November 2024

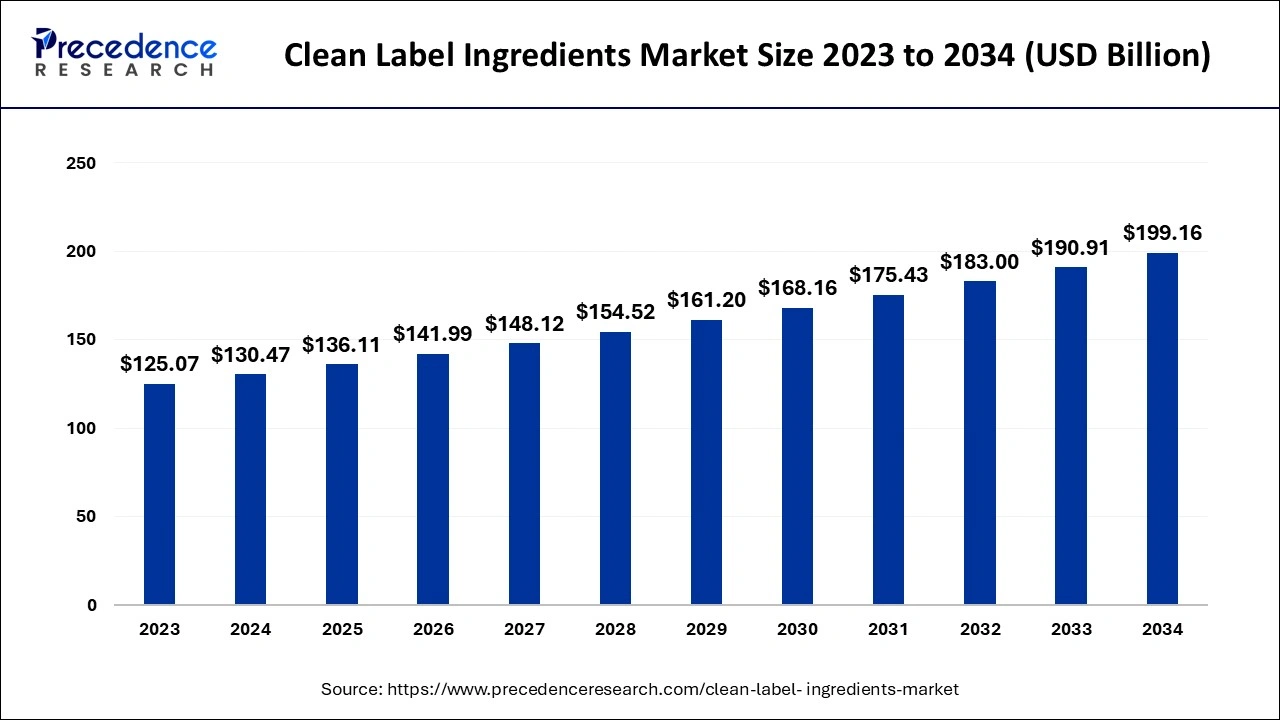

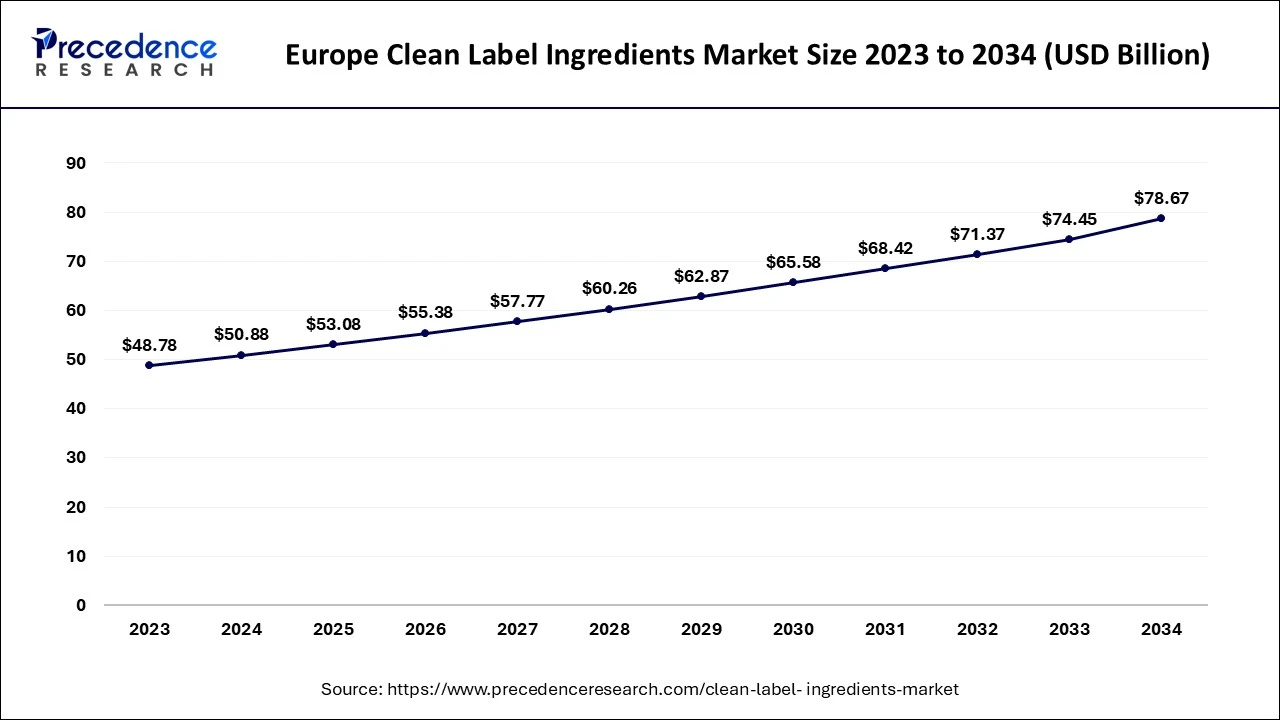

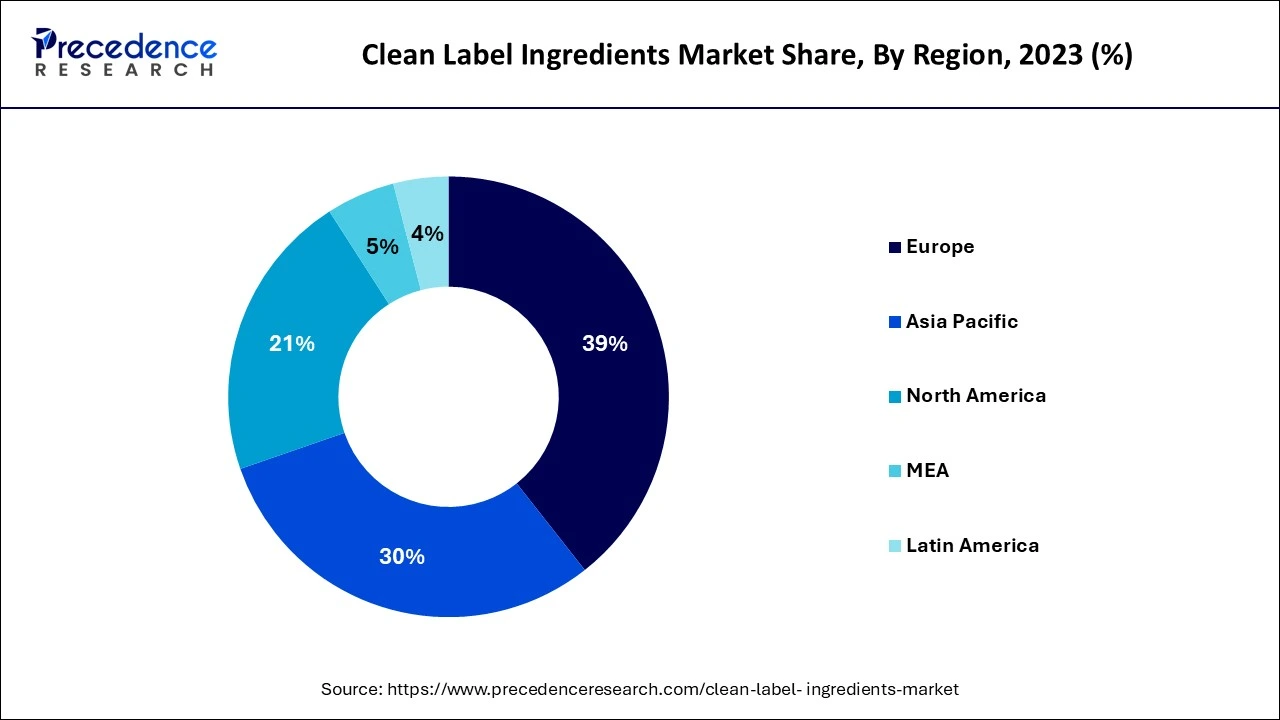

The global clean label ingredients market size is calculated at USD 130.47 billion in 2024, grew to USD 136.11 billion in 2025 and is projected to reach around USD 199.16 billion by 2034. The market is growing at a CAGR of 4.32% between 2024 and 2034. The Europe clean label ingredients market size is worth around USD 50.88 billion in 2024 and is expected to grow at a CAGR of 4.44% during the forecast year.

The global clean label ingredients market size accounted for USD 130.47 billion in 2024 and is anticipated to reach around USD 199.16 billion by 2034, expanding at a CAGR of 4.32% from 2024 to 2034. The increasing demand of consumers to avoid artificial ingredients and incorporate natural flavors and stevia is raising the adoption of the clean label ingredients market.

The Europe clean label ingredients market size is estimated to grow from USD 50.88 billion in 2024 to approximately USD 78.67 billion by 2034, growing at a CAGR of 4.44% from 2024 to 2034.

Europe dominated the clean label ingredients market in 2023. Consumers across Europe are increasingly becoming more health and label-conscious. The increasing consumer demand for transparency and simplicity in ingredients is observed in the European food and beverage sector. The region's growing focus on reducing sugar content, particularly using low-calorie sweeteners derived from natural sources, considers the preferences of health-conscious consumers and encourages innovation in product development.

North America will witness significant growth in the market during the forecast period. The market is expected to increase as a result of consumer’s growing desire for products that are more sustainable, high-quality, and healthy. North American consumers are also concerned with supply chain safety regulations. Since they prefer locally made products with cleanliness and environmental friendliness.

IFT First 2024 in Chicago, Foodology presented its latest prototype solutions. The company provided insights into the potential evolution of protein fortification, clean-label products, and plant-based options while also highlighting its commitment to environmental sustainability.

Clean-label ingredients are manufacturing products with ingredients that are recognized and understood by the consumer instead of using chemical and synthetic ingredients. Through this action, the consumer becomes aware of the food content and develops trustworthy natural-based products. The incorporation of clean-label ingredients is achieved by harvesting crops using a physical processing method. Plants such as wheat, tapioca, maize, bamboo, and peas are utilized in this production. The clean label aims to remove or reduce unwanted ingredients such as artificial colors and flavors, no genetically modified organisms, and many more.

How is AI Changing the Clean Label Ingredients Market?

With the emerging trend of clean labels, manufacturers are focusing on more natural products. Implementation of artificial Intelligence in the clean label ingredients market offers an analysis of consumer preference, dietary needs, and purchase history. AI has the potential to operate a tailored shopping experience, achieve health goals, and recommend clean-label products as per individuals’ preferences. This action will also educate people about the variety of clean-label products available. AI-based technology helps brands and retailers keep track of constantly changing trends and consumer preferences, which allows them to modify their marketing strategies.

| Report Coverage | Details |

| Market Size by 2034 | USD 199.16 Billion |

| Market Size in 2024 | USD 130.47 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.32% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Consumer awareness and preferences

Clean Label is a consumer-driven market, and with rising health hazards, consumers are becoming more conscious of their food choices. Clean and mindful eating has become a crucial practice among people since the pandemic due to the need to eat more natural and nutritious food. The popularity of clean labels is expected to grow continuously as consumers are greatly prioritizing products that contain recognizable ingredients that are minimally processed using familiar methods.

In present-day brands, being transparent with the customers means being open and honest about the whole food supply chain and all the ingredients used in the products. Some manufacturer formulates their products to align with customer preferences. Products that are free from additives such as artificial flavors and colorings. Products that fulfill dietary requirements, such as food allergies and intolerances, are also widely available.

Challenges faced by food manufacturers

As consumer trends regarding clean labels change, they are majorly impacting the food industry. Food manufacturers are facing challenges in meeting consumer demand for clean-label products. They are in a predicament to fulfill consumer demand and stay competitive in the market. It is difficult to produce natural products with higher production costs. It is a struggle to maintain the same taste and texture with alternative additives. Not all additive has a natural alternative. Some functional additives such as preservatives or thickeners are added to get the desired texture, provide smoothness and uniformity, color, and flavor, extend shelf-life, and reduce food spoilage and browsing effects. These requirements cannot be guaranteed with natural alternatives.

Cutting-edge technology and innovations

Food manufacturing companies are incorporating cutting-edge technologies and extensive research to develop natural ingredient that offers the same functionality as artificial additives. These innovations are important to maintain product quality and consumer satisfaction. Plant-based proteins are catering to the increasing vegan and vegetarian market and provide an alternative to animal-based protein.

Natural preservative is another focus area. Traditional preservatives such as sodium benzoate and potassium sorbate are known to cause potential health problems. Therefore, they will be replaced with natural preservation that includes rosemary extract, vinegar, and fermented ingredients. Organic emulsifiers and stabilizers are rising in popularity. These ingredients aid in maintaining the consistency of the desired texture of the product. The natural alternatives to synthetic emulsifiers are lecithin from sunflower seeds or acacia gum.

The powder segment generated the biggest share of the clean label ingredients market in 2023. Along with the clean label being a part of dietary supplements, it is also established in the pharmaceutical industry and reconsidering the use of synthetics. As consumers demand dietary supplements, they expect the same clean label system in medicines. The pharmaceutical companies are switching from silicon dioxide to bamboo powder, which has the same properties.

The liquid segment will show significant growth in the clean label ingredients market during the forecast period. There is a wide range of clean-label, nature-friendly preservation options. The liquid form of clean labels is boosting the market. Vinegar is made from natural fermentation and is very demanding. Vinegar contains acetic acid, a powerful organic acid with antimicrobial properties. Consumers recognize vinegar as an ingredient often found in kitchen cupboards that can help food last longer. This offers optimum performance, taste, and nutrition profile in the application.

The natural flavor segment led the clean label ingredients market in 2023. Today's food manufacturers must understand key clean label terms to comply with ever-changing regulatory guidelines when adding fresh flavors on the clean label. Various organic flavors can be found in clean-label products, including milk, butter, cheesy, sweet dairy, masking, and cultured varieties - each setting new standards for taste impact and functional performance. The products should be 100% organic by USDA and contain no toxins, GMOs, growth hormones, antibiotics, color, or artificial flavors.

The fruits & vegetables segment is expected to grow at a significant rate in the clean label ingredients market during the forecast period. Organically and naturally grown fruits and vegetables without synthetic pesticides, herbicides, and artificial fertilizers should be chosen. Environmental Working Group (EWG) is a non-profit organization dedicated to educating the public about topics such as agricultural practices, natural resource protection, and chemical health effects. Annually releases a list of 12 fruits and vegetables with the highest pesticide residue levels. The current list includes strawberries, spinach, kale, and nectarines, among others. Consumers must educate themselves about post-harvest chemicals. Some commonly used post-harvest chemicals include sodium ortho phenyl phenate (SOAP) and thiabendazole (TBZ). They are used as fungicides, germicides, household disinfectants, and laboratory reagents.

The food segment recorded the highest share of the clean label ingredients market in 2023. Several food additives are added to the processed food to ensure it remains safe and in good condition throughout the manufacturing process and till the consumer’s pantry. Additives are used to modify the sensory characteristics of food, such as taste, smell, and appearance. Artificial flavoring agents are synthesized chemicals that imitate natural flavors. Manufacturers do not that have the authority to add artificial flavors to products with deceptive names, such as synthetic vanilla or diluted cinnamaldehyde.

The dairy, non-dairy, & fermented beverages segment is anticipated to grow with the highest CAGR in the clean label ingredients market during the studied years. It is widely believed that dairy beverages (yogurt drinks, fresh or fermented milk) are excellent sources of probiotics. Modified additives, such as pectin, inulin, sodium alginate, and gelatin, enhance yogurt's physicochemical, textural, sensory, and rheological properties. Additives incorporated in dairy and fermented beverages may be natural or modified. Natural additives have been found in dairy formulations, including moringa, date palm, grape seed, and alger leaf extracts, cornelian cherry paste, mulberry fruit powder, lentil flour, different fibers, lemongrass and spearmint essential oils, and honey.

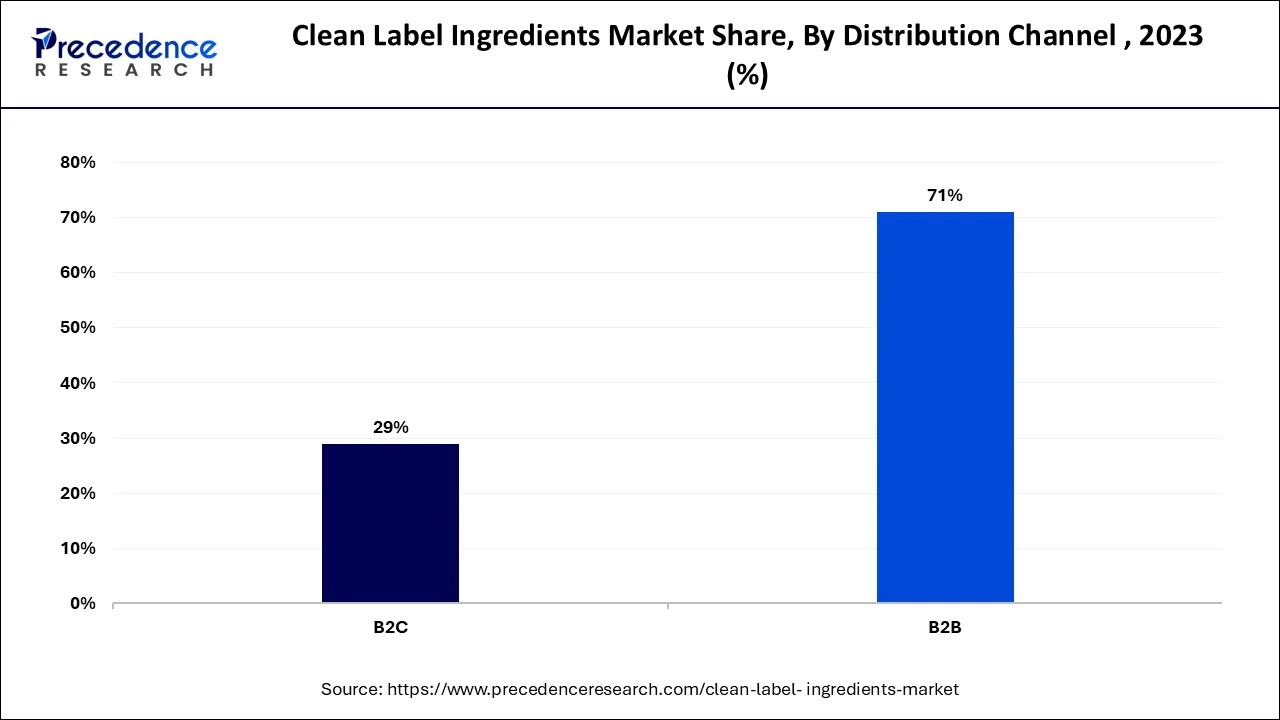

The B2B segment led the global clean label ingredients market in 2023. Clean-label products are frequently linked to superior quality. When B2B companies utilize clean ingredients, it convinces consumers about product integrity. Strict clean label regulations are established both domestically and internationally, which encourages businesses to promote clean labeling practices.

Segments Covered In This Report

By Form

By Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

March 2025

December 2024

October 2024