge research centers. Due to the increasing frequency of cardiovascular illnesses in the area, there is a growing need for novel and efficient therapies. This leads to a large number of clinical trials targeted at resolving various health issues.

Numerous well-known biotechnology and pharmaceutical firms with significant R&D budgets are based in North America. These businesses carry out a significant number of clinical trials to create novel cardiovascular treatments. With one of the largest per capita healthcare spending in the world, North America is able to fund a significant amount of research and development, including cardiovascular disease clinical trials. Clinical trials in the region are more efficient and successful when cutting-edge technology like telemedicine, big data analytics, artificial intelligence, and electronic health records are integrated.

Asia Pacific is expected to grow at the highest CAGR in the cardiovascular clinical trials market during the forecast period. The pharmaceutical and biotechnology businesses find Asia Pacific intriguing since clinical trial costs are cheaper there than in North America and Europe. This entails reduced labor, patient acquisition, and operating costs.

The vast and genetically heterogeneous population in the area offers a wide range of trial candidates, which is advantageous for the validity and applicability of clinical trial findings. Clinical trial conduct is getting easier as a result of the streamlining and harmonization of regulatory frameworks with international norms in many Asia Pacific nations. This includes more open regulatory rules and expedited approval processes.

Market Overview

The cardiovascular clinical trials market refers to the subsector of the clinical trials industry for cardiovascular diseases. These investigations are conducted to assess the efficacy, safety, and possible advantages of novel therapies, medications, equipment, or interventions intended to prevent, identify, or manage cardiovascular illnesses. Heart failure, hypertension, arrhythmias, coronary artery disease, and other problems affecting the heart and blood arteries are among these diseases.

The development and validation of novel therapies and interventions that can enhance the identification, treatment, and prognosis of cardiovascular illnesses depend heavily on cardiovascular clinical trials. The cardiovascular clinical trials market is fragmented with multiple small-scale and large-scale players, such as SGS SA, Worldwide Clinical Trials, Eli Lilly and Company, Veeda Clinical Research, PPD Inc, Syneos Health, Vial, IQVIA Inc, Caidya, ICON plc, Medpace, Inc.

Cardiovascular Clinical Trials Market Growth Factors

- Rising healthcare expenditure can boost the cardiovascular clinical trials market.

- The rising aging population can grow the cardiovascular clinical trials market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.62 Billion |

| Market Size in 2025 | USD 6.30 Billion |

| Market Size in 2024 | USD 5.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.98% |

| Largest Marke | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase, Study Design, Indication, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for drugs for cardiovascular diseases

The rising demand for drugs for cardiovascular diseases can boost the cardiovascular clinical trials market. Effective therapies are becoming more and more necessary as cardiovascular disorders become more common. This results in an increase in clinical studies testing novel medications & treatments. As the world's population ages, cardiovascular illnesses become more common, increasing the need for novel therapies and the number of clinical trials needed to produce them.

Restraint

High cost of research

The high cost of research may slow down the cardiovascular clinical trials market. The high cost of research might restrict the amount of money available. The clinical trials may be postponed or discontinued as a result of smaller businesses or academic institutions' inability to get adequate financing.

Opportunity

Integration of technologies

The integration of technology can be the opportunity to boost the cardiovascular clinical trials market. The process of better data collection and analysis, improved patient recruitment and retention, streamlined trial procedures, personalized medicine enabled, remote monitoring made easier, big data and AI leveraged, data security guaranteed, and a variety of VR and AR applications, technology integration can dramatically increase the market for cardiovascular clinical trials.

Phase Insights

The phase IV segment dominated the cardiovascular clinical trials market in 2023. Due to a number of significant factors that emphasize the significance and distinctive qualities of this stage of clinical research, the phase IV segment controlled the cardiovascular clinical trials market by phase in 2023. Phase IV studies, often referred to as post-marketing surveillance trials, are carried out following the public approval of a therapy. The monitoring of the long-term safety and effectiveness of cardiovascular therapies in a larger patient group requires phase IV studies. Any unusual or long-term negative effects that might not have been noticeable in previous periods are identified with the assistance of this continued observation. These studies gather empirical data about the performance of therapies outside the controlled setting of previous clinical trials, offering important new perspectives on the efficacy of these interventions in everyday clinical practice.

The phase I segment is expected to grow at the highest CAGR in the cardiovascular clinical trials market during the forecast period. Increased funding for early-stage research, the rise in cardiovascular disease prevalence, technological advancements, regulatory support, the emergence of new therapeutic areas, collaboration and partnerships, an emphasis on safety and risk management, and improved patient recruitment and engagement are the main factors driving the expected high growth rate of the phase I segment in the market during the forecast period. All of these elements work together to highlight how important phase I trials are to the creation of novel cardiovascular therapies and the general growth of the cardiovascular clinical trials market.

Study Design Insights

The interventional segment dominated the cardiovascular clinical trials market in 2023. The intended effect of interventional trials is to evaluate the safety and effectiveness of novel medications, medical devices (like pacemakers or stents), treatments (like coronary artery bypass grafting), or combinations of these. These studies frequently assess the efficacy of experimental medications in comparison to placebos or accepted treatments, offering vital information for clinical decision-making. For novel medicines to be approved for clinical use by regulatory agencies, strong evidence from interventional studies is necessary. Before advanced treatments are widely used, these studies are crucial to proving their safety, effectiveness, and advantages. The interventional category trials follow strict requirements established by regulatory bodies such as the European Medicines Agency (EMA) in Europe and the Food and Drug Administration (FDA) in the United States.

The observational segment is expected to grow at the highest CAGR in the cardiovascular clinical trials market during the forecast period. Because they don't entail the administration of novel drugs or intensive laboratory testing, observational studies usually need less budget than interventional trials. This increases their viability for a wider group of scientists and organizations. Regulations, payers, and healthcare providers are beginning to place a greater emphasis on observational studies because they offer practical information on how therapies function in everyday clinical practice. By shedding light on therapy efficacy and safety across a larger patient group, these data can supplement randomized controlled trials (RCTs). When it is unethical to withhold therapy from a control group, as might be the case with severe cardiovascular problems, observational studies are frequently used. These kinds of investigations enable researchers to get important information without sacrificing patient care.

Indication Insights

The coronary artery disease segment dominated the cardiovascular clinical trials market in 2023. Coronary artery disease is a common and frequently deadly cardiovascular illness that affects people all around the world. Because of the condition's high prevalence and high fatality rate, clinical trials and research are essential. Despite advances in treatment, there is a great need for safer and more effective CAD medications. This drives a large lot of clinical research to create better therapy solutions. To evaluate the safety and effectiveness of novel drugs, technologies, and treatments for coronary artery disease (CAD), extensive clinical trials are necessary. Novel anti-platelet medications, cholesterol-lowering drugs, and cutting-edge stent technology are a few examples of them.

The stroke segment is expected to grow at the highest CAGR in the cardiovascular clinical trials market during the forecast period. The need for novel and efficient therapies for stroke, which continues to be a major cause of mortality and disability globally, is fueling the expansion of clinical studies in this field. There is a greater need for research into stroke prevention, acute care, and rehabilitation as the aging population worldwide is more likely to experience a stroke. Growth in this market is being driven by recent developments in stroke therapy, such as thrombectomy devices, clot-busting medications, and neuroprotective medicines, which require extensive clinical studies to assess their safety and efficacy. Early intervention is becoming more and more important in avoiding strokes and improving outcomes. More clinical trials with the goal of determining efficient methods for early identification, risk mitigation, and acute therapy have resulted from this.

Cardiovascular Clinical Trials Market Companies

- IQVIA Inc

- ICON plc

- SGS SA

- Eli Lilly and Company

- PPD Inc

- Syneos Health

- Caidya

- Worldwide Clinical Trials

- Vial

- Veeda Clinical Research

- Medpace, Inc.

Recent Developments

- In April 2024, Advances in medical therapy may lead to a significant reduction in the need for implanted cardioverter defibrillators (ICD) for patients with heart failure, according to a $27 million study being conducted by cardiac experts at the University of Rochester Medical Center (URMC).

- In March 2024, A clinical study for bras that might help identify cardiac abnormalities and other issues that can cause heart disease is scheduled to begin at a small company in Cambridge.

- In February 2024, CU Safety Gene therapy trials for heart disorders are about to begin. Three decades of research on dilated cardiomyopathy have produced ground-breaking findings. It began as a record of people with cardiac conditions in the early 1990s. The current generation of medicines for dilated cardiomyopathy is being informed by data gathered from over 2,000 families.

- In September 2023, the Ohio State University Wexner Medical Center randomized the world's first patient in a clinical study testing a gadget intended to reduce heart failure symptoms. The first patient is a 54-year-old Bellefontaine, Ohio, man whose acute dyspnea was brought on by heart failure.

Segment Covered in the Report

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional

- Observational

- Expanded Access

By Indication

- Acute Coronary Syndrome

- Coronary Artery Disease

- Ischemic Heart Disease

- Pulmonary Arterial Hypertension

- Stroke

- Cardiac Arrhythmias

- Heart Failure

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client