February 2025

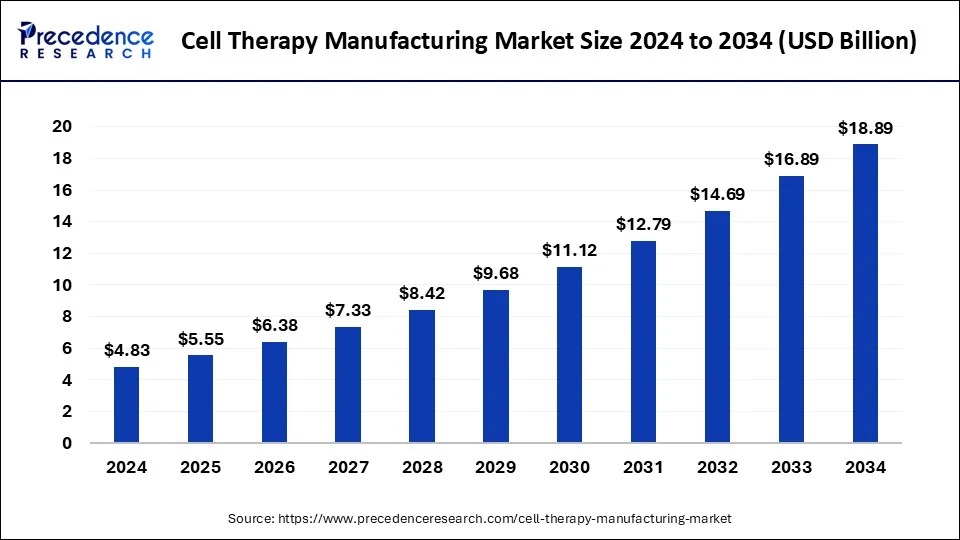

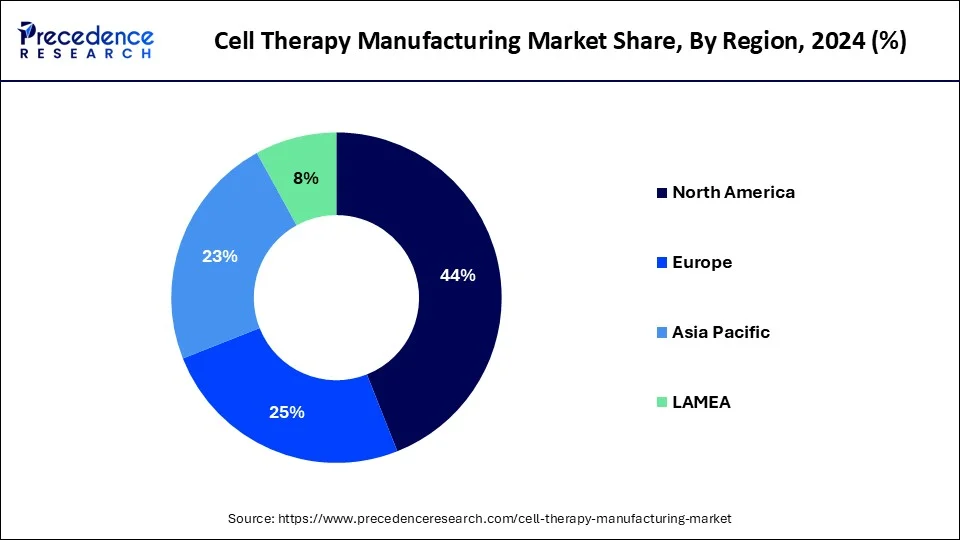

The global cell therapy manufacturing market size is calculated at USD 5.55 billion in 2025 and is forecasted to reach around USD 18.89b illion by 2034, accelerating at a CAGR of 14.61% from 2025 to 2034. The North America cell therapy manufacturing market size surpassed USD 2.13 billion in 2024 and is expanding at a CAGR of 14.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell therapy manufacturing market size was estimated at USD 4.83 billion in 2024 and is predicted to increase from USD 5.55 billion in 2025 to approximately USD 18.89 billion by 2034, expanding at a CAGR of 14.61% from 2025 to 2034. The rising incidence of chronic diseases such as cancer, autoimmune disorders, and degenerative conditions are key factors driving the market growth.

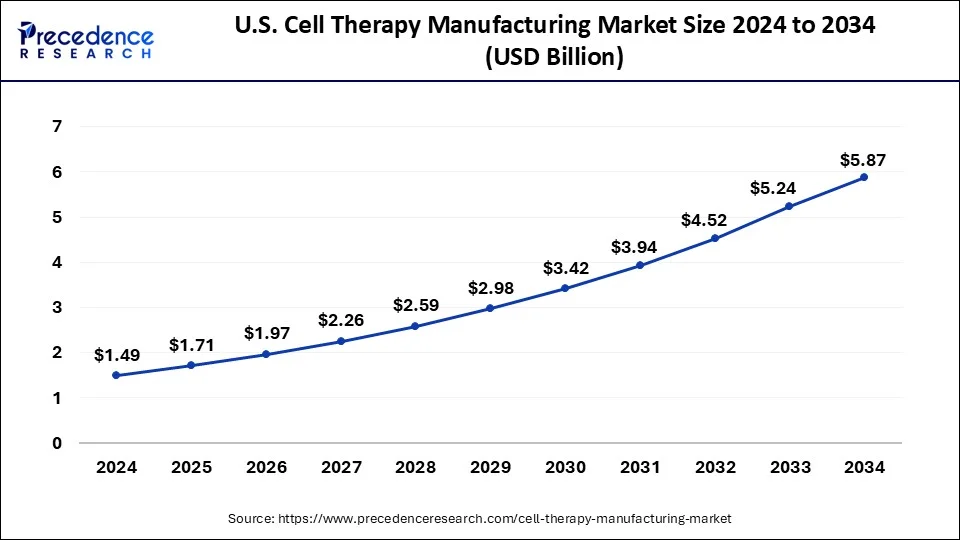

The U.S. cell therapy manufacturing market size was estimated at USD 1.49 billion in 2024 and is predicted to be worth around USD 5.87 billion by 2034, at a CAGR of 14.70% from 2025 to 2034.

North America dominated the global cell therapy manufacturing market. The United States led in North America in 2023 and is expected to maintain this position in the forecast period. Factors such as the rising prevalence of sickle cell disease and the presence of numerous developers of gene, cell, and tissue-based therapeutics are driving growth. Moreover, the region benefits from many contract development organizations and local companies are expanding their manufacturing facilities.

Asia Pacific is expected to witness the fastest growth during the forecast period. Countries such as China, Japan, and South Korea are investing heavily in research and development and constructing state-of-the-art manufacturing facilities. The region benefits from a sizable patient population, rising healthcare spending, and government support to foster the growth and acceptance of cell therapies. Additionally, Asia Pacific is becoming a center for contract manufacturing organizations (CMOs) providing cell therapy manufacturing services.

The cell therapy manufacturing market comprises industries that produce therapeutic products using isolated tissue to treat disorders or wounds. Cell therapy manufacturing is essential for developing and commercializing cell-based treatments, such as CAR-T cell and stem cell therapies. It is critical to have efficient and scalable manufacturing processes to meet the increasing demand for these innovative treatments and make them available to patients around the world.

The process of cell therapy includes harvesting cells from a patient or donor, modifying or growing them in a lab, and then reintroducing them into the patient's body to improve biological functions. Manufacturing includes steps like isolating cells, expanding them, performing genetic modifications if needed, conducting quality control tests, and preparing the final product. These steps are carried out in highly controlled environments to ensure the safety, purity, and effectiveness of therapeutic cells.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.61% |

| Market Size in 2024 | USD 4.83 Billion |

| Market Size in 2025 | USD 5.55 Billion |

| Market Size by 2034 | USD 18.89 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Technology Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Outsourcing manufacturing processes

In the cell therapy manufacturing market, businesses not well-versed in cell therapy manufacturing, establishing a robust supply chain to meet consumer demand can be daunting and time-consuming. Companies with a strong grasp of their product's biology but lack experience in transitioning from small-scale to large-scale automated production can bridge this gap with the help of external organizations like contract manufacturing organizations (CMOs).

Outsourcing manufacturing capabilities presents growth opportunities for new players in the cell therapy manufacturing market to scale up their products for widespread distribution. Moreover, it spares manufacturers from investing in extensive systems and helps them prepare for potential product delays or regulatory challenges in the future.

Complex manufacturing process

The cell therapy manufacturing market is complex due to biological variations, making it difficult to standardize and ensure quality control. Moving from small-scale research to large-scale production while maintaining consistent product quality is a major hurdle. Additionally, meeting strict regulatory standards, especially for new and personalized therapies, adds further challenges, particularly concerning product safety, effectiveness, and manufacturing protocols.

Increasing use of allogeneic therapies

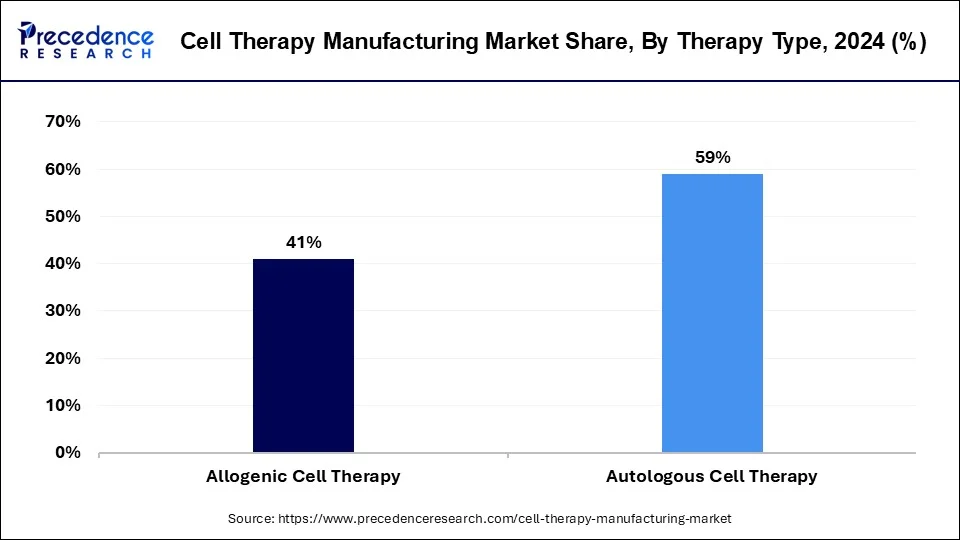

Allogeneic cell therapies offer advantages as they produce immune cells that can target and eliminate cancer cells left behind by chemotherapy. These therapies come from healthy sources, providing a greater supply of functional cells. Moreover, allogeneic techniques allow for the creation of multiple medicines, making them a key driver of growth in the cell therapy manufacturing market. Compared to autologous therapies, allogeneic treatments are notably more cost-effective, further fueling the expansion of the market.

Despite the limited number of approvals, companies specializing in cell therapies are attracting increased funding from both private investors and government sources. Over the projected period, there has been a significant rise in private equity and capital investments in the life sciences sector. As a result, investments in the cell therapy industry play a crucial role in driving the growth of the cell therapy manufacturing market.

The autologous cell therapy segment was the leading therapy type in the cell therapy manufacturing market in 2024. Autologous therapy is a novel treatment approach that involves using a person's own cells or tissues. These cells or tissues are treated outside the body before being re-inserted into the donor. This method is widely used in various fields of medicine, including orthopedics and dermatology, for both therapeutic and cosmetic purposes.

According to market projections, the allogenic cell therapy segment is expected to experience the highest growth rate in the cell therapy manufacturing market over the forecast period. Allogenic cell therapies involve using cells from healthy donors of the same species, as opposed to xenogeneic therapies, which use cells from different species. In this type of therapy, cells are expanded and potentially modified to treat multiple patients.

The somatic cell technology segment held the largest share of the cell therapy manufacturing market in 2023. These benefits stem from this type of therapy. Besides advancing stem cell research and therapies, somatic cell nuclear transfer (SCNT) has the special ability to produce cells tailored to individual patients for regenerative medicine. Also, it can be used to breed transgenic animals for biomedical purposes. These factors can drive the segment growth further.

The 3D technology segment is expected to grow at the fastest rate during the projected period. This is attributed to the three-dimensional (3D) technologies, like biomaterial scaffolds, that serve various purposes. They support cell survival, prompt cell specialization, provide a surface for cell growth, aid tissue regeneration, determine tissue shape and size, deliver growth factors, and shield cell transplants from the immune system to prevent rejection. These are some important functions of 3D technologies in medical applications.

The IPSC (induced pluripotent stem cell) segment dominated the cell therapy manufacturing market in 2023. Induced pluripotent stem cells (iPSCs) are viewed as an excellent option for creating ready-made allogeneic cell therapies. They can multiply indefinitely, are easily modified genetically, allow for the selection of specific clones after modification, and eliminate the need for individual cell collection.

The bone marrow segment is the second largest segment in the global cell therapy manufacturing market. A bone marrow transplant (BMT) is a specialized treatment for individuals with specific cancers or other medical conditions. It entails extracting stem cells from the bone marrow, filtering them, and reintroducing them into either the same individual (donor) or another recipient.

The oncology segment dominated the cell therapy manufacturing market in 2024. An oncologist is a doctor who specializes in identifying, diagnosing, and treating cancer in patients. They are trained to address various types of cancer affecting different parts of the body. The advancement of biotechnology, personalized medicine, and innovative treatment methods has elevated oncology's significance in the market.

The neurological segment is projected to show the fastest growth during the forecast period. This is because, in recent years, there has been an increasing focus on using cell transplantation or cell therapy to treat nerve injuries. This approach has gained attention for its potential in treating neurological diseases by giving new treatment options. Cell therapy in neurological diseases aims to mimic the natural process of cell repair and development in the nervous system. This can help address the root causes of the disease, improve dysfunction, and facilitate tissue repair.

By Therapy Type

By Technology Type

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025