List of Contents

Cell Counting Market Size and Forecast 2025 to 2034

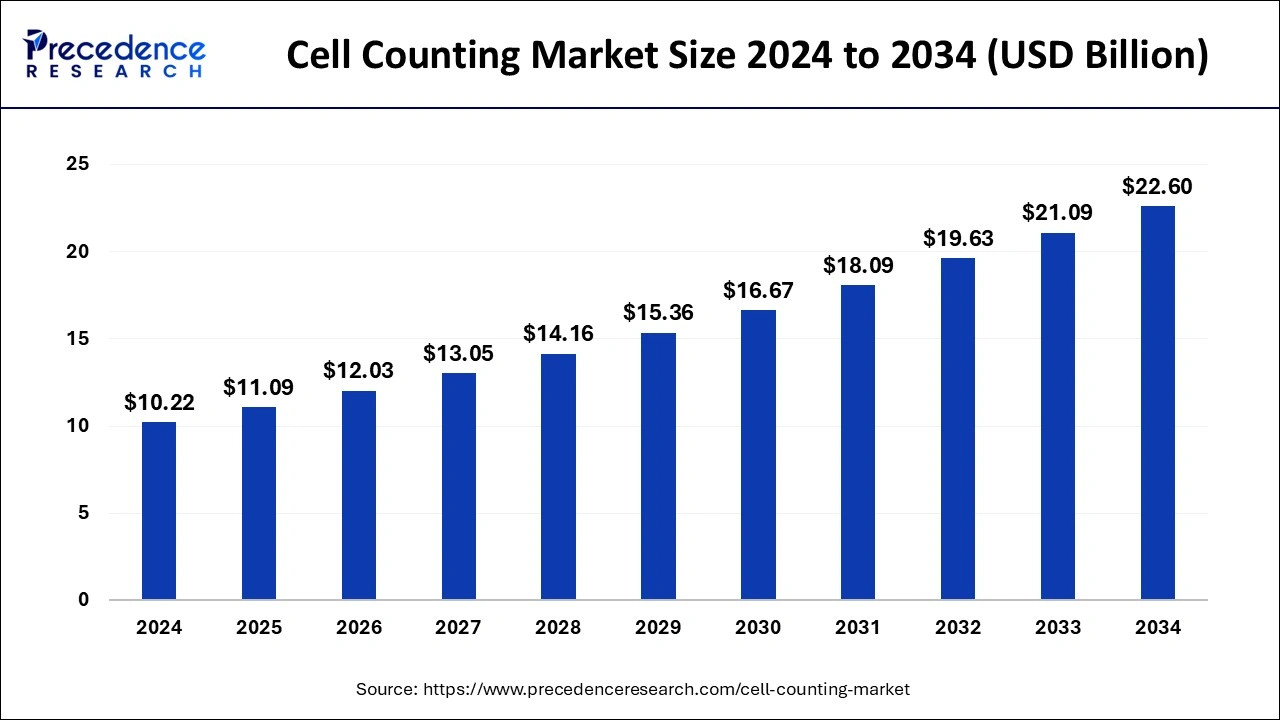

The global cell counting market size was calculated at USD 10.22 billion in 2024 and is predicted to reach around USD 22.60 billion by 2034, expanding at a CAGR of 8.26% from 2025 to 2034.

Cell Counting Market Key Takeaways

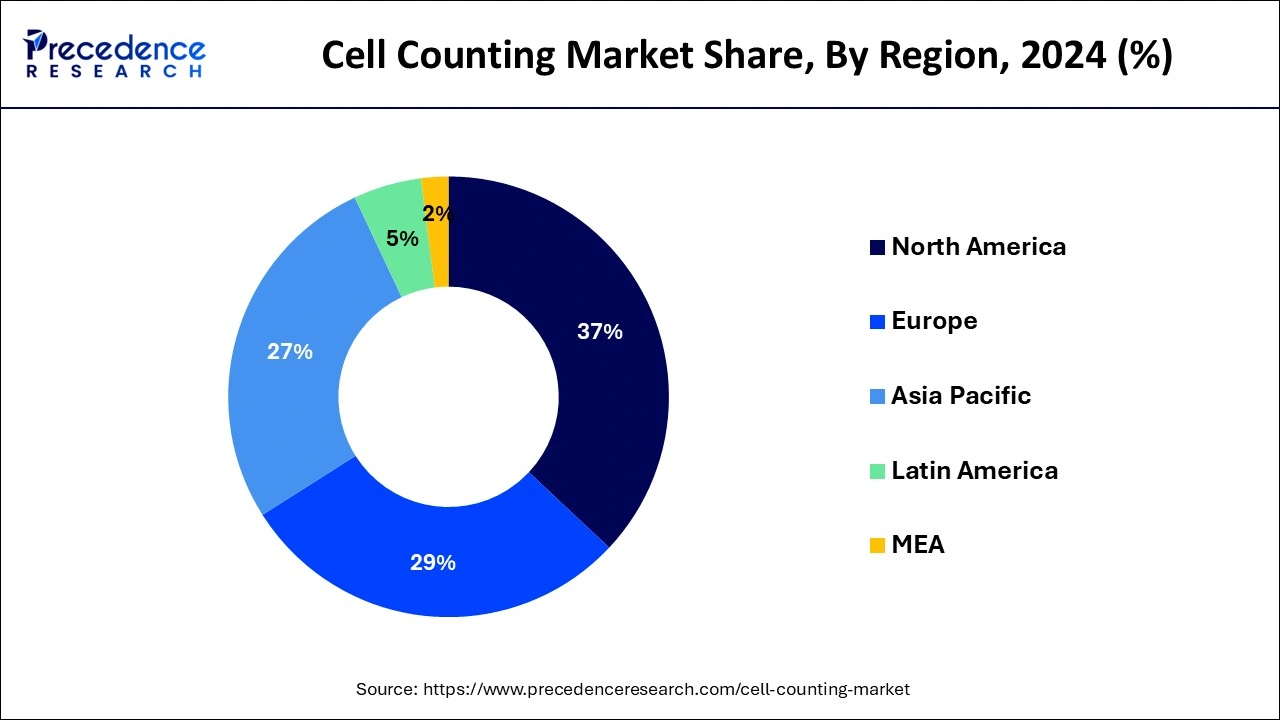

- North America generated more than 36.14% of revenue share in 2024.

- By Product, the consumables and accessories recorded for more than 51% of revenue share in 2024.

- By Application, the complete blood count segment generated the largest revenue share in 2024.

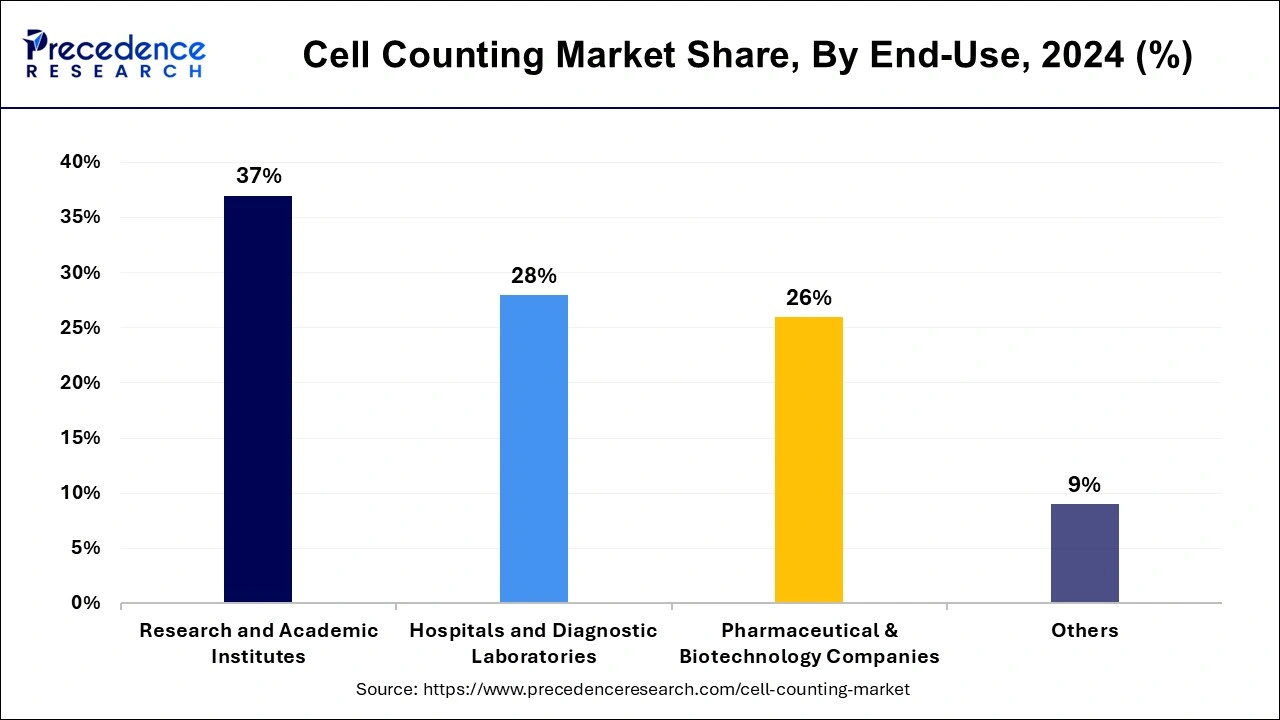

- By End-use, the Academic and research institutes contributed the largest revenue share of around 37% in 2024.

U.S.Cell Counting Market Size and Growth 2025 to 2034

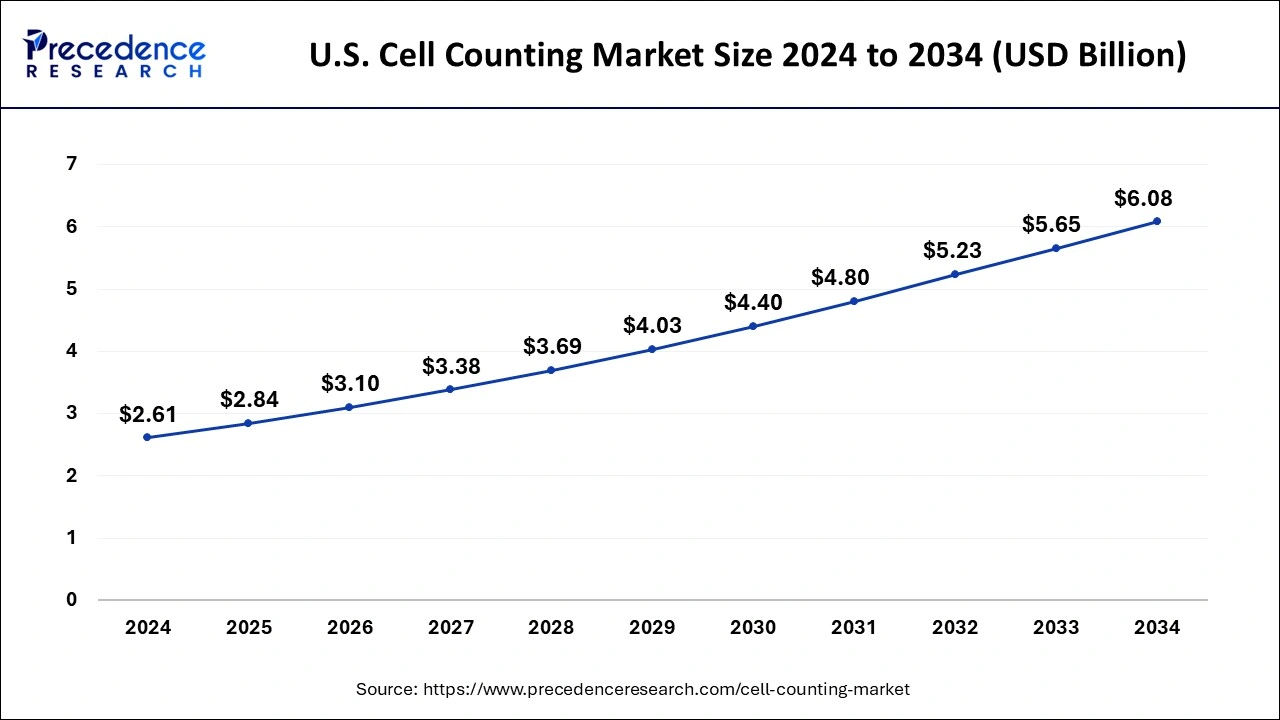

The U.S. cell counting market size was exhibited at USD 2.61 billion in 2024 and is projected to be worth around USD 6.08 billion by 2034, growing at a CAGR of 8.82% from 2025 to 2034.

In 2024, North America accounted for the largest revenue share of around 36.14%due to the growing emphasis on biomedical and cancer research. One of the key factors influencing the use of these devices is the rise in the prevalence of chronic diseases, such as blood and cardiovascular disorders. According to the American National Red Cross, 90,000 to 100,000 Americans are affected by sickle cell disease.

During the predicted period, Asia Pacific is anticipated to increase exponentially. This region's concentration of clinical research andbiopharmaceutical businesses can be the driver for the exponential growth. In addition, the region's market is primarily being driven by the ageing geriatric population, which is extremely sensitive to chronic ailments. Due to an increase in the number of elderly patient clinical tests performed each year, this has led to an unparalleled rate of growth in the use of these devices.

Market Overview

Cell counting is a technique for counting cells for medical purposes and is crucial to both clinical and research endeavors. In liquid media, cell counts are represented as a number of cells per unit of volume or concentration. Cell counting is required for the execution of numerous treatment processes. For instance, the quantity of red blood cells or white blood cells can reveal important details about a patient's health.

The concentration of white blood cells and red blood cells, the prevalence of pathogens, and the toxicity effects of particular drugs on model cells are all determined by cell counting. Additionally, it aids in calculating the quantities of compounds and reagents to add to a solution. The development of the cell counting market has been fueled by these advantages of cell counting and rising international research activity.

Cell counting reduces intra-tumor heterogeneity, a crucial stage in figuring out how cancer is progressing within the body of the patient. It also detects primary tumors, metastatic cancers, and circulating malignancies, which aids in therapeutic targeting, tracking, and choosing future treatment strategies. Cell counts are more in demand as a consequence of rising cancer and acquired immunodeficiency syndrome rates.

Cell Counting Market Growth Factors

Rapid technical advancements in cell counting reagents and apparatus have led to increased product innovation, rising sales, and increasing production all of which have helped foresee market expansion. For instance, in 2020, the Best New Life Science Product of the Year honor was given to CellDrop, a DeNovix Inc. automatic cell counter that enables counting cells without slides.

For the diagnosis of several chronic illnesses, such as cancer and AIDS, cell counting is essential. Global demand for cell counting products is being driven by these illnesses' rising prevalence. Promoting these goods to expand the cell counting market is also encouraged by expanding governmental efforts and investments in stem cell research.

Key Factors Influencing Future Market Trends

- Automated technology- The use of sophisticated automated technology and artificial intelligent image-based use of this technology is simplifying and improving the accuracy of cell counting, which is also minimizing the chance of manual counting errors, and is especially valuable in high volume laboratories or clinical research labs.

- Increasing need for personalized medicine- As new personalized therapies proliferate, accurate cell counting is of utmost importance for accurate drug dosing, especially for individualized oncology, immunotherapy, and regenerative medicine applications.

- Increased biopharmaceutical R&D- The increase in biologics product development is resulting in increased demand for improved cell analysis technologies that support quality assurance, reduced variation, and consistent product delivery in a timely manner.

- Increasing use of point-of-care testing- Miniaturized hand-held cell counters are increasingly being used in non-traditional decentralized, and out-of-hospital settings as they allow for rapid results, and minimize time-to-treatment for patients in resource-limited, and remote locations.

- New developments in flow cytometry- The new generation of flow cytometers is improving multivariable parameter cell sorting and counting, allowing for simultaneous analysis, quantification, and characterization. This is especially useful for characterization in immunology and hematology research.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.09 Billion |

| Market Size by 2034 | USD 22.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.26% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The growing prevalence of AIDS and cancer amongst the global population is the major factor driving the market growth

Worldwide instances of cancer and acquired immunodeficiency syndrome (AIDS) are on the rise, which has greatly increased the demand for cell counting. Cell counting makes it easier to evaluate intra-tumor heterogeneity, a crucial step in determining how quickly cancer is spreading throughout the patient's body. The determination and recognition of primary tumors, metastatic tumors, and circulating tumors are all aided by cell counting.

The identification of these tumors is absolutely essential for the tracking and therapeutic targeting processes that determine the course of additional treatment. According to a World Health Organization (WHO) report from September 2018, cancer was the second top cause of death worldwide, accounting for about 9.6 million deaths.

According to a different report from 2018, there were roughly 37.9 million AIDS-positive individuals worldwide. Cell counting has become crucially important due to the fact that the number of cases is significantly increasing, which has helped the market expand. Additionally, cell counting is now a standard process in clinical and hospital settings.

Cell counting makes it easier to assess the immune system and find bacteria, viruses, and other pathogens in the host's body by finding the concentration of platelets, plasma, red blood cells, and white blood cells. The demand for cell counting methods and equipment is rising as a result of all these factors, which are strongly encouraging the use of cell counting in numerous treatments, medical procedures, and research endeavors.

Restraint

High cost

The high cost of cell counting equipment might be a major barrier for smaller labs or research institutes hampering the growth of the market. Depending on the technology, brand, and features, cell counting equipment can range substantially in price. For instance, automated cell counters with cutting-edge capabilities like flow cytometry or fluorescence imaging might cost tens of thousands or even hundreds of thousands of dollars. In addition to the instrument's cost, consumables and reagents are needed to operate it, which might raise the entire cost.

Opportunities

Increased government and corporate funding, improved image analysis solutions, and development of enhanced informatics solutions to create lucrative market opportunities

Global healthcare industries have seen significant growth due to increased investments from both corporate and government entities. Due to the growth of infrastructure, large expenditures have made it possible for research facilities, educational institutions, hospitals, and other medical facilities to purchase the most recent technology in the cell counting field. It is anticipated that the industry will have tremendous potential opportunities due to the increasing inflow of expenditures for research.

Moreover, highly developed and upgraded image analysis systems are now economically available everywhere. These imaging technologies improve cell counting by improving accuracy and cutting down on time. Also, the process of data processing and visualization has been boosted through the creation of advanced informatics systems. Many of these elements have influenced the demand for biologics to treat chronic diseases, which has greatly expanded the market for cell counting.

Impact of COVID-19:

The COVID-19 pandemic has had a mixed impact on the global cell counting market. On one hand, the demand for cell counting technologies has increased due to the surge in research activities related to the virus and the development of vaccines and treatments. On the other hand, the pandemic has led to supply chain disruptions, temporary closures of manufacturing facilities, and reduced investment in research and development, which has affected the overall growth of the market.

During the initial stages of the pandemic, there was a significant surge in demand for cell counting technologies such as flow cytometry and hematology analyzers due to the need for accurate and rapid testing of patients with COVID-19. However, the supply chain disruptions caused by the pandemic led to shortages of key components and reagents required for these tests, resulting in delays and reduced access to testing.

In addition, the pandemic has also impacted the funding for research and development, which has slowed down the development of new cell counting technologies and limited the adoption of existing technologies. The cell counting market is expected to rebound as the pandemic situation improves and the demand for research and development activities returns to pre-pandemic levels.

Product Insights

In 2024, consumables and accessories contributed for more than 51% of total revenue. Some of the consumables and accessories used with these devices include reagents, microplates, magnetic beads, and chamber slides. Their extensive usage is a factor in the growth of consumables and accessories. Also, the release of novel products encourages market growth.

For instance, in December 2020, eNuvio unveiled a reusable 3D cell culture microplate. With the help of this cutting-edge plate, scientists can produce embryoid bodies, which are needed in order to generate larger organoids or spheroids from stem cells. According to eNuvio, scientists will profit for a very long time from this environmentally friendly equipment in both an economic and scientific sense.

The agent sub-segment had the biggest revenue share in 2024. The sizeable revenue share is due to the frequent purchase of these products for use in flow cytometry, spectrophotometry, and automated cell counting. The need for periodic calibrations prior to starting experiments increases the need for this equipment.

Application Insights

In 2024, the greatest revenue share was for a complete blood count. The complete blood count is one of the most popular tests used to evaluate a person's general health. The test measures a variety of blood constituents, including RBC, WBC, haemoglobin, hematocrit, and platelets. Complete blood counts are often used to monitor blood conditions like leukaemia and anaemia, which are expected to drive market expansion.

Stem cell research is predicted to experience the fastest CAGR growth during the projection period. The exponential growth in demand for human stem cells is being driven by the growing need for large-scale production for medical and scientific research.

In areas like transplantation, cancer treatment, and regenerative medicine, stem cells are absolutely essential. Automated tools make it easier to precisely determine the stem cell viability and nucleated cell content in cord blood or human bone marrow. Fluorescence imaging and other aspects are also being used more frequently to measure green fluorescent protein (GFP) efficiency for transfecting stem cell applications.

End-Use Insights

Academic and research institutes contributed for the largest revenue share of around 37% in 2024. The high percentage can be attributed to the extensive use of cytometers in cell biology research studies. To study the evolution of viruses, illnesses, and other microorganisms, researchers use cytometers to evaluate criteria such physical traits, kind, and lineage. Major market participants' strategic moves are another factor driving the segment. For instance, in March 2021, Alliance Global installed an automated cell counting system at the University of the United Arab Emirates in Al Ain.

Throughout the projection period, the pharmaceutical and biotechnology industries are expected to experience exponential growth. A crucial component in evaluating the effectiveness of any biological product is cell counts. These tools count the cells in a specific culture solution before adding it to the bioreactors or fermenters to produce the desired product. Throughout the upcoming years, it is projected that rising demand for biologics created by bioprocessing in these bioreactors/fermenters will increase device demand.

Recent Developments

- In August 2024, DeNovix announced the release of the new CellDrop FLi Automated Cell Counter. This includes enhanced hardware for improved cell counting performance, along with six new cell counting applications, including fixed samples, hepatocytes, and Erythrosin B.

- In October 2024, NewBiologix, a technology innovation company pioneering innovative tools enabling efficient, cost-effective, and large-scale production of viral vectors for gene therapy, announced the launch of the Xcell™ Portfolio. This is a suite of advanced technologies that offers reliable and scalable solutions that address critical challenges in gene therapy production, such as low yields, batch heterogeneity, scalability, and high cost

- In October 2023, the DeNovix CellDrop™ Automated Cell Counter achieved the ACT Label certification from My Green Lab, making it the first automated cell counter accredited by the program. The instrument's patented DirectPipette™ technology allows users to load samples directly into a permanent chamber, thereby eliminating the need for plastic cell counting slides.

- On 31 Sept, 2022, the Binding Site Group ("The Binding Site"), a world leader in speciality diagnostics, was bought by Thermo Fisher Scientific Inc. from a shareholder group led by the European private equity company Nordic Capital in an all-cash deal estimated at £2.25 billion, or $2.6 billion at the time of writing.

- On 17 Sept, 2022, the Gibco CTS DynaCellect Magnetic Separation System (DynaCellect) was introduced by Thermo Fisher Scientific Inc. to make it simpler for companies developing cell therapies to transition from process and clinical development to commercial manufacture. This cutting-edge instrument for cell separation, activation, depletion, and Dynabeads magnetic beads removal offers a scalable, adaptable, automated, and closed system to aid in streamlining the production of cell therapies. As a result, DynaCellect ensures that the appropriate cells are identified and manufacturing faults are kept to a minimum.

Cell Counting Market Companies

- ThermoFisher Scientific, Inc.

- Merck KGaA

- Agilent Technologies

- PerkinElmer, Inc.

- BD

- Danaher

- Bio-Rad Laboratories, Inc.

- BioTek Instruments, Inc.

- GE Healthcare

- DeNovix Inc.

Segments Covered in the Report

By Product

- Instruments

- Spectrophotometers

- Flow Cytometers

- Hemocytometers

- Automated Cell Counters

- Microscopes

- Others

- Consumables & Accessories

- Reagents

- Microplates

- Others

By Application

- Complete Blood Count

- Automated Cell Counters

- Manual Cell Counters

- Stem Cell Research

- Cell Based Therapeutics

- Bioprocessing

- Toxicology

- Others

By End-Use

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client