August 2024

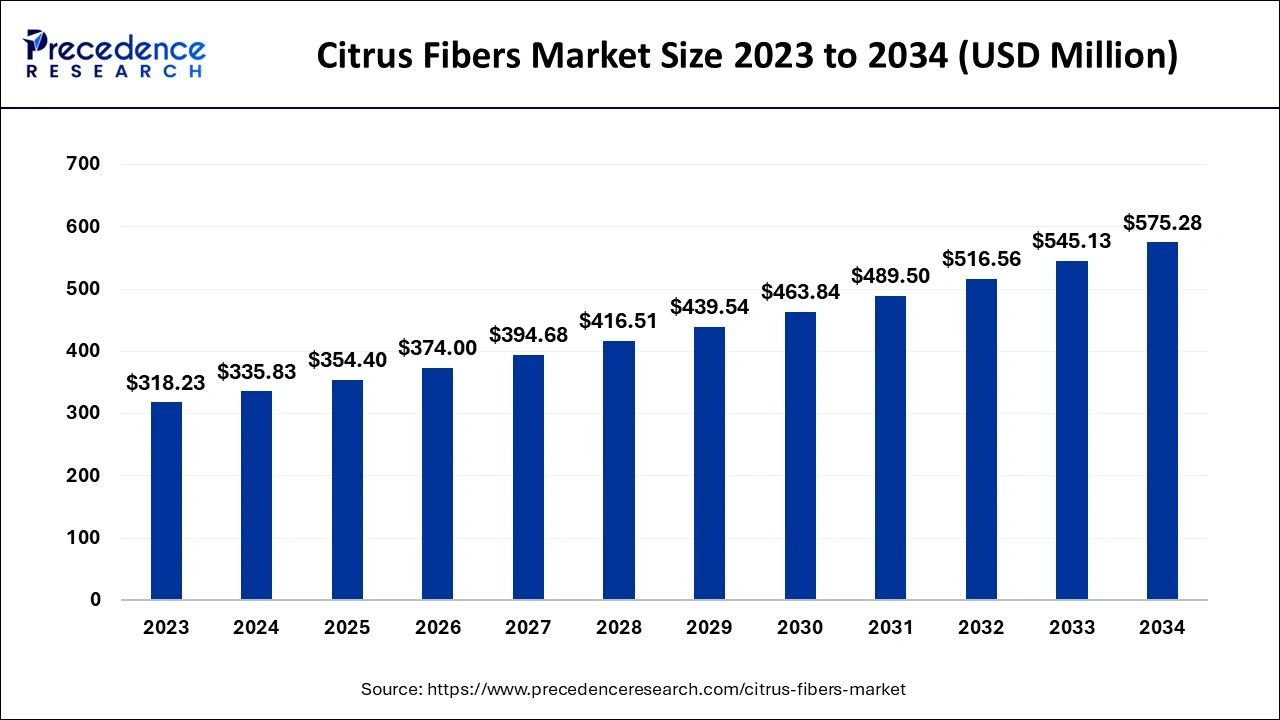

The global citrus fibers market size accounted for USD 335.83 million in 2024, grew to USD 354.40 million in 2025 and is projected to surpass around USD 575.28 million by 2034, registering a CAGR of 5.53% between 2024 and 2034. The North America citrus fibers market size is calculated at USD 117.54 million in 2024 and is expected to grow at a CAGR of 5.67% during the forecast year.

The global citrus fibers market size is worth around USD 335.83 million in 2024 and is anticipated to reach around USD 575.28 million by 2034, growing at a CAGR of 5.53% from 2024 to 2034. The citrus fibers market is driven by the food and beverage industry's increasing need for natural and clean-label ingredients.

To forecast the best periods for harvesting citrus crops and guarantee the highest possible yield of premium citrus fibers, AI-driven algorithms examine data from citrus farms, including weather, soil quality, and plant health. AI aids in the creation of novel citrus fiber formulations for a range of markets, including food, cosmetics, and pharmaceuticals. For example, it can recommend combinations to improve food products' texture, emulsification, or water retention. AI effectively finds ways to employ residual citrus peel trash to manufacture fiber, facilitating circular economy practices.

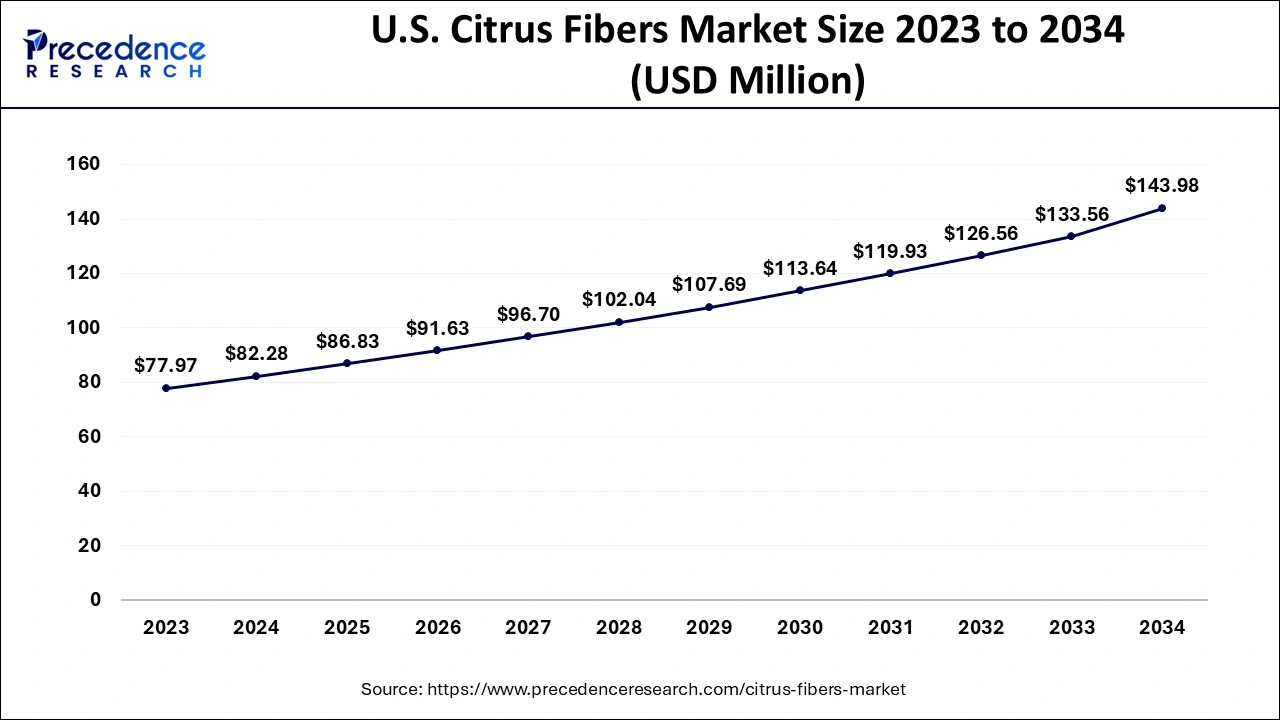

The U.S. citrus fibers market size is exhibited at USD 82.28 million in 2024 and is expected to exceed around USD 143.98 million by 2034, growing at a CAGR of 5.73% from 2024 to 2034.

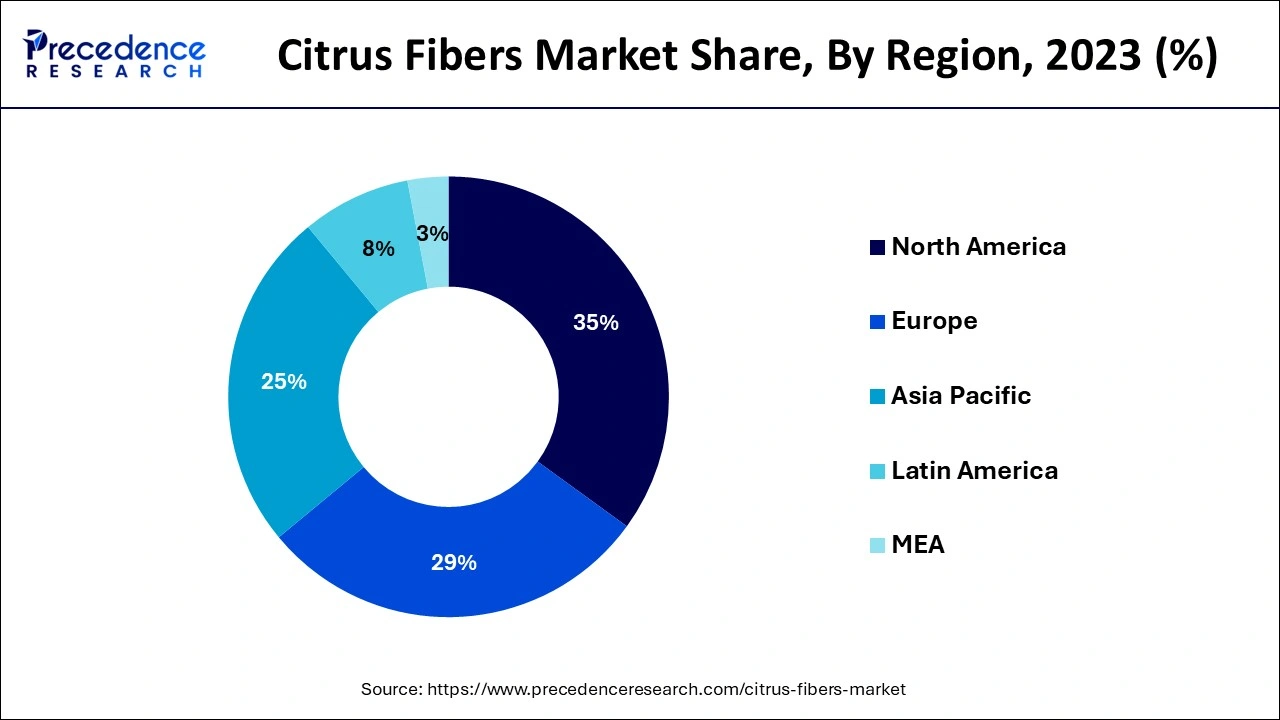

North America carrieid the largest share in the citrus fibers market in 2023. North American consumers who are concerned about their health are looking for tasty, nutritious foods. Rich in dietary fiber, citrus fibers have practical advantages such as promoting weight management, digestion, and gut health. Citrus fibers are employed in baked goods, beverages, dairy products, and snacks as consumers become increasingly conscious of the health advantages of fiber. This is in line with the region's expanding functional food trend.

Asia-Pacific is observed to be the fastest growing in the citrus fibers market during the forecast period.Plant-based and clean-label products are becoming increasingly popular as people choose natural, sustainable, and minimally processed ingredients. Because they come from a natural source, citrus fibers suit these customer expectations and are becoming increasingly well-liked in the area. There is a particularly strong demand for plant-based foods in nations where traditional plant-based diets are common, such as China and India. Customers are becoming more conscious of dietary fiber's role in reducing long-term conditions, including diabetes, heart disease, and obesity.

The indigestible portion of citrus fruit, which primarily travels through the human digestive system undigested, is the source of citrus fiber, a type of dietary fiber. In food products, citrus fibers are natural thickeners, stabilizers, emulsifiers, and water-binding agents, replacing artificial or allergic substitutes such as xanthan gum or gelatin. Citrus fibers, which are clean-label, sustainable, and devoid of artificial additives, are becoming more and more popular as consumers' preferences for natural ingredients grow.

| Report Coverage | Details |

| Market Size by 2034 | USD 575.28 Million |

| Market Size in 2024 | USD 335.83 Million |

| Market Size in 2025 | USD 354.40 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Form, Function, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing consumer preference for natural and clean-label ingredients

The demand for vegan and gluten-free products in the food and beverage industry is a major factor in the increased sales of citrus fibers. There is a noticeable movement toward plant elements as people grow more conscious of the negative health impacts linked to processed meals. Consumers seek items that provide additional health benefits beyond straightforward nutrition as part of the larger trend toward functional foods. Because of their fiber concentration, citrus fibers are a useful element that can help with weight management, gut microbiota support, and digestive health. They are increasingly used in functional food products such as snacks, fortified foods, and dietary supplements.

Increasing focus on health and wellness

Citrus fibers provide low-calorie, low-sugar substitutes for conventional components, supporting the global movement toward healthy diets and weight control. Citrus fibers can replace fat and sugar in some applications without sacrificing flavor or quality because of their capacity to improve texture, mouthfeel, and bulk. This makes them useful in creating calorie-conscious, health-conscious products, particularly for the snack, beverage, and dessert industries.

Limited availability of raw materials

Usually, citrus fibers are taken from the leftovers of citrus fruits such as oranges. The peel, pulp, and membranes that remain after juicing and other processing operations are examples of these by-products. The number of citrus fruits cultivated and collected determines the availability of citrus fibers. Because citrus fruits are seasonal, there may be variations in the supply of citrus by-products, which restricts the year-round availability of raw materials. For firms that depend on these by-products for fiber extraction, this leads to uncertainties in the supply chain.

Regulatory challenges

Citrus fibers are frequently sold as natural, dietary, or functional additives, and scientific proof is required to support their health advantages (such as being high in fiber and facilitating digestion). All health claims on food labels must adhere to stringent regulations set by regulatory agencies. Many marketplaces have strict laws regarding the listing of ingredients in products. Citrus fibers may be subject to fines or product recalls if they are not appropriately declared or classified, particularly if customers have citrus allergies.

Innovations in product formulations and packaging

Food recipes contain citrus fibers, especially pectin, to enhance mouthfeel and texture. They are perfect for dairy, confections, and plant-based food items since they can function as gelling agents, stabilizers, or emulsifiers. The creative use of citrus fibers to create functional formulations can produce better quality and texture goods. Innovations in citrus fiber formulations that enhance its functionality (such as emulsification or gelling properties) can lead to the creation of value-added products like functional beverages, sauces, dressings, and plant-based products.

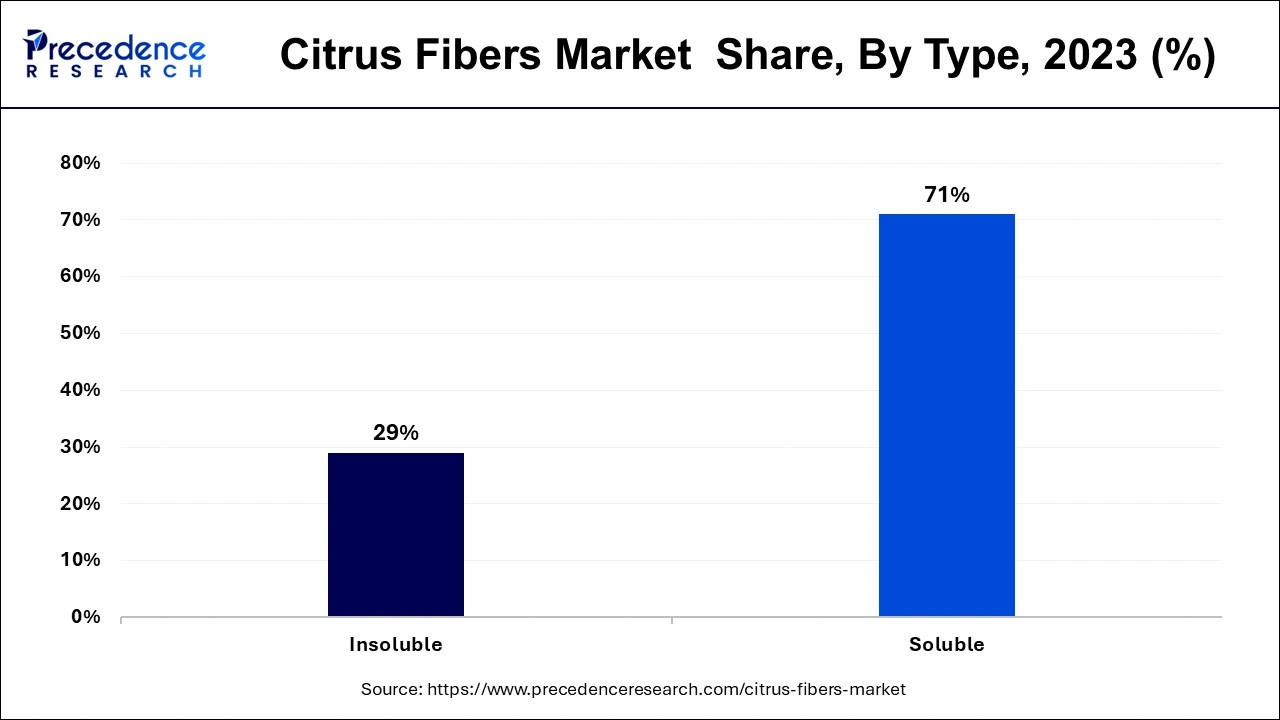

The soluble segment dominated the citrus fibers market in 2023. Due to their exceptional ability to retain water, soluble citrus fibers are perfect for preserving moisture in food items. This is very useful for dressings, sauces, and baked items. Encouraging a healthy gut flora and enhancing bowel regularity supports digestive health. They are frequently found in functional foods meant to improve general health. The global movement to decline waste and promote circular economies is in line with the sustainable production of citrus fibers, frequently by-products of the citrus juice business.

The insoluble segment shows a notable growth in the citrus fibers market during the forecast period. Insoluble fibers improve bowel movements and help avoid constipation by increasing stool volume. Insoluble fibers contribute to appetite management by promoting feelings of fullness. Since insoluble citrus fibers are made from citrus byproducts, they support the circular economy and encourage waste reduction, which aligns with global sustainability trends. Citrus peels, a byproduct of the juicing business, are being used by manufacturers more and more to make these fibers, which lessens their impact on the environment while producing goods with added value.

The orange segment dominated the citrus fibers market in 2023. Oranges make up a sizable portion of citrus production and are one of the most extensively grown citrus fruits worldwide. Due to the fruit's extensive use in juice manufacturing, many by-products are produced, including pulp and peels, which can be efficiently turned into fibers to cut down on waste. These fibers have superior emulsification and water-holding qualities, which improve the texture and stability of food products like sauces, drinks, and baked goods.

The lemon and lime segment is observed to be the fastest growing in the citrus fibers market during the forecast period. The market for citrus fibers, especially those from lemon and lime, has increased due to growing customer awareness of the advantages of natural and clean-label ingredients. These fibers are considered safer, chemical-free substitutes for artificial stabilizers, thickeners, and emulsifiers. Because of their anti-aging, brightening, and exfoliating qualities, lemon and lime fibers, strong in antioxidants and vitamin C, are highly sought-after in skincare products. The expanding trend for natural and organic cosmetics further supports their demand.

The thickening agent segment dominated the citrus fibers market in 2023. Citrus fibers are excellent thickening agents because of their remarkable capacity to hold onto water. This quality is especially prized for improving texture and retaining moisture without changing flavor characteristics in the food business. Citrus fibers improve viscosity and stabilize emulsions in processed meals, giving consumers a better sensory experience. Citrus peels, a by-product of the juice business, are used to produce citrus fibers, which is in line with international sustainability objectives. This cyclical method produces an environmentally friendly thickening solution while reducing waste.

The food and beverage industry segment dominated the citrus fibers market in 2023. Citrus fibers improve the consistency and texture of meals and drinks. They can enhance the mouthfeel and sensory experience of fruit juices, smoothies, sauces, dressings, and baked goods by acting as thickeners, stabilizers, and emulsifiers. Due to this functional adaptability, food producers can better satisfy consumer demands for higher-quality products. In the food and beverage business, where product freshness is critical, citrus fibers can contribute to extending the shelf life of products by inhibiting oxidation and microbiological growth. The global citrus fiber market is expanding exponentially due to the growing use of citrus fibers in various industries, including bakeries, sauces & seasonings, sweets, ice creams, drinks, flavorings, and coatings.

The pharmaceutical industry segment shows a significant growth in the citrus fibers market during the forecast period. Citrus fibers' ability to prevent disease opens the door for more health-conscious customers to include them in their regular diets. People are being influenced to embrace a healthier lifestyle that incorporates the usage of organic, natural, and healthful products by diseases like diabetes, allergies, and cardiovascular illnesses. Citrus fiber is becoming increasingly popular because of its health benefits, which include lowering body weight, controlling blood sugar, cleansing the skin, and enhancing immunity.

The personal care and cosmetics industry segment shows a notable growth in the citrus fibers market during the forecast period. Citrus fibers are becoming increasingly common in personal care products because of their brightening and antioxidant qualities. Pectin is a common ingredient in personal care products. Citrus fiber is the source of pectin, which propels the market for citrus fiber. The citrus fiber market players are seeing opportunities due to Asia-Pacific's growing demand for personal care products. Clean-label products emphasizing natural and environmentally friendly components are becoming increasingly popular with consumers. Because they are sustainable, biodegradable, and provide a clean production method, citrus fibers- made from the peels of citrus fruits- a byproduct of the juice industry, fit in well with this trend.

The supermarkets/hypermarkets segment dominated the citrus fibers market in 2023. Due to modern consumers' hectic lifestyles, ready-to-eat and processed foods are becoming increasingly popular. These frequently include extra functional components, such as citrus fibers, which have health advantages like enhancing texture and supporting digestive health. By providing natural products with citrus fiber, fostering customer trust, and meeting the growing need for food production transparency, supermarkets and hypermarkets can profit from this trend.

By Type

By Form

By Function

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024